Francis Dogbe / Perfil

- Información

|

9+ años

experiencia

|

2

productos

|

36

versiones demo

|

|

1

trabajos

|

0

señales

|

0

suscriptores

|

Amigos

1783

Solicitudes

Enviadas

Francis Dogbe

Mostrar todos los comentarios (6)

Francis Dogbe

2014.04.20

@ Rogerio, what can be done to avoid repaint?

Rogerio Figurelli

2014.04.20

Francis, first of all, write an indicator code good enough to just look to past and present data at each moment. And, the main part, don't "retrade" when losing, if you are not in a backtesting or self adjusting mode.

Francis Dogbe

2014.04.20

Ok, i get you. So do your indicators re-paint because i want to try them....?

Francis Dogbe

Other names for USD:

greenbacks,

bones,

benjis,

benjamins,

cheddar,

paper,

loot,

scrilla,

cheese,

bread,

moolah,

dead presidents,

cash money.

Did you also know that in Peru, a nickname for the U.S. dollar is Coco, which is a pet name for Jorge (George in Spanish),

greenbacks,

bones,

benjis,

benjamins,

cheddar,

paper,

loot,

scrilla,

cheese,

bread,

moolah,

dead presidents,

cash money.

Did you also know that in Peru, a nickname for the U.S. dollar is Coco, which is a pet name for Jorge (George in Spanish),

Francis Dogbe

When not to trade

There is no system that is 100% automated or mechanical that will yield extraordinary results — there will always be some decisions that you will have to make, like deciding when not to trade.

Trading carries a risk and each time you place a trade, you should understand that you can either lose the trade or win the trade. As long as you stick to only risking 2% on an single trade, you are able to protect your account from draw down effects.

Any strategy that has a set of rules can be more profitable in one set of hands than another. The difference is down to the trader and the way the strategy is applied to the markets. For this reason, there is always a certain amount of discretion that needs to be involved. In our additional articles, we help you develop your decision-making abilities in order to apply your strategy to the markets.

Most traders that have become successful will tell you that their best decisions do not revolve around when to trade, but rather when not to trade. In this lesson, we address some of these situations that will help you understand when it is best not to trade.

1.What happens when the price goes above the R3 or the S3?

The R3 and the S3 are the last pivot points to the top and the bottom. The price sometimes trades above the R3 or below the S3. When the price is trading outside of these ranges, they are trading above or below a normal daily range. This means that there has been some substantial buying pressure or selling pressure that has pushed the price beyond these levels. When this happens, the price is likely to stall as traders are likely to start taking their positions off.

In these cases it is best to stay out of the markets and wait until the next day to resume trading.

2. Currency pairs can move with each other

You must also be aware that trading different currency pairs that are correlated can add to your risk. Currencies are generally traded in pairs, however pairs cannot be thought of in isolation, because if one currency in the pair increases in value, then it is likely to increase against other currencies in different pairs as well.

For example, if the value of, say, the US dollar rises in value against the euro, it is not likely to just increase against the euro, but rather it will increase against all other currencies. So if the value of the EUR/USD rises, then it is likely that the AUD/USD will also rise.

If you then open up a buy trade on both currency pairs at the same time and you have risked 2% on each trade, then you have effectively risked 4% on a single trade. This is because if the EUR/USD falls, then the AUD/USD is likely to fall as well – you could lose both trades because they are strongly correlated with each other.

Not paying attention to the correlation effect between currency pairs is likely to have a negative draw down effect on your trading account, because you are likely to be increasing the risk when trading.

3. Entry is close to a pivot point

Sometimes when you go to enter into a trade, you will notice that your entry is very close to your profit target. This leaves a question open about whether you should enter into a trade or not. It is a little difficult to judge because most of the time you do not know how close is too close either.

As a general rule of thumb, if your profit target is over 5 pips away from your entry, then you can go ahead and enter your trade as normal. If the profit target is less than five pips away from your entry point, then you can choose to target the next pivot point beyond your profit target.

3. Trades before the weekend

Yes. If trading the beginner strategy, always close your positions on Friday. It is essential in the beginning to avoid leaving trades open over the weekend. Even though the markets are closed, speeches, catastrophes and political events — for example — can happen that will move the price.

However, because the markets are closed, market gaps are likely to occur as traders cannot react to these events until the markets open on Monday. Market gaps can be large and may even go past your stop loss, which can lead to a large loss on your open trade.

4. Trading with the news

Throughout the day, economic news are released that give indications as to the strength of an economy of a particular country. When these economic reports indicate that an economy is doing well, generally as a rule of thumb the currency will rise. There are many different reports that are released and each one generally reports on a specific segment of the economy. However, at the time of publication, this economic news can create a lot of market volatility. If you are in a trade set-up or your trade has already been triggered, then the market can quite literally whipsaw you out of the market before continuing on.

So what do you do when these economic reports are being released? If you have not yet entered into a trade, then it is generally best to stay out of the market until the news has been released. This may mean waiting for a new trade set-up, but it is a much safer option than entering during a news release.

There is no system that is 100% automated or mechanical that will yield extraordinary results — there will always be some decisions that you will have to make, like deciding when not to trade.

Trading carries a risk and each time you place a trade, you should understand that you can either lose the trade or win the trade. As long as you stick to only risking 2% on an single trade, you are able to protect your account from draw down effects.

Any strategy that has a set of rules can be more profitable in one set of hands than another. The difference is down to the trader and the way the strategy is applied to the markets. For this reason, there is always a certain amount of discretion that needs to be involved. In our additional articles, we help you develop your decision-making abilities in order to apply your strategy to the markets.

Most traders that have become successful will tell you that their best decisions do not revolve around when to trade, but rather when not to trade. In this lesson, we address some of these situations that will help you understand when it is best not to trade.

1.What happens when the price goes above the R3 or the S3?

The R3 and the S3 are the last pivot points to the top and the bottom. The price sometimes trades above the R3 or below the S3. When the price is trading outside of these ranges, they are trading above or below a normal daily range. This means that there has been some substantial buying pressure or selling pressure that has pushed the price beyond these levels. When this happens, the price is likely to stall as traders are likely to start taking their positions off.

In these cases it is best to stay out of the markets and wait until the next day to resume trading.

2. Currency pairs can move with each other

You must also be aware that trading different currency pairs that are correlated can add to your risk. Currencies are generally traded in pairs, however pairs cannot be thought of in isolation, because if one currency in the pair increases in value, then it is likely to increase against other currencies in different pairs as well.

For example, if the value of, say, the US dollar rises in value against the euro, it is not likely to just increase against the euro, but rather it will increase against all other currencies. So if the value of the EUR/USD rises, then it is likely that the AUD/USD will also rise.

If you then open up a buy trade on both currency pairs at the same time and you have risked 2% on each trade, then you have effectively risked 4% on a single trade. This is because if the EUR/USD falls, then the AUD/USD is likely to fall as well – you could lose both trades because they are strongly correlated with each other.

Not paying attention to the correlation effect between currency pairs is likely to have a negative draw down effect on your trading account, because you are likely to be increasing the risk when trading.

3. Entry is close to a pivot point

Sometimes when you go to enter into a trade, you will notice that your entry is very close to your profit target. This leaves a question open about whether you should enter into a trade or not. It is a little difficult to judge because most of the time you do not know how close is too close either.

As a general rule of thumb, if your profit target is over 5 pips away from your entry, then you can go ahead and enter your trade as normal. If the profit target is less than five pips away from your entry point, then you can choose to target the next pivot point beyond your profit target.

3. Trades before the weekend

Yes. If trading the beginner strategy, always close your positions on Friday. It is essential in the beginning to avoid leaving trades open over the weekend. Even though the markets are closed, speeches, catastrophes and political events — for example — can happen that will move the price.

However, because the markets are closed, market gaps are likely to occur as traders cannot react to these events until the markets open on Monday. Market gaps can be large and may even go past your stop loss, which can lead to a large loss on your open trade.

4. Trading with the news

Throughout the day, economic news are released that give indications as to the strength of an economy of a particular country. When these economic reports indicate that an economy is doing well, generally as a rule of thumb the currency will rise. There are many different reports that are released and each one generally reports on a specific segment of the economy. However, at the time of publication, this economic news can create a lot of market volatility. If you are in a trade set-up or your trade has already been triggered, then the market can quite literally whipsaw you out of the market before continuing on.

So what do you do when these economic reports are being released? If you have not yet entered into a trade, then it is generally best to stay out of the market until the news has been released. This may mean waiting for a new trade set-up, but it is a much safer option than entering during a news release.

Francis Dogbe

Sergey Golubev

Comentario sobre el tema EURUSD Technical Analysis 2014 13.04 - 20.04: Bullish

Forum on trading, automated trading systems and testing trading strategies Press review newdigital , 2014.04.15 19:48 EUR/USD rejected by minor retracement EUR/USD has come under steady downside

Francis Dogbe

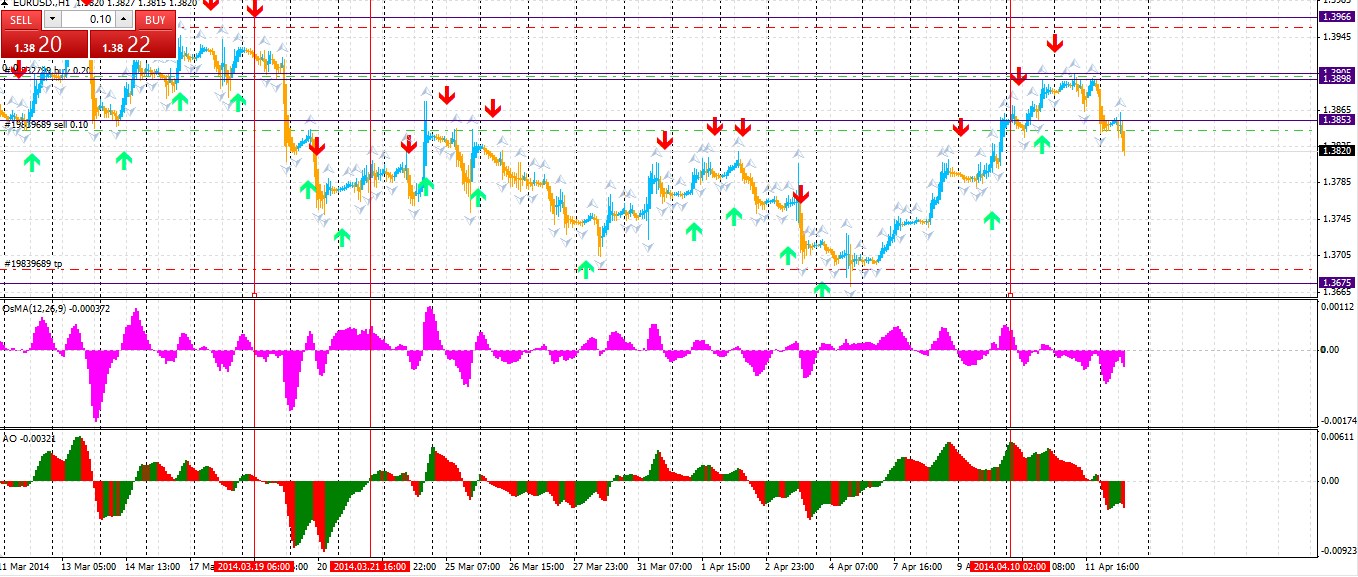

EURUSD Forecast for April 10

Good morning everyone! Today we could be in for some action on many currency pairs as there are many fundamental news items to be coming out through the day. Basically we could see some action on all currency pairs as fundamental watch items like G20 meetings can affect all the currencies. Yesterday’s forecast was on the positive side as we had 4 pairs out of seven behaving very close to what we had predicted. GBPUSD, USDCAD, USDCHF and NZDUSD were very close, although the oceanic pairs did not move into our blue zones they did go in that particular direction before bouncing off Today we could be in for strong US Dollar and on the other hand Japanese Yen could weaken. Not adding any hedged pairs to offset the trading risk. Happy Trading!

Forecasts Outlook

US Dollar: Strong

Today we're expecting the EURUSD to proceed Long above the barrier levels of 1.38118 and 1.37814.

Good morning everyone! Today we could be in for some action on many currency pairs as there are many fundamental news items to be coming out through the day. Basically we could see some action on all currency pairs as fundamental watch items like G20 meetings can affect all the currencies. Yesterday’s forecast was on the positive side as we had 4 pairs out of seven behaving very close to what we had predicted. GBPUSD, USDCAD, USDCHF and NZDUSD were very close, although the oceanic pairs did not move into our blue zones they did go in that particular direction before bouncing off Today we could be in for strong US Dollar and on the other hand Japanese Yen could weaken. Not adding any hedged pairs to offset the trading risk. Happy Trading!

Forecasts Outlook

US Dollar: Strong

Today we're expecting the EURUSD to proceed Long above the barrier levels of 1.38118 and 1.37814.

Francis Dogbe

[Eliminado]

2014.04.10

I can!

because when we want, we can!

See is to know,

dare is to have,

want is power ...

because when we want, we can!

See is to know,

dare is to have,

want is power ...

Francis Dogbe

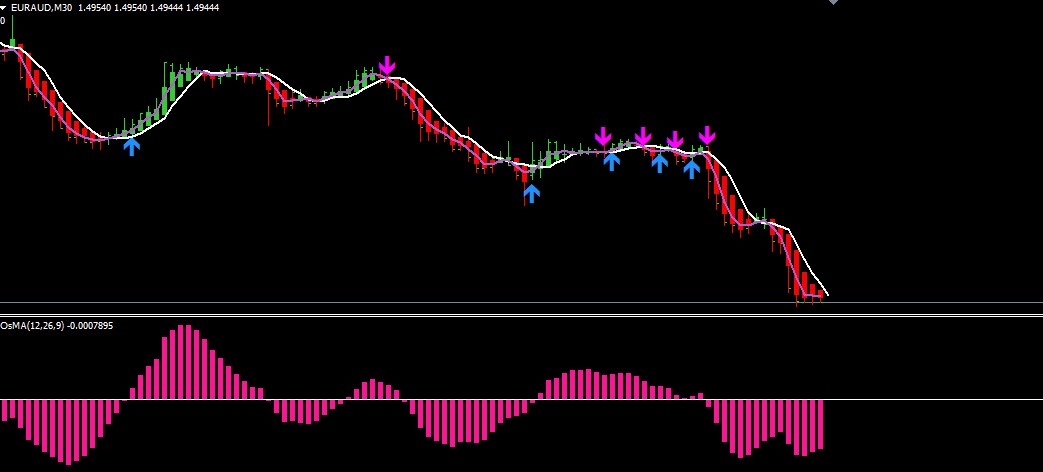

In order to determine the market direction, find the last broken up fractal and the last broken down fractal. Determine which of these two fractals broke last. If the up fractal broke last, the market direction is up. If the down fractal broke last, the market direction is down.

Note: it does not matter where the actual fractal that is broken is located, what counts is the location of the point where it breaks. It is important to understand that it is the last break of a fractal that counts to determine the market direction, and not the fractal itself.

Check out this link.

http://youtu.be/pW6In-K2QDA

Note: it does not matter where the actual fractal that is broken is located, what counts is the location of the point where it breaks. It is important to understand that it is the last break of a fractal that counts to determine the market direction, and not the fractal itself.

Check out this link.

http://youtu.be/pW6In-K2QDA

Francis Dogbe

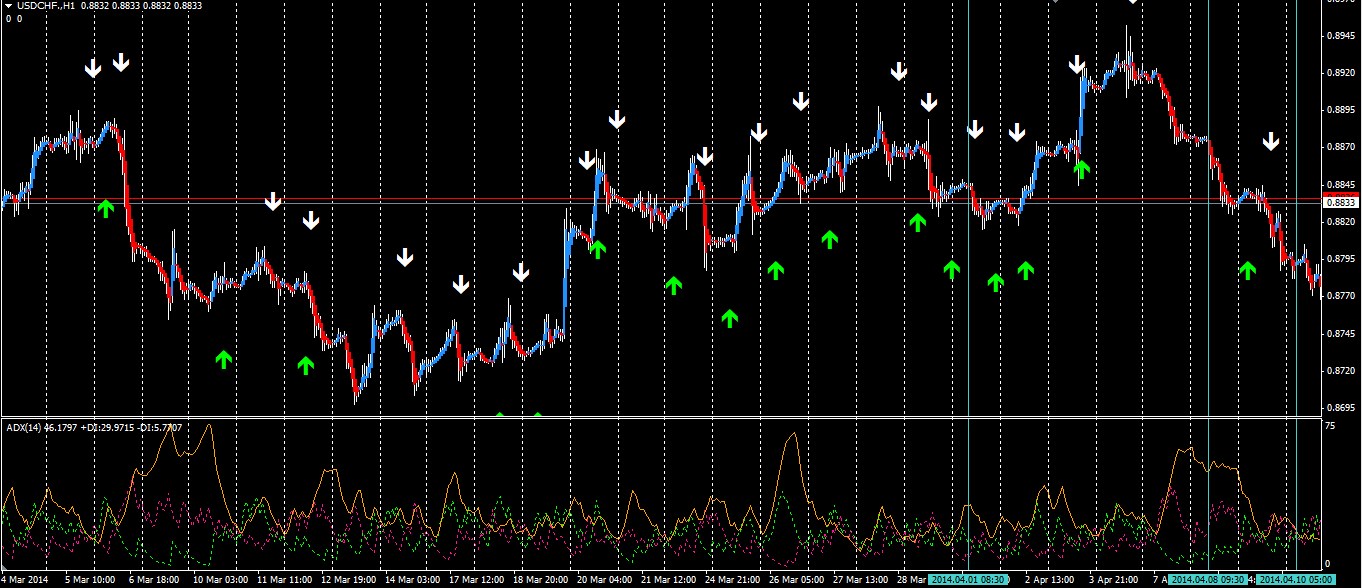

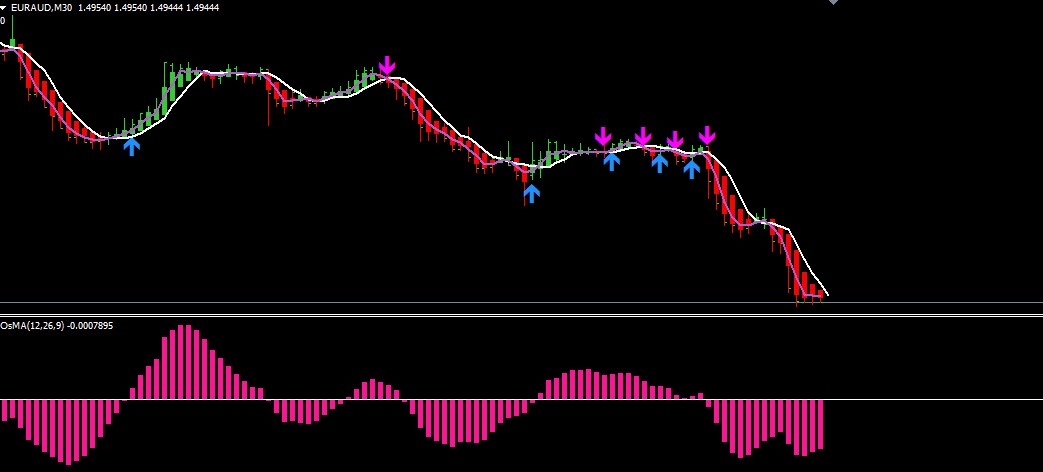

My trading strategy is pretty quite simple.

Indicators:

1. Hieken Ashi

2. 2 -SMA

3. Moving Average Oscillator

Indicators:

1. Hieken Ashi

2. 2 -SMA

3. Moving Average Oscillator

Francis Dogbe

Ha dejado el comentario sobre el Ejecutor por el trabajo MAC.Buy.Sell

Steven is a master in small clothing. He really pulled of a good job for me and i love. I recommend him anyone. Thanks and keep up the good work. Cheers

: