Lavoro terminato

Tempo di esecuzione 1 giorno

Feedback del cliente

Good developer, recommend to anyone

Feedback del dipendente

Great customer. Clear description of requirement specification, fast communication. Looking forward to working with you again.

Thanks

Specifiche

This is a very straight forward request.

What I need is for the Bollinger Bands Buy / Sell functions below to perform the same as the indicator that is attached.

Delivery will comprise of a video / demonstration that the functions will work within an expert advisor / work in a similar manner to the indicator.

I've shared the following below:

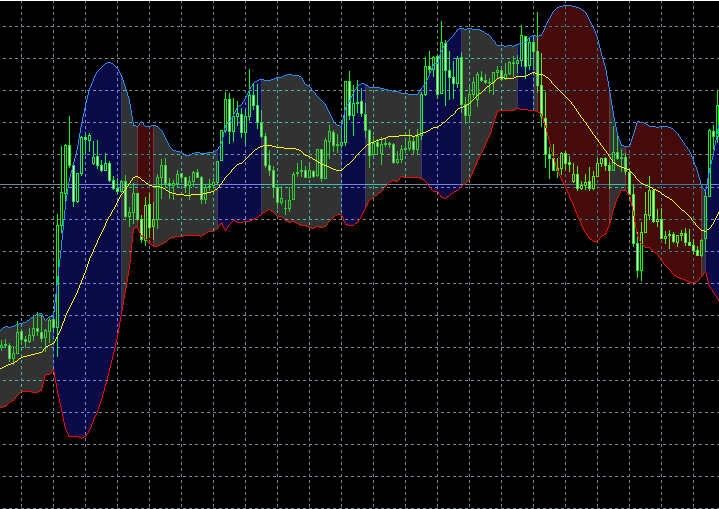

- Photo of Indicator (ibbfill2)

- Functions Bollinger Bands Buy / Sell (these functions should match the conditions of the ibbfill2 indicator (i.e. when the Indicator shades Blue - that is the same as Bollinger Bands Buy / vice versa for Bollinger Bands Sell)

- iBandsMQL4 Function (because MT5 does not have shift / a proper way to indicate the MAIN / UPPER / LOWER Bound) I have created this function. Note if you have an alternative, feel free to replace this.

Photo of Indicator:

Functions - Bollinger Bands Buy & Sell:

bool BollingerBandsBuy(string symb) { bool state = false; double bid = SymbolInfoDouble(symb, SYMBOL_BID); double ask = SymbolInfoDouble(symb, SYMBOL_ASK); double close = iClose(symb, PERIOD_M5, 1); static bool conditionMet[12]; // Array to store conditionMet for each symbol string symbols_group[] = {symb1, symb2, symb3, symb4, symb5, symb6, symb7, symb9, symb10, symb11, symb12 }; int numSymbols = ArraySize(symbols_group); if (ArraySize(conditionMet) != numSymbols) { ArrayResize(conditionMet, numSymbols); } int symbolIndex = -1; for (int i = 0; i < numSymbols; i++) { if (symb == symbols_group[i]) { symbolIndex = i; break; } } if (symbolIndex == -1) { Print("Symbol not found in the group."); return false; } //------------------------------------------------------------------------ double iBandsMain1 = iBandsMQL4(symb, PERIOD_M15, 20, 2, 0, 1); double iBandsUpper1 = iBandsMQL4(symb, PERIOD_M15, 20, 2, 1, 1); double iBandsLower1 = iBandsMQL4(symb, PERIOD_M15, 20, 2, 2, 1); //------------------------------------------------------------------------ //---------------------- Buy Condition Initial Trigger ------------------- if (close > iBandsUpper1) { conditionMet[symbolIndex] = true; } else if (close < iBandsMain1) { conditionMet[symbolIndex] = false; } //---------------------- Condition Start --------------------------- if (conditionMet[symbolIndex] && ask > iBandsMain1) { state = true; } return state; } //-------------------------------------------------------------------------------------------------------------++ bool BollingerBandsSell(string symb) { bool state = false; double bid = SymbolInfoDouble(symb, SYMBOL_BID); double ask = SymbolInfoDouble(symb, SYMBOL_ASK); double close = iClose(symb, PERIOD_M5, 1); static bool conditionMet[12]; // Array to store conditionMet for each symbol string symbols_group[] = {symb1, symb2, symb3, symb4, symb5, symb6, symb7, symb9, symb10, symb11, symb12 }; int numSymbols = ArraySize(symbols_group); if (ArraySize(conditionMet) != numSymbols) { ArrayResize(conditionMet, numSymbols); } int symbolIndex = -1; for (int i = 0; i < numSymbols; i++) { if (symb == symbols_group[i]) { symbolIndex = i; break; } } if (symbolIndex == -1) { Print("Symbol not found in the group."); return false; } //------------------------------------------------------------------------ double iBandsMain1 = iBandsMQL4(symb, PERIOD_M15, 20, 2, 0, 1); double iBandsUpper1 = iBandsMQL4(symb, PERIOD_M15, 20, 2, 1, 1); double iBandsLower1 = iBandsMQL4(symb, PERIOD_M15, 20, 2, 2, 1); //------------------------------------------------------------------------ //---------------------- Buy Condition Initial Trigger ------------------- if (close < iBandsLower1) { conditionMet[symbolIndex] = true; } else if (close > iBandsMain1) { conditionMet[symbolIndex] = false; } //---------------------- Condition Start --------------------------- if (conditionMet[symbolIndex] && close < iBandsMain1) { state = true; } return state; }

- Note: I have added a conditionMet function to this so that I can store the boolean for the first time it exceeds the Upper Bollinger Band. I need this to work with multicurrencies hence the array that contains 12 symbols.

iBands MQL4 Function:

double iBandsMQL4(string symb, ENUM_TIMEFRAMES tf, int period, double StdDeviation, int line, int shift) { ENUM_TIMEFRAMES timeframe3 = TFMigrate(tf); int handleBB = iBands(symb, timeframe3, period, 0, StdDeviation, PRICE_CLOSE); double bbUpper[], bbLower[], bbMiddle[]; ArraySetAsSeries(bbUpper, true); ArraySetAsSeries(bbLower, true); ArraySetAsSeries(bbMiddle, true); CopyBuffer(handleBB, BASE_LINE, 1, shift + 1, bbMiddle); CopyBuffer(handleBB, UPPER_BAND, 1, shift + 1, bbUpper); CopyBuffer(handleBB, LOWER_BAND, 1, shift + 1, bbLower); double iBandsValue; if (line == 0) { iBandsValue = NormalizeDouble(bbMiddle[shift], SymbolInfoInteger(symb, SYMBOL_DIGITS)); } else if (line == 1) { iBandsValue = NormalizeDouble(bbUpper[shift], SymbolInfoInteger(symb, SYMBOL_DIGITS)); } else if (line == 2) { iBandsValue = NormalizeDouble(bbLower[shift], SymbolInfoInteger(symb, SYMBOL_DIGITS)); } else { iBandsValue = 0.0; // Default value in case of invalid line parameter } return iBandsValue; }

Con risposta

1

Valutazioni

Progetti

313

28%

Arbitraggio

33

27%

/

64%

In ritardo

10

3%

Gratuito

2

Valutazioni

Progetti

499

67%

Arbitraggio

5

40%

/

0%

In ritardo

4

1%

Gratuito

Pubblicati: 8 codici

Ordini simili

Hello, I have a breakout EA with reversal logic. I own the full source code for both MT4 and MT5 versions. I need the modifications implemented for both MT4 and MT5 versions. I need several modifications: – Multiple reversals with configurable parameters – Breakeven functionality – Entry only after candle close beyond range + offset – Time-based activation – Alternative offset calculation logic – Automatic close at

Hi I have a simple task (hopefully) I have a custom strategy that I built with the help of Claude Anthropic - everything is finished and I zipped it with power shell but when importing it NT8 gives me the error message that the file was made from an older, incompatible version or not a NinjaScript. My folder structure is correct as far I can see so I don't know what the issues is and it's costing me too much to go

Subject: Development of Ultra-High Precision Confluence Indicator - M1 Binary Options (Non-Repaint) Hello, I am looking for a Senior MQL5 Developer to create a custom "Surgical Precision" indicator for MetaTrader 5, specifically optimized for 1-minute (M1) Binary Options trading. The system must integrate three distinct layers of algorithmic analysis. 1. Core Logic: Triple-Layer Confluence The signal (Call/Put)

Hello, I have an MQ4 indicator that works with a specific strategy. I want to modify some aspects and convert the file to MQ5. It's simple and won't take much effort or time for someone experienced in this field. Ideally, the person undertaking this task should be familiar with the MX2Trading software, as I will be using it to transfer the signals from the indicator to the trading platform

Phahla fx boto

30+ USD

99.99% signal accuracy 10-15 trades distribution all currency trade and meta AI assistance on loss[advice] stop and start robot cyber security firewall protection activation code: 20060605TLP20 Please create a trading bot with any logo with the name elevation

Does anyone have a ready made sierra chart absorption indicator ready made or anything similar to below. I would like to buy it. You must have understanding of order flow, sierra chart and is able to code or coded this before https://www.emojitrading.com/product/absorption-pro/ https://www.emojitrading.com/product/price-rejector-pro/

1. Shift the Time Gate (Critical) Current start time: 08:30 New required start time: 08:35:01 The EA is currently triggering trades too early (between 08:25 – 08:30 ), which is causing incorrect entries. Please ensure the EA cannot enter any trade before 08:35:01 . 2. Change Order Execution Logic The current code is using Pending Orders . Please remove pending order logic completely . Replace it with Direct Market

Project Title Freedom ORB – Fully Automated MT5 Expert Advisor (ORB + Structure + Liquidity) (MT5) Project Description I require a fully automated MT5 Expert Advisor based on a structured Opening Range Breakout (ORB) model with market structure and liquidity confirmation. The EA must: Detect ORB session range Wait for breakout (close-based) Wait for retrace Confirm M1 structure + displacement Execute trade

Gold - Quick Scalper EA with TP, SL

30 - 40 USD

I’m looking for a trading bot where I can use a balance of £1000 to make regular entries making £20-£40 per entry. obviously, I want to have minimum loss with a lot more profit being made

I need a developer to code an indicator for tradingview to plot trends. There is already a similar free indicator available in Tradingview but it's not 100% correct. You can use it as starting point. We need to avoid plotting containment trends that are not significant. To understand this there will be many examples that will be provided at a later stage. I have coded an MT5 version for this indicator and can be used

Informazioni sul progetto

Budget

40+ USD

Scadenze

a 1 giorno(i)