Md Ariful Islam / Perfil

Best Broker for trading Exness. Because in this broker you can trade everything in one account. Exness Professional Pro Account is swap free and commission free also. In this account you can trade Forex, UK Stocks, UK Stocks, JPY Stocks, Commodities (Gold, Silver), Oil (XRB/USD), Crypto-currencies, UK Brent, US Oil, US Oil, CFD, ETC. I Mean everything everything in one account. So if you don’t have an account, create now for better signal. Open a Exness Professional Pro Account: https://one.exness.link/a/pug3t17q

Amigos

72

Solicitudes

Enviadas

Md Ariful Islam

Bitcoin News & Analysis in English Audio ।। Is Bitcoin go 1000K (1M) in 2022?

🔻

Listen this full audio voice message and Subscribe my Channel

https://youtu.be/436cimlURvg

🔻

Listen this full audio voice message and Subscribe my Channel

https://youtu.be/436cimlURvg

Md Ariful Islam

Crypto market slipping into stagnation or even downtrend. Some experts warn that the crypto market might click into a suspend mode in the near future. Bitcoin will emerge from hibernation not until the end of 2024.

According to the cautious outlook, the flagship cryptocurrency is set to trade sluggishly for another couple of years. Jun Du, co-founder and CEO of crypto trading platform Huobi, also predicts that the most popular token will remain stagnant for a few years. The crypto market could revive in late 2024 – early 2025 that would propel a bitcoin’s rally.

The crypto expert explains that bullish and bearish cycles of digital assets are driven by halving. “Following this cycle, it won’t be until end of 2024 to beginning of 2025 that we can welcome next bull market on bitcoin,” Jun Du said. The halving process slashes the rewards that miners gain for verifying transactions. As a result, tokens are generated at a slower speed and miners are able to issue twice fewer new coins.

The halving event is launched once every 4 years. The latest one took place in May 2020. Last year, the bitcoin price topped a historical high of $68,000 per token. The previous halving was conducted in 2016. Bitcoin also rallied to record highs a year later.

Most analysts say that the crypto market is sliding into the crypto winter when digital assets might replay the situation that occurred in 2017-2018. Plumbing the depth of the bear market, bitcoin used to nosedive by 80%.

For the time being, the fair price of the most popular token is 12% lower than its current value. Experts made this conclusion based on bitcoin’s volatility relative to gold.

According to the cautious outlook, the flagship cryptocurrency is set to trade sluggishly for another couple of years. Jun Du, co-founder and CEO of crypto trading platform Huobi, also predicts that the most popular token will remain stagnant for a few years. The crypto market could revive in late 2024 – early 2025 that would propel a bitcoin’s rally.

The crypto expert explains that bullish and bearish cycles of digital assets are driven by halving. “Following this cycle, it won’t be until end of 2024 to beginning of 2025 that we can welcome next bull market on bitcoin,” Jun Du said. The halving process slashes the rewards that miners gain for verifying transactions. As a result, tokens are generated at a slower speed and miners are able to issue twice fewer new coins.

The halving event is launched once every 4 years. The latest one took place in May 2020. Last year, the bitcoin price topped a historical high of $68,000 per token. The previous halving was conducted in 2016. Bitcoin also rallied to record highs a year later.

Most analysts say that the crypto market is sliding into the crypto winter when digital assets might replay the situation that occurred in 2017-2018. Plumbing the depth of the bear market, bitcoin used to nosedive by 80%.

For the time being, the fair price of the most popular token is 12% lower than its current value. Experts made this conclusion based on bitcoin’s volatility relative to gold.

Md Ariful Islam

JPM: oil may soar to $125 per barrel in 2022. This year, oil may show a stellar rally. Experts foresee explosive growth in crude prices. Some optimists expect $125 per barrel. Notably, just several months ago, there was not even a sign of such a dramatic rise.

In November, crude prices tumbled by almost 20%. As a result, on November 30, Brent futures for February delivery cost $66.18. In general, during the last year and a half, the global oil market was showing poor performance. Crude was depreciating at the record pace, touching one low after another. Thus, in March of 2020, oil prices nosedived by more than 50%. In November, they collapsed again amid the new Omicron strain.

However, this year, the situation has changed considerably. Analysts at JPMorgan were among the first optimists who expected a jump to $125 per barrel in 2022. They suppose that in a year, crude prices may hit $150 per barrel. The global production recovery and OPEC’s output cut could become the main drivers of oil prices. Christian Malek, the head of EMEA oil and gas equity research at J.P. Morgan, said that OPEC+ might face a lack of investments.

JPM estimates “true OPEC spare capacity next year to be around 2 million barrels per day (BPD) below consensus estimates of 4.8 million bpd.”

In November, crude prices tumbled by almost 20%. As a result, on November 30, Brent futures for February delivery cost $66.18. In general, during the last year and a half, the global oil market was showing poor performance. Crude was depreciating at the record pace, touching one low after another. Thus, in March of 2020, oil prices nosedived by more than 50%. In November, they collapsed again amid the new Omicron strain.

However, this year, the situation has changed considerably. Analysts at JPMorgan were among the first optimists who expected a jump to $125 per barrel in 2022. They suppose that in a year, crude prices may hit $150 per barrel. The global production recovery and OPEC’s output cut could become the main drivers of oil prices. Christian Malek, the head of EMEA oil and gas equity research at J.P. Morgan, said that OPEC+ might face a lack of investments.

JPM estimates “true OPEC spare capacity next year to be around 2 million barrels per day (BPD) below consensus estimates of 4.8 million bpd.”

Md Ariful Islam

Bitcoin’s fair value revealed by JPMorgan. Recently, experts have calculated the real value of Bitcoin. The current price of the number one cryptocurrency is said to be 12% higher than its fair value. The estimates are made based on Bitcoin’s volatility in comparison with gold. Strategists at JPMorgan Chase & Co. found out that BTC is roughly four times more volatile than gold. Therefore, its fair price should be around $38,000. If its volatility narrows to three times, the fair value will rise to $50,000. High volatility has always been a problem for Bitcoin. “The biggest challenge for Bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption,” the strategists wrote. A long-term target for Bitcoin is to reach the level where its total market value is equal to the value of all gold held privately for investment purposes. The analysts at JPMorgan Chase & Co. also said that “January’s price correction looks less like a capitulation than the one last May, which saw Bitcoin tumble as much as 50%.” However, some data indicates a “more long-standing and thus more worrisome position reduction trend” for Bitcoin in the market.

Md Ariful Islam

Another country may soon launch its own digital currency. The central bank of Zambia is seriously considering this idea. At the same time, local authorities have always been concerned about cryptocurrencies and other digital assets. Earlier, the regulator stressed that it did not recognize cryptocurrencies as legal tender in Zambia. Yet, the development of the central bank digital currency is seen as a wise step aimed at reinforcing the country’s financial system. “The results of the research will form part of the input in the policy considerations on whether to introduce a central bank digital currency in Zambia,” Nkatya Kabwe, acting assistant director of communications at the regulator, explained. At the same time, speaking about crypto, he warned that “people who want to deal with them should have a clear understanding of all the risks that come with such payment and investment instruments.” Unlike cryptocurrencies, central bank digital currencies are pegged to fiat money. Zambia may soon join such nations as China, the US, Israel, Ghana, the Bahamas, and Nigeria that are going to or have already issued a digital version of their national currencies. The same is true about Russia. Its central bank plans to test the digital ruble prototype this year. If successful, it may become the third official means of payment in the country.

Md Ariful Islam

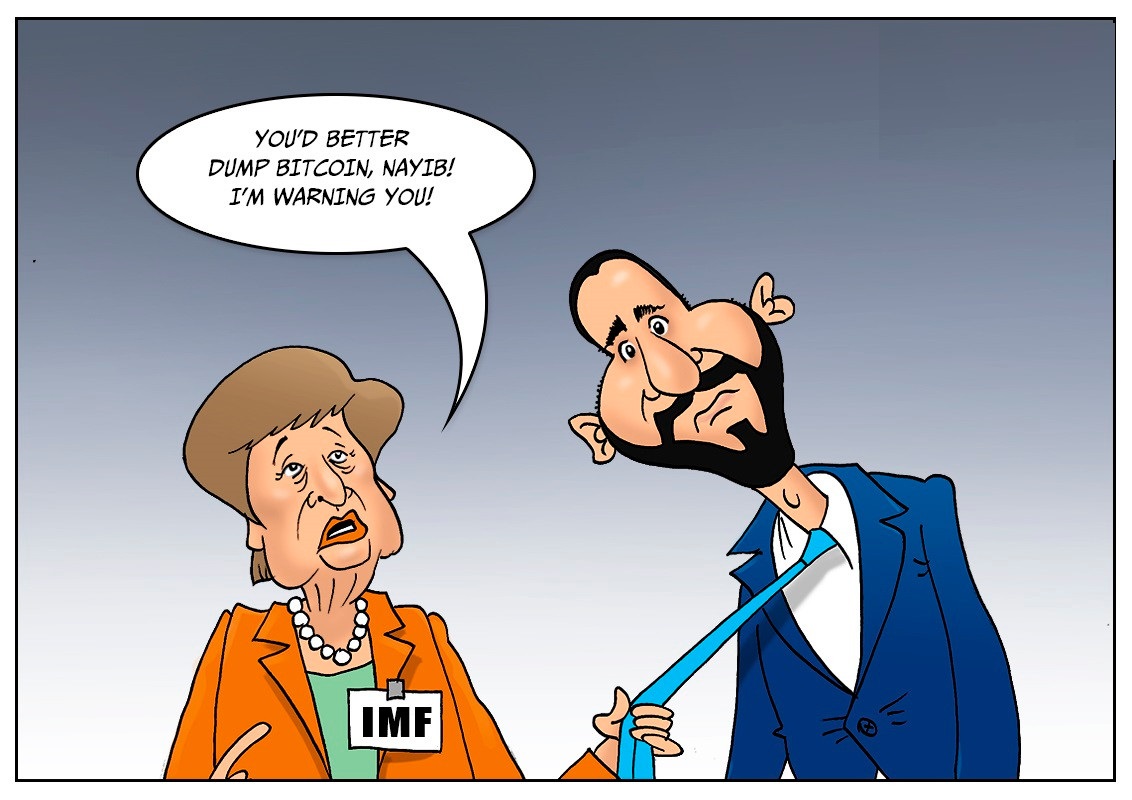

IMF urges El Salvador to drop bitcoin as legal tender. The International Monetary Fund has urged El Salvador to reverse its recognition of bitcoin as legal tender. The Latin American country allowed the use of the cryptocurrency for all transactions in September 2021, becoming the first country to do so. The government of El Salvador bought 1,801 BTC for about $50,000 per coin. The country lost about $20 million when bitcoin nosedived by 45% from its high of $68,000 in late 2021.

Md Ariful Islam

All of Facebook’s attempts to launch its cryptocurrency have been in vain. After sustained opposition in Washington, the company is winding down its long-term stablecoin project.

Md Ariful Islam

US Fed to tighten monetary policy despite turbulence on Wall Street. Market participants and the Fed’s policymakers view the situation in the US stock market from different angles. Whereas investors are spooked by the ongoing deep correction, the Federal Reserve does not consider this an argument to revise the unveiled course of aggressive monetary tightening.

: