Ophelos Advisor

- エキスパート

- Kevin Agustine Mickle

- バージョン: 1.0

- アクティベーション: 5

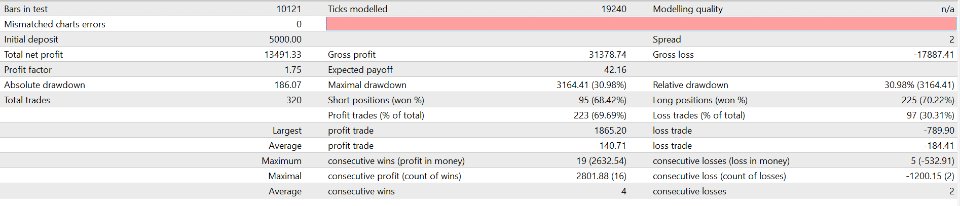

Proven to trade at almost 70% Profitability in total trades

Expert Advisor Overview:

Introducing the Ophelos Expert Advisor (EA), meticulously designed to automate trading decisions using a combination of moving averages and the MACD indicator as the primary indication. A strategy that is simple but effective. However, revolves around a highly developed rick management system, take profit, and stop losses in multiple but different ways.

Trading Strategy:

The Ophelos EA leverages a sophisticated strategy that focuses on trend following and breakout trading. By pinpointing trends and breakout points, it aims to enter trades in alignment with the prevailing market momentum. The EA employs dynamic trade management, allowing profitable positions to run while swiftly cutting losses. It is designed to execute trades without a predefined take profit, as the take profit level is strategically integrated. This EA is specifically optimized for the USD/JPY pair on the one-hour (1H) time frame, ensuring optimal performance and consistent results.

Key Features:

- Technical Indicators Utilized:

- The EA uses a combination of moving averages and the MACD indicator to identify potential entry and exit points in the market.

- Entry and Exit Conditions:

- Trades are initiated based on specific conditions, such as the MACD crossing above its signal line for buy trades and below for sell trades, with additional checks on moving average crossovers.

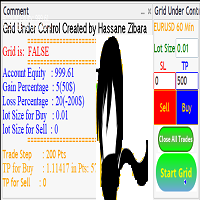

- Dynamic Lot Sizing:

- Lot sizes for each trade are determined dynamically based on a percentage of the account balance, allowing for flexible risk management and ensuring proportional trade sizes.

- Consecutive Candle Management:

- The EA closes all trades market movement that moves against the position, enhancing risk management by preventing prolonged adverse conditions.

Usage Instructions:

- Installation:

- Attach the EA to the USD/JPY one-hour (1H) chart in your MetaTrader platform. This EA is exclusively designed for trading on the USD/JPY pair and the one-hour time frame.

- Parameter Customization:

- Customize input parameters such as slippage, order ID, and risk percentage according to your preferences and risk tolerance.

- Monitoring and Adjustment:

- Regularly monitor the EA's performance and adjust parameters as necessary. Stay attuned to market conditions and be ready to intervene if needed.

USD/JPY Characteristics:

The USD/JPY currency pair is renowned for its liquidity and sensitivity to risk sentiment in the financial markets. Influenced by factors such as interest rate differentials between the US Federal Reserve and the Bank of Japan, geopolitical events, and economic data releases, USD/JPY can experience significant price movements. Traders often use it as a barometer for risk appetite, with the Japanese yen considered a safe-haven currency.

Trading Advice:

- Adaptive Take Profit:

- The EA does not have a set take profit level, allowing it to adapt to changing market conditions and optimize trade exits dynamically.

- Risk Control:

- Lot sizes are calculated based on a percentage of the account balance, facilitating controlled risk management. Set this percentage conservatively to avoid overexposure.

- Diversification:

- Diversify your trading portfolio by using multiple EAs or strategies across different currency pairs or asset classes to spread risk.

- Stay Informed:

- Keep abreast of macroeconomic events, market news, and geopolitical developments. While the EA automates trading decisions, staying informed can help you make timely adjustments.

- Risk Disclosure:

- Trading involves inherent risks, including the risk of loss. Only trade with capital you can afford to lose, and consider seeking advice from a qualified financial advisor if you're uncertain about trading's suitability for your financial situation.

Important Note:

Use this EA exclusively on the USD/JPY pair and only on the one-hour time frame to ensure optimal performance and avoid unexpected outcomes.

Testing and Validation:

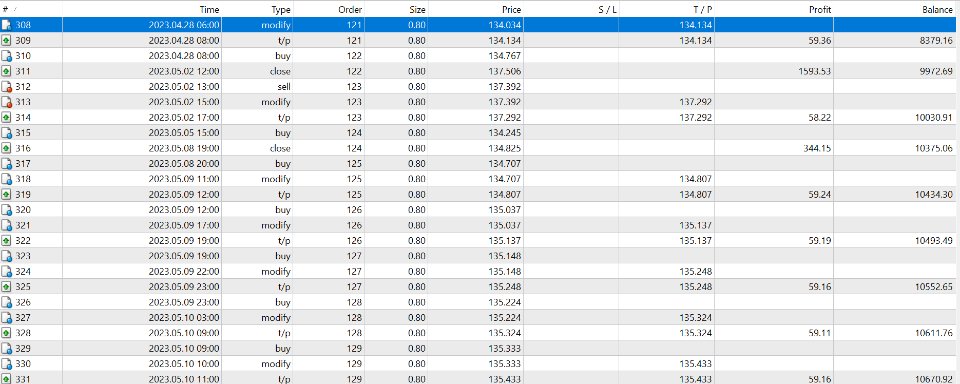

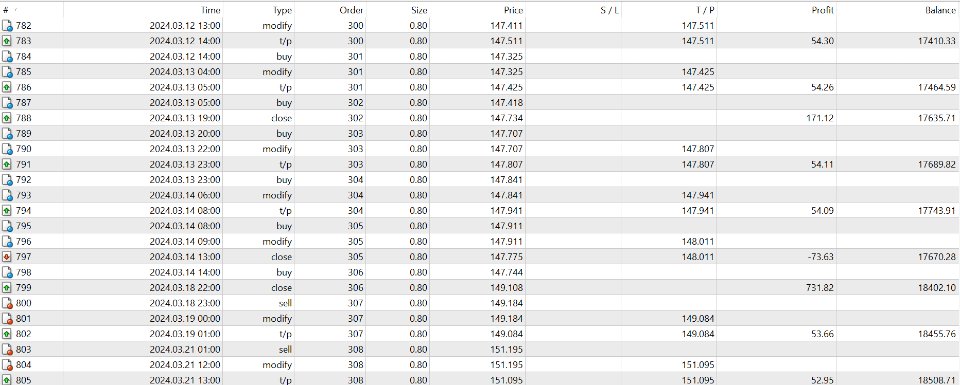

The Ophelos EA has undergone extensive testing from December 2022 to May 2024, ensuring robustness and reliability under various market conditions. Back testing results provide insights into its performance and validate the strategy's effectiveness.