Can should should show lines and arrows when conditions meet .

The goal of the Trend Line Theory strategy is to find out if a breakout is valid by evaluating:

a) The trend

b) The number of pullback - swings

c) The relative swing length

d) The swing retracement percentage

To do that, let’s see how we can use trendlines to target the end of a retracement and enter in the direction of the larger trend.

The basic logic in price action analysis is that the stronger a move is the more likely the price will continue to move in that direction.

The same holds true of pullbacks during a trend.

The stronger a pullback is the more likely it is that it will turn into a full blown reversal at the end. And, conversely, the weaker a pullback is the more likely it will be just a retracement and the more likely that the original trend will resume.

And this is where John Hill’s Trend Line Theory will help us, namely in determining the strength or weakness of a pullback.

Note that in order to use this strategy there needs to be what John calls a complex pullback, which is just a pullback with at least 3 swings in it.

In essence, the strategy consists of drawing two trendlines and then analyzing how they interact with each other and with price.

Those 2 trendlines are the 0-2 and the 0-4 line, as John calls them.

• Point 0 is always the starting point of the pullback. So, that would be the high in an uptrend and the low in a downtrend.

• Point 1 is the ending point of the first swing inside of the pullback.

• Point 2 is the ending point of the second swing inside of the pullback.

• Point 3 is the ending point of the third swing inside of the pullback.

• Point 4 is the ending point of the fourth swing inside of the pullback.

Now, to get the 0-2 and 0-4 line all we need to do is connect the respective points inside of the pullback. It doesn’t matter which swing point is higher or lower, just connect the 0-2 and the 0-4 points.

So, after drawing the two lines we can get a sense of the strength of the pullback by analyzing the trendlines.

If line 0-4 is steeper then the pullback has momentum and may turn into a complete reversal of the larger trend. Don’t enter on the breakout of line 0-4.

If line 0-2 is steeper then the pullback is weak and the larger trend is more likely to resume. Enter on the breakout of the 0-4 line in the direction of the larger trend.

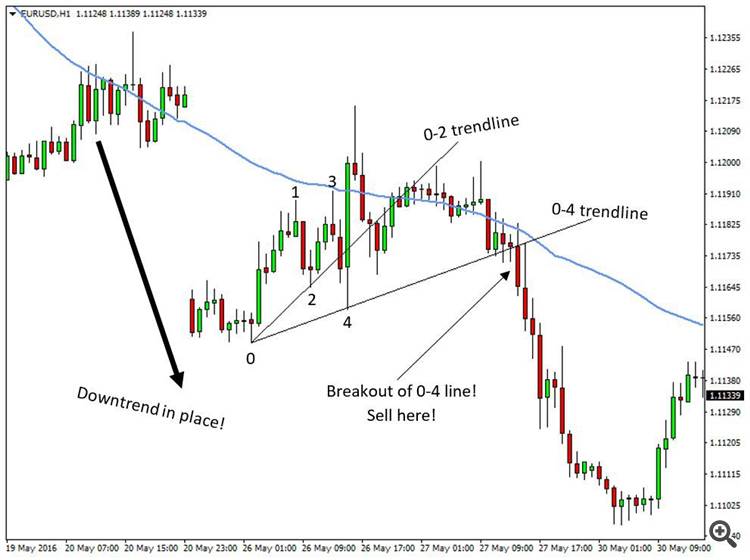

Let’s look at a few examples so that you can better understand this strategy. First an example of the trendline theory in a downtrend on the EUR/USD pair.

To determine the trend on this chart, we are using a 50-period simple moving average represented with the blue line. The price is clearly below of the MA for most of the time and the MA is sloping down indicating strength of the larger trend.

• The start of the pullback is the swing low of the initial down move on the left and it’s marked with the number 0 on the chart.

• In line with John Hill’s trend line theory, the first swing high inside of the pullback is marked with number 1 on the chart

• The first swing low inside of the pullback is marked with number 2 on the chart

• The second swing high inside of the pullback is marked with number 3 on the chart

• The second swing low inside of the pullback is marked with number 4 on the chart

類似した注文

APARTE DE PASAR EL CÓDIGO A MT5 QUIERO QUE CONTENGA TODOS LOS DATOS NECESARIOS PARA QUE ESTE NUEVO CÓDIGO SE PUEDA USAR EN LA FÁBRICACIÓN DE UN ROBOT, NO SE MUCHO DE ESTO PERO INVESTIGUE QUE DEBE LEER BUFFERS Y OTRAS COSAS

Create a ZigZag indicator, which is constructed based on extreme values determined using oscillators. It can use any classical normalized oscillator, which has overbought and oversold zones. The algorithm should first be executed with the WPR indicator, then similarly add the possibility to draw a zigzag using the following indicators: CCI Chaikin RSI Stochastic Oscillator Algorithm and Terms The first stage is the

I need an Expert Advisor for MetaTrader 5 based on SMT and CISD strategy using NASDAQ and S&P500. Strategy logic: - The bot compares NASDAQ and S&P500. - Timeframe: 3 minutes. - First condition: One of the pairs must take liquidity from a previous high or low while the other pair does NOT take that liquidity (SMT divergence). - Second condition: The pair that took liquidity must close back below the high (or above

I’m looking for a Pine Script developer who can reverse engineer the “Swing Only” logic of the Polytrends indicator on TradingView. The goal is to recreate how the swing trends are detected and plotted so it can be used as a custom indicator. If you have experience with TradingView Pine Script and reverse-engineering indicator logic , please reach out

I am looking for a quality coder that know the work to be done, i will only select coder with good feedback review be aware. price is flexible. I am looking to make an indicator based on API info from brokers. you will need to search if possible or not and what not possible be upfront and clear. The indicator design must be very confortable, easily readable, adjusteed based on different screen , compatibility is

attached is an nt8 indicator i would like modifications to. this will not be simple. once you review the indicator you will see it prints arrows and dots. the arrows print after the dots stop forming. i am using default settings, on the instrument es, using ninza renko 8:4 i want the arrow to be placed on the first dot. i do not want the arrow to just be backpainted into the past much like a swing indicator or

We are looking for an experienced TradingView / Technical Analysis expert who can suggest and build the best combination of indicators for a profitable and structured trading strategy. This is not about random indicator stacking. We need someone who understands market structure, confirmation logic, risk management, and strategy optimization. The goal is to create a clean, high-probability setup with minimal false

Does anyone know what indicator this is on the image because I'm looking for something like this but just a bit more sensitive. Speaking about the diamonds all the rest is irrelevant

Hello . Hello I already have an indicator on TradingView written in Pine Script. I need some modifications and fixes for the existing indicator. The indicator sometimes gives wrong signals and I want to improve it. I will provide the Pine Script source code. The developer should check the code, fix the problems, and adjust the logic if needed

DO NOT RESPOND TO WORK WITH ANY AI. ( I CAN ALSO DO THAT ) NEED REAL DEVELOPING SKILL Hedge Add-On Rules for Existing EA Core Idea SL becomes hypothetical (virtual) for the initial basket and for the hedge basket . When price hits the virtual SL level , EA does not close the losing trades. Instead, EA opens one hedge basket in the opposite direction. Original basket direction Hedge basket direction (opposite) Inputs