Fibonacci Wave Bands

- インディケータ

- Luc Michael Botes

- バージョン: 1.0

- アクティベーション: 12

Fibonacci Wave Bands Indicator

The Fibonacci Wave Bands indicator utilizes Fibonacci ratios to create dynamic bands around a central moving average. These bands are derived from key Fibonacci ratios (typically 38.2%, 50%, 61.8%) and adapt to market volatility, offering insights into potential support and resistance zones.

Key Features:

-

Fibonacci Levels: The indicator plots multiple bands above and below a central moving average based on Fibonacci ratios.

-

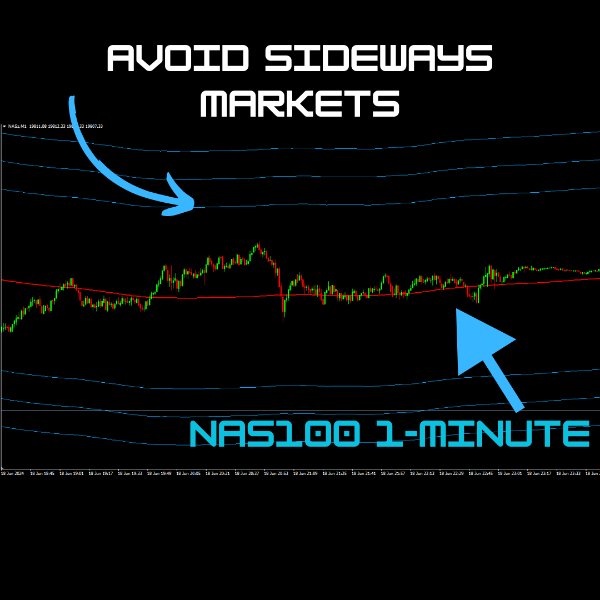

Dynamic Support and Resistance: Bands serve as dynamic support and resistance levels that adjust with price movements.

-

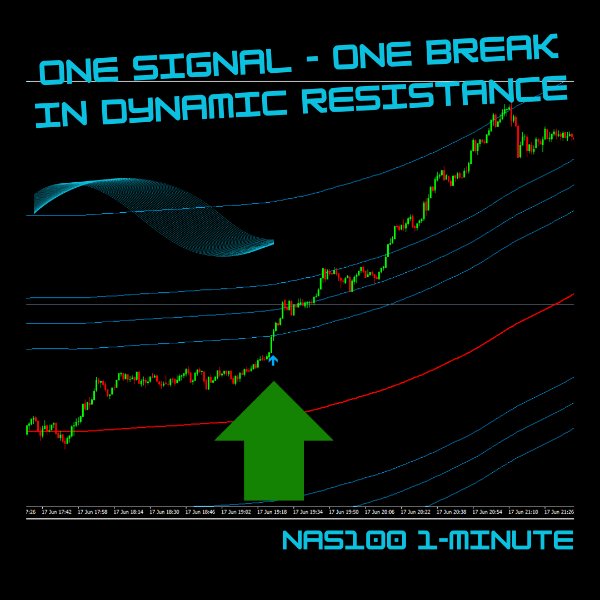

Trend Confirmation: Crossing these bands can signal potential trend reversals or continuations, providing traders with entry and exit points. A crossing of the first Fibonacci level in either direction, is marked with a non-repainting arrow, once the relevant candle has closed above this level.

-

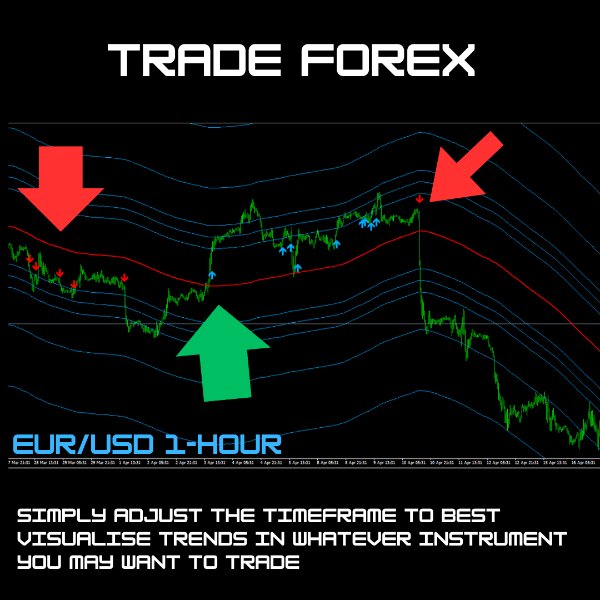

Volatility Adjustment: Bands widen during high volatility and contract during low volatility, reflecting changes in market conditions. I personally use this indicator on Indices like the Nasdaq100, on the 5-minute and 1-minute timeframes. If you want to trade other instruments, like Forex, simply find a timeframe where the trend is most clear from the trade signals.

-

Customizable Parameters: Traders can adjust the sensitivity and appearance of the bands to suit different trading strategies and timeframes.

How to Use:

-

Trend Identification: Look for price reactions near the bands to confirm trend direction.

-

Reversal And Continuation Signals: Watch for price crossing over (marked with arrows) or bouncing off the bands as potential reversal signals.

-

Entry and Exit Points: Use band breaches as entry signals and consider exiting trades as price reaches your desired level as a target.

The Fibonacci Bands indicator combines the power of Fibonacci retracement levels with the flexibility of adaptive bands, offering traders a comprehensive tool for technical analysis and decision-making.