+134,828 USD Post-FOMC USD/JPY Surge Scenario and Outlook for Bitcoin & AUD Strategies

+134,828 USD

Post-FOMC USD/JPY Surge Scenario and Outlook for Bitcoin & AUD Strategies

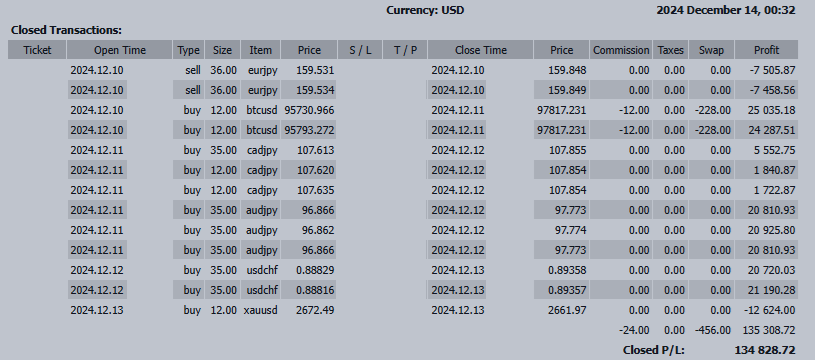

Weekly Trading Results (December 9–13, 2024)

Total Profit: +134,828 USD

This week began with volatility driven by China’s economic easing measures and speculation surrounding the Bank of Japan’s policy outlook. After careful analysis, a strategic pivot to JPY selling and AUD buying proved successful, delivering positive results. In particular, China’s economic developments provided tailwinds for the AUD, significantly boosting profits.

Moving forward, we remain focused on China’s stimulus measures, yuan movements, and the upcoming FOMC and BOJ meetings, positioning for further JPY depreciation and AUD strength.

Review of Last Week

Major Currency Pairs

- USD/JPY

- Movement: Rose from 149.69 to the mid-153 range following BOJ's potential delay in rate hikes and reports of China allowing yuan depreciation.

- Drivers: Global risk-on sentiment and shifting monetary policy outlooks.

- EUR/USD

- Movement: Declined from 1.0594 to the mid-1.04 range after a 25bps rate cut by the ECB.

- Drivers: Uncertainty around European political stability and concerns over Trump tariffs.

- AUD/JPY

- Movement: Fluctuated between the mid-95 range and 98.

- Drivers: RBA’s dovish stance and yuan depreciation news impacting AUD demand.

Next Week's Forex Outlook (December 16–20, 2024)

Key Economic Events

- December 18 (Wednesday): FOMC Rate Decision

- Forecast: A 25bps rate cut. Focus on terminal rate forecasts and dot plot projections.

- December 19 (Thursday): BOJ Monetary Policy Meeting

- Highlights: Likely rate hike deferral, with statement and Governor Ueda’s remarks potentially causing significant yen volatility.

- December 20 (Friday): Canada CPI Release

- Outlook: A softer easing approach by the Bank of Canada could impact CAD’s performance.

Strategic Points

- USD/JPY

- Outlook: Post-FOMC rate cut expectations may lead to further gains.

- Strategy: Position carefully ahead of potential BOJ-driven volatility.

- AUD/JPY

- Outlook: Supported by China’s economic stimulus measures.

- Strategy: Monitor yuan trends and sustain a cautious bullish bias.

- EUR/USD

- Outlook: Weighed down by the ECB's dovish tone.

- Strategy: Focus on political instability and short opportunities.

- CAD/JPY

- Outlook: Observe BOC’s cautious stance for potential CAD strength.

- Strategy: Monitor for support to take long positions.

Closing Thoughts: Optimizing Trading Performance

Long trading hours and critical market events can strain decision-making. Managing cognitive performance is key for sustained success.

Key Nutrients for Brain Optimization

- Vitamin D: Boosts focus and cognitive function.

- Omega-3 Fatty Acids: Enhances memory and attention.

- Magnesium: Reduces stress and sharpens concentration.

- L-Theanine: Promotes calm, rational decision-making.

Incorporating quality sleep and regular exercise further optimizes trading efficiency. By refining your nutrition and habits, you can elevate your trading to new heights.

Have a fantastic weekend! Take time to recharge and prepare for another exciting trading week ahead.