Neural Bitcoin Impulse

- エキスパート

- Denys Babiak

- バージョン: 3.2

- アップデート済み: 9 10月 2024

- アクティベーション: 5

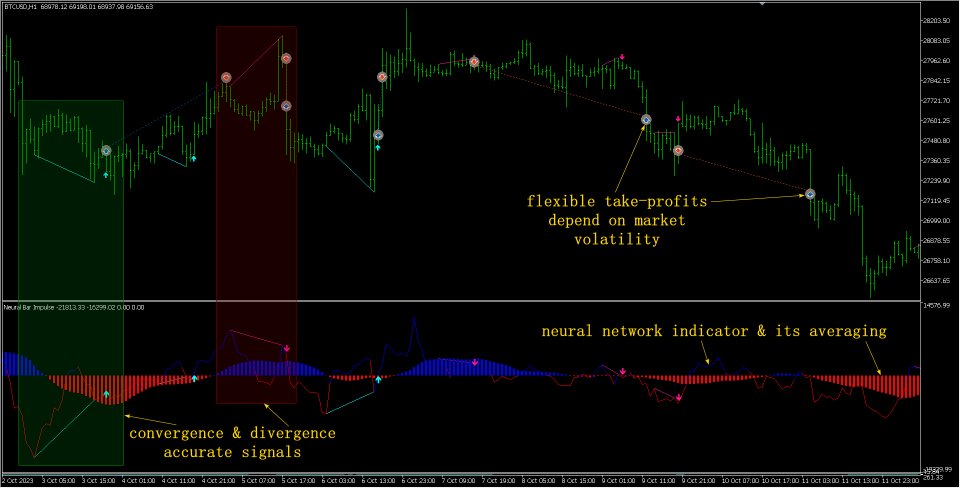

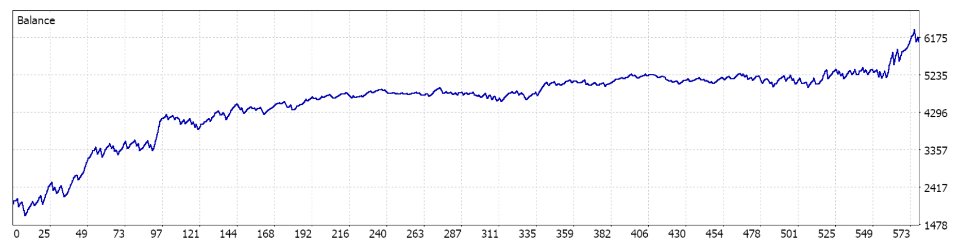

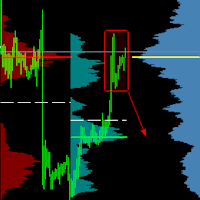

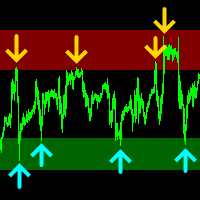

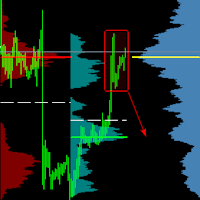

Introducing Neural Bitcoin Impulse - an innovative trading bot created using neural network training technology on voluminous market data sets. The built-in mathematical model of artificial intelligence searches for the potential impulse of each next market bar and uses the resulting patterns of divergence and convergence between the predictive indicators and the price to form high-precision reversal points for opening trading positions.

The trading robot is based on the Neural Bar Impulse indicator that we created earlier. To solve the task of predicting the bar impulse, the indicator uses a Recurrent Neural Network (RNN) with a complex and modern architecture, which combines LSTM layer for analysing dependencies in time series, BatchNormalization and Dropout to stabilize learning and prevent overtraining, as well as fully connected layers to extract higher-level features from the data. Training such a model allows it to capture complex temporal dependencies in currency exchange rate data and make predictions based on these dependencies.

These advantages make the Neural Bitcoin Impulse trading robot a powerful tool for automating and optimizing the trading process in the cryptocurrency market.

- Innovative technology: The robot uses advanced neural network training technology on large amounts of market data, which allows it to analyze information and make decisions based on a deeper understanding of market dynamics.

- High accuracy: Thanks to the inbuilt mathematical model of artificial intelligence and the use of sophisticated data processing algorithms, the robot is able to form highly accurate reversal points for opening trading positions, which can increase the probability of successful trades.

- Timing: The robot uses recurrent neural networks (RNN), which are able to analyze and take into account timing dependencies in market data. This allows it to predict the momentum of market bars based on complex time dependencies, which improves the quality of trading decisions.

- Stabilized learning: The use of Batch Normalization and Dropout techniques in the neural network architecture helps to prevent overtraining of the model and ensure its stable training on a variety of data.

- Efficient use of data: By utilizing large amounts of market data and sophisticated data processing algorithms, the robot is able to extract important attributes from the data and make informed trading decisions.

- Ease of use: The trader does not need to have a deep understanding of the technicalities of the market.

### BOT SETTINGS ### - Bot settings.

ATR Period - ATR indicator period.

Positions Volume - Volume of trading positions.

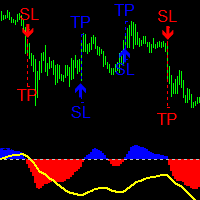

Positions Stop-Loss ATRs - Stop-Loss of trading positions (in ATR values).

Positions Take-Profit ATRs - Take-Profit of trading positions (in ATR values).

Positions Magic Number - Magic number of trading positions.

Positions Comment - Comment of trading positions.

Positions Open In One Side Max Count - Maximum allowed number of trading positions opened in one side.

Positions Min Intervals ATRs - Minimum interval (in ATR values) between trading positions.

Positions Close Current By Contra - Close the current open trading position when a signal appears in the opposite direction: NO_CLOSE - do not close, CLOSE_IN_PLUS - close only if the current position is in plus, CLOSE_ALWAYS - close always.

Positions Averaging - Averaging trading positions.

Positions Averaging Volume Multiplier - The volume multiplier of each next averaging trading position relative to the previous one.

Stop-Kran Max Drawdown -$ - Maximum drawdown (the sum of profit of all open and closed trading positions) for Stop-Kran (emergency closing of all open positions).

Stop-Kran Start Date - Date from which the sum of profit of closed trading positions for Stop-Kran starts counting.

Tester Interval Months - Number of months to break down the deposit curve into intervals and analyze during tester optimization.

Tester Drawdown Exponent - Exponent for calculating the optimization criterion in the strategy tester.

Tester Interval Months - Number of months to break down the deposit curve into intervals and analyze during tester optimization.

Tester Drawdown Exponent - Exponent for calculating the optimization criterion in the strategy tester.

### INDICATOR SETTINGS ### - Indicator (Neural Bar Impulse) settings.

=== RATES HISTORY CALCULATIONS === - Calculation of historical bars settings.

Calculate History From Bar Shift - History bar number from which the indicator calculation begins.

Calculate History From Bar DateTime - Date/time of the history bar from which the indicator calculation begins.

=== MOVING AVERAGE === - Moving average settings.

Averaging Period - Averaging period (based on the indicator).

=== DIVERGENCE === - Divergence settings.

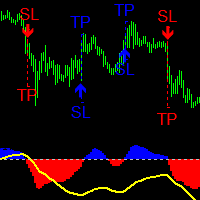

Divergence By... - How we build divergence: DIVERGENCE_BY_INDICATOR - on the extreme values of the indicator, DIVERGENCE_BY_AVERAGING - on the extreme values of the averaging.

Indicator Extremums Min. Height % - The minimum height of the indicator extremum in order to consider it a top and use it to draw divergence lines on the indicator chart.

Indicator Extremums Min. Deviation % - Minimum deviation between two indicator extremes. The higher the value, the greater the slope of the divergence lines, that is, the steeper the declines/rises between extremes on the indicator chart.

Price Extremums Min. Deviation % - Same as in the previous parameter, only for price extremes, not the indicator.