DAX H1 3stars MT5

- エキスパート

- Marek Kupka

- バージョン: 1.0

- アクティベーション: 5

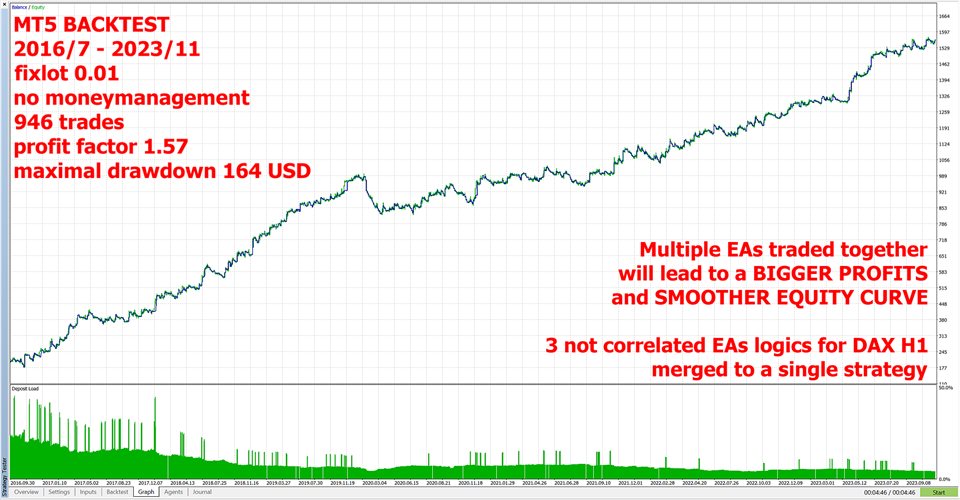

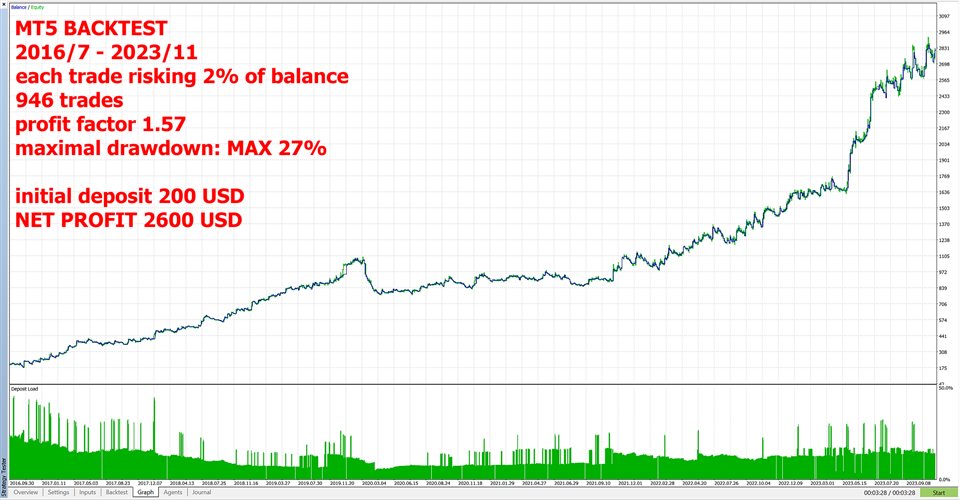

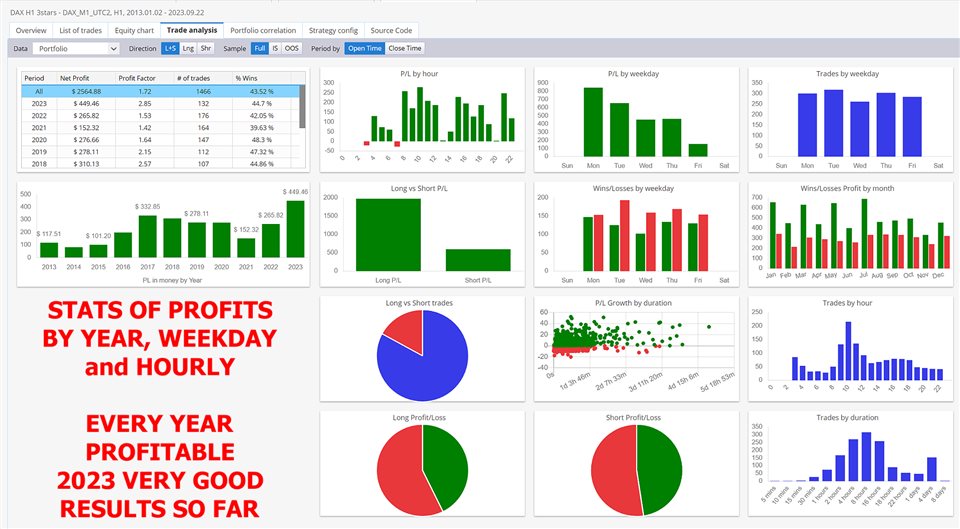

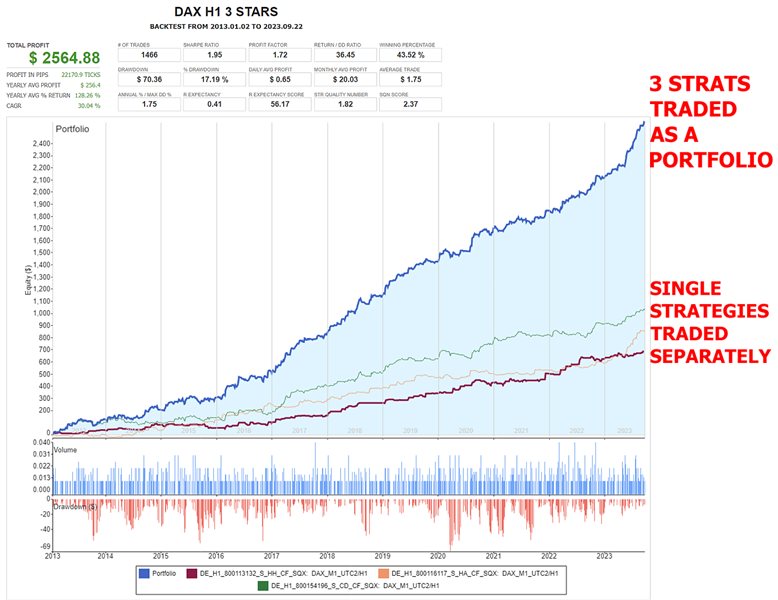

This PORTFOLIO of 3 strategies has been developed, tested and traded live on DAX H1 timeframe.

Multiple EAs traded together will lead to a BIGGER PROFITS and SMOOTHER EQUITY CURVE.

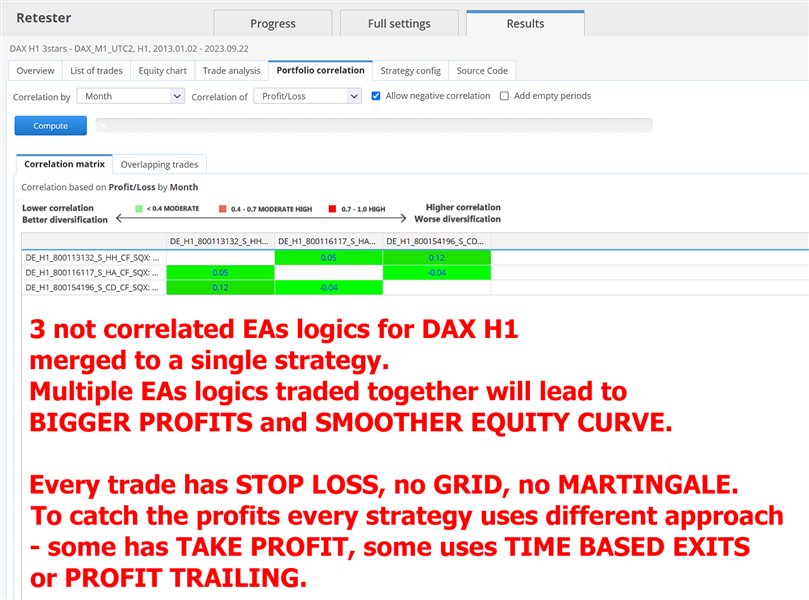

3 not correlated EAs logics for DAX H1 timeframe merged to a single strategy. Very SIMPLE STRATEGIES with only FEW PARAMETERS. Every trade has his own logic for STOP LOSS. To catch the profits every strategy uses different approach - some has TAKE PROFIT, some uses TIME BASED EXITS or PROFIT TRAILING.

- EA has been backtested on more than 14-year long tick data with 99% quality of modeling.

- Everything is already set up for DAX H1 timeframe. There is no need to set up parameters, all settings are already optimized and fine-tuned.

- You need to set only the Fixed Lotsize (or Risk Fixed % Of Balance) depending on the amount of capital in relation to the expected risk

- At 9:00 pm we are closing trading every Friday to prevent from weekly gaps. !!!Adjust this time to your broker time. Preset values are for UTC+2 only!!!

For every candle the pending orders are modified to adapt the market behavior. The enclosed screenshots demonstrate the complexity and coverage of the tests which every strategy of mine must fulfill:

- System parameter permutation - method how to reasonably estimate the long-run expected performance of a trading system.

- Correlation check - to the portfolio are added only noncorrelated strategies with different logics. So the equity curve of the portfolio is smoother and profits are bigger.

- IS/OOS tests.

- Slippage test.

- Test on lower and higher timeframe.

- Monte Carlo Robustness tests:

- Simulations of Randomize trades order.

- Randomly skip trades.

- Randomize strategy parameters.

- Randomize history data - volatility change.

- Sensitivity for spread and slippage.

- Walk forward matrix - verify how the strategy is adaptable to a big range of market conditions.

My recommendation is to have a look at the rest of my products, because the benefits of portfolio are diversification through the markets, timeframes, etc. Portfolio of strategies works better together in combination.

A broker with a small spread and slippage is recommended for better performance. There is no need to use a large account.

Features:

- Each trade is protected by Stop Loss.

- No martingale, no grid, no scalp, no hedge, no latency, no arbitrage.

- No excessive consumption of CPU resources.

- User-friendly settings.

- All settings optimized.

- Long-term strategy.

If you have any questions, please contact me before buying.

Settings:

- Magicnumber = 800113132 - trade ID.

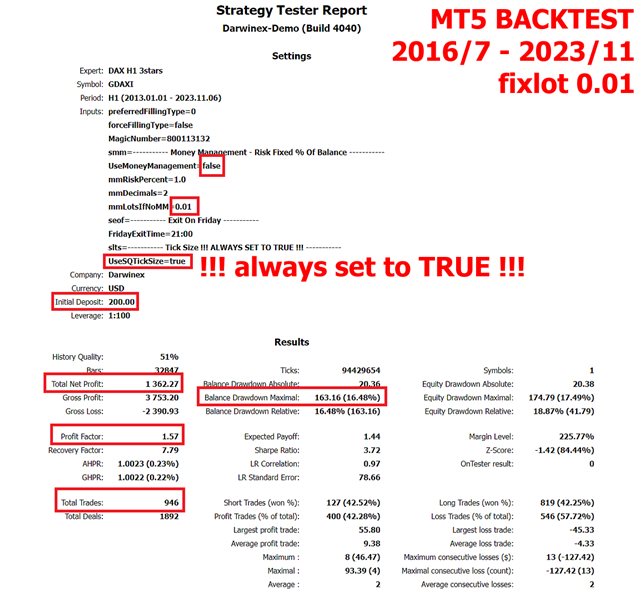

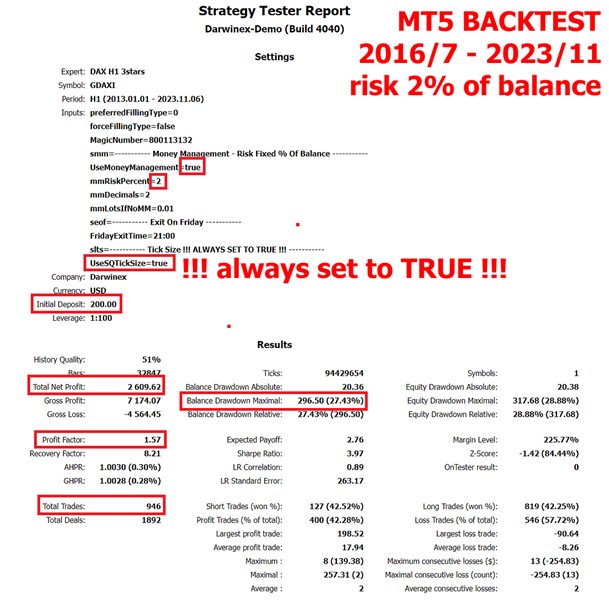

- UseMoneyManagement = false/true - if you want to trade only fixedlots use FALSE. If you want to risk % of balance you need to set this to TRUE.

- mmRiskPercent = 1 - If UseMoneyManagement is set to TRUE, you set the risk in Fixed Percentage of balance.

- mmDecimals = 2 - If UseMoneyManagement is set to TRUE, you need to set lotsize step accordingly to your broker settings. If you can trade 0.01/0.02 lots, your decimals is 2, if you can trade 0.1/0.2 lots, you need to set decimals to 1.

- mmLotsIfNoMM = 0.01 - If UseMoneyManagement is set to FALSE, you set the Fixed Lotsize here.

- FridayExitTime = 21:00 - Every trade will be closed at this time every Friday to prevent weekly gaps. This time is UTC+2, adjust this time by your broker timezone.

- UseSQPipSize = false/true - ALWAYS SET THIS TO TRUE.