Administrator

- ユーティリティ

- Juan David Ochoa Garcia

- バージョン: 3.98

- アップデート済み: 26 9月 2024

Over time, we have developed an Expert Advisor with the aim of providing a tool that facilitates trading, especially for those who are just starting in the forex market or those who, having a full-time job, want an additional source of income without neglecting their daily responsibilities.

We believe that the first step, and the simplest thing a person new to the trading world can do, is to join our Telegram group. In this space, our Expert Advisor publishes market entry alerts, providing valuable real-time information. This allows users to evaluate these alerts and, using their own judgment, decide if it is a good entry opportunity or not. Additionally, the group offers a collaborative environment where members can share experiences and strategies, facilitating learning and growth in the trading field.

- Telegram Group (Investment Laboratory) JOIN

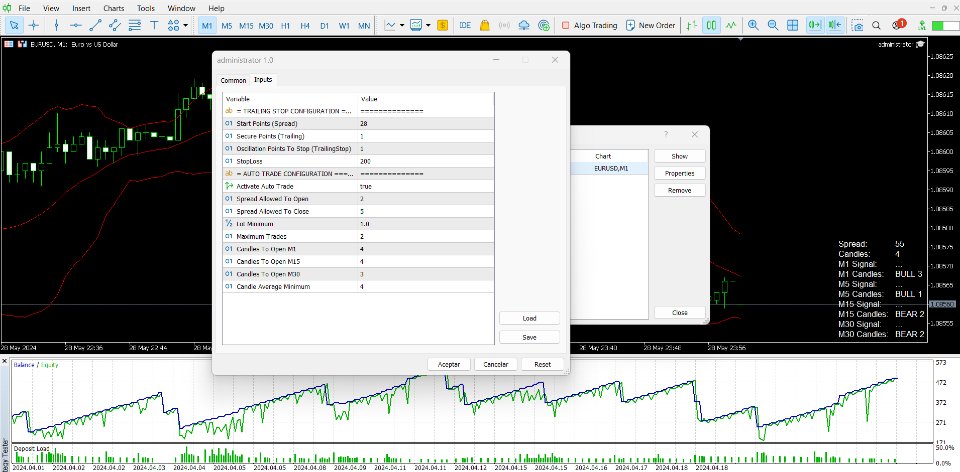

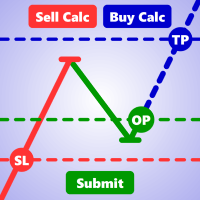

Position Manager:

The first and most important functionality of our Expert Advisor is its ability to efficiently manage open positions. This advanced system works as an enhanced trailing stop, continuously adjusting to the market price to secure positive points or ticks in favor of the user. As the price advances, the trailing stop adjusts dynamically, protecting the accumulated gains. When the market price retraces, the Expert Advisor automatically closes the position, ensuring that the obtained gains are maintained. This functionality not only optimizes the performance of the operations but also provides greater peace of mind to the trader, allowing them to focus on other tasks without missing market opportunities.

- Start Points (Spread): These are the initial points that the manager accumulates first, which can be used to cover the broker's spread or to secure an initial amount of profit before activating the trailing stop.

- Secure Points: This is the number of points that, each time they are reached, the manager automatically adjusts the stop loss to secure those gains. This method allows the consolidation of gains as the market moves in favor of the position, thereby reducing the risk of losses.

- Oscillation Points To Stop: These are the points allowed for the market to oscillate and move against the position before closing the trade. This amount of points defines the margin of fluctuation tolerated before considering that the trend has reversed and it is necessary to exit the position to avoid greater losses.

- Stop Loss: This is the number of points you are willing to lose once the position has entered the market. This value is set to limit the losses in a trade. By setting a stop loss, the maximum acceptable loss level is defined so that if the market moves against the position to that point, the trade is automatically closed. This strategy is crucial for risk management, as it helps prevent excessive losses and protects the investor's capital.

Auto-Trade:

Our Expert Advisor has the ability to operate autonomously, making market entries and exits automatically according to the configurations set at the time of installation. This advanced software is designed to analyze the market, identify trading opportunities, and execute trades based on overbought and oversold trends. It uses technical indicators to detect these market states, optimizing risk management and maximizing potential profits. Its autonomous operation allows traders to take advantage of market opportunities 24 hours a day, even when they cannot be in front of the screen, thus leveraging market fluctuations to achieve favorable results.

- Activate Auto Trade Message Alert: When this functionality is activated, the Expert Advisor will send an audible and visual alert to the MetaTrader 5 trading platform on the computer and a notification to the mobile device if the platform is installed. Each time a possible market entry opportunity is detected according to the configurations established at the time of installation, the user will be notified. This feature allows traders to stay aware of trading opportunities without constantly monitoring the market.

- Activate Auto Trade: When this functionality is activated, the Expert Advisor will automatically enter the market each time a buy or sell opportunity is detected. This allows for more efficient and faster trading, taking advantage of real-time opportunities without manual intervention.

- Spread Allowed To Open: This option sets a maximum spread to execute an automatic buy or sell order. By establishing this limit, it is possible to avoid paying higher commissions when the market presents elevated spreads due to various conditions. This helps keep transaction costs under control.

- Spread Allowed To Close: This option sets a maximum spread to close an open position. Similar to the previous function, it allows avoiding paying higher commissions when the market has wide spreads, thereby protecting the obtained gains and minimizing losses due to excessive commissions.

- Lot Maximum: This option sets the maximum lot size with which the Expert Advisor will enter the market. This allows controlling the size of the positions and effectively managing risk, avoiding excessive exposures in each trade.

- Maximum Trades: This option determines the maximum number of trades that the Expert Advisor can open at the same time or keep active at all times. By limiting the number of simultaneous trades, it is possible to control the overall risk and avoid overexposure in the market.

- Candles To Open M1: This option sets the number of consecutive candles required to determine that the price is at a good entry point when the market is in an overbought or oversold situation in a one-minute timeframe. This parameter helps confirm the trend before making a trade.

- Candles To Open M5: This option sets the number of consecutive candles required to determine that the price is at a good entry point when the market is in an overbought or oversold situation in a five-minute timeframe. It helps to identify entry opportunities more accurately based on price action.

- Candles To Open M15: This option sets the number of consecutive candles required to determine that the price is at a good entry point when the market is in an overbought or oversold situation in a fifteen-minute timeframe. It allows analyzing broader trends and reducing market noise.

- Candles To Open M30: This option sets the number of consecutive candles required to determine that the price is at a good entry point when the market is in an overbought or oversold situation in a thirty-minute timeframe. It provides a broader perspective and helps capture significant market movements.

- Candle Average Minimum To Open: This option sets the minimum average size of the last candles created to consider that it is a good time to enter the market. By setting a candle size threshold, it ensures that entries are made in market conditions with sufficient volatility, thereby increasing the probability of successful trades.

- Number Of Candles To Average: This option sets the number of previous candles that will be taken into account to calculate the average candle size. By determining the reference period, the sensitivity of the Expert Advisor to current market conditions can be adjusted, filtering out potential false signals and improving the precision of entries.

- Bounce Validation: This option activates an experimental functionality that ensures the price is bouncing within a channel continuously before entering the market. This feature avoids entering the market during a trend rally without pauses, reducing the risk of entering positions during extreme and potentially volatile movements. By validating bounces, it aims to operate in more stable and predictable conditions.