Advanced BreakOut System

- エキスパート

- Raymond Codjia

- バージョン: 1.0

- アクティベーション: 5

ADVANCED RANGE BREAKOUT SYSTEM

The advanced range breakout system is a popular approach used in forex trading to capitalize on price movements that occur when a currency pair breaks out of a defined range. The strategy involves identifying key levels of support and resistance that confine the price within a range and then initiating trades when the price breaks above or below those levels.

This EA can be used:

- With all brokers

- On all timeframes

- With currency pairs

- Indices

- Cryptocurrencies

IDENTIFICATION AND BREAKOUT

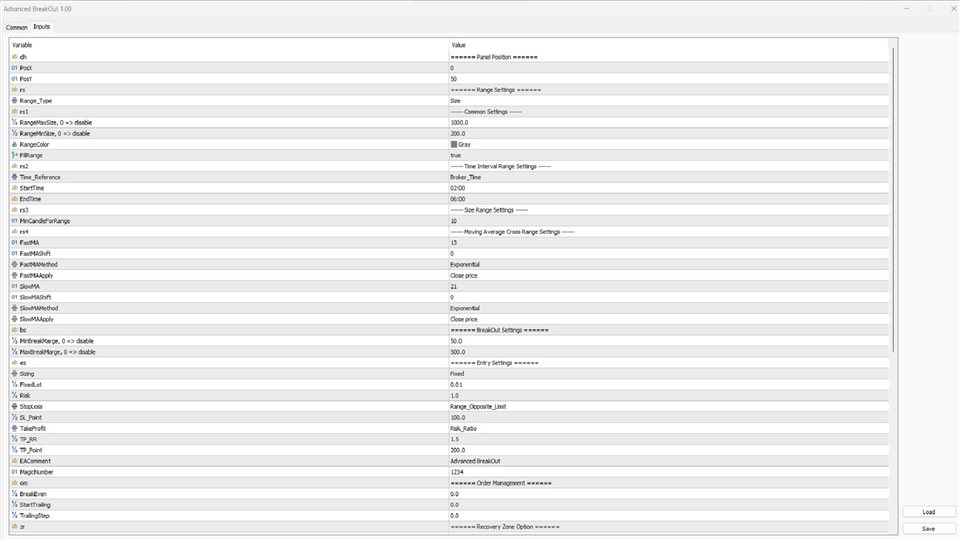

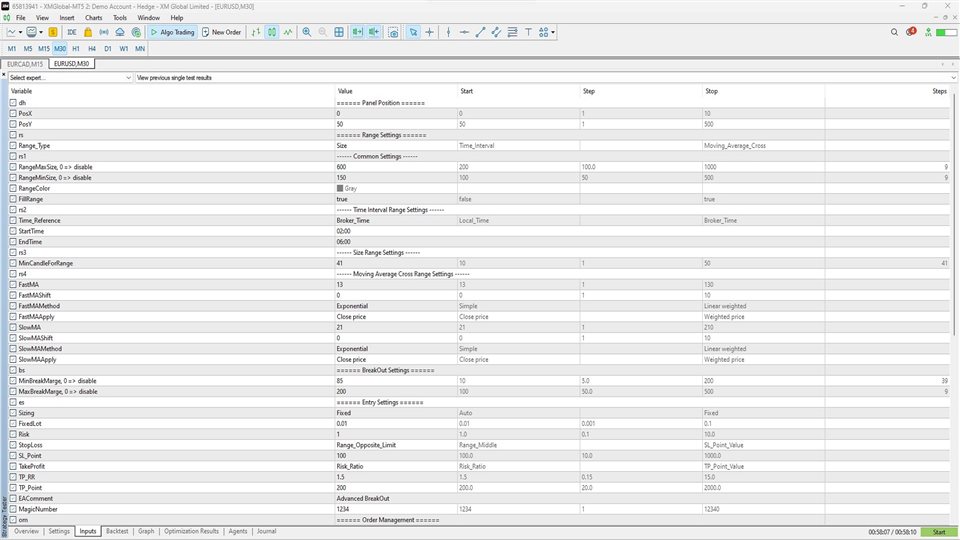

This system offers the ability to define breakout trading logic. It provides three methods for identifying ranges:

- Time interval: The user defines a time range, and the range will be determined by the highest and lowest price during that time period.

- Size: This method identifies the highest and lowest levels over a minimum number of candles defined by the user.

- Moving averages: The levels here represent the last fractal before the crossing of the moving averages and the first fractal after the crossing.

Two filters are applied when identifying the range zone to only select solid zones based on the currency pair, index, or cryptocurrency:

- Range Max Size: This is the maximum acceptable size in points for a valid zone. The filter will not be applied if this value is equal to 0.

- Range Min Size: This is the minimum acceptable size in points for a valid zone. The filter will not be applied if this value is equal to 0.

After identifying the range zone, the EA waits for a breakout to place an order. To avoid entering too early or too late, two additional filters are applied to the breakout:

- Min Break Margin: For an upside breakout, this value represents the difference between the candle's closing price and the upper bound of the zone. This value must be greater than or equal to the minimum margin specified by the user in points. This filter is not applied if the specified value is equal to 0.

- Max Break Margin: For an upside breakout, this value represents the difference between the candle's closing price and the upper bound of the zone. This value must be less than or equal to the maximum margin specified by the user in points. This filter is not applied if the specified value is equal to 0.

Once the identification and breakout conditions are met, the EA places the order. An upside breakout triggers a buy order, while a downside breakout triggers a sell order.

ORDER MANAGEMENT

Our system manages open orders in two different ways:

Standard method:

The order has a stoploss and takeprofit and closes when either of these levels is reached.

- Sizing: The user chooses how the lot size is calculated. Either a fixed lot is applied, or it is calculated based on a defined risk.

- Fixed_Lot: The fixed lot size to be used if this option is chosen.

- Risk: The risk per order if this option is chosen.

- StopLoss: For selecting the stop loss level, three possibilities are available:

- Range Middle: The stoploss is placed in the middle of the zone.

- Range Opposite Limit: The stoploss is placed on the opposite boundary of the zone.

- SL Point Value: The stop loss is placed based on the specified value in points.

- SL_Point: The value in points to be used if this option is chosen.

- TakeProfit: Two possibilities are available:

- Risk_Ratio: The take profit is placed based on a multiple of the stop loss's point value.

- TP_Point_Value: The take profit is placed based on the specified value in points.

- TP_RR: The multiplier if Risk Ratio is chosen.

- TP_Point: The value in points to be used if this option is chosen.

- EAComment: The comment to be read in the orders placed by the EA.

- MagicNumber: This is a tag used by the EA to recognize its own orders. It is recommended to use a unique value for each chart if the file is run multiple times.

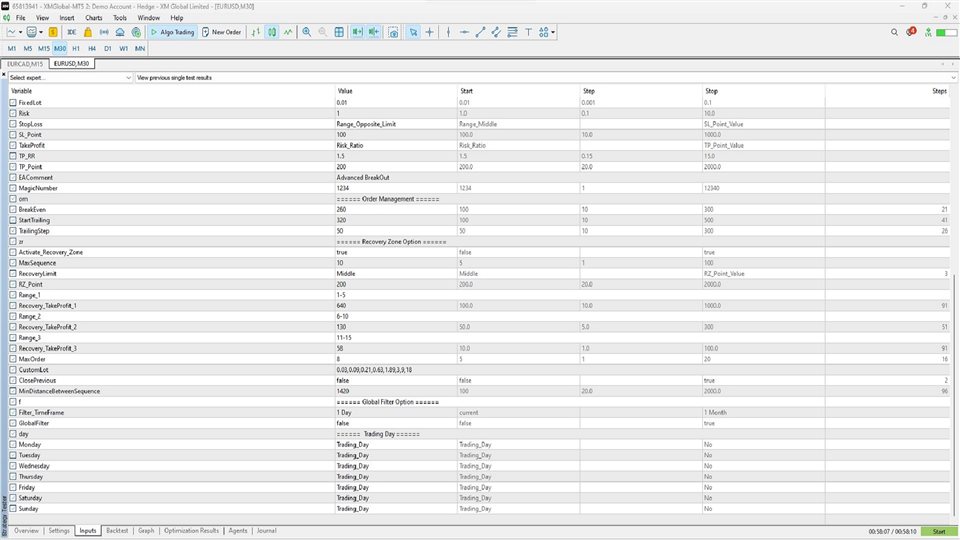

- BreakEven: Secures a position when the profit in points reaches this value. When this value is equal to 0, the option is disabled.

- StartTrailing: The stop loss of a position starts to follow the market price once the profit in points reaches this value. The option is disabled if the value is equal to 0.

- TrailingStep: The distance to maintain the stop loss when it starts to follow the market price.

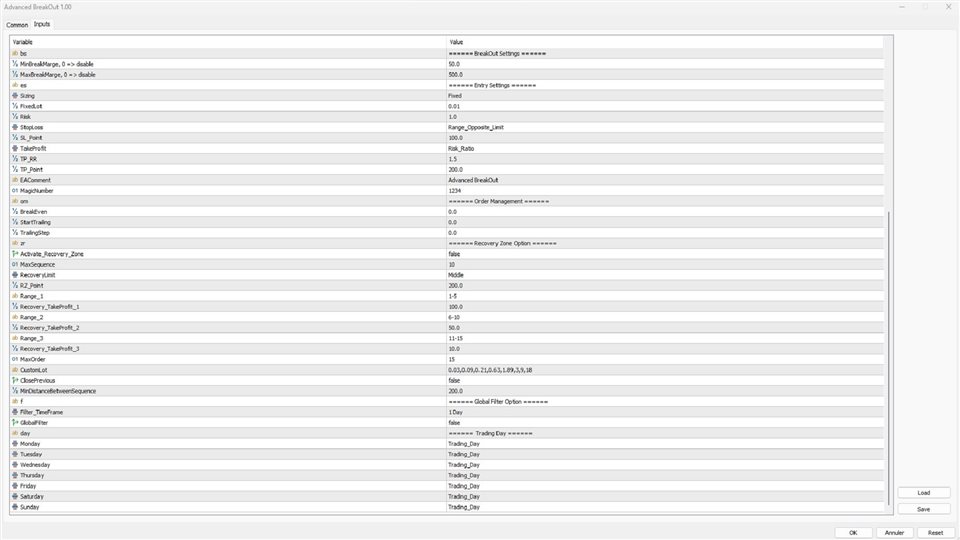

Zone Recovery:

The Zone Recovery trading system is a money management hedging strategy that allows you to profit even when the price goes against you. You set a fixed takeprofit, which, if hit, closes the trade with a profit. If the market moves against you by x pips, it opens a trade in the opposite direction with a slightly higher lot size. This process continues until the price breaks in either direction.

- Activate_Recovery_Zone: Enables Zone Recovery trading.

- MaxSequence: The EA is designed to handle multiple recovery sequences individually. This parameter determines the number of simultaneous sequences.

- RecoveryLimit: Determines the level where you want to place the recovery order. There are three possibilities:

- Middle: The recovery order is placed in the middle of the range zone.

- Opposite Limit: The recovery order is placed on the opposite boundary of the range zone.

- RZ Point Zone: The recovery order is placed based on the specified value in points.

- RZ Point: The value in points to be used for the recovery order if this option is chosen.

For most zone recovery trading systems, the take profit is determined relative to the last active position. However, in this system, the average price of all active positions (long and short) is calculated, and the take profit is derived from that price. This logic allows us to add an extra layer of order management security. We have three configurable take profit levels, which allows us to reduce the take profit level as orders accumulate in a recovery sequence to reach the target quickly.

- Range_1: The first take profit level "from-to."

- Recovery_TakeProfit _1: The value in points for the take profit to be applied to the first level.

- Range_2: The second take profit level "from-to."

- Recovery_TakeProfit_2: The value in points for the take profit to be applied to the second level.

- Range_3: The third take profit level "from-to."

- Recovery_TakeProfit_3: The value in points for the take profit to be applied to the third level.

- MaxOrder: The maximum allowed positions for a recovery sequence.

- CustomLot: The lot sequence to be applied in the recovery. These values are separated by commas.

- ClosePrevious: This parameter allows the EA to close the previous sequence before starting a new one.

- MinDistanceBetweenSequence: To avoid multiple recovery sequences in the same zone, this parameter defines the minimum distance between sequences. If a sequence does not meet this distance requirement, it will not be initiated.

The system has a filter that only allows breakouts in the direction of the trend identified on a higher timeframe if it is enabled.

- Filter Timeframe: Choose the timeframe for the filter.

- Global Filter: Enable or disable the filter.

We can also choose the days when the EA is allowed to trade.

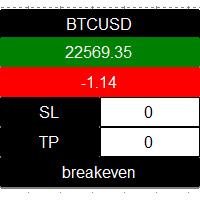

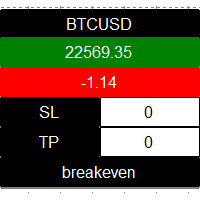

Lastly, a small dashboard allows you to view useful information for each open sequence (number of positions, profit/loss, total lot) and a button to manually.

Thank you, i am open to any suggestions for improving the system.