Seasonal Pattern Trader

- エキスパート

- Dominik Patrick Doser

- バージョン: 1.6

- アップデート済み: 21 12月 2023

- アクティベーション: 10

Disclaimer: Keep in mind that seasonal patterns are not always reliable. Therefore, thoughtful risk management is crucial to minimize losses.

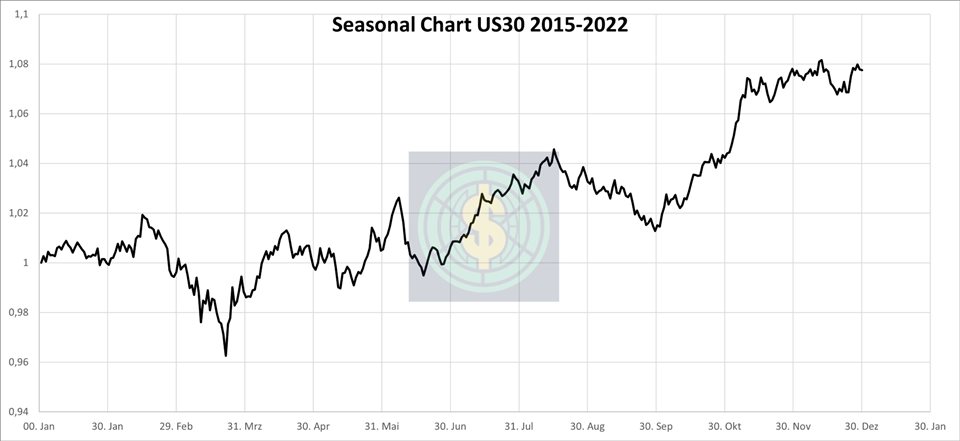

Seasonal patterns in the financial world are like a well-guarded secret that successful investors use to their advantage. These patterns are recurring price movements that occur during specific periods or around special events. Additionally, there are also intraday patterns that repeat. For example, Uncle Ted from Forex Family suggests examining previous days and weeks to identify and apply patterns, much like what Raja Banks and DonVo do on a daily basis. However, this Expert Advisor is specifically designed to trade patterns that last for more than 10 days.

Here are some examples and guidelines for making the most of these patterns:

Example 1: The "Santa Claus Rally" in December

In December, the S&P 500 Index often experiences the so-called "Santa Claus Rally." The positive sentiment among investors before the year-end leads to an increase. Investors can benefit from this rally by investing at the right time.

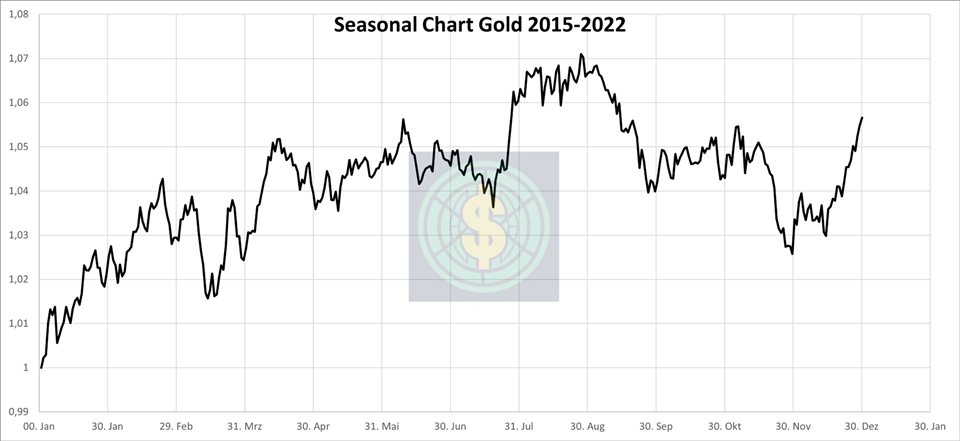

Example 2: Gold in January

Gold prices exhibit a seasonal pattern by rising in January. This increase is due to the heightened demand for gold as a hedge against inflation or uncertainty in the new year.

How can seasonal patterns be optimally used?

Historical data analysis: Analyze historical price developments to identify seasonal patterns.

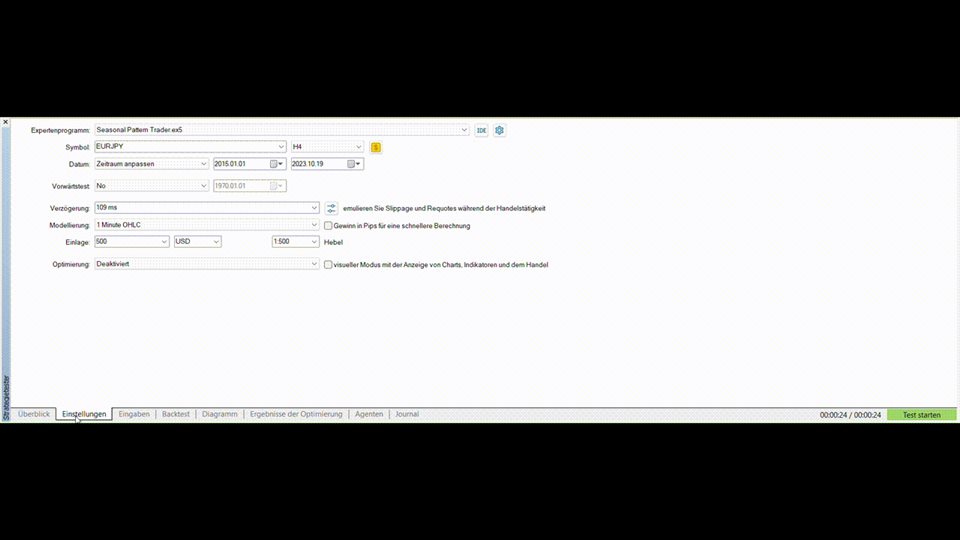

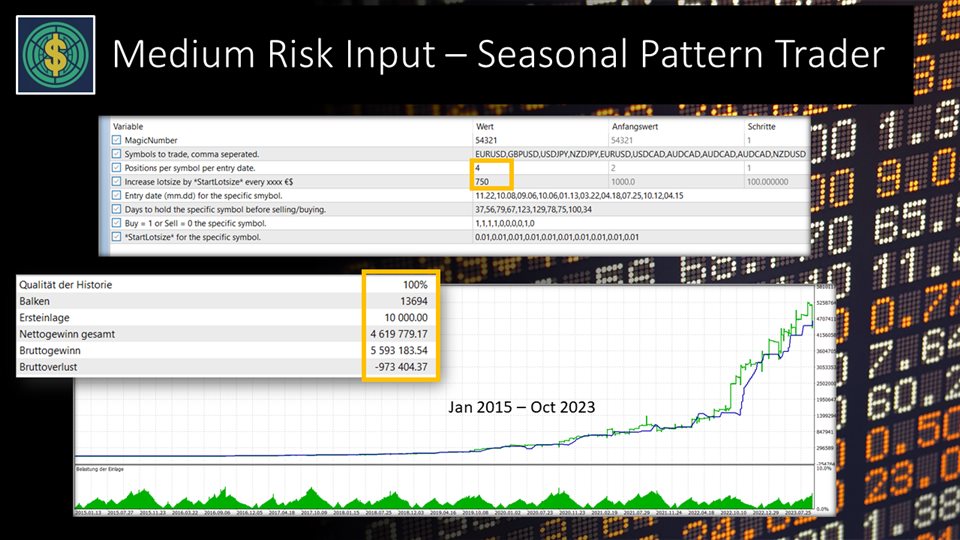

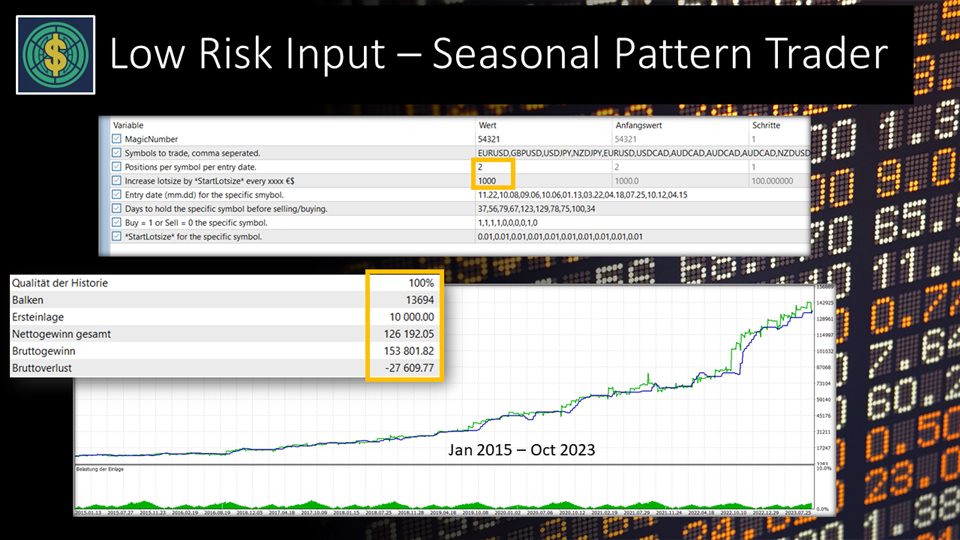

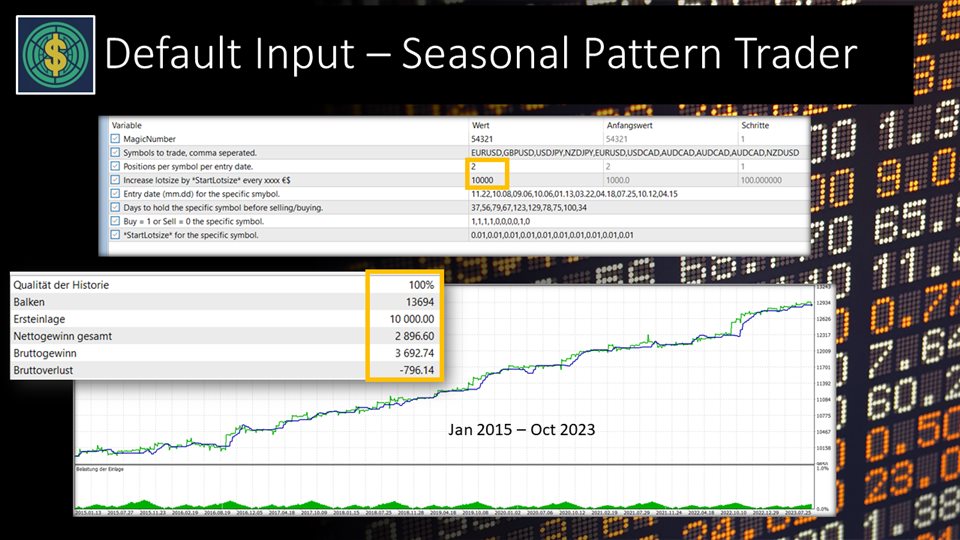

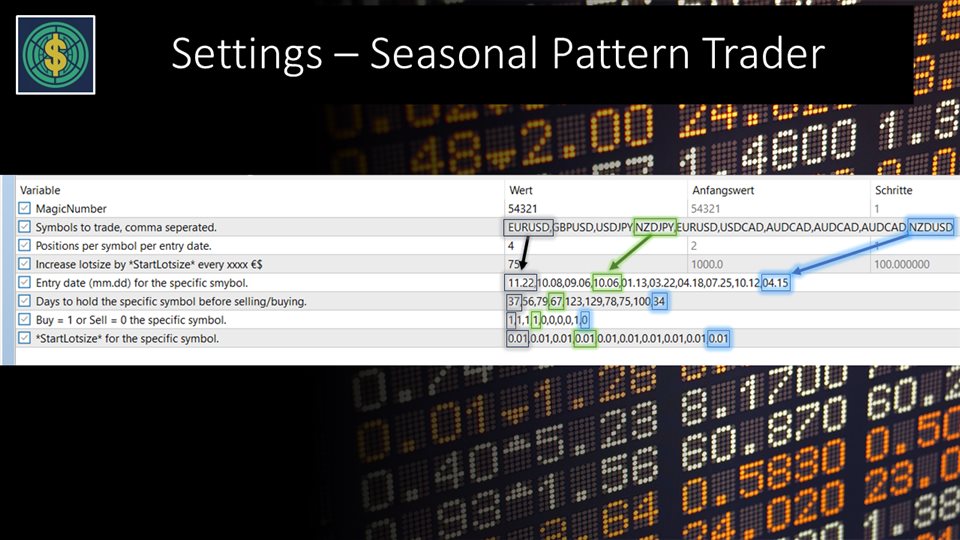

Seasonal patterns provide astute investors with an excellent opportunity to refine their investment strategies and take advantage of potential trading opportunities. We have developed an Expert Advisor that automates buying or selling at a time you set and then holds for a specified period. A great resource to find seasonal patterns is: Seasonax, TradeMiner or you are doing your own analysis with an excel sheet.