Specifiche

Hi Everyone,

I need a programmer to help develop an EA with the below content/ criteria. We can discuss on further clarifications if needed.

Thanks

3 POINT POSITION STRATEGY EA

This strategy is based on identifying 3 positions/ prices for the product to reach before activating the bid. And each next point of activation will result in an higher pip size as the market crosses above or below the price positions.

As a result, the EA will identify the first pip size for the first price to activate and future activations will be increased in multiples of first pip size or at specific increase plan eg .01,.02,.04,.08,.16,.32 OR .01,.02,.05,.01,.25,.5 OR .01,.02,.03,.04,.05,.06. It may also have a maximum position to stop the increase for example say after the fifth or sixth move across the various points.

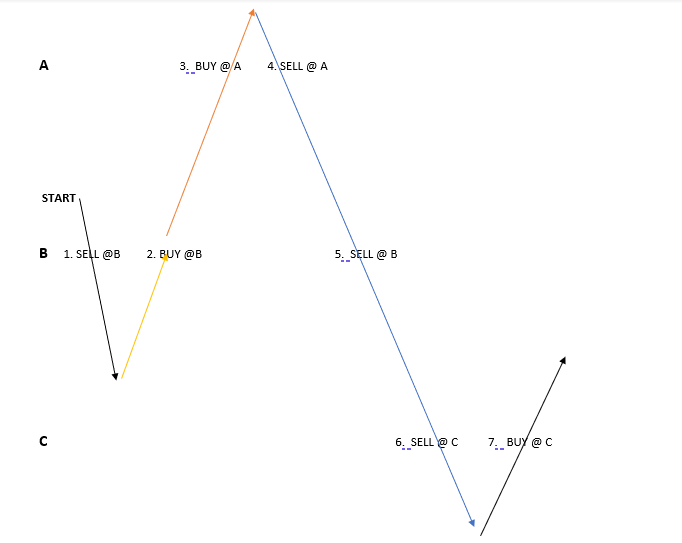

So at the beginning of the period, which can be daily, weekly, bi-monthly or Monthly, the 3 price settings are established. EG say Prices A, B and C. Price A will be at the top, Price B will be below A but above C, while Price C will be Below A and B.

If market crosses price B to price C direction, then it will activate a SELL bid at .01 in price B. If it reaches price C, and crosses below price C, then it will activate a SELL at price C at .02 for the downwards trend. If however the market reaches Price C and returns back to Price B, then it will activate a BUY at the next pip size (.04/.05/.03 as shown in above sample trend) and follow the trend continually. Everytime the actual market movement crosses any of the 3 prices set at the beginning of the period, it will take a bid towards the direction and at the higher pip size from the previous move/bid.

Once the 3 positions are established at the beginning of the period, the market follows the direction and activates the bids in line with the position direction and pip size continually until the end of the stated period.

Every existing bid should close itself if it tries to cross back from existing start price to the opposite direction. Ie if Price C activates a SELL based on moving from B to below C and attempts to return back to B, then it should close the SELL bid at C and then reactivate a new BUY bid at C towards direction B. Same thing if BUY at C decides to cross downwards below C, it should close the BUY at C and activate a new SELL at C for the below movement.

Take profit position will be set for each move, while the stop loss will already be the take off position/price as described above.

DESCRIPTION OF SETTING

PRICE STARTS AT START POSITION

PRICE MOVES LOW BELOW B THEREFORE ACTIVATING A SELL AT POSITION 1.

PRICE MOVES BACK UP TO B WITHOUT REACHING C, THEREFORE ACTIVATING A BUY POSITION AT 2.

PRICE MOVES OVER TO A THEREFOREFORE ACTIVATING A BUY POSITION AT 3.

PRICE GOES ABOVE A AND RETURNS BACK TO A THEREFORE ACTIVATING A SELL AT 4

PRICE MOVES TO B FROM A THEREFORE ACTIVATING A SELL AT 5

PRICE MOVES TO C FROM B THEREFORE ACTIVATING A SELL AT 6

PRICE MOVES BACK UP ABOVE C THEREFORE ACTIVATING A BUY AT 7

THE EA WILL BE SUCH THAT WILL AUTOMATE PRICES IMMEDIATELY IN REAL TIME TO ADJUST THE BIDS WHERE NECESSARY IN REAL TIME

ALL STOP LOSSES WILL CLOSE IF PRICE REVERTS BACK TO STARTING POINT WITHOUT CLOSING AT PROFIT

PLEASE NOTE THAT I WILL NEED AT LEAST INITIAL 14 DAYS TO TEST THE EA FOR ANY IMMEDIATE ANOMALITIES.

ALSO I WANT SOMEONE WITH AT LEAST 60 DAYS REVIEW AS I WILL HAVE TO TEST IT IN REAL TIME TO IDENTIFY ANY ISSUES AS MOST OF MY PREVIOUS CLIENTS BECOMES UNAVAILABLE AFTER PAYMENT THEREBY CAUSING THE ROBOTS USELESS TO ME.

SOURCE CODES WILL BE OBTAINED AT END OF CONTRACT

IMMEDIATELY AVAILABLE PROGRAMMERS ARE REQUIRED

PROJECT COST MAY BE SPLIT IN STAGES FOR TESTING PERIOD WHICH CAN BE BETWEEN 30-60 DAYS OF COMPLETION OF DEMO VERSION AND WILL BE PAID FOR AS AGREED BETWEEN US.

NB This is phase 1 of the Project.