Specifiche

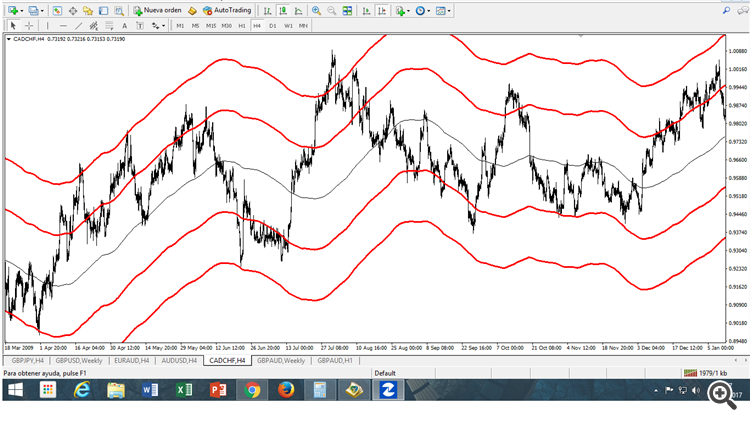

EA 1: It consists of a moving average with 4 levels; Two up and two down. When the price touches the first level above is sold, by touching the second top is bought. When it arrives to the first one of below it is bought, and to the second one of below it is sold. The EA must have the option to choose between: Balance or not; It means that the trader chooses between entering in a simple way (the form already mentioned), or to stop emitting signals in level 1 until it touches the average of 400 again. They are not BOLLINGER BANDS. It is a moving average of 400 with 4 levels.

1: IMAGE

EA 2: It's very simple; To exist three or four repeated candles is executed an order against the tendency. The candle zero is identified, which is the candle against tendency, and the candle 1,2,3 and 4 are the consecutive candles that appear to the right of the candle zero. From candles upwards like in the picture, a sale is executed; Of being candles to the lower runs a purchase. EA 2: IMAGE

EA 2: It's very simple; To exist three or four repeated candles is executed an order against the tendency. The candle zero is identified, which is the candle against tendency, and the candle 1,2,3 and 4 are the consecutive candles that appear to the right of the candle zero. From candles upwards like in the picture, a sale is executed; Of being candles to the lower runs a purchase.

EA 2: IMAGE

EA 3:

MACD that when crossing the first bar to the rise executes purchase; And selling when it crosses to the low. In addition it manages a very simple risk management law: When the order touches the STOP immediately enters in the opposite direction: From sale to purchase, from purchase to sale. And to play for the second consecutive time the STOP returns to enter immediately making the transition from sale to purchase, from purchase to sale, does this until the order reaches the profit. In the meantime, the MACD entries are paused when the bars are crossed, until the open orders reach the profit.