LVL Creator Pro

- エキスパート

- LVL Invest

- バージョン: 14.3

- アップデート済み: 30 12月 2023

- アクティベーション: 10

Build your own trading strategy using the combination of indicators you want from those offered (each indicator can be used up to 2 times) in addition to a few personal touches:

-

Average True Range

-

Bollinger Bands

-

Ichimoku Kumo Breakout

-

Ichimoku Tenkan Sen Kijun Sen Cross (TKC)

-

MACD

-

MFI

-

Mobile Average

-

RSI

-

SAR

-

Stochastic

-

Double Mobile Average

-

Triple Mobile Average

Other free expert advisors are available in my personal space as well as signals, do not hesitate to visit and leave a comment, it will make me happy and will make me want to offer content.

Expert advisors currently available:

- LVL Creator

- LVL Bollinger Bands

- LVL RSI mt5

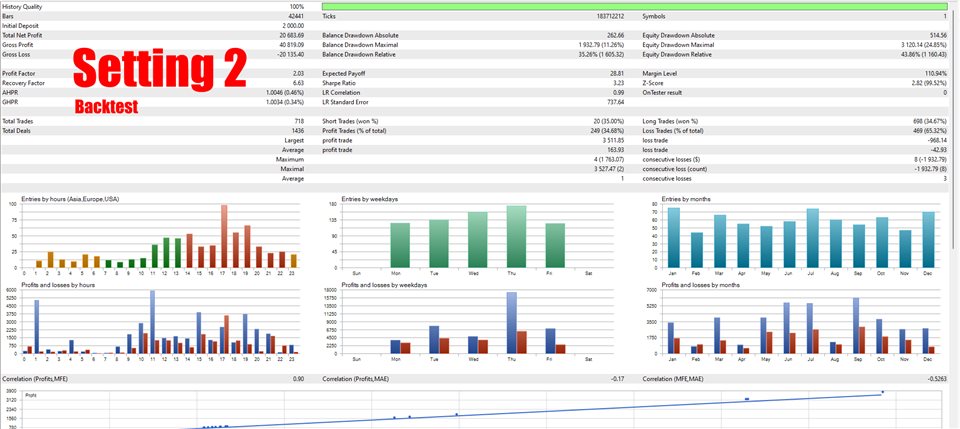

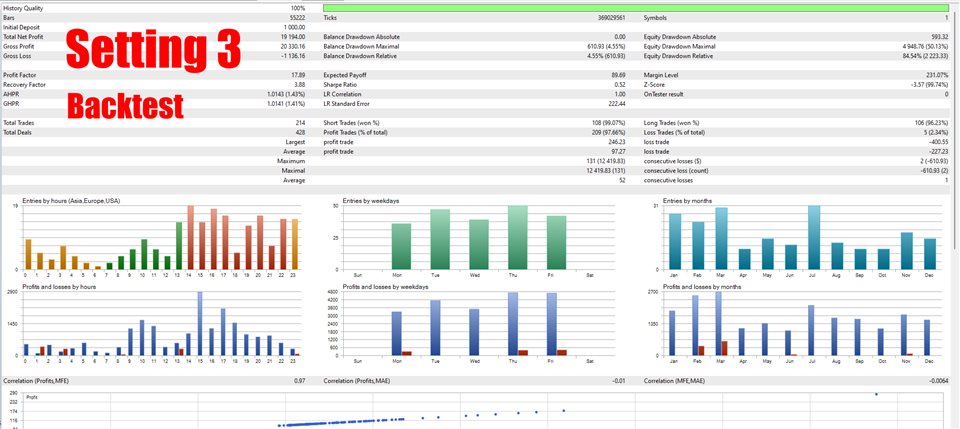

Please, send me a message after your purchase (mention the version of the EA), I will send you setting files (only for this version).

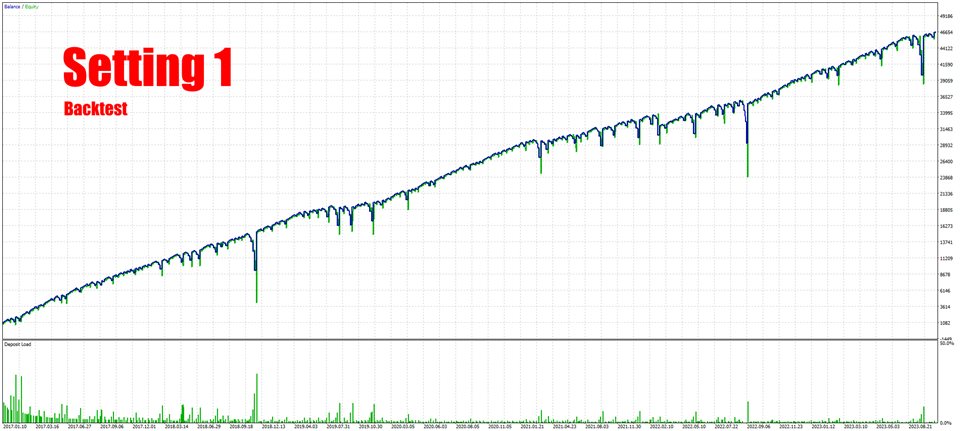

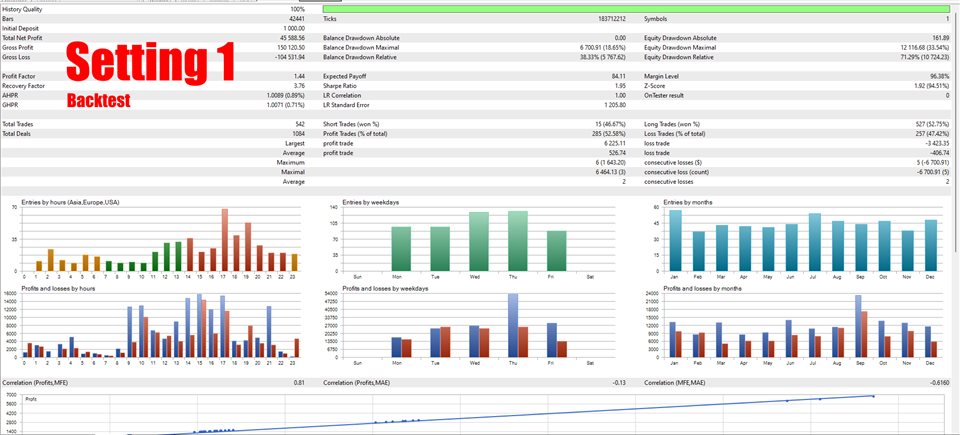

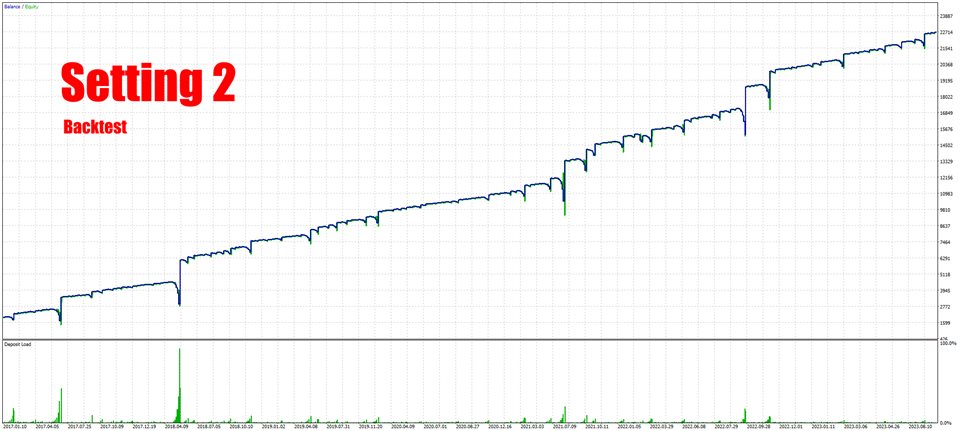

Trading is not a magic solution, so before using this expert on a live account, carry out your back tests and tests on a demo account.

When you will use that expert advisor on a live account, don't hesitate to share your account link with me, I would be delighted to follow your results.

. Suggested symbols:

-

EURUSD

-

USDCHF

-

USDJPY

. Definition of parameters:

Values between parentheses mean the default values of the indicators.

-

Risk Management

-

Allocation Type: how the allocation is calculated

-

Size: size value depending of the allocation type

-

Stop Loss

-

Use stop loss when opening order: true to set a stop loss while opening a position, false otherwise

-

Use trailing stop loss: true to use a trailing stop loss, false otherwise

-

Stop loss type: stop loss type to use

-

Stop loss value: stop loss value to use

-

Take Profit

-

Use take profit: true to set a take profit while opening a position, false otherwise

-

Take profit type: take profit type to use

-

Take profit value: take profit to use

-

Settings

-

Reverse trades: true to open the opposite type of position provided by the strategy, false otherwise

-

Close all positions and switch off the EA: true to close all open positions and switch off the expert advisor

-

Magic number: magic number to open positions

-

Trading Hours

-

Trading start hour: the time from which the EA can open a position

-

Trading end hour: the time from which the EA closes a position

-

Trading Days

-

Monday: true open a position on Monday, false otherwise

-

Tuesday: true open a position on Tuesday, false otherwise

-

Wednesday: true open a position on Wednesday, false otherwise

-

Thursday: true open a position on Thursday, false otherwise

-

Friday: true open a position on Friday, false otherwise

-

Saturday: true open a position on Saturday, false otherwise

-

Sunday: true open a position on Sunday, false otherwise

-

Trades

-

Close all positions every day: true to close all positions every day at the time corresponding to “Trading end hour”, false otherwise

-

Close all positions on Friday: true to close all positions on every Friday at the time corresponding to “Trading end hour”, false otherwise

-

Open buy positions: true to authorise the EA to open buy positions, false otherwise

-

Open sell positions: true to authorise the EA to open sell positions, false otherwise

-

Position Management

-

Position management: type of position management (none, martingale or grid)

-

Coefficient type: if the new lot size is an addition or a multiplication from the last lot size

-

Coefficient management: the value to add or multiply to calculate the new lot size

-

Max number of positions: the maximum number of positions in case of grid

-

Min distance between positions: the minimum distance in points between the last and the new position

-

Average True Range

-

Number of ATR to use: number of ATR to use

-

ATR timeframe short: timeframe of the first ATR

-

ATR timeframe long: timeframe of the second ATR (useless if 1 ATR)

-

Mobile Average Period: period

-

Value for high volatility: averaging period

-

Bollinger Bands

-

Number of Bollinger Bands to use: number of Bollinger Bands to use

-

Bollinger Bands timeframe short: timeframe of the first Bollinger Bands

-

Bollinger Bands timeframe long: timeframe of the second Bollinger Bands (useless if 1 Bollinger Bands)

-

Mobile average period: period for average line calculation

-

Mobile average shift: horizontal shift of the indicator

-

Deviation: number of standard deviations

-

Ichimoku Kumo BO

-

Number of Ichimoku Kumo BO to use: number of Ichimoku Kumo BO to use

-

Ichimoku Kumo BO timeframe short: timeframe of the first Ichimoku Kumo BO

-

Ichimoku Kumo BO timeframe long: timeframe of the second Ichimoku Kumo BO (useless if 1 Ichimoku Kumo BO)

-

Tenkan Sen: period of Tenkan-sen

-

Kijun Sen: period of Kijun-Sen

-

Senkoun-Span: period of Senkou-Span

-

Ichimoku TKC

-

Number of Ichimoku TKC to use: number of Ichimoku TKC to use

-

Ichimoku TKC timeframe short: timeframe of the first Ichimoku TKC

-

Ichimoku TKC timeframe long: timeframe of the second Ichimoku TKC (useless if 1 Ichimoku TKC)

-

Tenkan Sen: period of Tenkan-sen

-

Kijun Sen: period of Kijun-Sen

-

Senkoun-Span: period of Senkou-Span

-

MACD

-

Number of MACD to use: number of MACD to use

-

MACD timeframe short: timeframe of the first MACD

-

MACD timeframe long: timeframe of the second MACD (useless if 1 MACD)

-

Period of the fast mobile average: period for Fast average calculation

-

Period of the slow mobile average: period for Slow average calculation

-

Signal of the period: period for their difference averaging

-

MACD value to open a buy: MACD value to open a buy position

-

MACD value to open a sell: MACD value to open a sell position

-

MFI

-

Number of MFI to use: number of MFI to use

-

MFI timeframe short: timeframe of the first MFI

-

MFI timeframe long: timeframe of the second MFI (useless if 1 MFI)

-

Period of the mobile average: averaging period

-

MFI value to open a buy: MFI value to open a buy position

-

MFI value to open a sell: MFI value to open a sell position

-

RSI

-

Number of RSI to use: number of RSI to use

-

RSI timeframe short: timeframe of the first RSI

-

RSI timeframe long: timeframe of the second RSI (useless if 1 RSI)

-

Period of the mobile average: averaging period

-

RSI value to open a buy: RSI value to open a buy position

-

RSI value to open a sell: RSI value to open a sell position

-

SAR

-

Number of SAR to use: number of SAR to use

-

SAR timeframe short: timeframe of the first SAR

-

SAR timeframe long: timeframe of the second SAR (useless 1 SAR)

-

Price increment step - acceleration factor: maximum value of step

-

Stochastic

-

Number of Stochastic to use: number of Stochastic to use

-

Stochastic timeframe short: timeframe of the first Stochastic

-

Stochastic timeframe long: timeframe of the second Stochastic (useless 1 Stochastic)

-

K Period: K-Period

-

D Period: D-Period

-

Slowing: final smoothing

-

Stochastic value to open a buy: Stochastic value to open a buy position

-

Stochastic value to open a sell: Stochastic value to open a sell position

-

Double EMA

-

Number of double EMA to use: number of Double EMA to use

-

Double EMA timeframe short: timeframe of the first Double EMA

-

Double EMA timeframe long: timeframe of the second Double EMA (useless if 1 Double EMA)

-

Horizontal shift: horizontal shift

-

Average period of the mobile average: averaging period

-

Triple EMA

-

Number of triple EMA to use: number of triple EMA to use

-

Triple EMA timeframe short: timeframe of the first triple EMA

-

Triple EMA timeframe long: timeframe of the second triple EMA (useless if 1 EMA)

-

Horizontal shift: horizontal shift

-

Averaging period of the first mobile average: averaging period of the first mobile average

-

Averaging period of the second mobile average: averaging period of the second mobile average

-

Averaging period of the third mobile average: averaging period of the third mobile average