IPDA Standard Deviations

- インディケータ

- Minh Truong Pham

- バージョン: 1.0

- アクティベーション: 5

> Introduction and Acknowledgements

The IPDA Standard Deviations tool encompasses the Time and price relationship as studied by Dexter's .

I am not the creator of this Theory, and I do not hold the answers to all the questions you may have; I suggest you to study it from Dexter's tweets, videos, and material.

> Tool Description

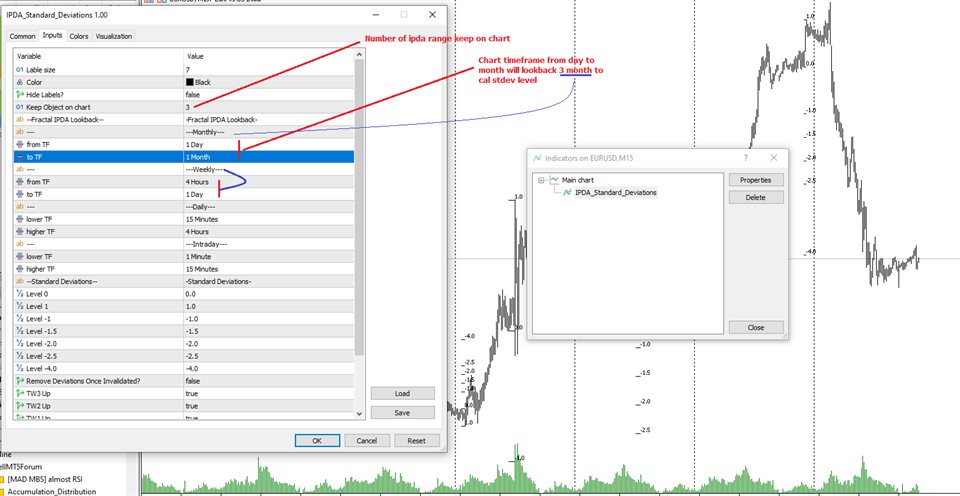

This is purely a graphical aid for traders to be able to quickly determine Fractal IPDA Time Windows, and trace the potential Standard Deviations of the moves at their respective high and low extremes.

The disruptive value of this tool is that it allows traders to save Time by automatically adapting the Time Windows based on the current chart's Timeframe, as well as providing customizations to filter and focus on the appropriate Standard Deviations.

> IPDA Standard Deviations by TraderDext3r

The underlying idea is based on the Interbank Price Delivery Algorithm's lookback windows on the daily chart as taught by the Inner Circle Trader:

IPDA looks at the past three months of price action to determine how to deliver price in the future.

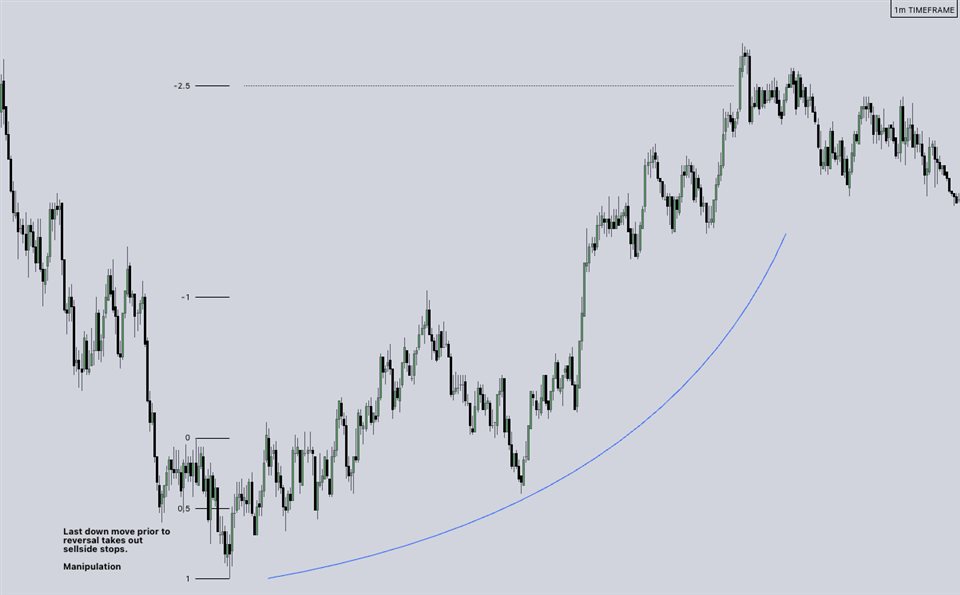

Additionally, the ICT concept of projecting specific manipulation moves prior to large displacement upwards/downwards is used to navigate and interpret the priorly mentioned displacement move. We pay attention to specific Standard Deviations based on the current environment and overall narrative.

Dexter being one of the most prominent Inner Circle Trader students, harnessed the fractal nature of price to derive fractal IPDA Lookback Time Windows for lower Timeframes, and studied the behaviour of price at specific Deviations.

For Example:

- The -1 to -2 area can initiate an algorithmic retracement before continuation.

- The -2 to -2.5 area can initiate an algorithmic retracement before continuation, or a Smart Money Reversal.

- The -4 area should be seen as the ultimate objective, or the level at which the displacement will slow down.

> Fractal IPDA Time Windows

The IPDA Lookbacks Types identified by Dexter are as follows:

Monthly – 1D Chart: one widow per Month, highlighting the past three Months.

Weekly – 4H to 8H Chart: one window per Week, highlighting the past three Weeks.

Daily – 15m to 1H Chart: one window per Day, highlighting the past three Days.

Intraday – 1m to 5m Chart: one window per 4 Hours highlighting the past 12 Hours.

Inside these three respective Time Windows, the extreme High and Low will be identified, as well as the prior opposing short term market structure point. These represent the anchors for the Standard Deviation Projections.