Can should should show lines and arrows when conditions meet .

The goal of the Trend Line Theory strategy is to find out if a breakout is valid by evaluating:

a) The trend

b) The number of pullback - swings

c) The relative swing length

d) The swing retracement percentage

To do that, let’s see how we can use trendlines to target the end of a retracement and enter in the direction of the larger trend.

The basic logic in price action analysis is that the stronger a move is the more likely the price will continue to move in that direction.

The same holds true of pullbacks during a trend.

The stronger a pullback is the more likely it is that it will turn into a full blown reversal at the end. And, conversely, the weaker a pullback is the more likely it will be just a retracement and the more likely that the original trend will resume.

And this is where John Hill’s Trend Line Theory will help us, namely in determining the strength or weakness of a pullback.

Note that in order to use this strategy there needs to be what John calls a complex pullback, which is just a pullback with at least 3 swings in it.

In essence, the strategy consists of drawing two trendlines and then analyzing how they interact with each other and with price.

Those 2 trendlines are the 0-2 and the 0-4 line, as John calls them.

• Point 0 is always the starting point of the pullback. So, that would be the high in an uptrend and the low in a downtrend.

• Point 1 is the ending point of the first swing inside of the pullback.

• Point 2 is the ending point of the second swing inside of the pullback.

• Point 3 is the ending point of the third swing inside of the pullback.

• Point 4 is the ending point of the fourth swing inside of the pullback.

Now, to get the 0-2 and 0-4 line all we need to do is connect the respective points inside of the pullback. It doesn’t matter which swing point is higher or lower, just connect the 0-2 and the 0-4 points.

So, after drawing the two lines we can get a sense of the strength of the pullback by analyzing the trendlines.

If line 0-4 is steeper then the pullback has momentum and may turn into a complete reversal of the larger trend. Don’t enter on the breakout of line 0-4.

If line 0-2 is steeper then the pullback is weak and the larger trend is more likely to resume. Enter on the breakout of the 0-4 line in the direction of the larger trend.

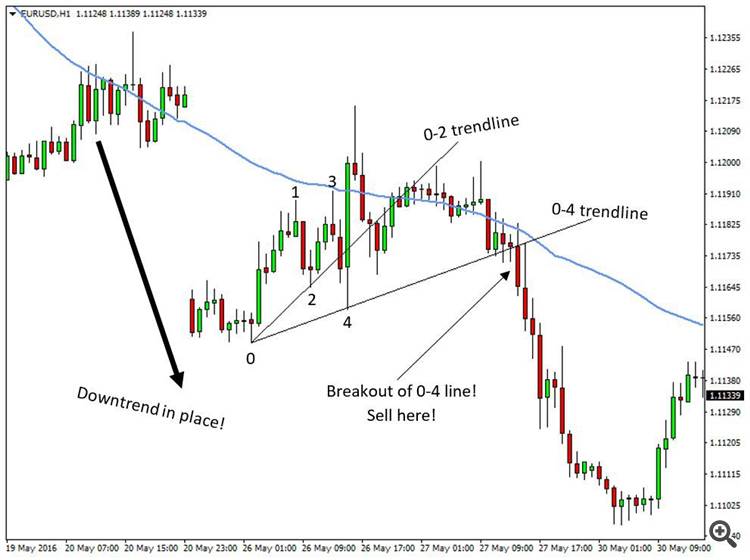

Let’s look at a few examples so that you can better understand this strategy. First an example of the trendline theory in a downtrend on the EUR/USD pair.

To determine the trend on this chart, we are using a 50-period simple moving average represented with the blue line. The price is clearly below of the MA for most of the time and the MA is sloping down indicating strength of the larger trend.

• The start of the pullback is the swing low of the initial down move on the left and it’s marked with the number 0 on the chart.

• In line with John Hill’s trend line theory, the first swing high inside of the pullback is marked with number 1 on the chart

• The first swing low inside of the pullback is marked with number 2 on the chart

• The second swing high inside of the pullback is marked with number 3 on the chart

• The second swing low inside of the pullback is marked with number 4 on the chart

類似した注文

99.99% signal accuracy 10-15 trades distribution all currency trade and meta AI assistance on loss[advice] stop and start robot cyber security firewall protection activation code: 20060605TLP20 Please create a trading bot with any logo with the name elevation

Does anyone have a ready made sierra chart absorption indicator ready made or anything similar to below. I would like to buy it. You must have understanding of order flow, sierra chart and is able to code or coded this before https://www.emojitrading.com/product/absorption-pro/ https://www.emojitrading.com/product/price-rejector-pro/

1. Shift the Time Gate (Critical) Current start time: 08:30 New required start time: 08:35:01 The EA is currently triggering trades too early (between 08:25 – 08:30 ), which is causing incorrect entries. Please ensure the EA cannot enter any trade before 08:35:01 . 2. Change Order Execution Logic The current code is using Pending Orders . Please remove pending order logic completely . Replace it with Direct Market

Project Title Freedom ORB – Fully Automated MT5 Expert Advisor (ORB + Structure + Liquidity) (MT5) Project Description I require a fully automated MT5 Expert Advisor based on a structured Opening Range Breakout (ORB) model with market structure and liquidity confirmation. The EA must: Detect ORB session range Wait for breakout (close-based) Wait for retrace Confirm M1 structure + displacement Execute trade

I’m looking for a trading bot where I can use a balance of £1000 to make regular entries making £20-£40 per entry. obviously, I want to have minimum loss with a lot more profit being made

I need a developer to code an indicator for tradingview to plot trends. There is already a similar free indicator available in Tradingview but it's not 100% correct. You can use it as starting point. We need to avoid plotting containment trends that are not significant. To understand this there will be many examples that will be provided at a later stage. I have coded an MT5 version for this indicator and can be used

I’m hiring an experienced MQL5 developer to finish and fix an existing project (NOT building from scratch). I have: An existing MT5 EA (.mq5 + .ex5) that is based on my TradingView logic A TradingView indicator version used for signals/alerts The EA works but has logic/consistency issues and needs improvements + cleanup Goal Make the EA reliable and consistent: Ensure entries/exits match the intended logic Fix

Good day to you, I am looking for someone who can convert the actual LuxAlgo smart money concepts indicator from pine script to mql5 and give me the source code what works the same as original indicator

I have a High-Frequency Trading EA and I need a full conversion and optimization for MT5. The goal is to ensure stable execution and reliable performance on real accounts (IC Markets Raw and similar ECN brokers). I need an experienced and reputable MQL5 developer to: Convert the existing strategy to MT5 with full fidelity to the original trading logic (entries, SL, breakeven, trailing, pending orders). Optimize the

I need a professional MT5 Expert Advisor (fully automated trading robot) for scalping on M1 timeframe. 1. General Requirements Platform: MetaTrader 5 Type: Fully automated EA (no manual confirmation) Timeframe: M1 only Symbols: XAUUSD, BTCUSD, USDCAD Must support running on multiple charts simultaneously Clean, optimized, and low-latency execution logic 2. Strategy Logic (Scalping Model) The EA should use: Trend +