LiteFinance / Perfil

Desde el año 2005, LiteFinance (ex. LiteForex) es un bróker de ECN online, que ofrece a los clientes la posibilidad de acceder a la más profunda liquidez en divisas, materias primas y mercados de valores. Para operar a través de LiteFinance (ex. LiteForex) están disponibles todos los principales pares de divisas, tasas cruzadas, petróleo, metales preciosos, índices bursátiles, acciones corporativas y el conjunto más grande de pares de criptomonedas entre los brókeres.

Amigos

380

Solicitudes

Enviadas

LiteFinance

Pandemic strengthened the euro. Forecast as of 29.12.2020

When everything is bad, people buy the dollar. When everyone hopes for the better, the greenback loses its shine. The EURUSD sentiment has radically changed in 2020. Let us discuss the Forex outlook and make up a EURUSD trading plan.

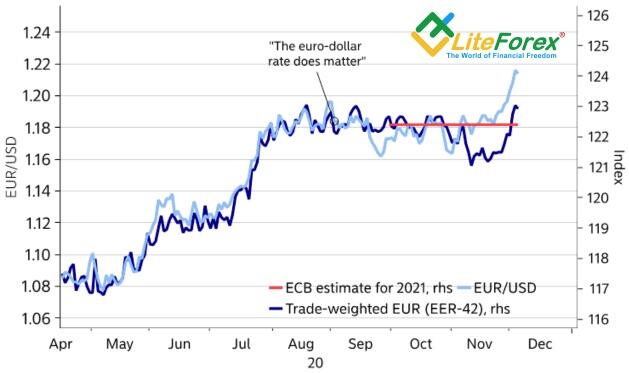

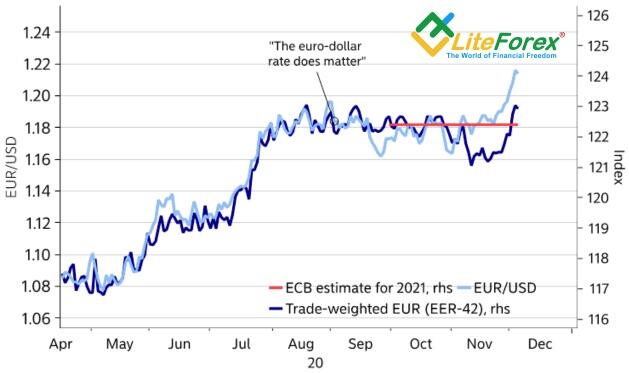

Weekly euro fundamental forecast

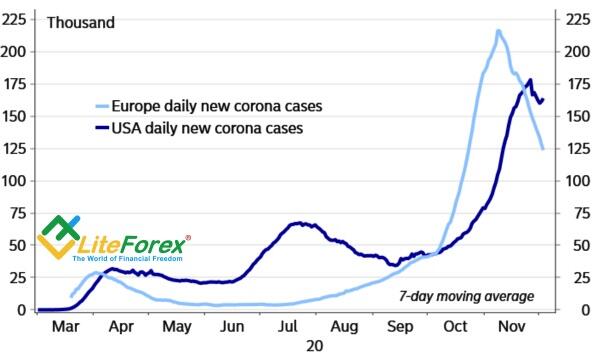

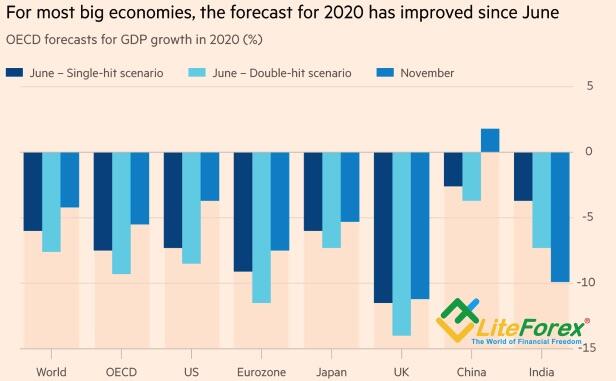

In the first half of 2020, the pandemic was the primary source of uncertainty, pressing down the global risk appetite. Everything has radically changed in the third and fourth quarters. COVID-19 saved American democracy, strengthened EU unity, and even pushed the UK and the European Union towards a Brexit deal. News about the development and successful trials of vaccines, as well as the launch of a vaccination campaign against coronavirus, has supported the global stock indices. The first half of 2021 should be more similar to the end of 2020 than the beginning. This is a bearish factor for safe-havens, including the US dollar.

Let us remember January 2020. Donald Trump’s positions were strong; he launched the tax reform and made China meet the US trade demands. Trump’s approval ratings were high, and few doubted that he would be re-elected for the second term. However, the inefficient pandemic management resulted in Trump’s defeat in the November election. The U.S. President used to be the main source of uncertainty due to his eccentric speeches and decisions, and the U.S. dollar was growing. The pandemic was one of the reasons for Trump’s loss, and, in fact, the uncertainty eased, weakening the greenback.

Something like this happened in the euro area. There had been the risks of the euro-area breakup before the first pandemic wave. However, the EU coronavirus recovery fund eliminated the breakup risks, eased political risks, and pressed down safe-haven assets. But for the COVID-19, the UK wouldn't have so readily agreed to sign the Brexit deal. The pandemic caused the UK economy to slide into the worst recession over the past three hundred years, and a no-deal Brexit could have made it worse.

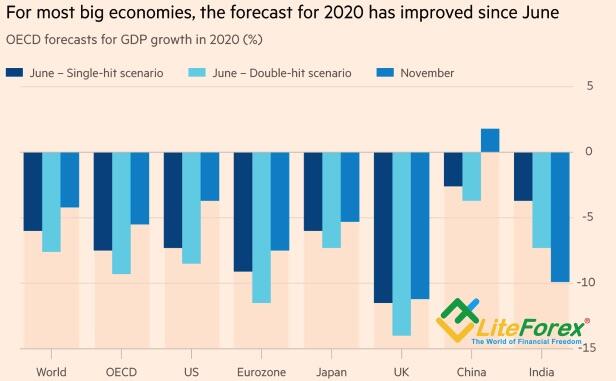

Therefore, the pandemic contributed to the uncertainty easing and the US dollar weakening as a safe haven. So, it is not surprising that the USD net bearish non-commercial positions have reached the highest levels since 2011.

At the end of the year, each new day is more likely to remove uncertainty than add it. So, the greenback’s weakness is not surprising. The markets are optimistic, and the S&P 500 hits fresh highs. The vaccination has started in the euro area. Besides, Donald Trump signed the new fiscal stimulus package. Furthermore, the House of Representatives voted to meet Trump’s demand to boost COVID-19 relief checks from $600 to $2,000, adding $464 billion to the aid plan. These factors support the growth of global stock indexes and EURUSD.

An obstacle to the euro’s rally is the pound’s drop. Traders exit pound longs and market analysts admit that the Brexit deal terms are not optimal for the UK.

Weekly EURUSD trading plan

If the US Senate adopts the House's bill, it will support the S&P 500 rally and increase the global risks appetite. In this case, the EURUSD could break out the resistances at 1.2245 and 1.226 and continue growing towards 1.2305 and 1.234.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/pandemic-strengthened-the-euro-forecast-as-of-29122020/?uid=285861726&cid=79634

When everything is bad, people buy the dollar. When everyone hopes for the better, the greenback loses its shine. The EURUSD sentiment has radically changed in 2020. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly euro fundamental forecast

In the first half of 2020, the pandemic was the primary source of uncertainty, pressing down the global risk appetite. Everything has radically changed in the third and fourth quarters. COVID-19 saved American democracy, strengthened EU unity, and even pushed the UK and the European Union towards a Brexit deal. News about the development and successful trials of vaccines, as well as the launch of a vaccination campaign against coronavirus, has supported the global stock indices. The first half of 2021 should be more similar to the end of 2020 than the beginning. This is a bearish factor for safe-havens, including the US dollar.

Let us remember January 2020. Donald Trump’s positions were strong; he launched the tax reform and made China meet the US trade demands. Trump’s approval ratings were high, and few doubted that he would be re-elected for the second term. However, the inefficient pandemic management resulted in Trump’s defeat in the November election. The U.S. President used to be the main source of uncertainty due to his eccentric speeches and decisions, and the U.S. dollar was growing. The pandemic was one of the reasons for Trump’s loss, and, in fact, the uncertainty eased, weakening the greenback.

Something like this happened in the euro area. There had been the risks of the euro-area breakup before the first pandemic wave. However, the EU coronavirus recovery fund eliminated the breakup risks, eased political risks, and pressed down safe-haven assets. But for the COVID-19, the UK wouldn't have so readily agreed to sign the Brexit deal. The pandemic caused the UK economy to slide into the worst recession over the past three hundred years, and a no-deal Brexit could have made it worse.

Therefore, the pandemic contributed to the uncertainty easing and the US dollar weakening as a safe haven. So, it is not surprising that the USD net bearish non-commercial positions have reached the highest levels since 2011.

At the end of the year, each new day is more likely to remove uncertainty than add it. So, the greenback’s weakness is not surprising. The markets are optimistic, and the S&P 500 hits fresh highs. The vaccination has started in the euro area. Besides, Donald Trump signed the new fiscal stimulus package. Furthermore, the House of Representatives voted to meet Trump’s demand to boost COVID-19 relief checks from $600 to $2,000, adding $464 billion to the aid plan. These factors support the growth of global stock indexes and EURUSD.

An obstacle to the euro’s rally is the pound’s drop. Traders exit pound longs and market analysts admit that the Brexit deal terms are not optimal for the UK.

Weekly EURUSD trading plan

If the US Senate adopts the House's bill, it will support the S&P 500 rally and increase the global risks appetite. In this case, the EURUSD could break out the resistances at 1.2245 and 1.226 and continue growing towards 1.2305 and 1.234.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/pandemic-strengthened-the-euro-forecast-as-of-29122020/?uid=285861726&cid=79634

LiteFinance

Gold got hooked on steroids. Forecast as of 28.12.2020

Six-month gold fundamental analysis

To see the future, you need to look back at the past. Gold is ready to demonstrate the best annual growth since 2010. Stimuli have been the main driver of the XAUUSD rally. In response to the recession caused by the pandemic, the US Congress and the Federal Reserve spared no expense, and most importantly, they acted quickly and decisively. As a result, in August, the precious metal managed to reach an all-time high of $2075 per ounce. In October, gold rallied in the hope of the blue wave. Finally, $892 billion fiscal stimulus endorsed by Congress and Donald Trump pushed gold up to the 6-week high. Can it count on the old trump cards in 2021?

I strongly doubt that next year the Federal Reserve is going to demonstrate a tenth of the madness that has become the Fed's calling card in the spring of 2020. Indeed, the FOMC's December forecasts suggest that the regulator is not going to raise the rate in 2021-2023. However, it is quite possible that it was just overreacting. If inflation expectations rise sharply due to oil, the blue wave, and the booming US economic recovery, the Fed's outlook will definitely change. The hawkish rhetoric and the earlier start of monetary policy normalization will lead to the dollar strengthening. However, I don't think this will happen before the second half of 2021.

In the period from January to June, financial markets will be dominated by the topics of defeating the pandemic, global economic recovery, and fiscal stimulus. The first two of them are likely to support the bears on the USD index. This is good news for the precious metal, but in reality, the gold trend will depend on the US Congress. Even more precisely, it will be determined by American voters. In January, they are going to decide who will get two seats in the Senate. If the Democrats win, the blue wave will become a reality, an $892 billion fiscal stimulus will mark the beginning, and a reflationary environment will become very possible.

On the contrary, the Republican victory would split Congress, make it harder for Joe Biden to push his ideas through lawmakers, and the XAUUSD upward movement will lose momentum. In the first case, gold will have the opportunity to return above $2000 per ounce. In the second, it risks entering the zone of mid-term consolidation of $1750-1950.

These scenarios are based on the weakness of the greenback in the first half of 2021. However, unexpected circumstances can lead to increased uncertainty and return the demand for safe-havens. As a result, the dollar will start to recover earlier than expected. This option is supported by the EURUSD reaction to the US presidential elections. Since 2000, the main currency pair has consistently peaked for one to three months after the vote, after which the prices began to fall.

Six-monthgold trading plan

In my opinion, there is a 60% probability of a divided Congress and a consolidation of gold in the range of $1750-1950 per ounce during the first half of 2021. I give the 30% chances of the blue wave and the rise of a precious metal’s price above $2000. There is a 10% probability of the premature strengthening of the US dollar, which will initiate the bear trend in XAUUSD.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/gold-got-hooked-on-steroids-forecast-as-of-28122020/?uid=285861726&cid=79634

EURUSD reaction to the US presidential election

Six-month gold fundamental analysis

To see the future, you need to look back at the past. Gold is ready to demonstrate the best annual growth since 2010. Stimuli have been the main driver of the XAUUSD rally. In response to the recession caused by the pandemic, the US Congress and the Federal Reserve spared no expense, and most importantly, they acted quickly and decisively. As a result, in August, the precious metal managed to reach an all-time high of $2075 per ounce. In October, gold rallied in the hope of the blue wave. Finally, $892 billion fiscal stimulus endorsed by Congress and Donald Trump pushed gold up to the 6-week high. Can it count on the old trump cards in 2021?

I strongly doubt that next year the Federal Reserve is going to demonstrate a tenth of the madness that has become the Fed's calling card in the spring of 2020. Indeed, the FOMC's December forecasts suggest that the regulator is not going to raise the rate in 2021-2023. However, it is quite possible that it was just overreacting. If inflation expectations rise sharply due to oil, the blue wave, and the booming US economic recovery, the Fed's outlook will definitely change. The hawkish rhetoric and the earlier start of monetary policy normalization will lead to the dollar strengthening. However, I don't think this will happen before the second half of 2021.

In the period from January to June, financial markets will be dominated by the topics of defeating the pandemic, global economic recovery, and fiscal stimulus. The first two of them are likely to support the bears on the USD index. This is good news for the precious metal, but in reality, the gold trend will depend on the US Congress. Even more precisely, it will be determined by American voters. In January, they are going to decide who will get two seats in the Senate. If the Democrats win, the blue wave will become a reality, an $892 billion fiscal stimulus will mark the beginning, and a reflationary environment will become very possible.

On the contrary, the Republican victory would split Congress, make it harder for Joe Biden to push his ideas through lawmakers, and the XAUUSD upward movement will lose momentum. In the first case, gold will have the opportunity to return above $2000 per ounce. In the second, it risks entering the zone of mid-term consolidation of $1750-1950.

These scenarios are based on the weakness of the greenback in the first half of 2021. However, unexpected circumstances can lead to increased uncertainty and return the demand for safe-havens. As a result, the dollar will start to recover earlier than expected. This option is supported by the EURUSD reaction to the US presidential elections. Since 2000, the main currency pair has consistently peaked for one to three months after the vote, after which the prices began to fall.

Six-monthgold trading plan

In my opinion, there is a 60% probability of a divided Congress and a consolidation of gold in the range of $1750-1950 per ounce during the first half of 2021. I give the 30% chances of the blue wave and the rise of a precious metal’s price above $2000. There is a 10% probability of the premature strengthening of the US dollar, which will initiate the bear trend in XAUUSD.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/gold-got-hooked-on-steroids-forecast-as-of-28122020/?uid=285861726&cid=79634

EURUSD reaction to the US presidential election

LiteFinance

Euro goes out on the ice. EURUSD forecast 24.12.2020

Weekly fundamental forecast for the euro

Most recessions begin when excessively high central bank rates reduce demand, which worsens the situation in the labour market and further reduces demand. The current downturn is reminiscent of the economy's response to a natural disaster, an earthquake or a tsunami. When they happen, businesses are closed and the supply decreases. Once the disaster is over, the economy faces a V-shaped recovery. In this regard, effective vaccinations will lead to rapid growth in global GDP, increase risk appetite and help continue the EURUSD rally. Everything seems to be very simple, however, life, and in particular Forex life, resembles an ice rink. You could fall at any moment.

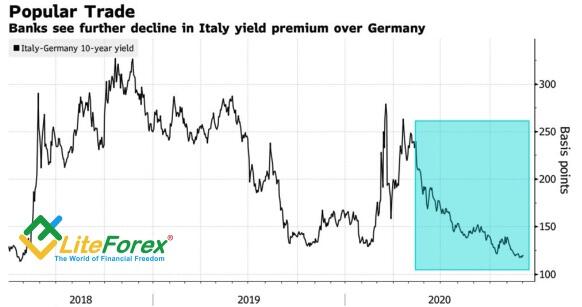

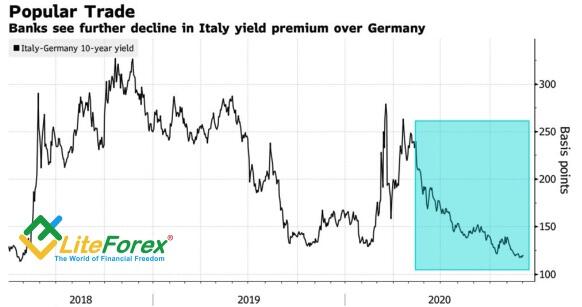

I would like to remind you that 2020 began positively. Markets rallied on expectations of a US-China trade deal that would have revived international trade, accelerated global GDP and boosted the euro. Alas, at the turn of winter and spring there was a force majeure in the form of a pandemic, cancelling the bulls' ambitious plans for EURUSD. But not for long. The second half of the year turned out to be great for the main currency pair. Today, the belief in its bright future is based not only on the positive impact of vaccinations on global GDP but also on the high demand for European assets. Particularly, for Italian bonds. Commerzbank, JP Morgan, HSBC and UBS believe in the further reduction in the yield spread between the Italian bonds and the German ones.

The main problems for the bulls on EURUSD are the two trump cards of the dollar. Will it get them out or not? I am talking about the potential strengthening of the greenback when uncertainty increases or in case of the American economy outpacing the world economy in growth (the dollar smile theory). Uncertainty is good for the USD index - it can be judged by its reaction to Donald Trump's threat to veto the $892 billion fiscal stimulus bill. The greenback rose, but the EURUSD bears weren't happy for long.

Congress passed the bill with more than 2/3 of the vote, therefore it has the right to override the president's veto. Trump's own party might cross his way. Democrats clung to the proposal of the president to increase the relief check for Americans from $600 to $2000 but the Republicans are ready to block it. If the 45th US president does not veto or sign the document, it will become law in 10 days. During these days, the dollar will continue finding support in uncertainty.

Trading plan for EURUSD for the week

Brexit is quickly becoming the main growth driver for EURUSD. The EU and the UK have agreed on fisheries and government aid and are about to conclude a historic deal. In theory, this should inspire the pound and the euro to rise, but bulls may start fixing their profits, being guided by "buy the rumour, sell the news" principle. A breakout of the resistance levels at 1.2225 and 1.2245 could trigger EURUSD to go up to the December high, but wouldn't it be better to act after Christmas?

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-goes-out-on-the-ice-eurusd-forecast-24122020/?uid=285861726&cid=79634

Yield spread dynamics for bonds in Italy and Germany

Weekly fundamental forecast for the euro

Most recessions begin when excessively high central bank rates reduce demand, which worsens the situation in the labour market and further reduces demand. The current downturn is reminiscent of the economy's response to a natural disaster, an earthquake or a tsunami. When they happen, businesses are closed and the supply decreases. Once the disaster is over, the economy faces a V-shaped recovery. In this regard, effective vaccinations will lead to rapid growth in global GDP, increase risk appetite and help continue the EURUSD rally. Everything seems to be very simple, however, life, and in particular Forex life, resembles an ice rink. You could fall at any moment.

I would like to remind you that 2020 began positively. Markets rallied on expectations of a US-China trade deal that would have revived international trade, accelerated global GDP and boosted the euro. Alas, at the turn of winter and spring there was a force majeure in the form of a pandemic, cancelling the bulls' ambitious plans for EURUSD. But not for long. The second half of the year turned out to be great for the main currency pair. Today, the belief in its bright future is based not only on the positive impact of vaccinations on global GDP but also on the high demand for European assets. Particularly, for Italian bonds. Commerzbank, JP Morgan, HSBC and UBS believe in the further reduction in the yield spread between the Italian bonds and the German ones.

The main problems for the bulls on EURUSD are the two trump cards of the dollar. Will it get them out or not? I am talking about the potential strengthening of the greenback when uncertainty increases or in case of the American economy outpacing the world economy in growth (the dollar smile theory). Uncertainty is good for the USD index - it can be judged by its reaction to Donald Trump's threat to veto the $892 billion fiscal stimulus bill. The greenback rose, but the EURUSD bears weren't happy for long.

Congress passed the bill with more than 2/3 of the vote, therefore it has the right to override the president's veto. Trump's own party might cross his way. Democrats clung to the proposal of the president to increase the relief check for Americans from $600 to $2000 but the Republicans are ready to block it. If the 45th US president does not veto or sign the document, it will become law in 10 days. During these days, the dollar will continue finding support in uncertainty.

Trading plan for EURUSD for the week

Brexit is quickly becoming the main growth driver for EURUSD. The EU and the UK have agreed on fisheries and government aid and are about to conclude a historic deal. In theory, this should inspire the pound and the euro to rise, but bulls may start fixing their profits, being guided by "buy the rumour, sell the news" principle. A breakout of the resistance levels at 1.2225 and 1.2245 could trigger EURUSD to go up to the December high, but wouldn't it be better to act after Christmas?

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-goes-out-on-the-ice-eurusd-forecast-24122020/?uid=285861726&cid=79634

Yield spread dynamics for bonds in Italy and Germany

LiteFinance

Dollar is humiliated. EURUSD forecast 23.12.2020

The 45th President of the United States demands Congress to reconsider the $900 billion bill it has passed and threatens not to sign it. How will this affect the dynamics of EURUSD? Let's discuss this and create a trading plan.

Weekly US dollar fundamental forecast

Many traders prefer technical analysis to fundamental analysis not because they trust the charts. In their opinion, fundamental analysis is just too complex. Indeed, after Congress approved an $892 billion fiscal stimulus, Capital Economics and Oxford Economics raised their forecasts for US GDP for 2021 by 0.5-1 percentage points, the IMF warned that due to the spread of COVID-19 in Europe it will be forced to lower its eurozone GDP estimates, yet the forecast for EURUSD is still bullish! Donald Trump threatens not to sign the fiscal stimulus bill, thus depriving the economy of financial aid, but the greenback is rising. Finally, rumours are heard in the market that if Joe Biden and Janet Yellen abandon their strong dollar policies, the USD Index will skyrocket. Where is the logic? In fact, fundamental analysis is simple.

In times of recession and in the post-crisis period, investors have a heightened sense of global risk appetite, so all events should be viewed through the S&P 500 perspective and the inverse correlation of the stock index with the US dollar. If the US economy accelerates thanks to the new fiscal stimulus, it would be good news for stocks but bad news for the greenback as a safe-haven asset. When Donald Trump brings confusion with his intention not to sign the bill approved by the Congress, the S&P 500 falls and pulls EURUSD down with it. The White House's abandonment of the strong dollar policy will be a blow to the financial markets that are used to it. Now let's wait for the correction of stock indices and the strengthening of the dollar. It's simple, isn't it?

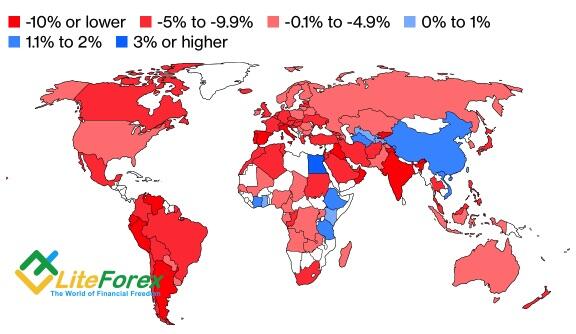

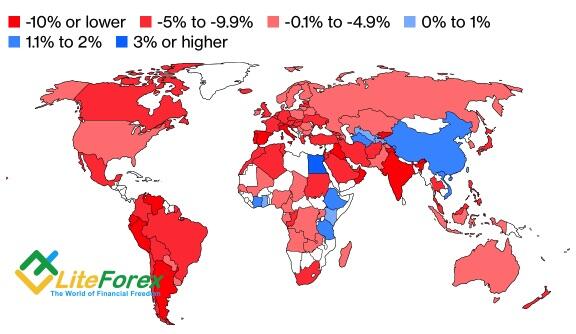

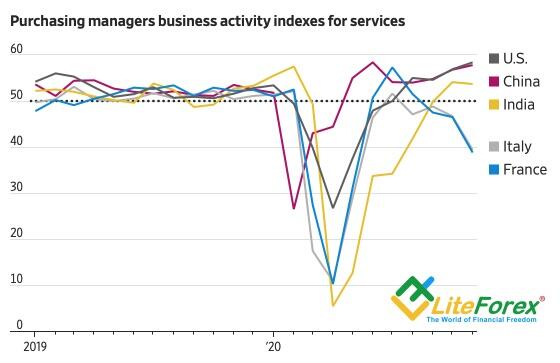

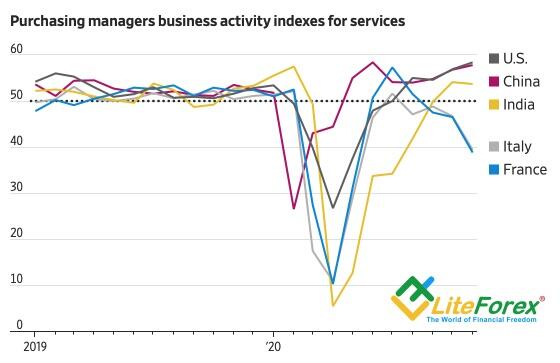

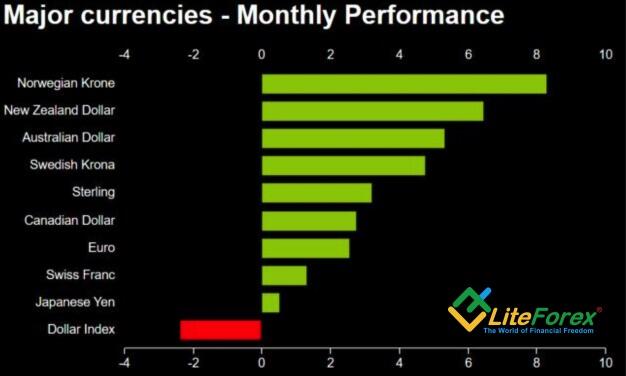

As for the IMF warnings about the reduction of forecasts for the eurozone GDP for 2020 (-8.3%) and 2021 (+ 5.2%) due to the spread of COVID-19 in the Old World, this is a matter of the euro, not the US dollar. Investors firmly believe in the victory over the pandemic with vaccines, in the acceleration of the global economy and international trade next year. Well, forecasts may be adjusted both for the worse and for the better.

Despite the loud statements of Donald Trump who called the fiscal stimulus bill a disgrace and demanded to increase checks for Americans from $600 to $2,000, many investors consider the 45th President's trick as a show-off. At the same time, the quiet reaction of the S&P 500 indicates that financial markets are confident that the document will be signed.

The same can be said about Brexit, which, along with the global risk appetite, is currently the key driver of EURUSD price changes. The EU's chief negotiator Michel Barnier calls Britain's proposal that it should have 35-60% of the €650 million in European fishermen's revenues unacceptable, but the pound is not falling. It looks like investors continue to believe in a last-minute trade.

Trading plan for EURUSD for the week

The second attempt of EURUSD to consolidate above the previously indicated resistance at 1.224-1.2245 was not successful. Will there be a third time? Or will the market decide to calm down on the eve of Christmas and go into short-term consolidation in the range of 1.2085-1.2245? In my opinion, the latter option is more likely. Time to relax?

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-humiliated-eurusd-forecast-23122020/?uid=285861726&cid=79634

IMF GDP Forecasts for 2020

The 45th President of the United States demands Congress to reconsider the $900 billion bill it has passed and threatens not to sign it. How will this affect the dynamics of EURUSD? Let's discuss this and create a trading plan.

Weekly US dollar fundamental forecast

Many traders prefer technical analysis to fundamental analysis not because they trust the charts. In their opinion, fundamental analysis is just too complex. Indeed, after Congress approved an $892 billion fiscal stimulus, Capital Economics and Oxford Economics raised their forecasts for US GDP for 2021 by 0.5-1 percentage points, the IMF warned that due to the spread of COVID-19 in Europe it will be forced to lower its eurozone GDP estimates, yet the forecast for EURUSD is still bullish! Donald Trump threatens not to sign the fiscal stimulus bill, thus depriving the economy of financial aid, but the greenback is rising. Finally, rumours are heard in the market that if Joe Biden and Janet Yellen abandon their strong dollar policies, the USD Index will skyrocket. Where is the logic? In fact, fundamental analysis is simple.

In times of recession and in the post-crisis period, investors have a heightened sense of global risk appetite, so all events should be viewed through the S&P 500 perspective and the inverse correlation of the stock index with the US dollar. If the US economy accelerates thanks to the new fiscal stimulus, it would be good news for stocks but bad news for the greenback as a safe-haven asset. When Donald Trump brings confusion with his intention not to sign the bill approved by the Congress, the S&P 500 falls and pulls EURUSD down with it. The White House's abandonment of the strong dollar policy will be a blow to the financial markets that are used to it. Now let's wait for the correction of stock indices and the strengthening of the dollar. It's simple, isn't it?

As for the IMF warnings about the reduction of forecasts for the eurozone GDP for 2020 (-8.3%) and 2021 (+ 5.2%) due to the spread of COVID-19 in the Old World, this is a matter of the euro, not the US dollar. Investors firmly believe in the victory over the pandemic with vaccines, in the acceleration of the global economy and international trade next year. Well, forecasts may be adjusted both for the worse and for the better.

Despite the loud statements of Donald Trump who called the fiscal stimulus bill a disgrace and demanded to increase checks for Americans from $600 to $2,000, many investors consider the 45th President's trick as a show-off. At the same time, the quiet reaction of the S&P 500 indicates that financial markets are confident that the document will be signed.

The same can be said about Brexit, which, along with the global risk appetite, is currently the key driver of EURUSD price changes. The EU's chief negotiator Michel Barnier calls Britain's proposal that it should have 35-60% of the €650 million in European fishermen's revenues unacceptable, but the pound is not falling. It looks like investors continue to believe in a last-minute trade.

Trading plan for EURUSD for the week

The second attempt of EURUSD to consolidate above the previously indicated resistance at 1.224-1.2245 was not successful. Will there be a third time? Or will the market decide to calm down on the eve of Christmas and go into short-term consolidation in the range of 1.2085-1.2245? In my opinion, the latter option is more likely. Time to relax?

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-is-humiliated-eurusd-forecast-23122020/?uid=285861726&cid=79634

IMF GDP Forecasts for 2020

LiteFinance

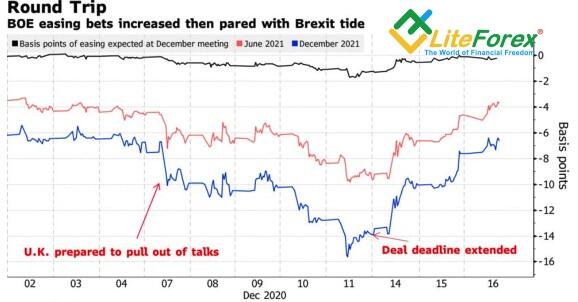

Yen will count up to 100. Forecast as of 22.12.2020

The uncertainty connected with the trade wars and the pandemic is gradually leaving the market, and safe-haven assets are growing weaker. How will the USDJPY feel in 2021? Let's find it out and make a trading plan.

Quarterly fundamental forecast for yen

Will the USDJPY bears reach the level of the century of 100 JPY to 1 USD? More and more large American and Japanese banks and investment companies think so. The question is, will the pair drop lower, or pull back from the 2016 levels instead amid the BoJ's discontent? The yen risks closing in the green zone for the sixth consecutive year. However, this time, the reason isn't its strength but the opponent's weakness.

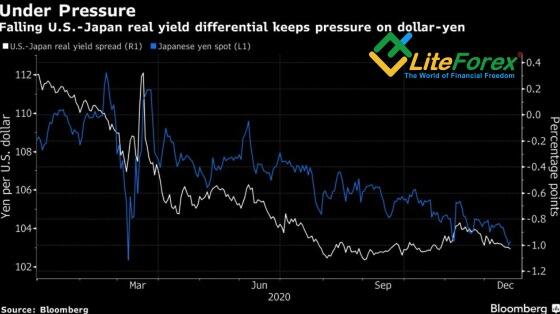

JP Morgan, Goldman Sachs, BNP Paribas, Mizuho Bank, and MUFG forecast that the USDJPY quotes will fall to 100 or 98 amid the USD's weakness. Double deficit, U.S. assets' lower investment appeal expressed in lower real bond yield and a huge money base pull the USD index down. The U.S. Q2 negative current account reached a record level since 2008, while Japan's surplus is only growing.

The Fed spares no money to save the economy and plans to continue its emergency bond-buying program of $120 billion a month until the unemployment and inflation develop to an improved condition. The Central Bank predicts that the federal funds rate will be at the current level until 2024 at least. And that's not a limit. If there's a smell of double recession, the Fed is ready for more. The Bank of Japan's potential is limited, though. It has purchased a major part of local bonds and is often compared with the whale in the Japanese pond/debt market. Although the evolution of consumer prices has been the worst in the past ten years, Haruhiko Kuroda didn't do anything at the BoJ's latest meeting, only saying that the Central Bank could revise the monetary policy.

The BoJ's passivity and the Fed's aggressive extension of the money base narrow U.S.-Japan yield spreads and foster the development of a downtrend in the USDJPY.

Some may think that the U.S. economy will be growing faster than Japan's because of the large monetary stimulus. Tokyo spares no fiscal support either. Cabinet of Japan approved the record big budget of $1 trillion for the fiscal year 2021, which can be easily extended through additional budgets as the 2020 experience has shown.

Quarterly trading plan for USDJPY, EURJPY, GBPJPY, and AUDJPY

If both the USA and Japan demonstrate booming economic growth next year, high-risk assets will benefit from that situation while safe-haven assets will still be kept down. I think the U.S. dollar and the yen will be the main Forex outsiders in 2021. The USDJPY is very likely to reach the level of 100, but I would suggest following November's strategy of buying EURJPY, GBPJPY, and AUDJPY with targets at 126.4 and 128.5, 142.5 and 144.7, 79.5 and 82.4. The first of them has already worked out.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/yen-will-count-up-to-100-forecast-as-of-22122020/?uid=285861726&cid=79634

USDJPY and U.S.-Japan yield differential

The uncertainty connected with the trade wars and the pandemic is gradually leaving the market, and safe-haven assets are growing weaker. How will the USDJPY feel in 2021? Let's find it out and make a trading plan.

Quarterly fundamental forecast for yen

Will the USDJPY bears reach the level of the century of 100 JPY to 1 USD? More and more large American and Japanese banks and investment companies think so. The question is, will the pair drop lower, or pull back from the 2016 levels instead amid the BoJ's discontent? The yen risks closing in the green zone for the sixth consecutive year. However, this time, the reason isn't its strength but the opponent's weakness.

JP Morgan, Goldman Sachs, BNP Paribas, Mizuho Bank, and MUFG forecast that the USDJPY quotes will fall to 100 or 98 amid the USD's weakness. Double deficit, U.S. assets' lower investment appeal expressed in lower real bond yield and a huge money base pull the USD index down. The U.S. Q2 negative current account reached a record level since 2008, while Japan's surplus is only growing.

The Fed spares no money to save the economy and plans to continue its emergency bond-buying program of $120 billion a month until the unemployment and inflation develop to an improved condition. The Central Bank predicts that the federal funds rate will be at the current level until 2024 at least. And that's not a limit. If there's a smell of double recession, the Fed is ready for more. The Bank of Japan's potential is limited, though. It has purchased a major part of local bonds and is often compared with the whale in the Japanese pond/debt market. Although the evolution of consumer prices has been the worst in the past ten years, Haruhiko Kuroda didn't do anything at the BoJ's latest meeting, only saying that the Central Bank could revise the monetary policy.

The BoJ's passivity and the Fed's aggressive extension of the money base narrow U.S.-Japan yield spreads and foster the development of a downtrend in the USDJPY.

Some may think that the U.S. economy will be growing faster than Japan's because of the large monetary stimulus. Tokyo spares no fiscal support either. Cabinet of Japan approved the record big budget of $1 trillion for the fiscal year 2021, which can be easily extended through additional budgets as the 2020 experience has shown.

Quarterly trading plan for USDJPY, EURJPY, GBPJPY, and AUDJPY

If both the USA and Japan demonstrate booming economic growth next year, high-risk assets will benefit from that situation while safe-haven assets will still be kept down. I think the U.S. dollar and the yen will be the main Forex outsiders in 2021. The USDJPY is very likely to reach the level of 100, but I would suggest following November's strategy of buying EURJPY, GBPJPY, and AUDJPY with targets at 126.4 and 128.5, 142.5 and 144.7, 79.5 and 82.4. The first of them has already worked out.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/yen-will-count-up-to-100-forecast-as-of-22122020/?uid=285861726&cid=79634

USDJPY and U.S.-Japan yield differential

LiteFinance

Dollar plays Mafia. EURUSD forecast 21.12.2020

At a time when liquidity in financial markets is falling on the eve of Christmas and uncertainty is growing, investors' interest in the US currency is returning. Let's talk about it and create a trading plan for EURUSD.

Monthly US dollar fundamental forecast

Uncertainty is an integral part of our life. Financial markets cannot exist without it. This is why investors return to the US dollar from time to time. Fish stuck in the nets of Brexit - let's sell GBPUSD; a new strain of COVID-19 is discovered in Britain and it spreads 70% faster than the previous one - let's buy the greenback; it's hard to tell how Congress will vote on the fiscal stimulus issue - time to return to the dollar. Uncertainty is not the only factor supporting the dollar. It is likely that the markets oversold it.

Although congressional leaders managed to negotiate about $900 billion in fiscal stimulus, the second-largest aid package in US history after the $2.2 trillion one in March, how the Senate and the House of Representatives will vote on December 21 is yet unknown. The stumbling block is the Fed's emergency lending programs. Democrats accuse Republicans of creating obstacles to the fiscal deal, and a potential clash could lead to the project being rejected.

The new strain of COVID-19 discovered in Britain is even greater uncertainty, forcing London to impose additional restrictions, and more than ten European countries to stop letting in tourists from Britain. While epidemiologists say that there is no connection between it and increased mortality rates and that vaccines may still work in the face of a new threat, but what if this is not the case? The entire plan to defeat the pandemic and rapidly restore global GDP in 2021 could go down the drain.

The uncertainty surrounding Brexit hasn't gone away at all. Boris Johnson needs clarification on the new EU fisheries proposal, he believes that the discussed financial aid package is unbalanced and will allow the EU to issue more subsidies than Britain, and Minister for the Cabinet Office Michael Gove argues that London and Brussels will be forced to conclude not one big deal but a few small agreements. The clock is ticking, time is running out, the pound is falling, dragging EURUSD down with it.

Investors are not sure whether the Fed will begin to tighten monetary policy in 2021. Yes, the FOMC forecasts suggest that rates are unlikely to rise before 2024, but there is also an emergency purchase program. Will the rise of inflation expectations, inspired by the current oil price rally, be the reason for the reduction in the scale of QE?

Dallas Fed President Robert Kaplan would prefer to start cutting down on bond purchases if GDP grows rapidly. Long QE creates problems, he says. It distorts financial markets and creates conditions for imbalances that will be difficult to manage.

Monthly EURUSD trading plan

As expected, the EURUSD pair couldn't hold above the 1.224-1.2245 level, while increased uncertainty increases the likelihood of consolidation in the range of 1.196-1.226. That is unless the vote in the US Congress goes off perfectly and the Brexit problems are resolved successfully in the last minute.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-plays-mafia-eurusd-forecast-21122020/?uid=285861726&cid=79634

Dynamics of the USD index

At a time when liquidity in financial markets is falling on the eve of Christmas and uncertainty is growing, investors' interest in the US currency is returning. Let's talk about it and create a trading plan for EURUSD.

Monthly US dollar fundamental forecast

Uncertainty is an integral part of our life. Financial markets cannot exist without it. This is why investors return to the US dollar from time to time. Fish stuck in the nets of Brexit - let's sell GBPUSD; a new strain of COVID-19 is discovered in Britain and it spreads 70% faster than the previous one - let's buy the greenback; it's hard to tell how Congress will vote on the fiscal stimulus issue - time to return to the dollar. Uncertainty is not the only factor supporting the dollar. It is likely that the markets oversold it.

Although congressional leaders managed to negotiate about $900 billion in fiscal stimulus, the second-largest aid package in US history after the $2.2 trillion one in March, how the Senate and the House of Representatives will vote on December 21 is yet unknown. The stumbling block is the Fed's emergency lending programs. Democrats accuse Republicans of creating obstacles to the fiscal deal, and a potential clash could lead to the project being rejected.

The new strain of COVID-19 discovered in Britain is even greater uncertainty, forcing London to impose additional restrictions, and more than ten European countries to stop letting in tourists from Britain. While epidemiologists say that there is no connection between it and increased mortality rates and that vaccines may still work in the face of a new threat, but what if this is not the case? The entire plan to defeat the pandemic and rapidly restore global GDP in 2021 could go down the drain.

The uncertainty surrounding Brexit hasn't gone away at all. Boris Johnson needs clarification on the new EU fisheries proposal, he believes that the discussed financial aid package is unbalanced and will allow the EU to issue more subsidies than Britain, and Minister for the Cabinet Office Michael Gove argues that London and Brussels will be forced to conclude not one big deal but a few small agreements. The clock is ticking, time is running out, the pound is falling, dragging EURUSD down with it.

Investors are not sure whether the Fed will begin to tighten monetary policy in 2021. Yes, the FOMC forecasts suggest that rates are unlikely to rise before 2024, but there is also an emergency purchase program. Will the rise of inflation expectations, inspired by the current oil price rally, be the reason for the reduction in the scale of QE?

Dallas Fed President Robert Kaplan would prefer to start cutting down on bond purchases if GDP grows rapidly. Long QE creates problems, he says. It distorts financial markets and creates conditions for imbalances that will be difficult to manage.

Monthly EURUSD trading plan

As expected, the EURUSD pair couldn't hold above the 1.224-1.2245 level, while increased uncertainty increases the likelihood of consolidation in the range of 1.196-1.226. That is unless the vote in the US Congress goes off perfectly and the Brexit problems are resolved successfully in the last minute.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/dollar-plays-mafia-eurusd-forecast-21122020/?uid=285861726&cid=79634

Dynamics of the USD index

LiteFinance

Everyone is kicking off the dollar

When the market is too bullish, the downturns can be very fast.

Investors believe the greenback should drop. Will the USD go down?

Christmas and New Year holidays are soon! Good husbands decorate the Christmas trees, and perfect husbands buy decorations for their wives. There only must be money. Of course, those who followed my recommendations and were buying out the euro at $1.075 since early March have cash. But what about those, carried away by the December euphoria and confidence in the EURUSD rise to 1.25, as large banks promise? They seem to have forgotten that more than one hundred billionaires have become rich on the natural human desire to get rich. Yes, Goldman Sachs claims that the euro will strengthen versus the US dollar in 2021, Morgan Stanley suggests the euro should be 10% up, and Citigroup says the USD should be 20% down. However, none of them has a crystal ball to the future. What if anything goes wrong?

People can pay a high price for being gullible. No matter how many business sharks assure you that the EURUSD will definitely grow, you need to believe in the best but prepare for the worst. At least you will avoid that type of financial stability when there was no money, you don’t have it now and don’t seem to have it in the future.

What are the arguments of dollar sellers? Should the uncertainty ease after the successful vaccines’ tests and Joe Biden’s victory in the 2020 election? But these events have already happened, the news has been traded, and the market uncertainty is always there. What if the vaccines won’t be effective or produce unwanted side effects? Why China and Iran are sure that Biden will be less aggressive than Donald Trump? I don’t think Biden wants China to outperform the USA during his term of power or Iran to make a nuclear bomb.

Should one sell the greenback because the Fed is insane and flooded the markets with cheap liquidity? However, Jerome Powell and his fellow central bankers have been passive for a few months already. The Treasury, led by the outgoing Steven Mnuchin, spares no effort to set the central bank back. First, the Treasury makes the Federal Reserve return the unused funds left over the emergency lending programs. Next, Mnuchin tries to pass through the Congress the Treasury’s decision not to renew several emergency Fed lending programs. So, there could be such a conversation between the US banks soon:

- Federal Reserve, could you lend us some money?

- In general, We can. However, We’d rather teach you the basics of austerity.

Other central banks, including the ECB, are now more aggressive than the Fed, so why should we give up on the dollar? How could anyone believe in the suggested twin deficit, the budget deficit, and the current account deficit? The USD bears were saying the same ahead of the recession. The greenback didn’t crash then; why should it drop now?

I don’t encourage you to enter the EURUSD shorts urgently. I am also a euro bull and believe the euro-dollar could rise to 1.25 next year, but I am not an obsessive buyer of any moving asset….Time will make everything clear. It’s time we wait and see.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/chatty-forex/everyone-is-kicking-off-the-dollar/?uid=285861726&cid=79634

When the market is too bullish, the downturns can be very fast.

Investors believe the greenback should drop. Will the USD go down?

Christmas and New Year holidays are soon! Good husbands decorate the Christmas trees, and perfect husbands buy decorations for their wives. There only must be money. Of course, those who followed my recommendations and were buying out the euro at $1.075 since early March have cash. But what about those, carried away by the December euphoria and confidence in the EURUSD rise to 1.25, as large banks promise? They seem to have forgotten that more than one hundred billionaires have become rich on the natural human desire to get rich. Yes, Goldman Sachs claims that the euro will strengthen versus the US dollar in 2021, Morgan Stanley suggests the euro should be 10% up, and Citigroup says the USD should be 20% down. However, none of them has a crystal ball to the future. What if anything goes wrong?

People can pay a high price for being gullible. No matter how many business sharks assure you that the EURUSD will definitely grow, you need to believe in the best but prepare for the worst. At least you will avoid that type of financial stability when there was no money, you don’t have it now and don’t seem to have it in the future.

What are the arguments of dollar sellers? Should the uncertainty ease after the successful vaccines’ tests and Joe Biden’s victory in the 2020 election? But these events have already happened, the news has been traded, and the market uncertainty is always there. What if the vaccines won’t be effective or produce unwanted side effects? Why China and Iran are sure that Biden will be less aggressive than Donald Trump? I don’t think Biden wants China to outperform the USA during his term of power or Iran to make a nuclear bomb.

Should one sell the greenback because the Fed is insane and flooded the markets with cheap liquidity? However, Jerome Powell and his fellow central bankers have been passive for a few months already. The Treasury, led by the outgoing Steven Mnuchin, spares no effort to set the central bank back. First, the Treasury makes the Federal Reserve return the unused funds left over the emergency lending programs. Next, Mnuchin tries to pass through the Congress the Treasury’s decision not to renew several emergency Fed lending programs. So, there could be such a conversation between the US banks soon:

- Federal Reserve, could you lend us some money?

- In general, We can. However, We’d rather teach you the basics of austerity.

Other central banks, including the ECB, are now more aggressive than the Fed, so why should we give up on the dollar? How could anyone believe in the suggested twin deficit, the budget deficit, and the current account deficit? The USD bears were saying the same ahead of the recession. The greenback didn’t crash then; why should it drop now?

I don’t encourage you to enter the EURUSD shorts urgently. I am also a euro bull and believe the euro-dollar could rise to 1.25 next year, but I am not an obsessive buyer of any moving asset….Time will make everything clear. It’s time we wait and see.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/chatty-forex/everyone-is-kicking-off-the-dollar/?uid=285861726&cid=79634

LiteFinance

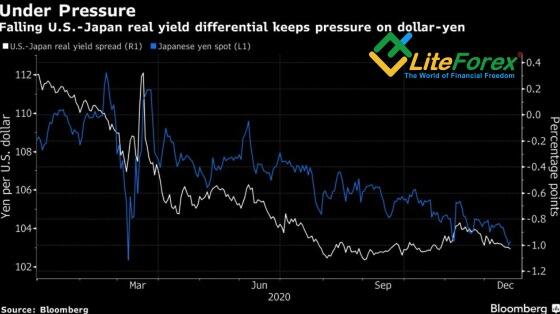

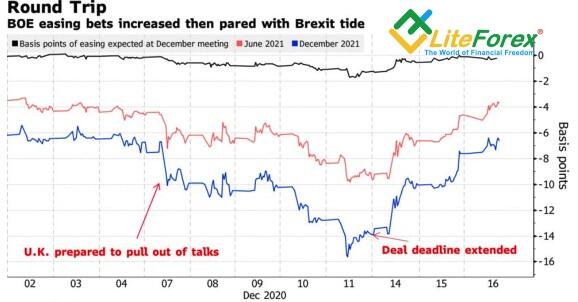

Pound both dead and alive at the same time! Forecast Forecast as of 17.12.2020

The UK withdrawal from the EU makes the British economy vulnerable. However, if London and Brussels sign a deal, everything will turn upside down. Where will the pound go? Let us discuss the pound future and make up a GBPUSD trading plan.

Fundamental pound forecast for a year

In early December, Forex traders were discussing the binary scenario. Provided the Brexit deal is signed, the pound will be alive. Otherwise, if the UK withdraws from the EU without a deal, the pound will be dead. However, the sterling is like a Schrödinger's cat; it has to be alive and dead. Following the GBPUSD crash to 1.314, indicated in the previous pound analytics, the pair soared and is about to hit an upside target at 1.367. Where will the British pound go next?

After a dinner meeting of British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen, everyone was prepared for a no-deal Brexit. But the talks continue, and Boris Johnson will recall the UK parliament over Christmas break to legislate for a deal if one is secured. The European Commission President claims that the fisheries problem the only issue they haven’t found a way forward yet. The French president Emmanuel Macron is the only opponent to the deal, while the German Chancellor Angela Merkel says a deal is better than no deal.

The headwind for a pound was quickly replaced by a tailwind. The chance of the interest-rate cut by the BoE has dropped, and the GBPUSD has soared to the highest level over the past 2.5 years. Of course, the major reason is in a weak dollar, weakened by the Fed and Congress. After all, all safe havens are unwanted now.

The uncertainty around Brexit should embarrass the Bank of England, whose condition also resembles Schrödinger's cat. However, the BoE can remain passive, keeping the rate around 0.1% and continuing QE of £895 billion. The BoE Governor Andrew Bailey noted last week, while the central bank still has room to buy more bonds and pump cash into the financial system, that won’t prevent long lines of trucks if borders are hardened.

Although the pound is up, the UK economy remains weak. The GDP is recovering very slowly, following the worst recession over the past 300 years, and the Bank of England expects a double-dip recession in the fourth quarter. The uncertainty around Brexit makes the UK lose its positions in the world exports.

GBPUSD trading plan for a year

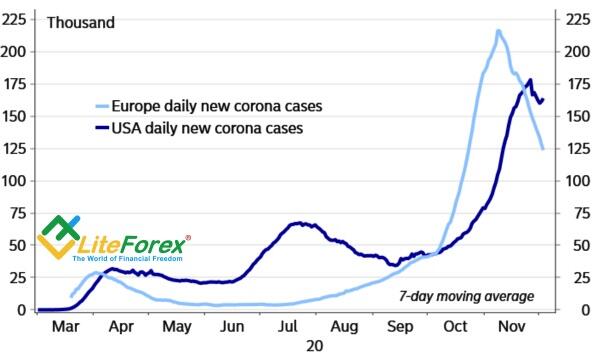

What doesn’t kill us makes us stronger. If London and Brussels sign a deal, the UK will improve its position in international trade. In addition to successful vaccination, associated with the increase in PMI, these factors will support the GBPUSD bulls in 2021. The downside driver in the first quarter will be the referendum on Scotland’s independence. However, I see a good chance of the pair’s rise to 1.4, based on the general situation. In the short run, traders could be exiting long and press the pound a little down, which will allow us to buy the sterling at a lower price.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/pound-both-dead-and-alive-at-the-same-time-forecast-forecast-as-of-17122020/?uid=285861726&cid=79634

The UK withdrawal from the EU makes the British economy vulnerable. However, if London and Brussels sign a deal, everything will turn upside down. Where will the pound go? Let us discuss the pound future and make up a GBPUSD trading plan.

Fundamental pound forecast for a year

In early December, Forex traders were discussing the binary scenario. Provided the Brexit deal is signed, the pound will be alive. Otherwise, if the UK withdraws from the EU without a deal, the pound will be dead. However, the sterling is like a Schrödinger's cat; it has to be alive and dead. Following the GBPUSD crash to 1.314, indicated in the previous pound analytics, the pair soared and is about to hit an upside target at 1.367. Where will the British pound go next?

After a dinner meeting of British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen, everyone was prepared for a no-deal Brexit. But the talks continue, and Boris Johnson will recall the UK parliament over Christmas break to legislate for a deal if one is secured. The European Commission President claims that the fisheries problem the only issue they haven’t found a way forward yet. The French president Emmanuel Macron is the only opponent to the deal, while the German Chancellor Angela Merkel says a deal is better than no deal.

The headwind for a pound was quickly replaced by a tailwind. The chance of the interest-rate cut by the BoE has dropped, and the GBPUSD has soared to the highest level over the past 2.5 years. Of course, the major reason is in a weak dollar, weakened by the Fed and Congress. After all, all safe havens are unwanted now.

The uncertainty around Brexit should embarrass the Bank of England, whose condition also resembles Schrödinger's cat. However, the BoE can remain passive, keeping the rate around 0.1% and continuing QE of £895 billion. The BoE Governor Andrew Bailey noted last week, while the central bank still has room to buy more bonds and pump cash into the financial system, that won’t prevent long lines of trucks if borders are hardened.

Although the pound is up, the UK economy remains weak. The GDP is recovering very slowly, following the worst recession over the past 300 years, and the Bank of England expects a double-dip recession in the fourth quarter. The uncertainty around Brexit makes the UK lose its positions in the world exports.

GBPUSD trading plan for a year

What doesn’t kill us makes us stronger. If London and Brussels sign a deal, the UK will improve its position in international trade. In addition to successful vaccination, associated with the increase in PMI, these factors will support the GBPUSD bulls in 2021. The downside driver in the first quarter will be the referendum on Scotland’s independence. However, I see a good chance of the pair’s rise to 1.4, based on the general situation. In the short run, traders could be exiting long and press the pound a little down, which will allow us to buy the sterling at a lower price.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/pound-both-dead-and-alive-at-the-same-time-forecast-forecast-as-of-17122020/?uid=285861726&cid=79634

LiteFinance

Fed and Butterfly Effect. EURUSD forecast 16.12.2020

The Fed’s passive attitude doesn’t shake the financial market s as a rule. However, investors are so stressed that a single word by Jerome Powell could result in a strong market move. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

When the financial market’s stress has reached its climax, even an unimportant factor could quickly move it up or down. The rising gauge of momentum inspires the US stocks bulls; bears note the extreme values of positive sentiment, including the excessive call option volumes. The Fed’s meeting could become the butterfly flapping its wings, which will start a wave of purchases or sales all over the world. Much, if not everything, depends on the S&P 500 trend now. The EURUSD is also very responsive to US stocks.

According to the US stock indexes, investors monitor the global risk appetite, whose growth has seriously weakened the US dollar recently. However, the US long-term economic outlook is bright, while the first quarter will be rather weak, according to the experts polled by the Wall Street Journal. Analysts expect the US GDP to go down to 1.9% in the January-March period, followed by the growth rate rise to 4% in April-June and July-September.

How can the Fed change investors’ risk appetite? The majority of the economists polled by Bloomberg expect the Fed to offer new guidance for its $120-billion asset purchase program. The QE should continue for several months as currently expected; however, investors want the Federal Reserve to link the terms with the inflation rate and unemployment. If the Fed doesn’t meet the expectations, the S&P 500 will go down.

Nonetheless, the primary driver for the S&P 500 moves, either up or down, is the Fed’s projections for the federal funds rate. The latest GDP forecasts suggest the US growth should contract by 3.7% in 2020 and expand by 4% in 2021. The good news about vaccines gives investors hope that the projections will be revised up. But what will the Federal Reserve do with the borrowing costs? The FOMC median gauge suggests that the interest rate will be at a level of 0%-0.25% through at least the end of 2023. If the FOMC officials hint at an earlier rate hike, it will press the US stock market down and strengthen the US dollar.

Weekly EURUSD trading plan

Nordea Markets expects that the Fed should start normalizing its monetary policy already in the first half of 2022 amid the quick rebound of the US economy and the inflation growth. I don’t think such a scenario is viable now. Jerome Powell and his fellow central bankers are more likely to wait and see, leaving the door for further monetary expansion open and sticking to the dovish tone. If so, the S&P 500 rally will continue, followed by the EURUSD rise towards 1.22 and 1.224. However, under the current conditions, it is risky to buy at highs or sell amid the correction expectations. I would rather open long positions on the corrections.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/fed-and-butterfly-effect-eurusd-forecast-16122020/?uid=285861726&cid=79634

Dynamics of momentum indicator and the demand for call option

The Fed’s passive attitude doesn’t shake the financial market s as a rule. However, investors are so stressed that a single word by Jerome Powell could result in a strong market move. Let us discuss the Forex outlook and make up a EURUSD trading plan.

Weekly US dollar fundamental forecast

When the financial market’s stress has reached its climax, even an unimportant factor could quickly move it up or down. The rising gauge of momentum inspires the US stocks bulls; bears note the extreme values of positive sentiment, including the excessive call option volumes. The Fed’s meeting could become the butterfly flapping its wings, which will start a wave of purchases or sales all over the world. Much, if not everything, depends on the S&P 500 trend now. The EURUSD is also very responsive to US stocks.

According to the US stock indexes, investors monitor the global risk appetite, whose growth has seriously weakened the US dollar recently. However, the US long-term economic outlook is bright, while the first quarter will be rather weak, according to the experts polled by the Wall Street Journal. Analysts expect the US GDP to go down to 1.9% in the January-March period, followed by the growth rate rise to 4% in April-June and July-September.

How can the Fed change investors’ risk appetite? The majority of the economists polled by Bloomberg expect the Fed to offer new guidance for its $120-billion asset purchase program. The QE should continue for several months as currently expected; however, investors want the Federal Reserve to link the terms with the inflation rate and unemployment. If the Fed doesn’t meet the expectations, the S&P 500 will go down.

Nonetheless, the primary driver for the S&P 500 moves, either up or down, is the Fed’s projections for the federal funds rate. The latest GDP forecasts suggest the US growth should contract by 3.7% in 2020 and expand by 4% in 2021. The good news about vaccines gives investors hope that the projections will be revised up. But what will the Federal Reserve do with the borrowing costs? The FOMC median gauge suggests that the interest rate will be at a level of 0%-0.25% through at least the end of 2023. If the FOMC officials hint at an earlier rate hike, it will press the US stock market down and strengthen the US dollar.

Weekly EURUSD trading plan

Nordea Markets expects that the Fed should start normalizing its monetary policy already in the first half of 2022 amid the quick rebound of the US economy and the inflation growth. I don’t think such a scenario is viable now. Jerome Powell and his fellow central bankers are more likely to wait and see, leaving the door for further monetary expansion open and sticking to the dovish tone. If so, the S&P 500 rally will continue, followed by the EURUSD rise towards 1.22 and 1.224. However, under the current conditions, it is risky to buy at highs or sell amid the correction expectations. I would rather open long positions on the corrections.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/fed-and-butterfly-effect-eurusd-forecast-16122020/?uid=285861726&cid=79634

Dynamics of momentum indicator and the demand for call option

LiteFinance

Kiwi is following the yuan up. Forecast as of 15.12.2020

Monthly fundamental forecast for New Zealand dollar

If the Chinese yuan can grow against the dollar up to the highest level since 1993, why not the New Zealand dollar continues the rally versus a basket of world major currencies? The trading idea suggested in the mid-November to buy the NZDUSD with the targets at 0.705 and 0.72. However, some investors may think the uptrend is exhausting. May the New Zealand GDP report for Q3 convince them otherwise?

According to Citigroup, the high demand for the yuan-backed assets will be supporting the yuan during the entire year of 2021. As a result, the USDCNH pair should be down below 6. That was the level last seen 27 years ago. What is good for the renminbi is good for the kiwi. About 30% of New Zealand exports go to China, so the Chinese economy's growth is a positive factor for Wellington. That is why the kiwi and the yuan are positively correlated.

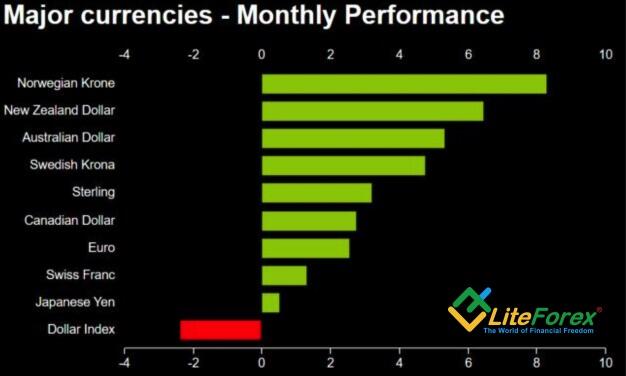

Beijing managed to defeat COVID-19. Furthermore, China’s manufacturing increased by 7%, retail sales – by 5% in November, and the fixed-asset investment went up 2.6% in the first eleven months of the year. Therefore, the OECD forecast suggesting China’s economy's growth by almost 10% in 2021 compared to the fourth quarter of 2019 is likely to come true.

Wellington also managed to deal with the pandemic effectively. Besides, there is a tailwind from China and the commodity market, as well as a lower chance of the interest-rate cut by the Reserve Bank of New Zealand, which lays a strong foundation for the NZDUSD uptrend. Six weeks ago, financial markets were fully confident that the cash rate would drop to -0.25% in 2021. Currently, the chances of such a scenario are estimated at 30%. The sharp rise in property prices could be the reason. The money has never been as cheap as now, and the housing prices soared. That is why New Zealand's prime minister, Jacinda Ardern, asked the RBNZ to take some measures to prevent growing social inequality among the people in New Zealand.

The NZD could follow the AUD trend, which soared after the report on the Australian GDP for Q3. Bloomberg experts suggest the New Zealand economy should expand by 12.9% in the July-September period, following the drop by 12.2% in the April-June period. Better than expected data could give a new momentum to the NZDUSD uptrend. After all, I believe the kiwi price is quite a dependant on the foreign environment. Therefore, a decline in the global risk appetite could result in a short-term correction, while the medium- and long-term NZD outlook remains bullish.

Monthly NZDUSD trading plan

Before Christmas, there will be uncertainty in the financial markets because of Brexit, adopting the fresh fiscal stimulus by the US Congress, and a potential trade war between China and Australia. Therefore, the US stock indexes, as well as the commodities, could be corrected down, pressing the NZDUSD also down. That is good! Traders will have a chance to buy the pair at a lower price and set the targets at 0.72 and 0.73-0.735.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/kiwi-is-following-the-yuan-up-forecast-as-of-15122020/?uid=285861726&cid=79634

Dynamics of NZDUSD and USDCNY

Monthly fundamental forecast for New Zealand dollar

If the Chinese yuan can grow against the dollar up to the highest level since 1993, why not the New Zealand dollar continues the rally versus a basket of world major currencies? The trading idea suggested in the mid-November to buy the NZDUSD with the targets at 0.705 and 0.72. However, some investors may think the uptrend is exhausting. May the New Zealand GDP report for Q3 convince them otherwise?

According to Citigroup, the high demand for the yuan-backed assets will be supporting the yuan during the entire year of 2021. As a result, the USDCNH pair should be down below 6. That was the level last seen 27 years ago. What is good for the renminbi is good for the kiwi. About 30% of New Zealand exports go to China, so the Chinese economy's growth is a positive factor for Wellington. That is why the kiwi and the yuan are positively correlated.

Beijing managed to defeat COVID-19. Furthermore, China’s manufacturing increased by 7%, retail sales – by 5% in November, and the fixed-asset investment went up 2.6% in the first eleven months of the year. Therefore, the OECD forecast suggesting China’s economy's growth by almost 10% in 2021 compared to the fourth quarter of 2019 is likely to come true.

Wellington also managed to deal with the pandemic effectively. Besides, there is a tailwind from China and the commodity market, as well as a lower chance of the interest-rate cut by the Reserve Bank of New Zealand, which lays a strong foundation for the NZDUSD uptrend. Six weeks ago, financial markets were fully confident that the cash rate would drop to -0.25% in 2021. Currently, the chances of such a scenario are estimated at 30%. The sharp rise in property prices could be the reason. The money has never been as cheap as now, and the housing prices soared. That is why New Zealand's prime minister, Jacinda Ardern, asked the RBNZ to take some measures to prevent growing social inequality among the people in New Zealand.

The NZD could follow the AUD trend, which soared after the report on the Australian GDP for Q3. Bloomberg experts suggest the New Zealand economy should expand by 12.9% in the July-September period, following the drop by 12.2% in the April-June period. Better than expected data could give a new momentum to the NZDUSD uptrend. After all, I believe the kiwi price is quite a dependant on the foreign environment. Therefore, a decline in the global risk appetite could result in a short-term correction, while the medium- and long-term NZD outlook remains bullish.

Monthly NZDUSD trading plan

Before Christmas, there will be uncertainty in the financial markets because of Brexit, adopting the fresh fiscal stimulus by the US Congress, and a potential trade war between China and Australia. Therefore, the US stock indexes, as well as the commodities, could be corrected down, pressing the NZDUSD also down. That is good! Traders will have a chance to buy the pair at a lower price and set the targets at 0.72 and 0.73-0.735.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/kiwi-is-following-the-yuan-up-forecast-as-of-15122020/?uid=285861726&cid=79634

Dynamics of NZDUSD and USDCNY

LiteFinance

Four reasons to buy Mexican peso. Forecast as of 14.12.2020

Quarterly peso fundamental forecast

Donald Trump’s attacks on the Fed in 2018-2019 are nothing compared to how other governments interfere with the central banks in other countries. Mexico’s Senate approved Wednesday a bill that will force the central bank to buy dollar bills from banks that can’t place them elsewhere, making it easier for the migrants to exchange the dollar, as they often sell the US dollars at a loss. In fact, a significant chunk of the dollars entering the country comes from drug trafficking, and the adoption of the bill by the House of Representatives will increase the risk of money laundering and terrorist financing, hurt the economy and undermine the international confidence that the Bank of Mexico took years to win. Mexico City can face Washington’s sanctions for money laundering.

Political risks must be the only factor that could prevent the peso from exceptional performance in Forex. Over the past six months, the USDMXN has been down by 11.5%. The gradual recovery of the Mexican economy, which was 12.1% up in the third quarter, the decline in the unemployment rate from 5.5% in June to 4.7% in October, in addition to the favorable foreign environment allow Bloomberg experts suggest the peso could be one of the most promising Forex currencies in 2021.

The world's leading central banks' ultra-easy monetary policy increased the negative-yielding global debt market to $18 trillion. Cheap money, amid investors’ confidence in a soon victory over the pandemic, support carry traders and emerging markets’ currencies. The major problem of developing economies is the slow introduction of coronavirus vaccines. However, Mexico authorizes the Pfizer-BioNTech coronavirus vaccine's emergency use, which should encourage the peso buyers.

About 83% of Mexican exports go to the USA. The experts polled by Wall Street Journal expect the US GDP to go up from 1.9% in the first quarter to 4% in the second and third quarter of 2021, which also encourages the USDMXN bears. Besides, Joe Biden has become the US president and the US-Mexico trade relations.

Besides the international trade also influences the exchange rates. According to Nordea Markets, the growth of international trade will, first of all, support the currencies of Latin America and the emerging markets.

Quarterly USDMXN trading plan

A weaker dollar supports the international financial conditions' improvement and creates a favorable environment for globalization and trade development, which will encourage the USDMXN bears. I believe, provided Mexico’s House of Representatives blocks the bill forcing the central bank to buy the dollars, the pair will continue falling towards 19.4 and 18.6. I recommend one to sell the dollar versus the peso on the USDMXN drawdowns.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/four-reasons-to-buy-mexican-peso-forecast-as-of-14122020/?uid=285861726&cid=79634

Quarterly peso fundamental forecast

Donald Trump’s attacks on the Fed in 2018-2019 are nothing compared to how other governments interfere with the central banks in other countries. Mexico’s Senate approved Wednesday a bill that will force the central bank to buy dollar bills from banks that can’t place them elsewhere, making it easier for the migrants to exchange the dollar, as they often sell the US dollars at a loss. In fact, a significant chunk of the dollars entering the country comes from drug trafficking, and the adoption of the bill by the House of Representatives will increase the risk of money laundering and terrorist financing, hurt the economy and undermine the international confidence that the Bank of Mexico took years to win. Mexico City can face Washington’s sanctions for money laundering.

Political risks must be the only factor that could prevent the peso from exceptional performance in Forex. Over the past six months, the USDMXN has been down by 11.5%. The gradual recovery of the Mexican economy, which was 12.1% up in the third quarter, the decline in the unemployment rate from 5.5% in June to 4.7% in October, in addition to the favorable foreign environment allow Bloomberg experts suggest the peso could be one of the most promising Forex currencies in 2021.

The world's leading central banks' ultra-easy monetary policy increased the negative-yielding global debt market to $18 trillion. Cheap money, amid investors’ confidence in a soon victory over the pandemic, support carry traders and emerging markets’ currencies. The major problem of developing economies is the slow introduction of coronavirus vaccines. However, Mexico authorizes the Pfizer-BioNTech coronavirus vaccine's emergency use, which should encourage the peso buyers.

About 83% of Mexican exports go to the USA. The experts polled by Wall Street Journal expect the US GDP to go up from 1.9% in the first quarter to 4% in the second and third quarter of 2021, which also encourages the USDMXN bears. Besides, Joe Biden has become the US president and the US-Mexico trade relations.

Besides the international trade also influences the exchange rates. According to Nordea Markets, the growth of international trade will, first of all, support the currencies of Latin America and the emerging markets.

Quarterly USDMXN trading plan

A weaker dollar supports the international financial conditions' improvement and creates a favorable environment for globalization and trade development, which will encourage the USDMXN bears. I believe, provided Mexico’s House of Representatives blocks the bill forcing the central bank to buy the dollars, the pair will continue falling towards 19.4 and 18.6. I recommend one to sell the dollar versus the peso on the USDMXN drawdowns.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/four-reasons-to-buy-mexican-peso-forecast-as-of-14122020/?uid=285861726&cid=79634

LiteFinance

Euro got a blank check. Forecast 11.12.2020

Monthly euro fundamental forecast

Compromise is not always the best way to solve a problem. Unlike Mario Draghi, who suppressed the Governing Council’s hawks with his authority, told the market what he considered necessary, and thus manipulated the euro as he wanted, Christine Lagarde prefers to convey to investors the collective position of the ECB. She said the Pandemic Emergency Purchase Programme (PEPP) might not be utilized in full scale, which sounded similar to Jens Weidmann and his supporters' speeches. The hawkish tone of Lagarde’s comments at the press conference following the ECB December meeting sent the EURUSD up to the zone of 2.5-year highs.

Of course, the ECB couldn’t have broken the euro uptrend, but at least it could have tried to press it down a little. In fact, the forecasts are too gloomy, and the actions are expected. The European Central Bank lowered its forecasts for 2021. The expected GDP growth is down from 5% to 3.9%; the expected inflation rate is down from 1.3% to 1.1%. Lagarde expects the euro-area economy to contract 2.2% in the fourth quarter. At the same time, the expansion of the emergency asset purchase program by € 500 billion, as well as the extension of PEPP until the end of March 2022 and LTRO until the end of June 2022, have not surprised investors at all. On the contrary, some of them expected that both programs' terms would be extended by twelve months. Extension by nine months is further evidence of Christine Lagarde's compromise with the hawks.

Considering the December adjustments, the ECB’s monetary stimulus will exceed € 3 trillion this year. The central bank is actually targeting the bond yields of the EU countries; that is, it gives a blank check to the EU governments. They could borrow money, and the ECB will pay the debts.

Germany and other EU countries actively use ECB programs. Through an agreement with Budapest and Warsaw, Berlin found a way to reverse the veto of Hungary and Poland on approving a € 1.8 trillion fiscal stimulus package, including the € 750 billion post-pandemic recovery fund. The approval of programs by the European Union is an important milestone in the development of the united Europe. The risk of the euro area breakup is down to almost zero. Furthermore, a massive fiscal stimulus will support further integration of European countries and transition to a low-carbon economy.

Monthly EURUSD trading plan

The current situation is similar to the market sentiment in the May-August period. At that time, the ECB officials suggested a potential yield control policy and launched the post-pandemic recovery fund. Besides, the recovery of the US stock indexes encouraged the EURUSD bulls to start a rally up. Now, history not only repeats itself but rhymes as well. The EURUSD buyers ignore Boris Johnson's promises to withdraw the UK from the EU with or without a deal. The bulls do not pay any attention to the S&P 500 correction amid the absence of the compromise on the fiscal stimulus in US Congress. The euro is rallying up to the targets at $1.224 and $1.23, and we can enjoy the victory and pick up corrections.

For more information follow the link to the website of the LiteForex

https://www.liteforex.com/blog/analysts-opinions/euro-got-a-blank-check-forecast-11122020/?uid=285861726&cid=79634

Dynamics of ECB quantitative easing programs

Monthly euro fundamental forecast

Compromise is not always the best way to solve a problem. Unlike Mario Draghi, who suppressed the Governing Council’s hawks with his authority, told the market what he considered necessary, and thus manipulated the euro as he wanted, Christine Lagarde prefers to convey to investors the collective position of the ECB. She said the Pandemic Emergency Purchase Programme (PEPP) might not be utilized in full scale, which sounded similar to Jens Weidmann and his supporters' speeches. The hawkish tone of Lagarde’s comments at the press conference following the ECB December meeting sent the EURUSD up to the zone of 2.5-year highs.