Focus on the Pound: Awaiting the Release of UK Consumer Price Index (CPI)

Market Trends from Yesterday: A Reversal Amid Risk Aversion Yesterday, in the overseas markets, tensions between Ukraine and Russia temporarily triggered risk aversion. Ukraine launched long-range missiles, provided by the US, into Russian territory, and Russia did not rule out the possibility of nuclear retaliation, leading to a decline in stocks and bond yields. The USD/JPY temporarily dropped to the low 153 yen level. However, the market then rebounded, and the USD/JPY recovered to the mid-155 yen range. The trend became less one-sided, with the market showing signs of uncertainty.

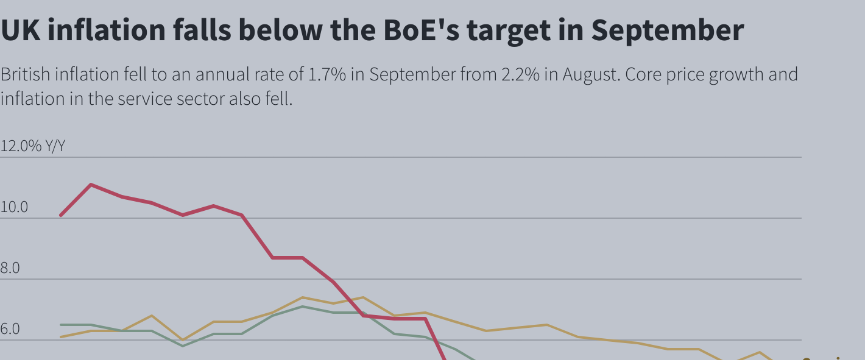

Today's Focus: UK Consumer Price Index (CPI) Release Later this morning in the London market, the UK Consumer Price Index (CPI) for October will be released. The market expectations are as follows:

- Year-on-Year: +2.2% (Previous: +1.7%)

- Core Year-on-Year: +3.1% (Previous: +3.2%)

- Services Price Year-on-Year: +4.9% (Same as previous)

Yesterday, UK financial officials testified in Parliament, highlighting that inflation remains persistent, leading to more cautious views on the pace of rate cuts. Furthermore, UK think tanks have raised concerns that the official employment data may underestimate the number of workers by about 1 million, which could make it more difficult for the Bank of England to manage its policy.

Currently, the pound is strengthening against the euro and other currencies, and market attention is on how the CPI data will affect the pound.

Other Key Economic Indicators and Events Economic Indicators:

- Germany Producer Price Index (October)

- Eurozone Construction Output (September)

- South Africa CPI (October), Retail Sales (September)

- US MBA Mortgage Applications Index (11/09 - 11/15)

- US Weekly Oil Inventory Data These indicators are expected to have a limited impact on the market.

Speech Events:

- ECB-related: Half-Year Financial Stability Report, speeches by ECB officials including President Lagarde

- Bank of England-related: Speech on monetary policy by Deputy Governor Ramsden

- Federal Reserve-related: Speeches by Vice Chairman Barr, Governor Cook, Governor Bowman, and President Collins

- NY session: Vice President De Guindos and other central bank governors will participate in events

- After the US stock market close, the highly anticipated Nvidia earnings report is scheduled.

Future Risk Outlook and Strategy Geopolitical risks surrounding Ukraine and Russia remain in focus. However, given that Ukraine quickly used long-range missiles, the likelihood of an immediate nuclear response from Russia is considered low. As a result, the risk aversion is expected to ease.

Gold buying has strengthened, but profit-taking could occur if risk aversion subsides.

Today's Strategy: Focus on USD Buying and Pound Movements

- Continue buying the US dollar: As risk aversion subsides, USD buying is expected to strengthen again.

- Monitor the pound's movements: Pay attention to the pound's reaction to the UK CPI data and make trading decisions at the appropriate timing.

- Emphasize risk management: Stay flexible in response to geopolitical risks and market volatility.