Orions WPR

- エキスパート

- Umberto Boria

- バージョン: 1.1

- アップデート済み: 30 6月 2023

06/30/23 v1.1 New features.

Read before operate.

Remarkable configurations:

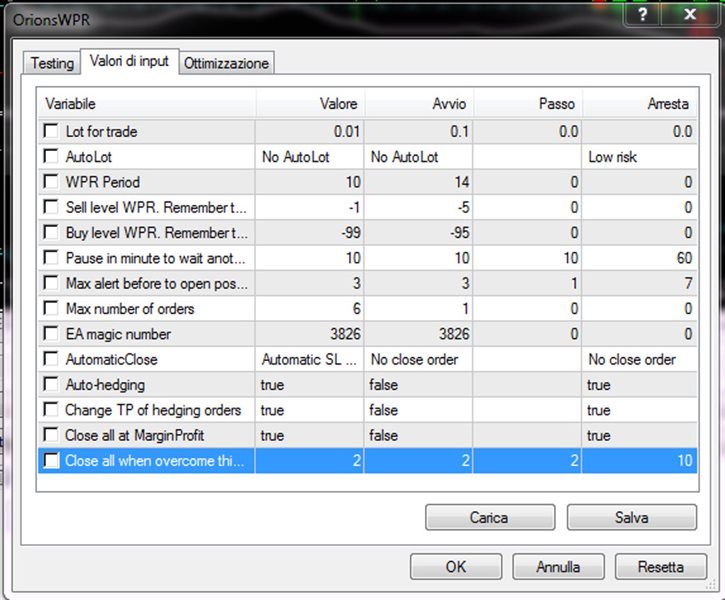

1) "No close order", "Auto-Hedging" FALSE, "Close all" FALSE : You can transform this EA in a assistant that simply open orders. After you will be the mind of the operativity. Warning : find a good setting of "Pause in minute" and "Max alert" to delay the operativity and filter the wrong signals. These last parameters can change by market condition and asset.

2) "Breakeven and WPR inversion", "Auto-Hedging" FALSE, "Close all" FALSE : The EA closes if the single order profit isn't negative and the WPR retrace. In nervous market this configurations reduce risk and profit. Warning : find a good setting of "Pause in minute" and "Max alert" to delay the operativity and filter the wrong signals. These last parameters can change by market condition and asset.

3) "Breakeven and WPR inversion", "Auto-Hedging" FALSE, "Close all" TRUE : The EA closes if the sum of order profit reach the target set in "Close all when overcome this amount". This configuration is a hedging solution at low risk and low profit.

4)"Breakeven and WPR inversion", "Auto-Hedging" TRUE, "Close all" TRUE : The EA open a pending and opposite sign double hedging order if the old open trade is far of half daily volatility. The EA closes if the sum of order profit reach the target set in "Close all when overcome this amount". This configuration is a hedging solution at high risk and good profit.

When the hedging is close at TP or SL, the EA would can open another hedging.5)"Breakeven and WPR inversion", "Auto-Hedging" TRUE, "Extra profit" TRUE : The EA open a pending and opposite sign double hedging order if the old open trade is far of half daily volatility. The EA sets the TP, but after it continue to move the TP when the target is near, in order to let it go the profit of the hedging. This configuration is a hedging solution at high risk and good profit.When the hedging is close at TP or SL, the EA would can open another hedging.

6)"Automatic SL e Extra profit", "Auto-Hedging" FALSE, "Close all" TRUE : With this configuration, the order are opened with TP equal to half daily volatiity. If the price is close TP, the EA sets the SL at breakeven. Also the TP is moved when the price is near at him. Ther isn't double hedging. Low risk, but operativity is very slow in opposite trend market.

7)"Automatic SL e Extra profit", "Auto-Hedging" TRUE, "Close all" TRUE : high risk, but good for a extended channel of the price. But how much extended this channel? 2 or 3 daily volatility for several days... It's not easy !

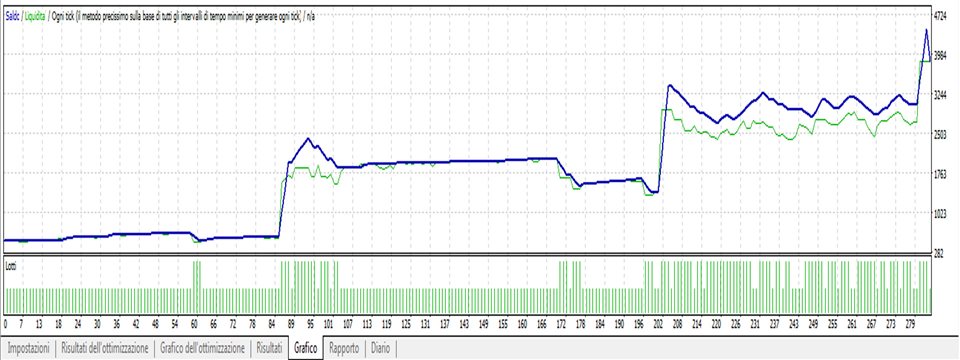

After the valuable experience with the open project "Gold explosion", I have developed several improvements by adopting new tricks.

I used a new operating timeframe (H1) and used the WPR indicator.

With this small expedient, the operations are more stable, but the possibility of inserting automatic hedging has also become necessary in several assets.

At the moment this project remains open, waiting to insert further features.

It can be used on GBP, EUR and Gold.

It's probably good for indexes too, but I delegate anyone who wants to try their hand at backtesting or demo.

I leave below some configurations that I have personally tested with small balance.

Please, use the comments to suggest improvements. Thanks.

Happy trading.

| GBPUSD | WPRPeriod=10 | ExtraProfit=1 | CloseAll=0 | LotSize=0.01 | SellWPR=-1 | BuyWPR=-99 | NumOrders=3 | Magic=3826 | AutomaticClose=1 | Hedging=1 |

| EURUSD | WPRPeriod=16 | ExtraProfit=1 | CloseAll=0 | LotSize=0.01 | SellWPR=-1 | BuyWPR=-99 | NumOrders=3 | Magic=3826 | AutomaticClose=1 | Hedging=1 |

| XAUUSD | WPRPeriod=6 | NumOrders=4 | Hedging=0 | LotSize=0.01 | SellWPR=-1 | BuyWPR=-99 | Magic=3826 | AutomaticClose=1 | ExtraProfit=0 | CloseAll=0 |