mazen nafee / Perfil

- Información

|

10+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Amigos

951

Solicitudes

Enviadas

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

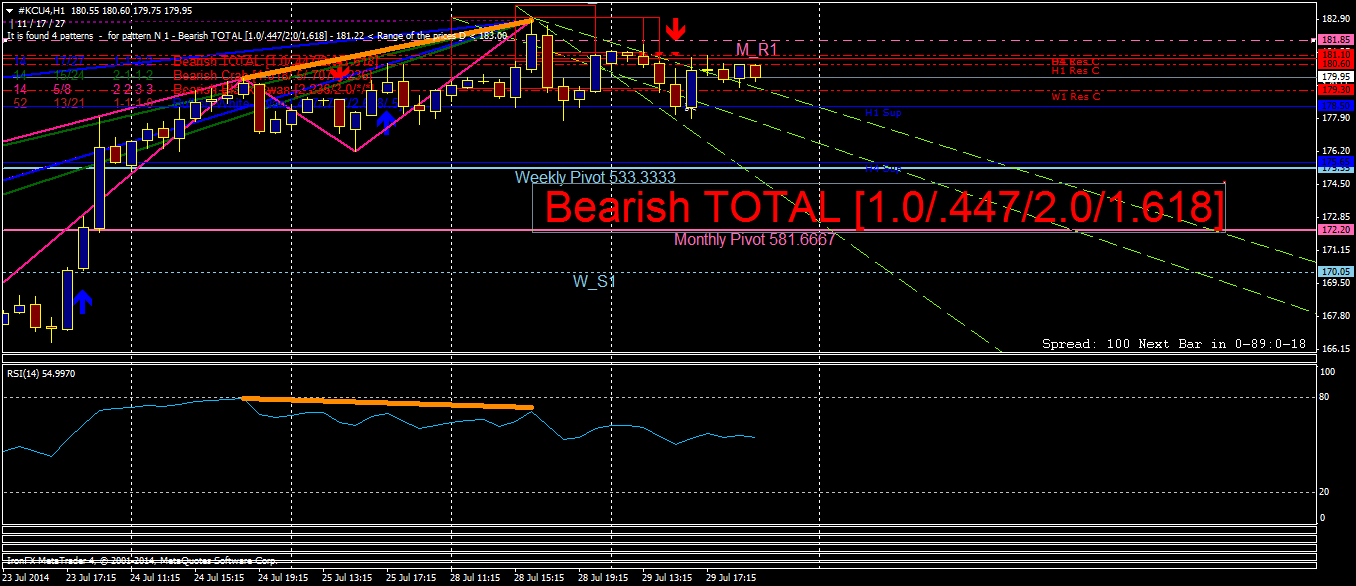

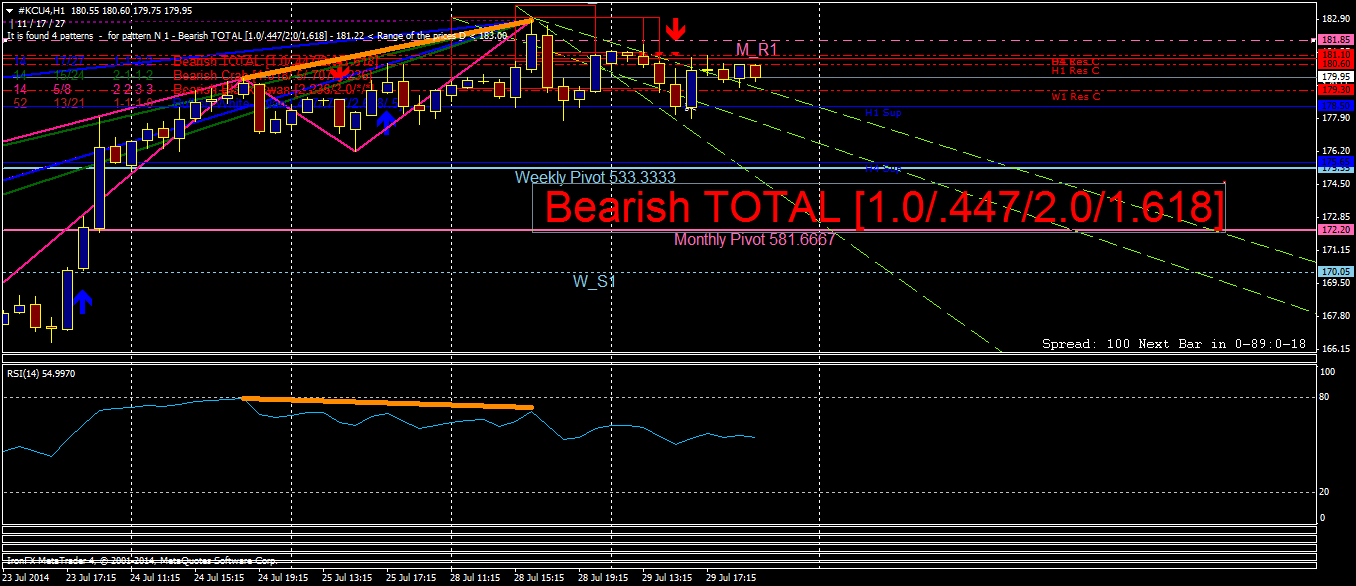

#KCU4 H1 ( September 2014 Arabica Coffee Futures ) Bearish TOTAL [1.0/.447/2.0/1.618] Pattern Bearish Divergence (RSI) Month Resistance at 181.85

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

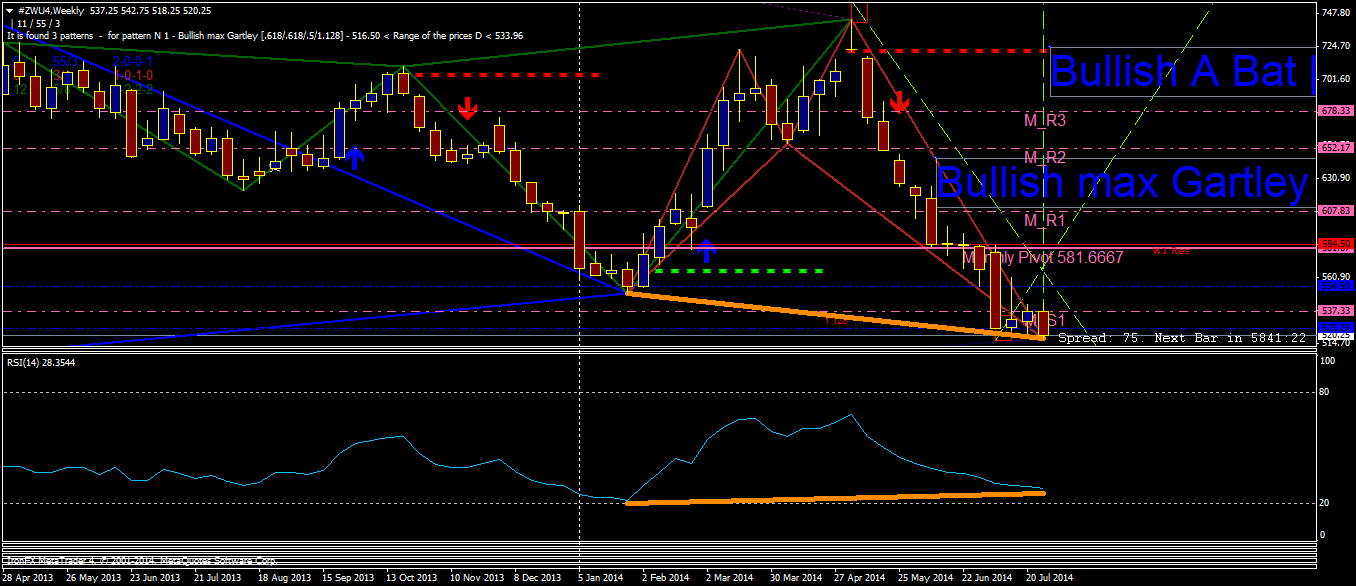

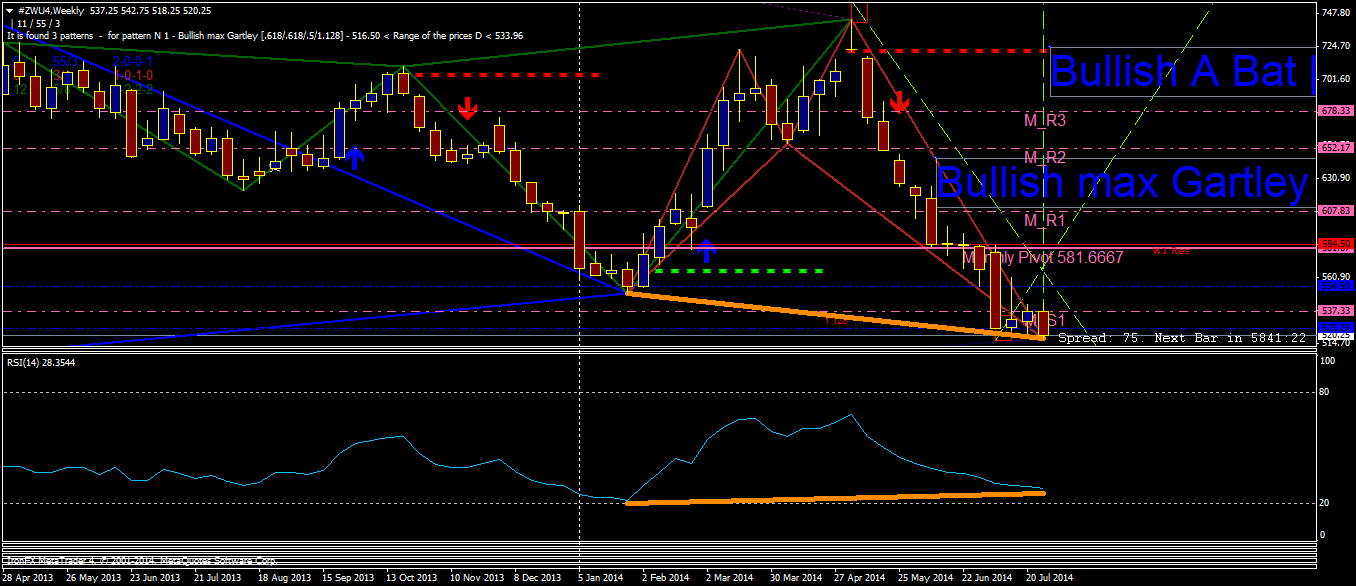

#ZWU4 Weekly Time Frame ( September 2014 Wheat Futures ) Bullish A Bat [1.128/.382/1.272/2.618] Pattern Bullish max Gartley [.618/.618/.5/1.128] Pattern Bullish Divergence (RSI) Support Month at

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

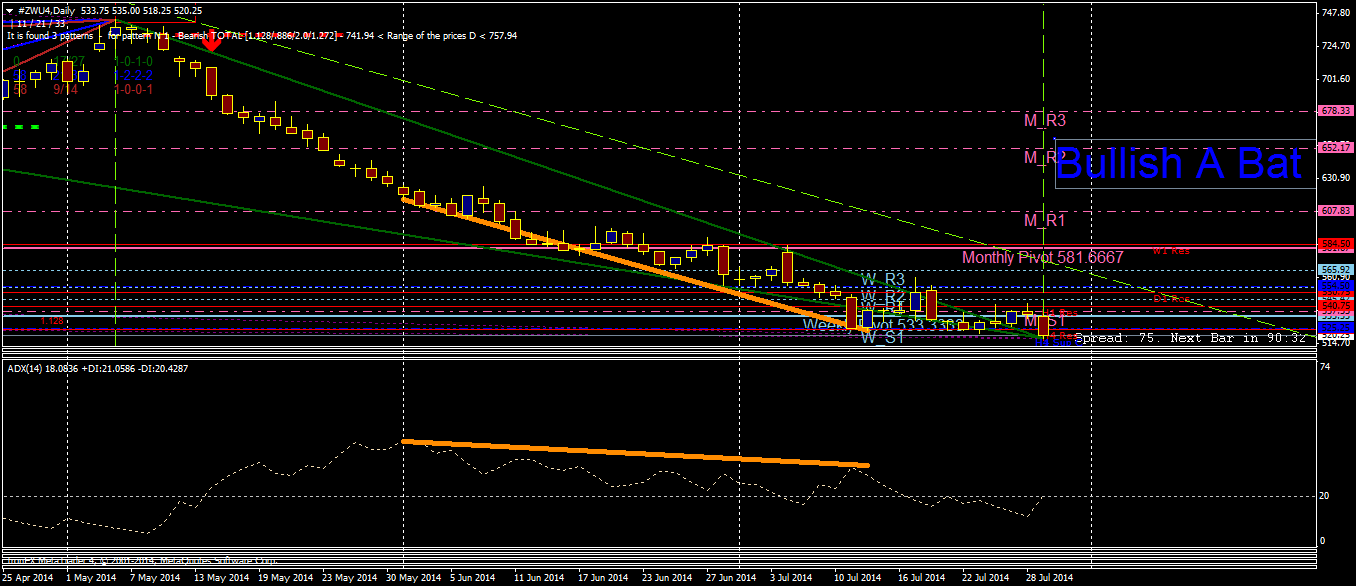

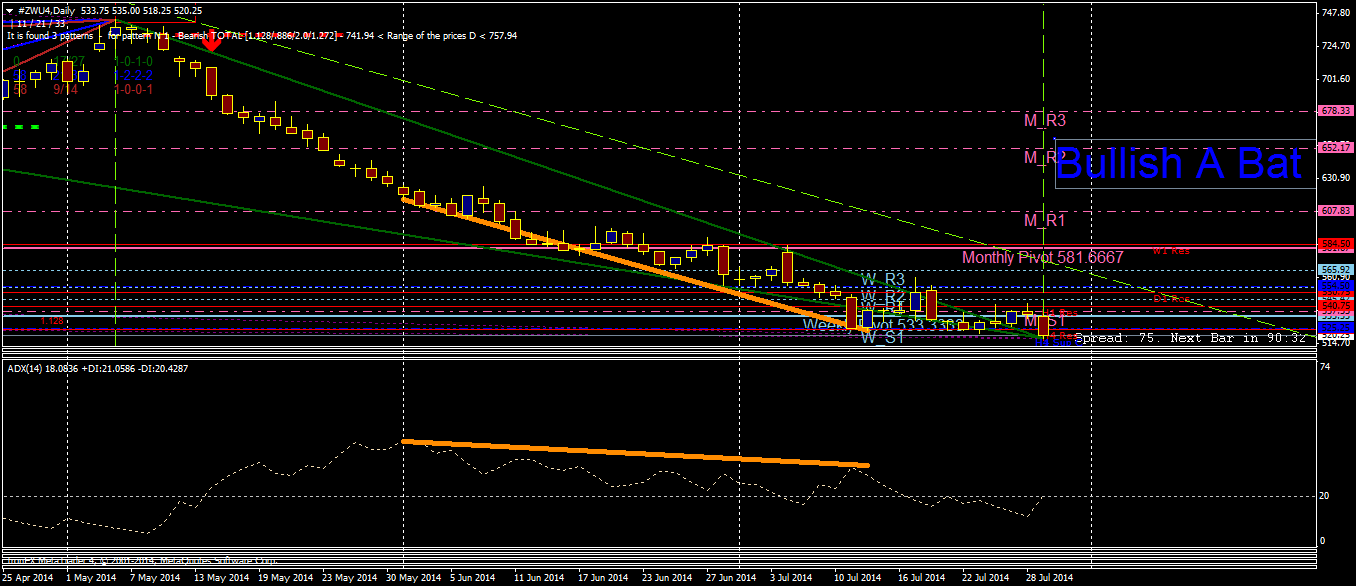

#ZWU4 Daily Time Frame ( September 2014 Wheat Futures ) Bullish A Bat [1.128/.382/1.272/2.618] Pattern Bullish Divergence (ADX) Support Week at 525.25

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

#ZWU4 H4 Time Frame ( September 2014 Wheat Futures ) Bullish TOTAL [1.128/.786/1.0/1.414] Pattern Bullish A Bat [1.128/.382/1.272/2.618] Pattern Bullish TOTAL [1.414/.447/1.272/2.618] Pattern

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

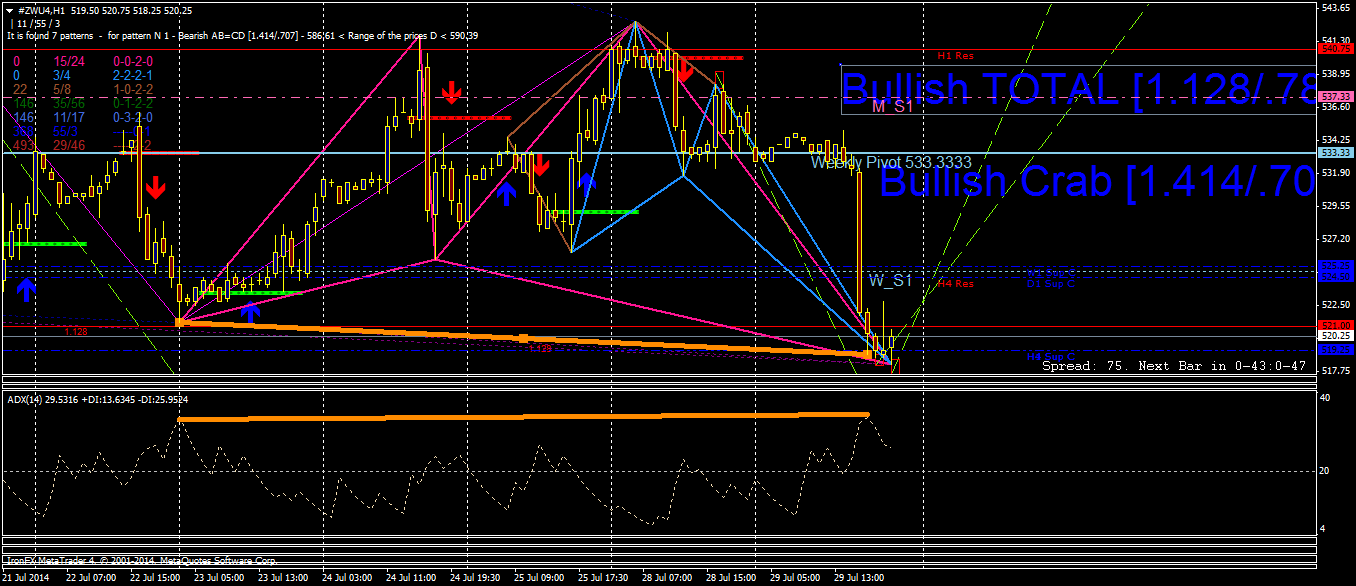

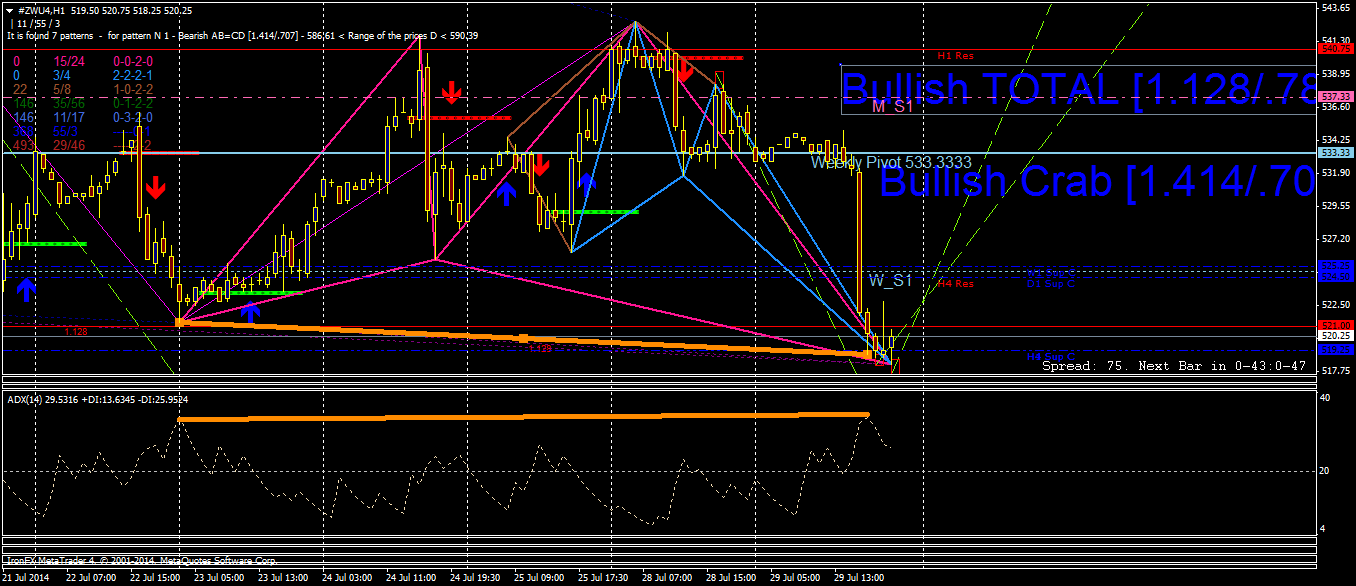

#ZWU4 H1 Time Frame ( September 2014 Wheat Futures ) Bullish TOTAL [1.128/.786/1.0/1.414] Pattern Bullish Crab [1.414/.707/.618/3.14] Pattern Bullish Divergence (ADX) Support H4 at 519.25

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

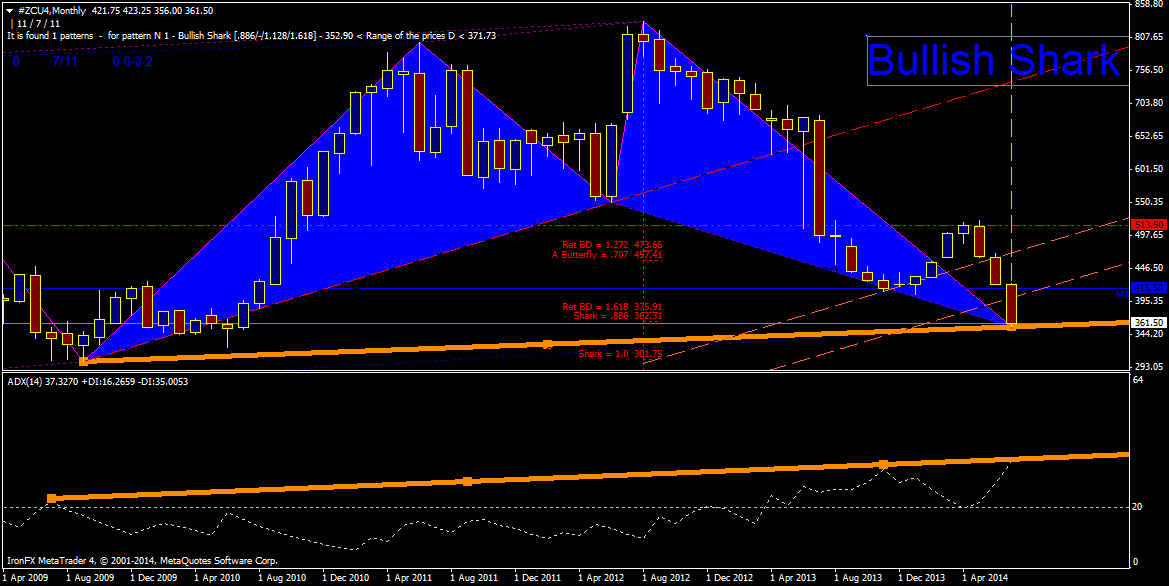

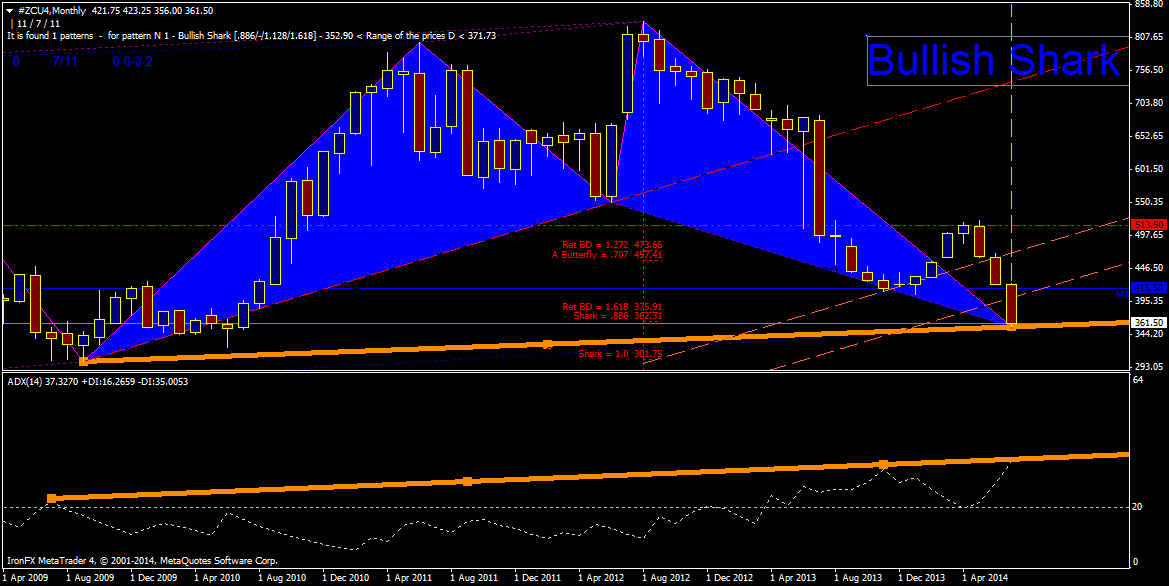

#ZCU4 Monthly Time Frame ( September 2014 Corn Futures ) Bullish Shark [.886/-/1.128/1.618] Pattern Bullish Divergence (ADX) Support Monthly at 415.50

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

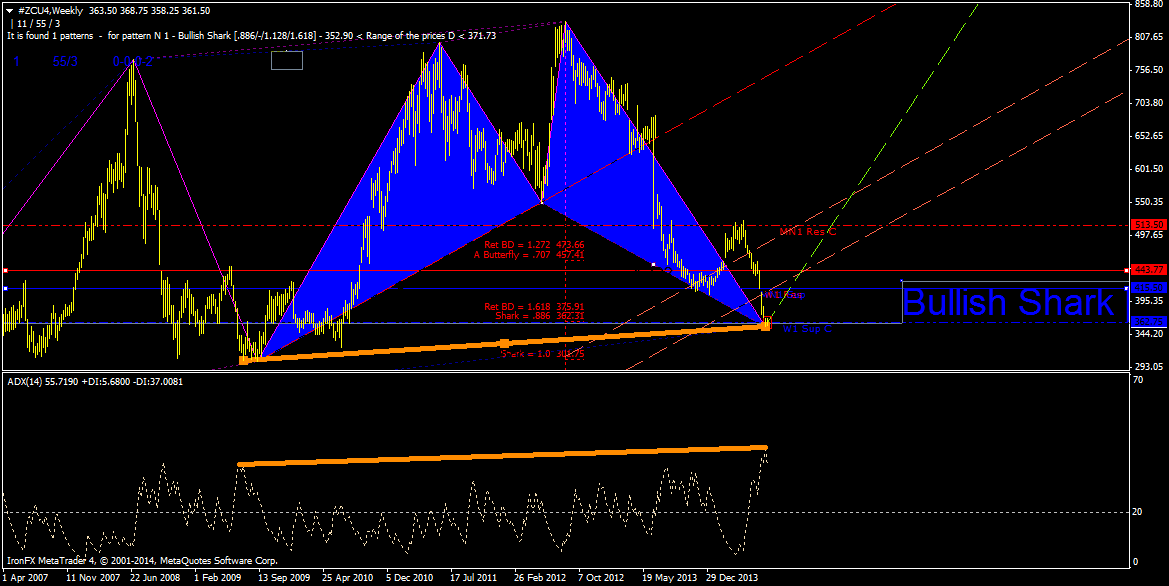

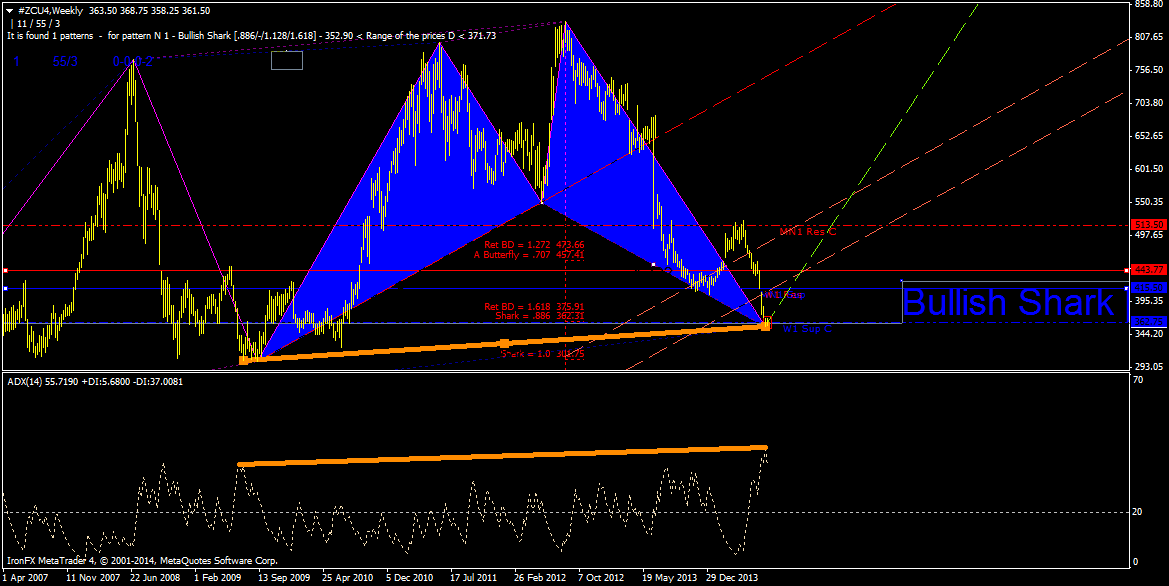

#ZCU4 WEEKLY TimeFrame ( September 2014 Corn Futures ) Bullish Shark [.886/-/1.128/1.618] Pattern Bullish Divergence (ADX) Support Week at 362.75

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

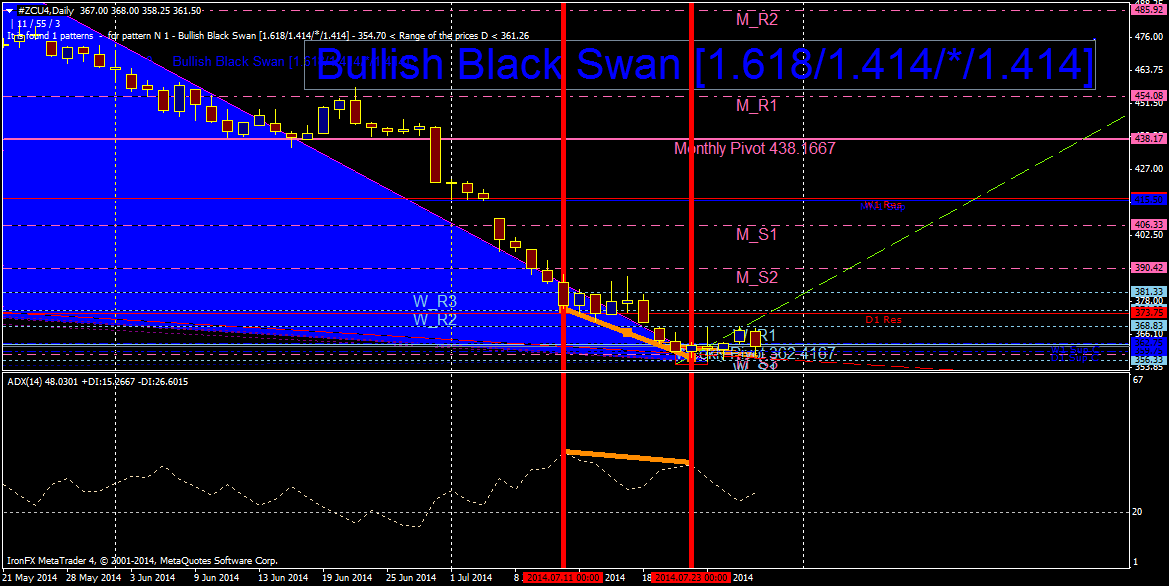

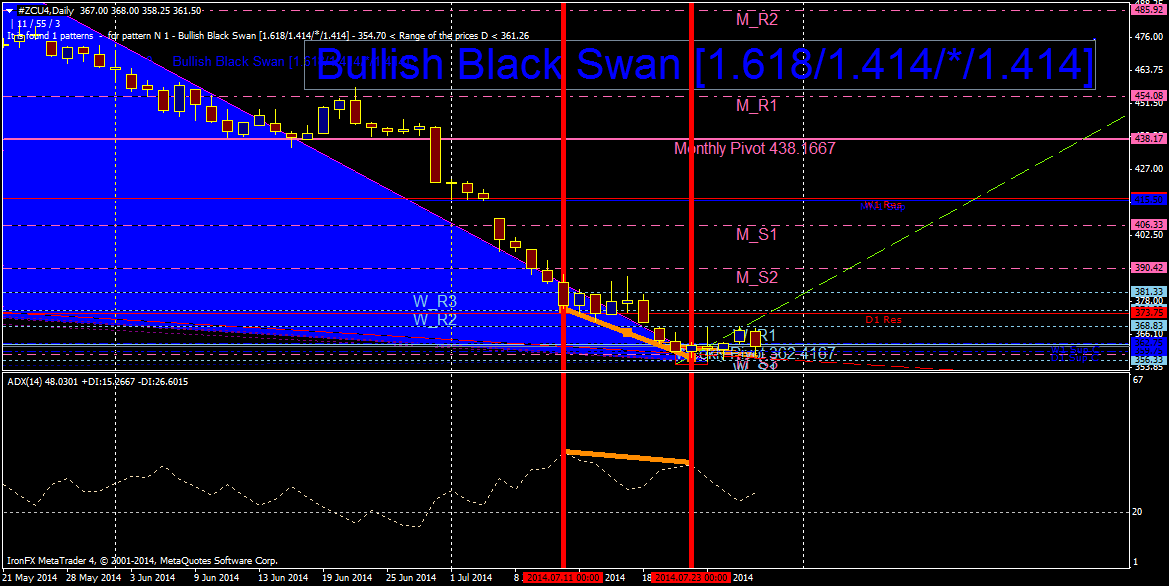

#ZCU4 Daily TimeFrame ( September 2014 Corn Futures ) Bullish Black Swan [1.618/1.414/*/1.414] Pattern Bullish Divergence (ADX) Support Month( 3) at 358.58

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

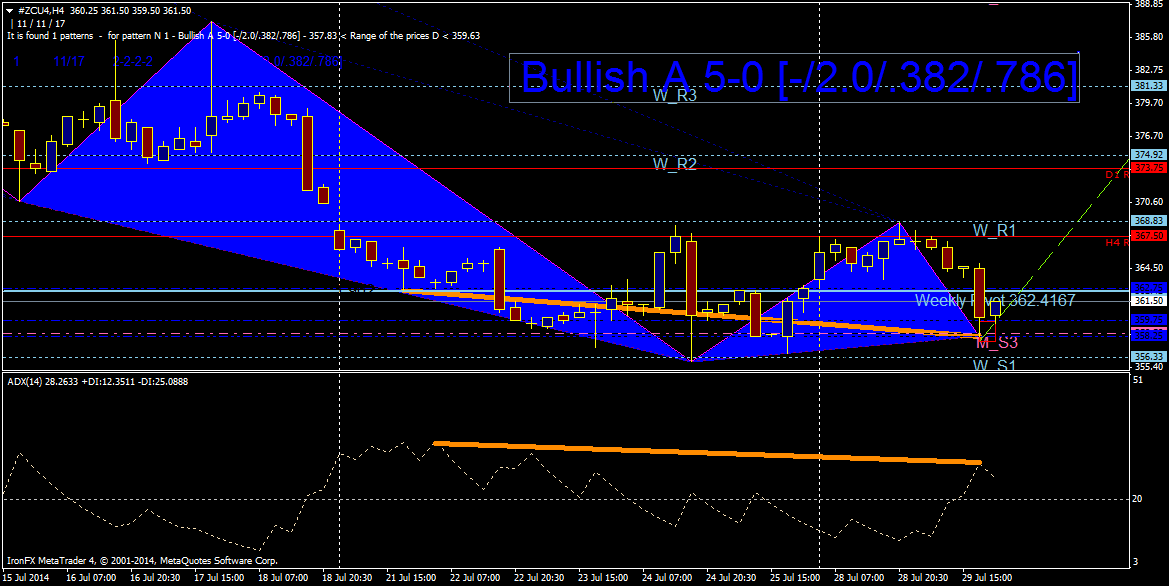

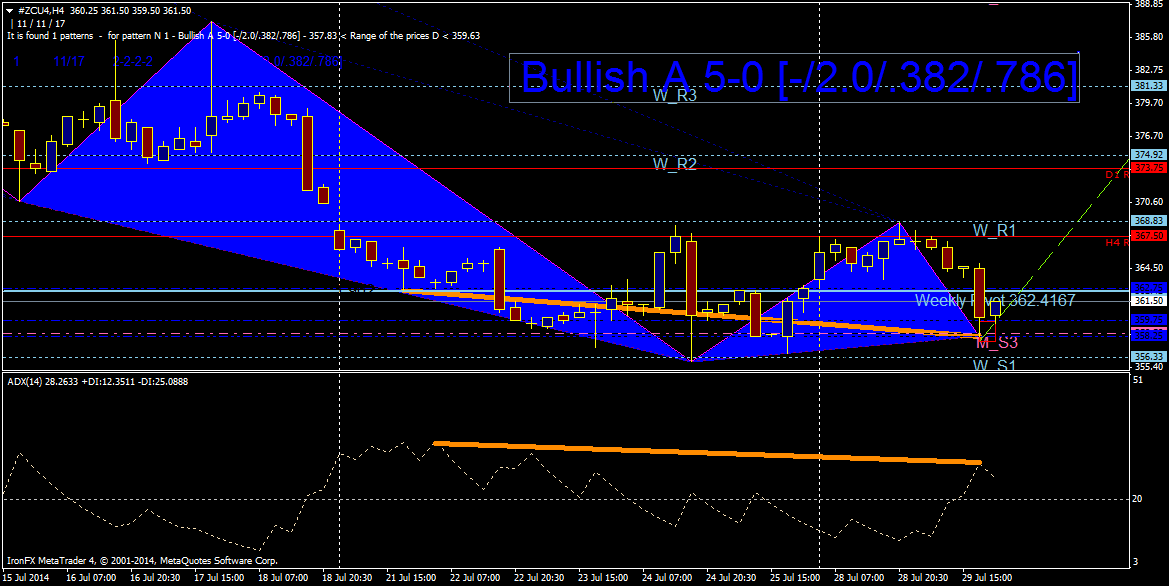

#ZCU4 H4 TimeFrame ( September 2014 Corn Futures ) Bullish A 5-0 [-/2.0/.382/.786] Pattern Bullish Divergence (ADX) Support Month( 3) at 358.58

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

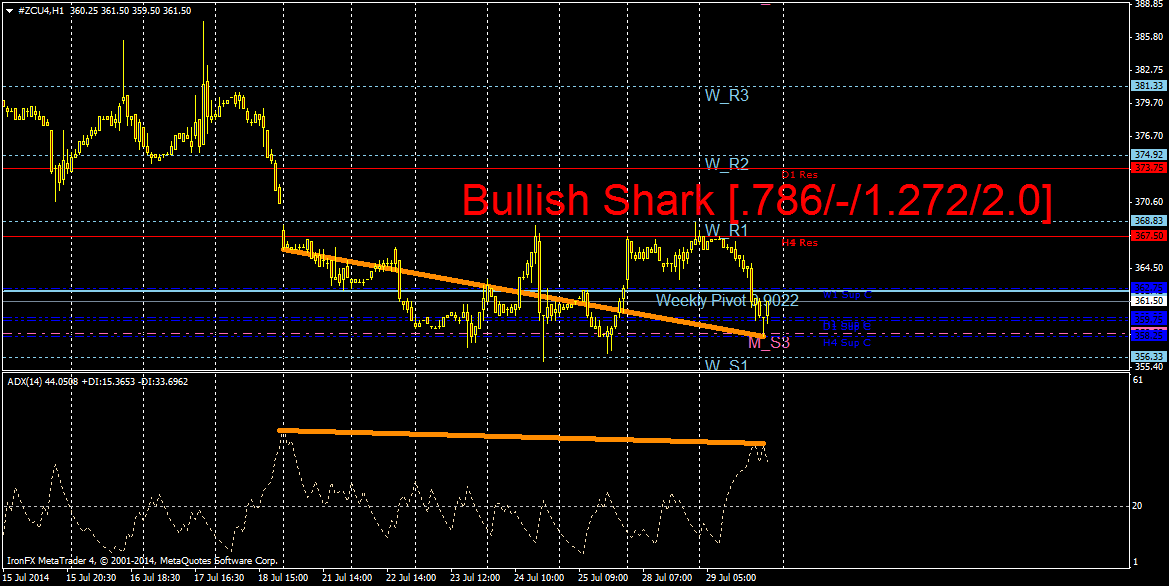

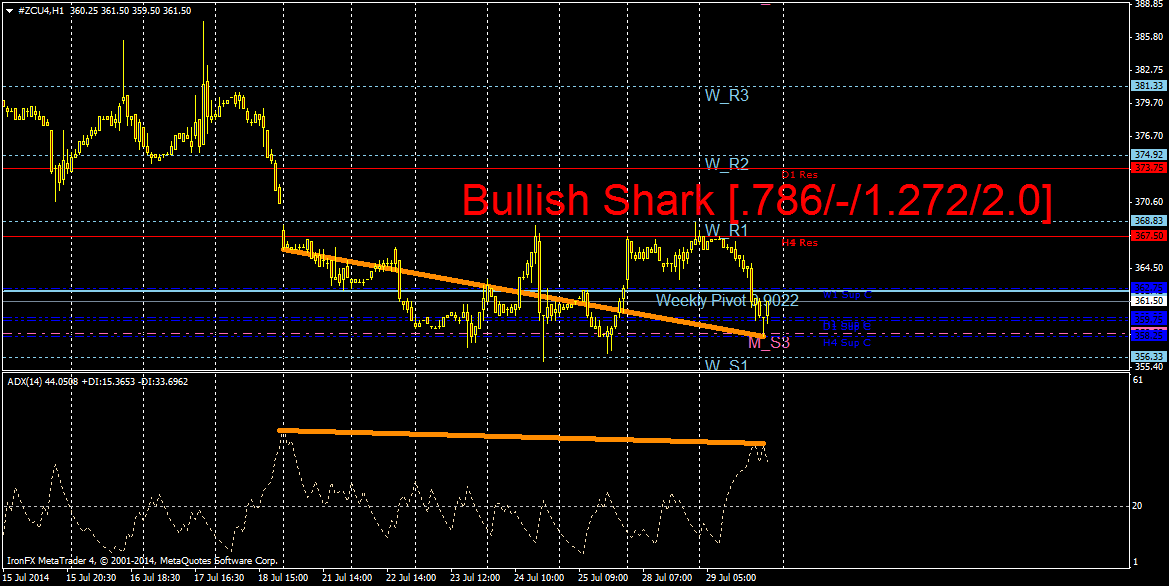

#ZCU4 H1 TimeFrame ( September 2014 Corn Futures ) Bullish Shark [.786/-/1.272/2.0] Pattern Bullish Divergence (ADX)

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

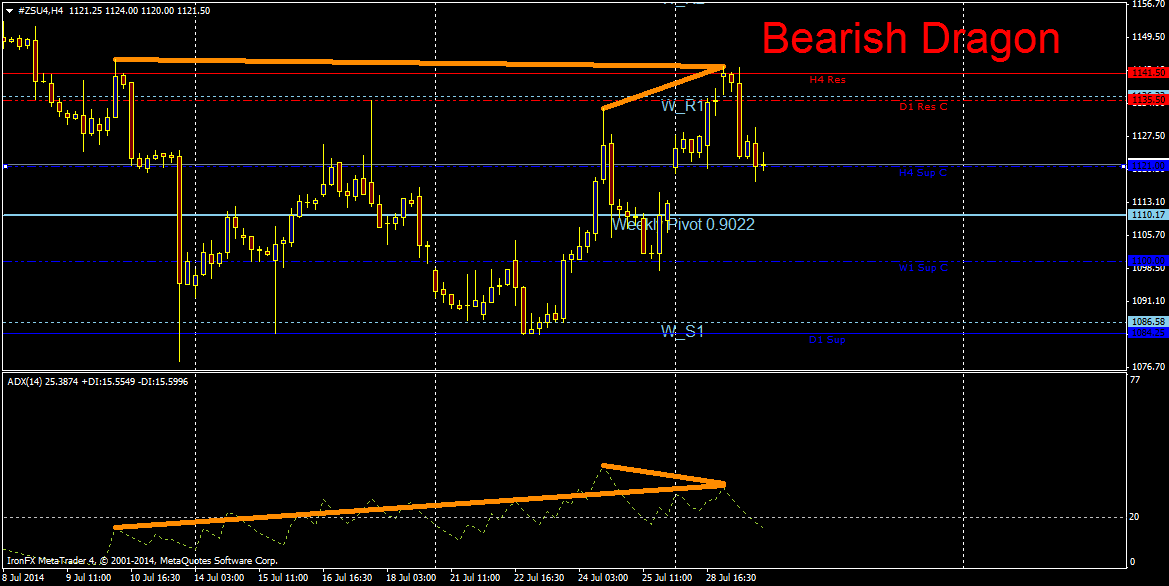

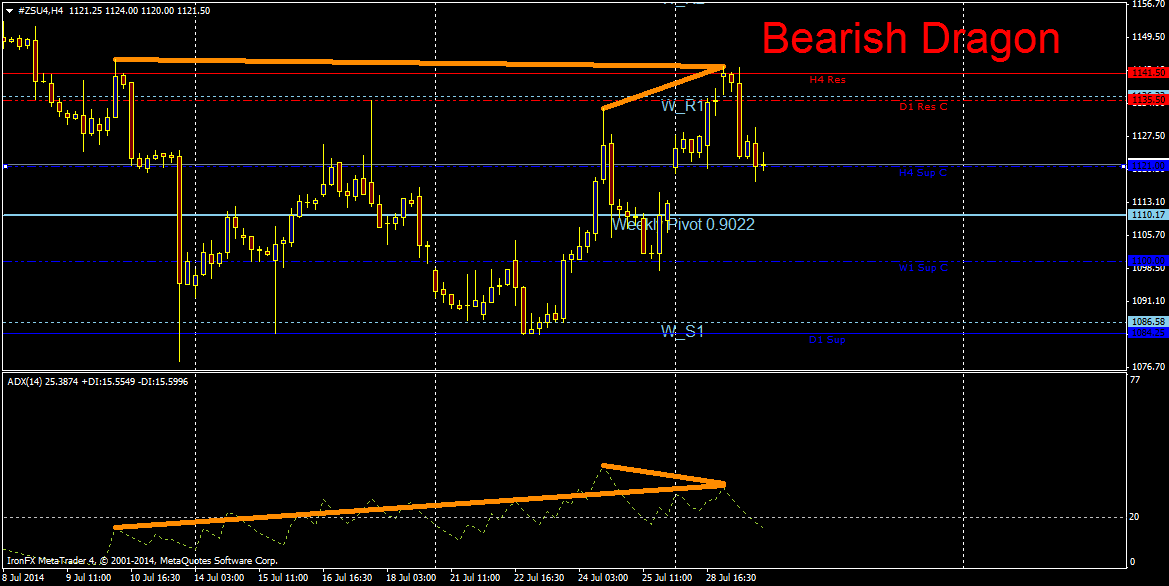

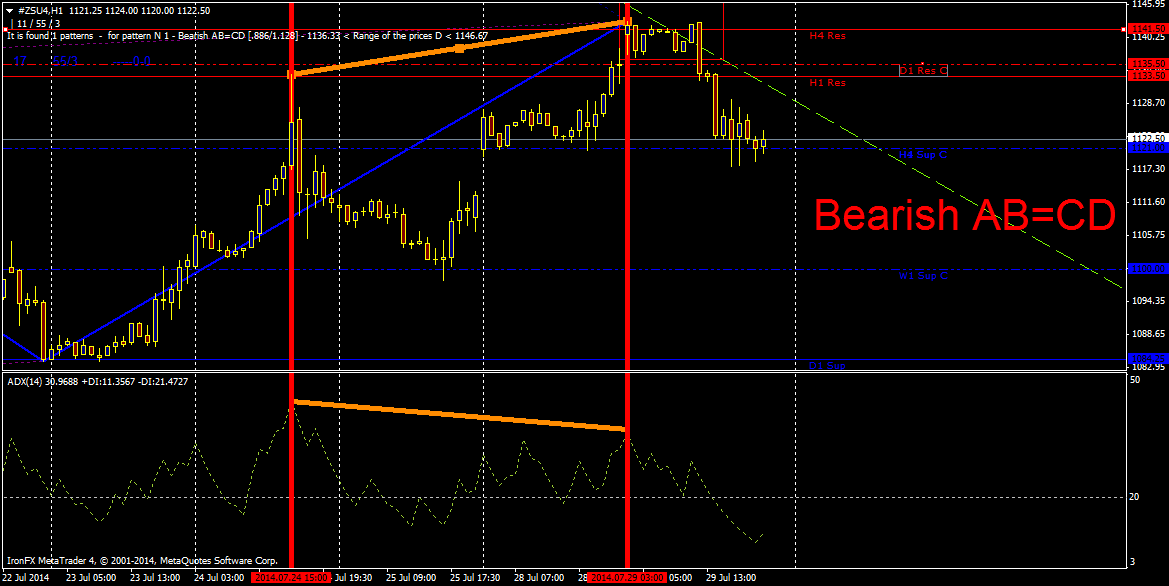

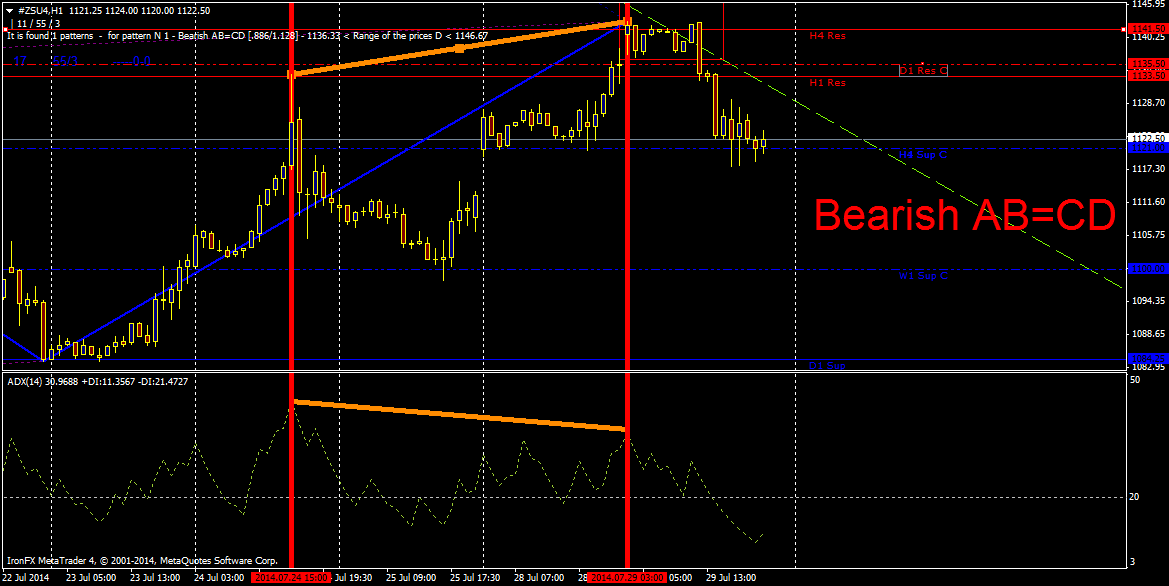

#ZSU4 H4 TimeFrame ( September 2014 Soybean Futures ) Bearish Dragon Pattern Bearish Divergence (ADX) (two possible )

mazen nafee

mazen nafee

Comentario sobre el tema Indices Technical Analysis

#ZSU4 H1 TimeFrame ( September 2014 Soybean Futures ) Bearish AB=CD Pattern Bearish Divergence (AXD)

mazen nafee

Sergey Golubev

1. Q2 2014 Advance GDP Price action should start to get interesting by Wednesday when the advance GDP report for the second quarter of 2014 is released. Due at 6:00 pm GMT, the report is anticipated to print at 3.1...

1

mazen nafee

Sergey Golubev

As many users want to make their technical/fundamental/any analysis so I have to explain about the rules how it should be going on this website. 1. Start your thread with your "technical/fundamental/any analysis/article...

1

mazen nafee

Frontier Communications ST: the RSI is overbought

Our pivot point is at 6.61.

Our preference: the upside prevails as long as 6.61 is support.

Alternative scenario: the downside breakout of 6.61 would call for 6.43 and 6.32.

Comment: the RSI is trading above 70. This could mean that either the stock is in a lasting uptrend or just overbought and that therefore a correction could shape (look for bearish divergence in this case). The MACD is above its signal line and positive. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at 5.88 and 5.79). Finally, Frontier Communications is trading above its upper Bollinger band (standing at 6.39). Frontier Communications is currently trading near its 52 week high reached at 7.24 on 29/07/14.

Supports and resistances:

7.82 **

7.7 *

7.59 **

7.47

6.9435 last

6.68

6.61 **

6.43 *

6.32 **

Our pivot point is at 6.61.

Our preference: the upside prevails as long as 6.61 is support.

Alternative scenario: the downside breakout of 6.61 would call for 6.43 and 6.32.

Comment: the RSI is trading above 70. This could mean that either the stock is in a lasting uptrend or just overbought and that therefore a correction could shape (look for bearish divergence in this case). The MACD is above its signal line and positive. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at 5.88 and 5.79). Finally, Frontier Communications is trading above its upper Bollinger band (standing at 6.39). Frontier Communications is currently trading near its 52 week high reached at 7.24 on 29/07/14.

Supports and resistances:

7.82 **

7.7 *

7.59 **

7.47

6.9435 last

6.68

6.61 **

6.43 *

6.32 **

mazen nafee

Shutterfly Inc ST: target 39.7

Our pivot point stands at 50.3.

Our preference: target 39.7.

Alternative scenario: above 50.3, look for 54.2 and 56.4.

Comment: the RSI is below 50. The MACD is positive and below its signal line. The MACD must penetrate its zero line to expect further downside. Moreover, the stock is trading under its 20 day MA (47.6) but above its 50 day MA (43.97).

Supports and resistances:

56.4 **

54.2 *

50.3 **

48.7

46.71 last

42

39.7 **

37.5 *

35.2 **

Our pivot point stands at 50.3.

Our preference: target 39.7.

Alternative scenario: above 50.3, look for 54.2 and 56.4.

Comment: the RSI is below 50. The MACD is positive and below its signal line. The MACD must penetrate its zero line to expect further downside. Moreover, the stock is trading under its 20 day MA (47.6) but above its 50 day MA (43.97).

Supports and resistances:

56.4 **

54.2 *

50.3 **

48.7

46.71 last

42

39.7 **

37.5 *

35.2 **

mazen nafee

USANA Health Sciences Inc ST: the downside prevails as long as 73.5 is resistance

Our pivot point stands at 73.5.

Our preference: the downside prevails as long as 73.5 is resistance.

Alternative scenario: the upside breakout of 73.5 would call for 78.3 and 81.1.

Comment: the RSI is below 50. The MACD is negative and below its signal line. The configuration is negative. Moreover, the share stands below its 20 and 50 day MA (respectively at 74.63 and 74.54).

Supports and resistances:

81.1 **

78.3 *

73.5 **

71.7

69.18 last

62.5

59.8 **

57 *

54.3 **

Our pivot point stands at 73.5.

Our preference: the downside prevails as long as 73.5 is resistance.

Alternative scenario: the upside breakout of 73.5 would call for 78.3 and 81.1.

Comment: the RSI is below 50. The MACD is negative and below its signal line. The configuration is negative. Moreover, the share stands below its 20 and 50 day MA (respectively at 74.63 and 74.54).

Supports and resistances:

81.1 **

78.3 *

73.5 **

71.7

69.18 last

62.5

59.8 **

57 *

54.3 **

mazen nafee

Petroquest Energy Inc ST: eye 5.61

7.28 is our pivot point.

Our preference: eye 5.61.

Alternative scenario: above 7.28, look for 7.88 and 8.24.

Comment: the RSI is below its neutrality area at 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is below its 20 day MA (6.93) but above its 50 day MA (6.65).

Supports and resistances:

8.24 **

7.88 *

7.28 **

7.05

6.79 last

5.95

5.61 **

5.25 *

4.91 **

7.28 is our pivot point.

Our preference: eye 5.61.

Alternative scenario: above 7.28, look for 7.88 and 8.24.

Comment: the RSI is below its neutrality area at 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is below its 20 day MA (6.93) but above its 50 day MA (6.65).

Supports and resistances:

8.24 **

7.88 *

7.28 **

7.05

6.79 last

5.95

5.61 **

5.25 *

4.91 **

mazen nafee

NBT Bancorp Inc ST: the downside prevails as long as 23.9 is resistance

23.9 is our pivot point.

Our preference: the downside prevails as long as 23.9 is resistance.

Alternative scenario: above 23.9, look for 24.5 and 24.9.

Comment: the RSI is below 50. The MACD is negative and below its signal line. The configuration is negative. Moreover, the share stands below its 20 and 50 day MA (respectively at 23.65 and 23.47).

Supports and resistances:

24.9 **

24.5 *

23.9 **

23.7

23.32 last

22.2

21.9 **

21.6 *

21.2 **

23.9 is our pivot point.

Our preference: the downside prevails as long as 23.9 is resistance.

Alternative scenario: above 23.9, look for 24.5 and 24.9.

Comment: the RSI is below 50. The MACD is negative and below its signal line. The configuration is negative. Moreover, the share stands below its 20 and 50 day MA (respectively at 23.65 and 23.47).

Supports and resistances:

24.9 **

24.5 *

23.9 **

23.7

23.32 last

22.2

21.9 **

21.6 *

21.2 **

mazen nafee

Bancfirst Corp ST: the downside prevails as long as 62.3 is resistance

Our pivot point is at 62.3.

Our preference: the downside prevails as long as 62.3 is resistance.

Alternative scenario: above 62.3, look for 64.1 and 65.1.

Comment: the RSI is below 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is trading under both its 20 and 50 day MA (respectively at 61.44 and 60.79). Bancfirst Corp is currently trading near its 52 week high reached at 64.31 on 01/07/14.

Supports and resistances:

65.1 **

64.1 *

62.3 **

61.6

60.49 last

58.1

57 **

56 *

54.9 *

Our pivot point is at 62.3.

Our preference: the downside prevails as long as 62.3 is resistance.

Alternative scenario: above 62.3, look for 64.1 and 65.1.

Comment: the RSI is below 50. The MACD is below its signal line and negative. The configuration is negative. Moreover, the stock is trading under both its 20 and 50 day MA (respectively at 61.44 and 60.79). Bancfirst Corp is currently trading near its 52 week high reached at 64.31 on 01/07/14.

Supports and resistances:

65.1 **

64.1 *

62.3 **

61.6

60.49 last

58.1

57 **

56 *

54.9 *

: