SterlingSniperBot

- エキスパート

- Diego Trigueros Makabe

- バージョン: 1.0

SterlingSniperBot is an advanced trading algorithm meticulously designed for the GBP/USD currency pair, specifically tailored to operate on 4-hour bars and synchronize seamlessly with brokers in the UTC+2 time zone. This sophisticated bot stands out as a precision instrument in the world of forex trading.

Key Features:

-

Timeframe Optimization: Operating exclusively on 4-hour bars, SterlingSniperBot focuses on capturing strategic trading opportunities within this specific time frame, aligning with the unique characteristics of the GBP/USD pair.

-

Market Insight: The bot's decision-making process is initiated during the opening of a new 4-hour bar, where it meticulously analyzes market conditions. Its discerning eye is tuned to rising highs and falling opens, enabling it to identify potential entry points with precision.

-

Strategic Entry Execution: SterlingSniperBot executes long entry signals with surgical precision. It calculates optimal entry, stop-loss, and profit-target prices, leveraging indicators meticulously tuned for the GBP/USD pair. This strategic approach ensures that the bot captures potential upside movements while effectively managing risk.

-

Tailored for GBP/USD: SterlingSniperBot is specifically calibrated for the GBP/USD pair, considering its unique behavior and characteristics. This targeted approach enhances the bot's effectiveness in navigating the intricacies of this particular currency pair.

-

Precision Instrument: The name SterlingSniperBot reflects its character as a precision instrument in forex trading. It embodies accuracy, discipline, and a calculated approach to capitalize on market opportunities.

Traders utilizing SterlingSniperBot benefit from a comprehensive solution that combines strategic trading, precision execution, and risk management excellence, all geared towards maximizing success in the ever-evolving forex market.

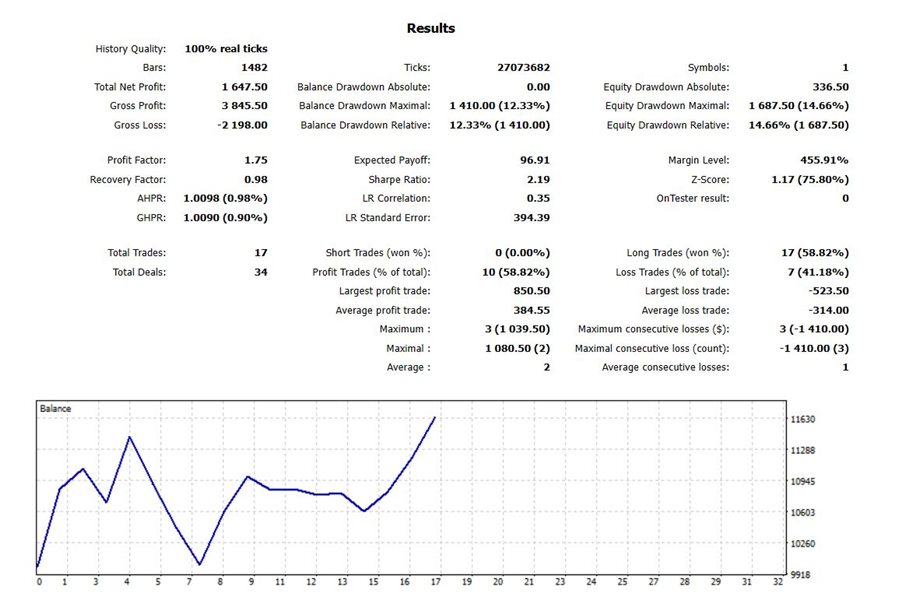

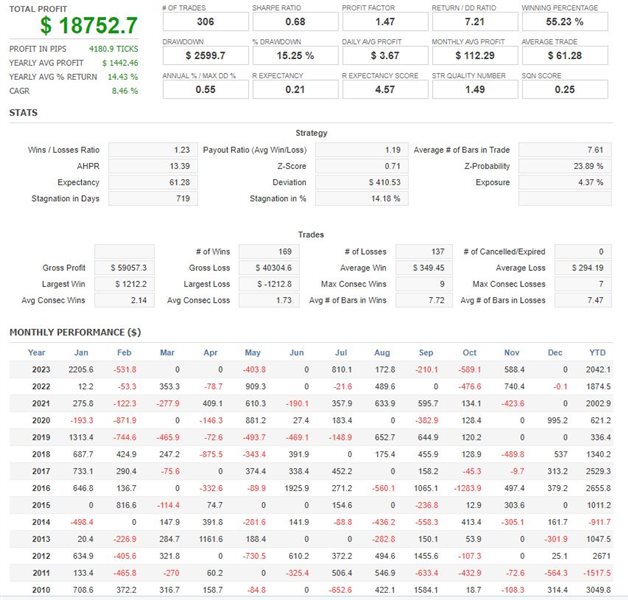

We have tested this strategy from 2010 until 2023 December with UTC+2 broker. with a lot of 0.5 in an account of 10 000 USD.

The provided test results reveal the performance metrics of a trading strategy. Here's an analysis of the key statistics , see the screenshots attached:

Profitability:

- Total Profit: $18,752.7

- Profit in Pips: 4,180.9

- Yearly Average Profit: $1,442.46

- Yearly Average % Return: 14.43%

- Compound Annual Growth Rate (CAGR): 8.46%

Trade Metrics:

- Number of Trades: 306

- Winning Percentage: 55.23%

- Profit Factor: 1.47

- Return/Drawdown Ratio: 7.21

Risk and Drawdown:

- Drawdown: $2,599.7

- % Drawdown: 15.25%

Average Profits:

- Daily Average Profit: $3.67

- Monthly Average Profit: $112.29

Trade Size and Expectancy:

- Average Trade: $61.28

- Annual % / Max DD %: 0.55

- R Expectancy: 0.21

- R Expectancy Score: 4.57

Advanced Metrics:

- Sharpe Ratio: 0.68

- SQN Score: 0.25

Trade Analysis:

- Wins/Losses Ratio: 1.23

- Payout Ratio (Avg Win/Loss): 1.19

- Average # of Bars in Trade: 7.61

- Largest Win: $1,212.2

- Largest Loss: -$1,212.8

- Max Consecutive Wins: 9

- Max Consecutive Losses: 7

Expectancy and Exposure:

- Expectancy: $61.28

- Exposure: 4.37%

Stagnation:

- Stagnation in Days: 719

- Stagnation in %: 14.18%

These metrics collectively provide a comprehensive overview of the trading strategy's performance, including its profitability, risk management, and trade characteristics. The strategy demonstrates a positive profit trajectory, albeit with fluctuations, and additional insights can be gained by further examining metrics like the Sharpe Ratio, Expectancy, and trade analysis details.