COG LR Osc AM

- インディケータ

- Andriy Matviyevs'kyy

- バージョン: 26.0

- アクティベーション: 10

The presented indicator allows you to determine potential entry points into the market and set protective orders at reasonable levels.

This product can be useful for both beginners and experienced traders.

The indicator is based on calculation methods proven by time and practicing traders.

The indicator is calculated in two stages:

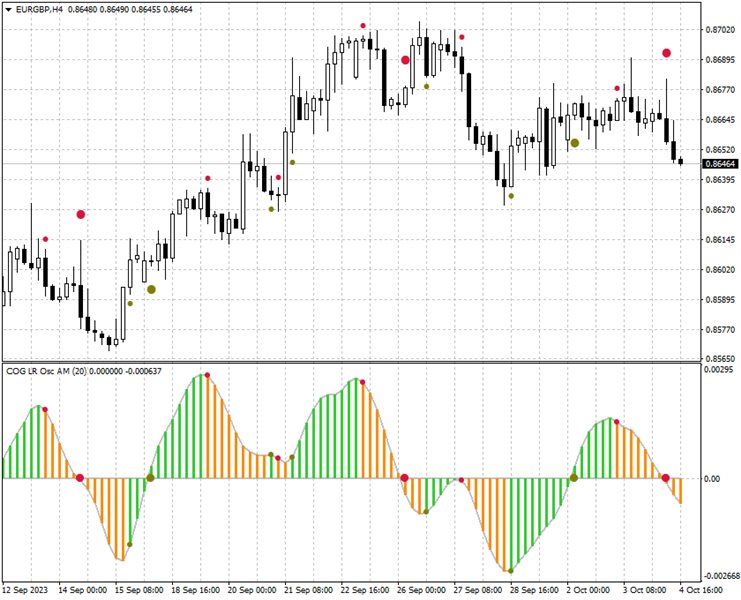

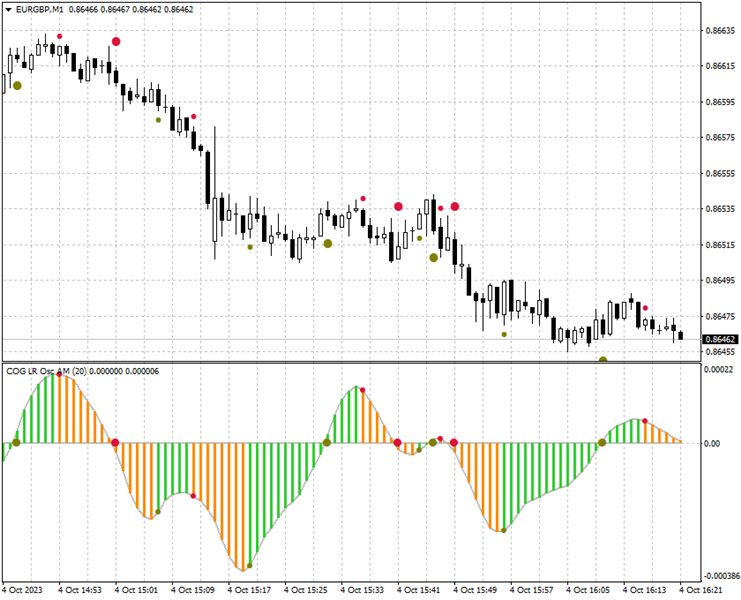

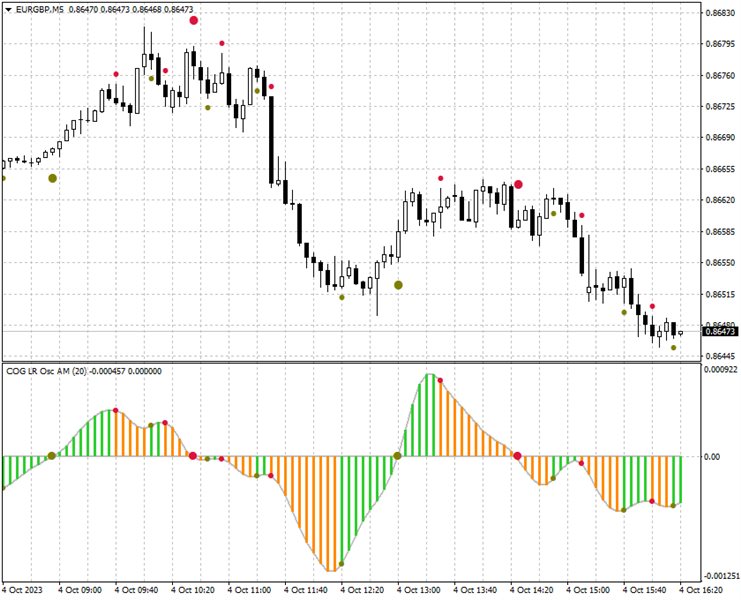

At the first stage, linear regression (LR) of the selected price type is determined for a given number of chart periods.

At the second stage, the obtained data is processed by the method proposed by J. F. Ehlers - the method of constructing the center of gravity (COG).

According to J.F. Ehlers, the center of gravity has essentially zero lag and allows turning points to be clearly defined.

Using the indicator:

- It should be taken into account that the values of the indicator on the zero bar (which has not finished forming yet) may change, so decisions should be made after the end of the bar formation, at the moment of opening a new zero bar.

- Confirmation of the indicator signals is usually the price breaking the high (for buying) or low (for selling) of the bar on which the signal was given.

- As a signal, the indicator crosses the zero line. When the zero line is crossed by the indicator from top to bottom, a sell signal is given, when from the bottom up, a buy signal is given.

- The second type of signal is a fall or rise in the indicator values. If the indicator values begin to decline after growth, this is a sell signal. If the indicator values begin to grow after falling, this is a signal to buy.

- The mark on the price chart is a reasonable level for setting a protective stop order or reversal order.