Mirza Baig / Perfil

- Información

|

10+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Most traders have a limited knowledge of trading’s fundamental rules, either from a psychological or a methodological point of view. This can lead to increasing loss probabilities on the markets, as

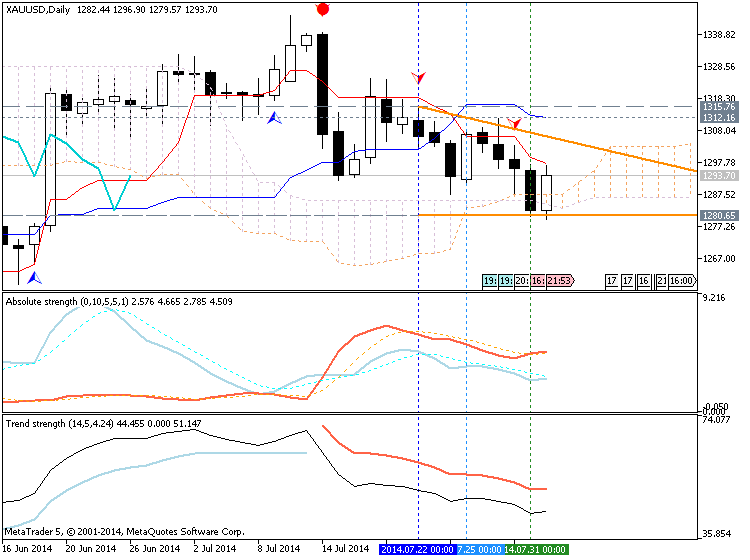

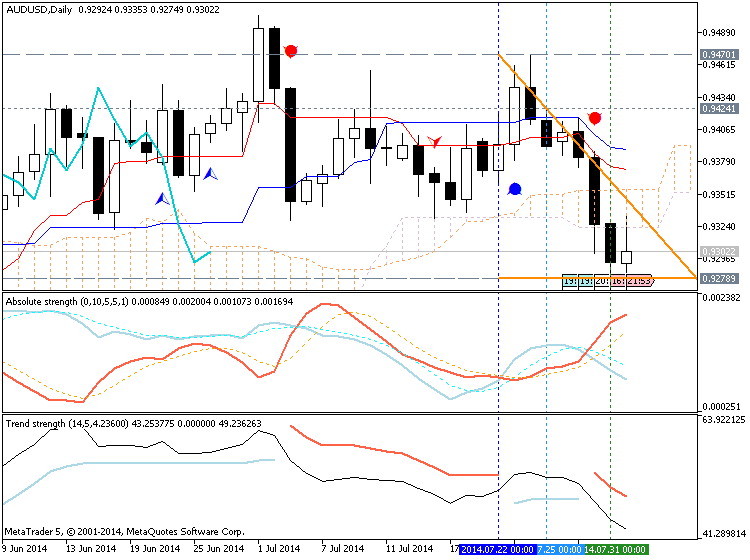

How to use the currency pairs correlation to predict the direction of the market? When I have a signal with a pair, but I need confirmation to take the position, I refer to the correlated currency

1. Price Action is not a System One thing that many beginning price action traders get confused about is that price action is not a trading ‘system’. When traders finally come over to the ‘price

As an old business saying goes, "Fail to plan and you plan to fail." It might not sound serious, but those who are serious about being successful, including traders, should follow these eight words as

Where to Draw the Fibonacci Retracement? Where exactly is that? For starters, we need to identify an extended move up or down on our chart. In other words, a swing low followed by a defined high or a

A Bearish Technical Case for Precious Metals (Brandt) Shale Is Not a Ponzi (FT Alphaville, Part II) Millennials Aren’t Changing Jobs as Much. That’s a Big Problem for the Economy (Wonkblog) see also

Identifying turning points in the market can be a daunting task. If you are already in a position, it’s easy to let your emotions take over and throw your larger goal out the window in favor of

This article is a capstone on the topic of support and resistance. Below we discuss multiple subjects within the field of support and resistance, many of which offer more detailed information by

Hoy vamos a dar forma acabada a la idea de publicación de las señales comerciales del EA en el Twitter a base de PHP. Hemos empezado a hablar sobre eso en la primera parte del artículo. Vamos a reunir las partes separadas del SDSS. En cuanto al lado del cliente de la arquitectura del sistema, vamos a utilizar la nueva función WebRequest() del MQL5 para el envío de las señales comerciales vía HTTP.