Unisciti alla nostra fan page

- Visualizzazioni:

- 6877

- Valutazioni:

- Pubblicato:

- 2018.06.14 13:08

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

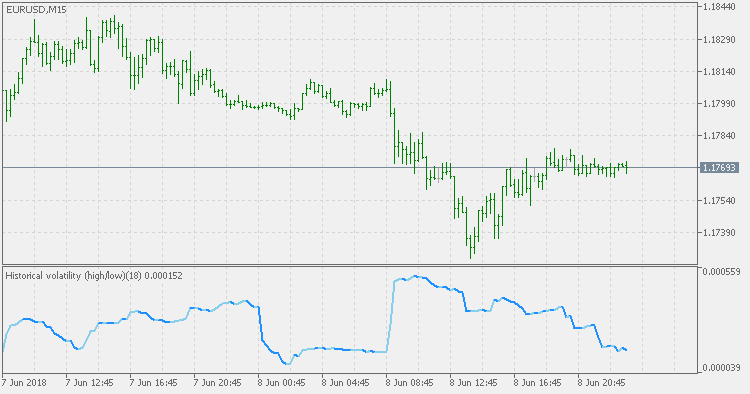

Historical Volatility (HV) is a statistical measure of the dispersion of returns for a given security or market index over a given period of time. Generally, this measure is calculated by determining the average deviation from the average price of a financial instrument in the given time period. Using standard deviation is the most common, but not the only, way to calculate Historical Volatility.

The higher the Historical Volatility value, the riskier the security. However, that is not necessarily a bad result as risk works both ways - bullish and bearish, i.e: Historical Volatility is not a directional indicator and should not be used as other directional indicators are used. Use to to determine the rising and falling price change volatility.

This version also does not use Close prices for volatility calculation. Instead it uses the High/Low ratio (the calculation is different from the "regular" Historical Volatility indicator).

Historical Volatility

Historical Volatility

Historical Volatility (HV) is a statistical measure of the dispersion of returns for a given security or market index over a given period of time. Generally, this measure is calculated by determining the average deviation from the average price of a financial instrument in the given time period.

BB Stops - Smoothed WPR

BB Stops - Smoothed WPR

BB Stops indicator of smoothed WPR.

Historical Volatility Bands

Historical Volatility Bands

Historical Volatility Bands constructed using average as the middle line, and upper and lower bands using the Historical Volatility for bands calculation.

RSI Сandles - Smoothed with Trend Envelopes

RSI Сandles - Smoothed with Trend Envelopes

RSI Candles with an additional option to filter (smooth) the prices prior to using them in RSI calculation (which, effectively makes it an RSI of average).