Today's Focus: U.S. Employment Report and Its Impact

Today, the highly anticipated December U.S. Employment Report will be released. This critical event will determine whether the dollar remains on a firm trajectory or sees an acceleration in corrective selling.

Overview of the U.S. Employment Report

- Nonfarm Payrolls: The market expects an increase of +165K (previous: +227K). Economist projections range widely from +100K to +268K.

- Unemployment Rate: 4.2% (same as the previous figure).

- Average Hourly Earnings:

- MoM: +0.3% (previous: +0.4%)

- YoY: +4.0% (previous: +4.0%)

If the results align with market expectations, a relatively muted response is anticipated. However, a significant underperformance could lead to accelerated dollar selling.

Current Dollar Trends and Outlook

- This week saw volatile movements due to the Trump tariff news, but there has been no major shift in the dollar's bullish trend.

- Confirmation of labor market resilience could further solidify the dollar's upward trajectory.

Key Points for the Canadian Dollar

- December Canadian Employment Report :

- Employment Change: +25K (previous: +50.5K)

- Unemployment Rate: 6.9% (previous: 6.8%)

Despite political turbulence following Prime Minister Trudeau's resignation, the Canadian dollar has remained relatively stable. Attention will be on how the loonie holds up if weak data emerges.

European and London Market Developments

In the European session, a wait-and-see mood persists ahead of the U.S. jobs data, with the following economic indicators set for release:

- Swiss Unemployment Rate (December)

- Norwegian CPI (December)

- French Industrial Production Index (November)

- Industrial Production Indices for India and Mexico (November)

Additionally, the continued decline in the pound warrants attention. Rising UK bond yields (sales) have exacerbated pound selling, particularly against the euro, which is likely to shape the pound's strength or weakness.

Strategies and Key Focus Points

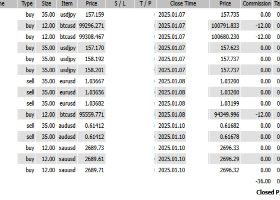

- USD/JPY:

- Further upside is expected if the employment report meets or exceeds expectations, while a downside miss poses a correction risk.

- EUR/USD:

- Likely to remain dollar-driven. A weaker-than-expected report may lead to temporary euro buying.

- CAD:

- Even with weaker-than-expected employment data, watch for resilience in the Canadian dollar due to a potential "sell the rumor, buy the fact" effect.

- Bitcoin:

- With its independent dynamics, monitor for a potential breakout above the $98,000 level.

Summary:

Today's U.S. Employment Report is a pivotal event for short-term trends. Carefully observe the market reaction post-release to pinpoint optimal entry opportunities.