Hansen / Perfil

- Información

|

3 años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Trader

en

Jakarta

Queridos colegas,

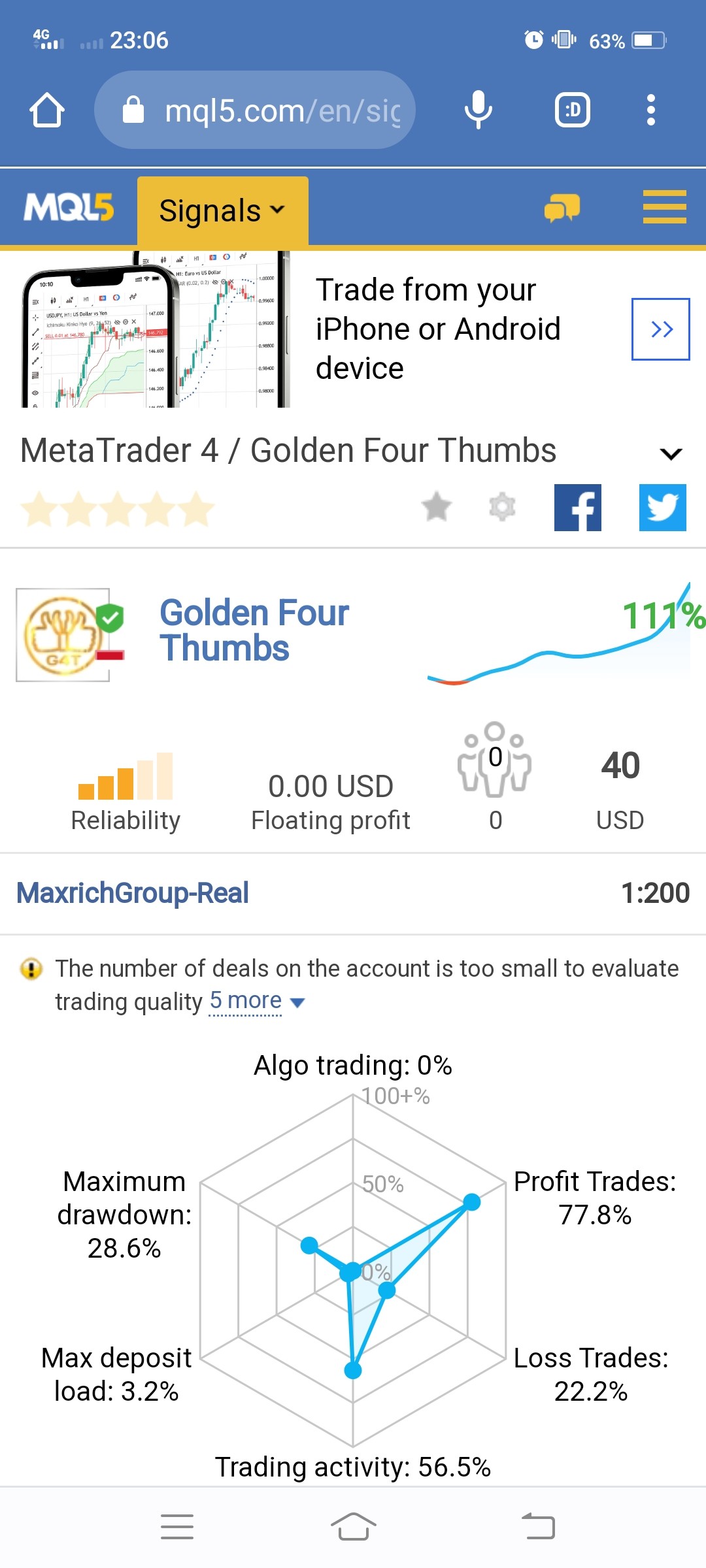

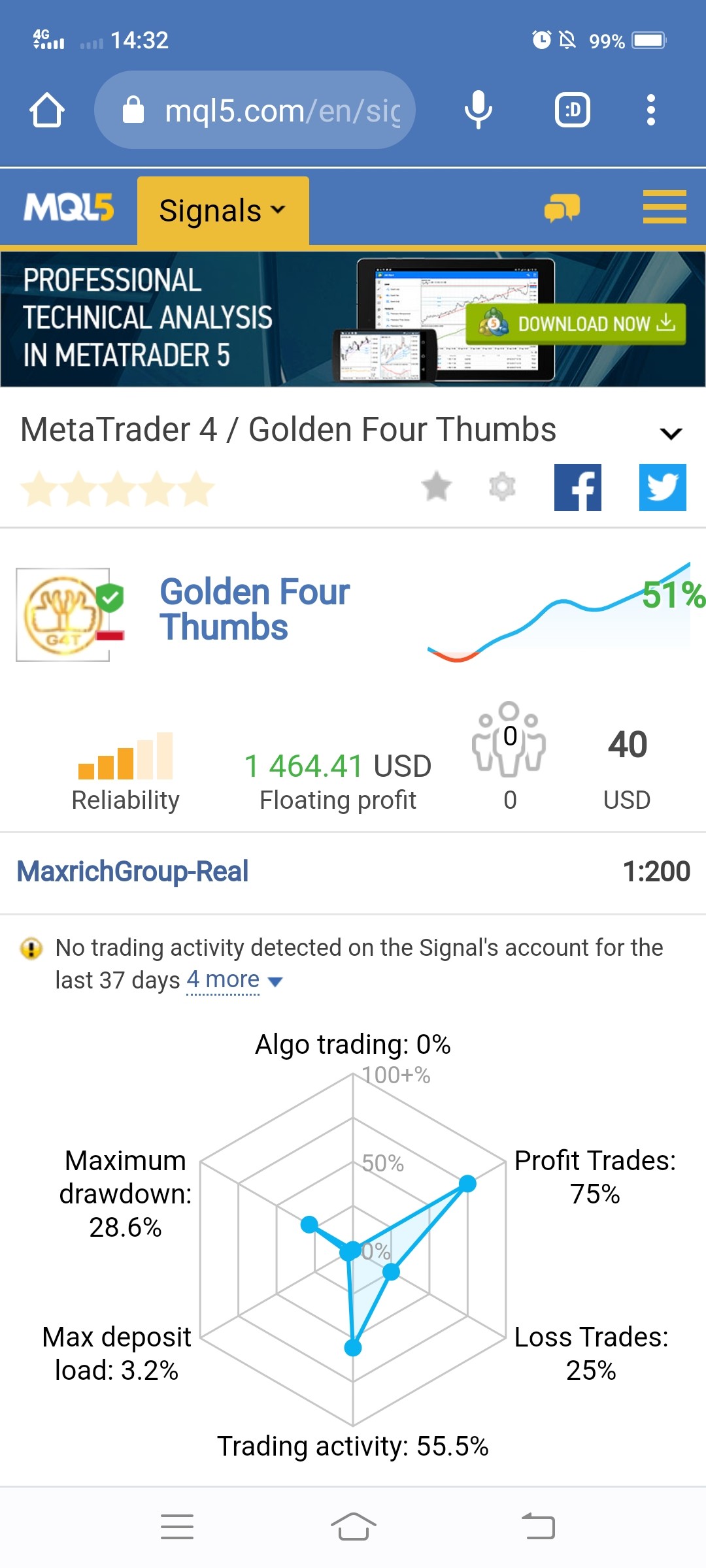

1. Concéntrese solo en GOLD/XAUUSD, así que no intercambie ningún par excepto XAUUSD

2. Cuando pierda la señal (abra una posición), no opere hasta la siguiente señal (nunca presione su suerte para enfrentar el mercado)

3. Si cree que el comercio es un negocio, debe tener paciencia (el comercio no es apostar)

4. Si no sabe a dónde va el mercado, no opere

5. No te dejes perder en el mercado ignorando estas reglas

6. La gestión de riesgos es la clave (usted está gestionando el riesgo siguiendo estas reglas).

Estilos comerciales:

1. Opere raramente o posicione el comercio

2. Abrir la posición (entrada) por debajo de diez veces/por año

3. Posición de entrada/salida basada en datos y análisis (consulte el historial de esta señal. Entonces sabrá que a veces no entramos en el mercado dentro de 2/3 meses (ninguna operación), y una vez que tenemos una entrada el período de ocupación de la posición puede ser de más de 2 meses (o menos))

“Rara vez comerciar y comerciar en un par es mejor siempre que sea rentable que comerciar y comerciar a menudo en muchos pares pero perdiendo. Lo más importante es que el patrimonio está creciendo”

Buena suerte

Cuatro pulgares dorados

1. Concéntrese solo en GOLD/XAUUSD, así que no intercambie ningún par excepto XAUUSD

2. Cuando pierda la señal (abra una posición), no opere hasta la siguiente señal (nunca presione su suerte para enfrentar el mercado)

3. Si cree que el comercio es un negocio, debe tener paciencia (el comercio no es apostar)

4. Si no sabe a dónde va el mercado, no opere

5. No te dejes perder en el mercado ignorando estas reglas

6. La gestión de riesgos es la clave (usted está gestionando el riesgo siguiendo estas reglas).

Estilos comerciales:

1. Opere raramente o posicione el comercio

2. Abrir la posición (entrada) por debajo de diez veces/por año

3. Posición de entrada/salida basada en datos y análisis (consulte el historial de esta señal. Entonces sabrá que a veces no entramos en el mercado dentro de 2/3 meses (ninguna operación), y una vez que tenemos una entrada el período de ocupación de la posición puede ser de más de 2 meses (o menos))

“Rara vez comerciar y comerciar en un par es mejor siempre que sea rentable que comerciar y comerciar a menudo en muchos pares pero perdiendo. Lo más importante es que el patrimonio está creciendo”

Buena suerte

Cuatro pulgares dorados

Hansen

7 tips to trade forex comfortably:

1. Learn the basics: Before you start trading forex, it's important to learn the basics of the market, including how it works, the major currency pairs, and the different trading strategies available.

2. Develop a trading plan: A trading plan is a set of rules that guide your trading decisions. It should include your trading goals, risk tolerance, and entry and exit strategies. A good trading plan can help you trade more comfortably by removing emotional decision-making from the equation.

3. Use a demo account: Practice trading on a demo account before trading with real money. This will help you get comfortable with the trading platform and the mechanics of placing trades.

4. Manage your risk: Risk management is a crucial part of trading forex comfortably. Use stop-loss orders to limit your losses and consider using a risk-reward ratio of at least 1:2, which means that your potential profit should be twice your potential loss.

5. Keep a trading journal: Keeping a trading journal can help you analyze your trades and identify areas where you can improve. It can also help you stay disciplined and focused on your trading plan.

6. Stay up-to-date on market news and events: Economic data releases and geopolitical events can have a significant impact on currency prices. Stay up-to-date on market news and events that may affect the currencies you are trading.

7. Take breaks: Forex trading can be mentally and emotionally taxing. Take regular breaks to refresh your mind and prevent burnout.

In summary, trading forex comfortably requires knowledge, experience, and discipline. Learn the basics, develop a trading plan, use a demo account, manage your risk, keep a trading journal, stay up-to-date on market news and events, and take breaks when needed. By following these tips, you can trade forex with greater confidence and comfort.

1. Learn the basics: Before you start trading forex, it's important to learn the basics of the market, including how it works, the major currency pairs, and the different trading strategies available.

2. Develop a trading plan: A trading plan is a set of rules that guide your trading decisions. It should include your trading goals, risk tolerance, and entry and exit strategies. A good trading plan can help you trade more comfortably by removing emotional decision-making from the equation.

3. Use a demo account: Practice trading on a demo account before trading with real money. This will help you get comfortable with the trading platform and the mechanics of placing trades.

4. Manage your risk: Risk management is a crucial part of trading forex comfortably. Use stop-loss orders to limit your losses and consider using a risk-reward ratio of at least 1:2, which means that your potential profit should be twice your potential loss.

5. Keep a trading journal: Keeping a trading journal can help you analyze your trades and identify areas where you can improve. It can also help you stay disciplined and focused on your trading plan.

6. Stay up-to-date on market news and events: Economic data releases and geopolitical events can have a significant impact on currency prices. Stay up-to-date on market news and events that may affect the currencies you are trading.

7. Take breaks: Forex trading can be mentally and emotionally taxing. Take regular breaks to refresh your mind and prevent burnout.

In summary, trading forex comfortably requires knowledge, experience, and discipline. Learn the basics, develop a trading plan, use a demo account, manage your risk, keep a trading journal, stay up-to-date on market news and events, and take breaks when needed. By following these tips, you can trade forex with greater confidence and comfort.

Hansen

Hi guys, I'm preparing to take a buy limit at XAUUSD around 1767,72 - 1780,34.

For TP clue, it will be a long range.

For TP clue, it will be a long range.

Hansen

Based on my analysis, starting on 25th July 2022 XAUUSD will Uptrend. Do you know where you set the Take Profit point?

Hansen

Hi guys,

I need your opinion about my new method. I did a backtest about my gold trading method. I used to period 2013 to 2022 (now), I only use 0,1 volume as long the period, here is the record:

1. 2013 = 3452,40 (Profit)

2. 2014 = 1237,30 (Profit)

3. 2015 = 2772,60 (Profit)

4. 2016 = (955,10) (Loss)

5. 2017 = 2147,20 (Profit)

6. 2018 = 227,50 (Profit)

7. 2019 = (1900,70) (Loss)

8. 2020 = (2264,50) (Loss)

9. 2021 = 2453,20 (Profit)

10. 2022 = 3954,80 (Profit)

Total = 11.125 (Profit)

is it worth being run?

Thanks

I need your opinion about my new method. I did a backtest about my gold trading method. I used to period 2013 to 2022 (now), I only use 0,1 volume as long the period, here is the record:

1. 2013 = 3452,40 (Profit)

2. 2014 = 1237,30 (Profit)

3. 2015 = 2772,60 (Profit)

4. 2016 = (955,10) (Loss)

5. 2017 = 2147,20 (Profit)

6. 2018 = 227,50 (Profit)

7. 2019 = (1900,70) (Loss)

8. 2020 = (2264,50) (Loss)

9. 2021 = 2453,20 (Profit)

10. 2022 = 3954,80 (Profit)

Total = 11.125 (Profit)

is it worth being run?

Thanks

: