すべてのブログ

Today's Option Information EUR/USD 1.0125: €637 million 1.0200: €3.6 billion 1.0275: €620 million 1.0400: €1 billion GBP/USD 1.2375: £1.2 billion USD/JPY 155.80: $596 million 156...

USD/JPY Fluctuates; Focus on BOJ Policy Meeting and U.S. PPI...

Today's Option Information EUR/USD 1.0200: €3.9 billion 1.0250: €2.5 billion 1.0300: €5.1 billion 1.0310: €2.4 billion 1.0375: €3.4 billion GBP/USD 1.2375: £1.2 billion USD/JPY 156...

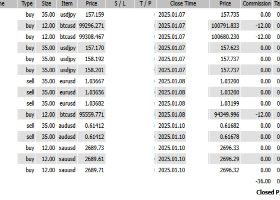

Buy Entry on XAU/USD (Gold) at 2689.90 Stop Loss set at 2669.00 This post is Half of all our entry and 5 mins late...

quick update on the position: Short Entry on AUD/USD at 0.6141 Stop Loss set at 0.6212 This post is Half of all our entry and 5 mins late...

The U.S. December Nonfarm Payrolls came in at +256K, significantly surpassing the forecast of +160K.

The U.S. December Nonfarm Payrolls came in at +256K, significantly surpassing the forecast of +160K...

Technical Analysis - January 10, 2025 Strength Overview (Ranked by Trading Volume/Liquidity...

Today's Option Information Euro/US Dollar (EUR/USD) 1.0200: €1.1 billion 1.0225: €769 million 1.0275: €1 billion 1.0300: €2.6 billion 1.0315: €1.4 billion 1.0325: €1.3 billion 1.0350: €1...

Today's Focus: U.S. Employment Report and Its Impact Today, the highly anticipated December U.S. Employment Report will be released...

Technical Analysis - January 9, 2025 ※ The following currency pairs and commodities are listed in order of trading volume (liquidity...

Today's Option Information EUR/USD (Euro/US Dollar) 1.0200: €4.2 billion 1.0250: €943 million 1.0260: €1.9 billion 1.0340: €866 million 1.0350: €1.9 billion...

U.S. Market Closure: Cautious Sentiment Ahead of Jobs Report Today, the U.S...

Technical Analysis - January 8, 2025...

Today's Option Data EUR/USD 1.0350 : €721 million 1.0500 : €833 million USD/JPY 157.50 : $1.7 billion 158.95 : $670 million AUD/USD 0.6400 : A$435 million USD/CAD 1.4130 : $730 million 1...

Adjusting Market Ahead of US Employment Report: Will the Dollar's Buying Trend Continue...

Position Update (Simplified): EUR/USD Entered a sell position at 1.0366 . Stop-loss set at 1.0412 . This post is Half of all our entry and 5 mins late...