Fibonacci Trend Tracker

- エキスパート

- Luiz Felipe De Oliveira Caldas

- バージョン: 1.0

- アクティベーション: 20

An expert advisor (EA) is an automated trading system designed to execute trades on behalf of traders in the financial markets. In the context of a buy and sell grid system of levels breakout, the EA is programmed to identify key price levels and initiate buy or sell trades when those levels are broken.

Here's a step-by-step description of how such an EA might work:

-

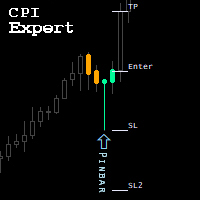

Level Identification: The EA identifies significant price levels on the chart, such as support and resistance levels or trendlines. These levels act as reference points for potential breakouts.

-

Grid Formation: The EA establishes a grid of buy and sell levels above and below the current price. The spacing between these levels can be predetermined or dynamically adjusted based on market conditions and the trader's preferences.

-

Breakout Detection: The EA continuously monitors the price movement and compares it to the established levels. When the price breaks above a resistance level or below a support level, it triggers a breakout signal.

-

Trade Execution: Upon detecting a breakout, the EA automatically executes trades based on the predefined rules. For instance, if the price breaks above a resistance level, the EA may initiate a buy trade. Conversely, if the price breaks below a support level, a sell trade may be initiated.

-

Grid Management: As trades are executed, the EA manages the grid by adjusting the levels and spacing. It may close profitable trades at predefined targets or use trailing stop-loss orders to protect gains. Additionally, the EA may open new trades at new grid levels as the price continues to move in a particular direction.

-

Risk Management: A well-designed EA incorporates risk management strategies to control exposure. It may include features like position sizing, stop-loss orders, or maximum risk limits to protect the trading account from excessive losses.

-

Monitoring and Optimization: The EA continually monitors the market conditions, including price movements, volatility, and other relevant factors. It can be programmed to adapt its trading strategy, such as adjusting grid levels or spacing, based on real-time market data. Traders can also optimize the EA's parameters using historical data to enhance its performance.

It's important to note that the effectiveness of any EA, including a buy and sell grid system of levels breakout, depends on various factors, such as market conditions, the quality of price levels identified, risk management parameters, and the trader's overall trading strategy. Traders should thoroughly test and validate any EA before using it with real funds in live trading.