Lavoro terminato

Tempo di esecuzione 16 giorni

Specifiche

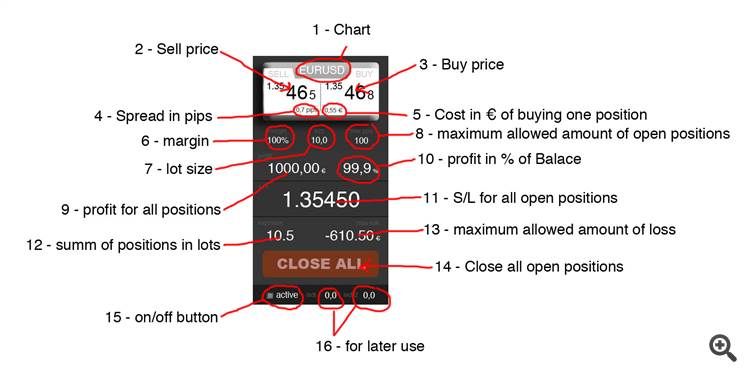

I have a problem with multiple open positions in MT4. Adjusting S/L or closing positions one and one is time consuming and irritating. This is a big problem around news releases. I need a custom mini terminal where I can close or change s/l on open orders as a group. I have done the graphics work, now I need a programmer.

The mini terminal basically can open new trades and adjust the s/l according to a set € maximum. Also it closes all open trades either buy manual command or buy pre set loss maximum in €.

Detailed description available on request.

Con risposta

1

Valutazioni

Progetti

1295

67%

Arbitraggio

84

26%

/

49%

In ritardo

338

26%

Gratuito

2

Valutazioni

Progetti

0

0%

Arbitraggio

2

0%

/

100%

In ritardo

0

Gratuito

3

Valutazioni

Progetti

0

0%

Arbitraggio

1

0%

/

100%

In ritardo

0

Gratuito

4

Valutazioni

Progetti

159

61%

Arbitraggio

40

18%

/

63%

In ritardo

70

44%

Gratuito

5

Valutazioni

Progetti

341

58%

Arbitraggio

7

14%

/

71%

In ritardo

9

3%

Gratuito

6

Valutazioni

Progetti

108

68%

Arbitraggio

3

33%

/

33%

In ritardo

40

37%

Gratuito

7

Valutazioni

Progetti

542

50%

Arbitraggio

55

40%

/

36%

In ritardo

225

42%

Caricato

8

Valutazioni

Progetti

7

43%

Arbitraggio

5

0%

/

60%

In ritardo

3

43%

Gratuito

9

Valutazioni

Progetti

208

54%

Arbitraggio

21

24%

/

52%

In ritardo

64

31%

Gratuito

10

Valutazioni

Progetti

20

15%

Arbitraggio

3

0%

/

67%

In ritardo

10

50%

Gratuito

Ordini simili

Setting up a contrarian trading strategy

150 - 200 USD

This project will be carried out in two phases Part one: Contrarian trading strategy Part two: Implement a control panel that will be displayed on the MT4 platform screen, including the required elements. What is a contrarian trading strategy? It is an investment approach that goes against the general market consensus. In other words, contrarian traders buy when the majority of investors are selling, and vice versa

Phyton 1 -1 Classes

30+ USD

Looking for someone who can teach me how to connect to Mt4 from phyton, code and backtest on phyton. This will be ongoing classes, once or twice a week for 1 hour

Looking for a professional programer

30 - 50 USD

Am looking to license an automated stock trading algorithm with a minimum live track record of 6-12 months . Must be able to show a verifiable track record. Feel free to apply if you have something that aligns

Financial website for market dealings

30 - 180 USD

here we will create market website, where we will display all our assets in graphical form, we will pull data from Metatrader platform and update the website in real time. I need something like this https://NgnRates.com but on our site we will display our own rate based on calculations performed on MT5 source

Hello everyone. I actually have a MT4 trading bot and need someone that can backtest and optimize the bot with 100% tick data. I will give you all the instructions to optimize the bot with the start, step and stop input to put on. Thank you

Programmer to help code a cTrader BOT

50 - 60 USD

I want to turn the attached trade into a bot. It may be a little hard to udnerstand, in simple terms I want to trade at a turn around point following a fair value gap. I may want to add two switches: Buy / sell only Only trade within zone x-y these additions will allow me to check fundamentals for buy/or sell, and then only trade when im in support/resistance. You may know a better more profitable way of going about

Need Tradingview pinescript developer

40 - 50 USD

Hello, I hope you're doing well. I recently developed a platform on TradingView, and I’m seeking assistance from a developer to guide me through the process. Based on the feedback provided, I will like you to help me make necessary modifications with it. Your expertise would be greatly appreciated! All Requirements will be sent via inbox. Thanks

Hello , I've developed a new trading view platform recently, and I'd like an expert to give me some feedbacks. I will try to modify it based on your feedback. Looking forward to the proficient proposal in the comment section

Hello. I'm going to develop quantower strategy. The strategy is follow: Short entry: when the candle open and close below the ema we take a short below the low of the candle Long entry: when the candle open and close above the ema we take a short above the high of the candle. when the trend doesn't get our way, in order to cover the loss; Short: open Long position at the High of the candle. Long: open Short position

Run Python Code and update it

30+ USD

Hello I have a piece of python code that connects telegram and pocket option, I need help running it and will update it before tomorrow speed is paramount.We can use anydesk for to connect my pocket option with telegram basically run the code, once that is done will give 2 updates on the code

Informazioni sul progetto

Budget