EUR/USD (Euro/US Dollar) - Strong Buy: Key Currency and Technical Analysis (15-Minute Chart) for May 31, 2024

EUR/USD (Euro/US Dollar) - Strong Buy

The EUR/USD pair is attempting to break above 1.0820 while consolidating after the previous day's bullish movement. Investors are awaiting key macroeconomic inflation statistics from both the Eurozone and the US. In the Eurozone, the Consumer Price Index (CPI) is expected to rise from 2.4% to 2.5%, and the core CPI, excluding energy and food, is expected to increase from 2.7% to 2.8%. If inflation exceeds market expectations, the European Central Bank (ECB) may decide to hold off on monetary easing at its June meeting. In the US, the Personal Consumption Expenditures (PCE) price index is in focus, with monthly increases expected at 0.3% and annual increases at 2.7%. Germany's retail sales have decreased by 0.6% year-over-year and by -1.2% monthly.

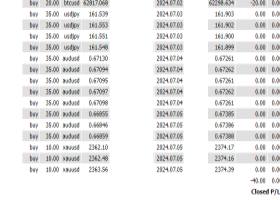

GBP/USD (British Pound/US Dollar) - Buy

The GBP/USD pair is showing mixed trading behavior and is testing support at 1.2720. Investors are awaiting the release of the US PCE price index for April, which is expected to show a monthly increase of 0.3% and an annual increase of 2.7%. The core PCE index is also expected to see similar increases. The Federal Reserve (Fed) is expected to cut rates once this year, possibly in November or December. In the UK, consumer credit is expected to decrease from 157.7 million pounds to 150 million pounds, while net lending to individuals is expected to increase from 180 million pounds to 200 million pounds.

NZD/USD (New Zealand Dollar/US Dollar) - Buy

The NZD/USD pair is showing weak growth and attempting to break above 0.6125. Investors are awaiting key US macroeconomic inflation statistics. The PCE price index is expected to increase by 0.3% monthly and 2.7% annually. China's business activity data has also been released, with the non-manufacturing PMI dropping to 51.1 points and the manufacturing PMI dropping to 49.5 points. New Zealand's business confidence index has decreased from 14.9 points to 11.2 points.

USD/JPY (US Dollar/Japanese Yen) - Sell

The USD/JPY pair is showing mixed trading behavior and is hovering around 156.70. Investors are awaiting the release of US inflation statistics for April. The PCE price index is in focus, with expected monthly and annual increases of 0.3% and 2.7%, respectively. Japanese macroeconomic statistics have not significantly impacted the yen, but Tokyo's CPI has risen from 1.8% to 2.2%. The unemployment rate remains unchanged at 2.6%, and retail sales have increased from 1.1% to 2.4% year-over-year.

XAU/USD (Gold/US Dollar) - Strong Buy

The XAU/USD pair is showing mixed movements and is trading around 2345.00. Investors are refraining from taking new positions ahead of key macroeconomic inflation statistics from the Eurozone and the US. European data is expected to show a rise in the core CPI from 2.7% to 2.8%, and the CPI from 2.4% to 2.5%. The US PCE price index is expected to increase by 0.3% monthly and 2.7% annually. US personal income and spending data are also set to be released, with April's income expected to decrease from 0.5% to 0.3% and spending expected to decrease from 0.8% to 0.3%. The rising US Treasury yields are putting pressure on gold positions.