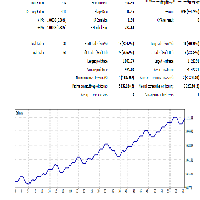

RSI Snowball Martingale

- エキスパート

- Rachyut Senakool

- バージョン: 777.999

- アップデート済み: 18 4月 2024

Expert Advisor (EA) that utilizes the basic Dow Theory strategy along with RSI for opening positions, and employs support and resistance levels from the Zigzag indicator as stop-loss and take-profit points, you can follow these guidelines:

-

Dow Theory Strategy: This involves analyzing trends using the Dow Theory principles, mainly focusing on identifying primary trends (bullish or bearish) and secondary trends (corrections). You'll need to implement rules for identifying these trends based on price action.

-

RSI for Confirmation: Relative Strength Index (RSI) can be used as a confirmation tool. For example, you might open a buy position when the price is in an uptrend according to Dow Theory and RSI is below a certain oversold threshold (e.g., RSI < 30), indicating potential buying opportunities.

-

Zigzag Indicator for Support and Resistance: The Zigzag indicator helps in identifying significant highs and lows in the price movement. You can use these levels as potential stop-loss and take-profit points. For instance, set stop-loss just below the recent swing low for long positions and take-profit at the nearest swing high.

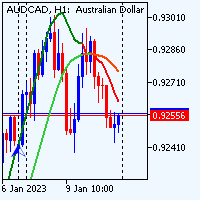

Currency pair: XAUUSD

Timeframe: M15

deposit : $100

Account type: Standard

Brokers : Exness (https://one.exnesstrack.net/a/t5m9v5m9)

When you resister Exness account please fill Partner code: t5m9v5m9 for commission pay back 50% (rebate)

it's ok....