Unisciti alla nostra fan page

- Visualizzazioni:

- 31170

- Valutazioni:

- Pubblicato:

- 2018.01.30 12:22

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

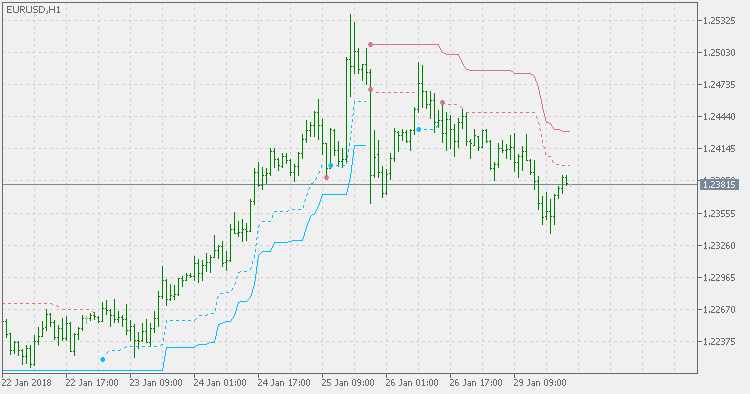

Developed by Charles Le Beau and featured in Alexander Elder's books, the Chandelier Exit sets a trailing stop-loss based on the Average True Range (ATR). The indicator is designed to keep traders in a trend and prevent an early exit as long as the trend extends. Typically, the Chandelier Exit will be above prices during a downtrend and below prices during an uptrend.

Calculation

The original Chandelier Exit formula consists of three parts: a period high or period low, the Average True Range (ATR) and a multiplier. Using the default setting of 22-periods on a daily chart, the Chandelier Exit will look for the highest high or lowest low of the last 22 days. Note that there are 22 trading days in a month. This parameter (22) will also be used to calculate the Average True Range.

This version is extended with additional (fast) stop - in order to add shorter term entries and exits to the main trend detection and estimation and allows different periods for ATR calculation and highest high and lowest low period (look back period).

Interpretation

The Chandelier Exit is basically a volatility-based system that identifies out-sized price movements. Le Beau defined volatility by using the Average True Range, which was developed by Welles Wilder, creator of RSI and the Average Directional Index. ATR uses the prior close, current high and current low to determine the True Range for a given period. After some smoothing, the daily True Range values evolve into the Average True Range for a given period of time.

Lot calculator - risk management tool

Lot calculator - risk management tool

This tool allows you to calculate the correct lot size of the next trade by following some simple money management rules.

RAVI iFish

RAVI iFish

Range Action Verification Index (RAVI) with inverse Fisher transform.

Reduce_risks

Reduce_risks

This is an MQL5 version of the Expert Advisor described in the article "How to reduce trader's risks" (https://www.mql5.com/en/articles/4233).

Rsi(var)

Rsi(var)

RSI variation.