Matthew Todorovski / Perfil

- Información

|

10+ años

experiencia

|

1

productos

|

557

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

“A billion dollars ain’t sh*t, for what I’m tryin’ to do.” (Akon)

http://bit.ly/34dBmRJ

[̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅]

Greetings and salutations fellow entrepreneur. Welcome to my profile.

I hope you will find some inspiration and encouragement here to assist you on your trading journey.

For the best trading conditions, I recommend using the world's largest true-ECN forex broker (2015): http://bit.ly/2t8SCL2

If you are unable to due to regulations, I recommend this one: http://bit.ly/2L9mdd2

Earn CashBack on your trading commissions: http://bit.ly/3ryoceI

If you want answers, this will help you: https://bit.ly/3gfkBM0

Thank you for visiting my profile.

May you enjoy many green pips!

Matt Todorovski

Maverick trader, currency speculator, professional gambler

◦ Computer Operator, Technological micro Data (2003-2006)

◦ Shop Assistant, Woolworths Supermarkets (2005 - 2017)

◦ Security Officer, [undisclosed employer] (2006 - today)

◦ Station Officer, [undisclosed employer] (2008 - today)

◦ Entrepreneur and property investor (2003-2012)

◦ Forex Wannabe, aspired self-employment (2008 - 2018)

◦ Forex Millionaire, achieved self-employment (2018 - today)

◦ Forex Trillionaire, achieved financial freedom (fait accompli): https://bit.ly/3e0fNcA

My opinion is gratuitous, your munificence is magnanimous!

http://bit.ly/34dBAs3

◦ High Hopes: http://bit.ly/2PbuVKp

◦ Remember The Name: http://bit.ly/2YCE02h

◦ Trader’s Anthem: http://bit.ly/2YIT2DC

THIS IS NOT DEMO

__________________________________________________

►MODERN DAY ALCHEMY: CREATING MONEY FROM "NOTHING"

"Before you start some work, always ask yourself three questions - Why am I doing it, What the results might be and Will I be successful. Only when you think deeply and find satisfactory answers to these questions, go ahead." (Chanakya, Indian teacher, philosopher, economist, jurist and royal advisor, c.371-283 BC)

➊ AIM

To generate a perpetual income on auto-pilot.

➋ HYPOTHESIS

▸ Hypothesis 1:

Foreign Exchange (forex) is the PRE-EMINENT method to make money:

◦ http://bit.ly/35d2v8p

◦ http://bit.ly/2Pem36Z

The benefits compared to conventional business, property, shares, etc:

◦ greater profit potential (high leverage, volatility) (Time + Leverage = Profit);

◦ lower entry barriers: easier to get started, few overhead costs (no employees, no inventory);

◦ highly liquid: immediate entry & exit of the market;

◦ better risk management: custom position sizing between 0.01 - 100 Lots, using trading strategies (eg. hedging);

◦ business-automation: trading robots (Expert Advisors);

◦ market is open 24 hours x 5 days: more trade opportunities, work when you choose;

◦ simplicity: fewer instruments to analyse and trade;

◦ ease of tax calculations: trading statements provide all evidence;

◦ scalability: ease of multiplying results;

◦ enormous volume: market manipulation more difficult;

◦ geographic independence: trade anywhere, mobile business;

◦ recession-proof: business continuity unaffected by disasters, macroeconomics, etc.;

◦ immediate analysis: obtain an accurate "statement of financial position" at all times.

"The most successful investors don't diversify. Rather, they FOCUS (Follow-One-Course-Until-Successful) and specialize. They get to know the investment category they invest in and how the business works better than anyone else." (Robert Kiyosaki, American businessman and author)

“Wide diversification is only required when investors do not understand what they are doing.” (Warren Buffett, American business magnate, investor, speaker and philanthropist)

“The price of a commodity will never go to zero. When you invest in commodities futures, you are not buying a piece of paper that says you own an intangible of a company that can go bankrupt.” (Jim Rogers, American businessman and financial commentator)

▸ Hypothesis 2:

"All unsustainable moves are corrected." (Scott Barkley, Forex Trainer and analyst, President ProAct Traders)

"This makes sense when you step back and look at the big picture. Nothing goes up in a straight line forever. Not stocks. Not real estate. Not anything. There always have to be periods of corrections… booms followed by busts." (Simon Black, international investor, entrepreneur, founder of Sovereign Man)

➌ EQUIPMENT / PREREQUISITES

☐ reliable external income source;

☐ Australian Business Number (ABN);

☐ Personal Computer (PC) with ADSL internet;

☐ FSA/ASIC-regulated ECN/STP broker (recommended: http://bit.ly/2t8SCL2 );

☐ Virtual Private Server (VPS) or Dedicated Server (DS);

☐ MetaTrader 4 (MT4) trading platform;

☐ minimum $10,000 risk capital;

☐ Expert Advisor (EA) trading robot (recommended EA here: https://bit.ly/3aDT7i1 )

☐ registered tax agent;

☐ determination, fortitude, patience, courage, FOCUS.

➍ METHOD OF PROCEDURE (MOP)

☐ have a reliable income source eg. a JOB (Just Over Broke) or a solid conventional business;

☐ register an ABN for taxation purposes;

☐ open a free $10,000 DEMO account at a regulated broker: http://bit.ly/2t8SCL2

☐ obtain a VPS (broker-sponsored or direct from provider);

☐ install MT4 terminal from broker's website;

☐ install EA on MT4 terminal;

☐ backtest EA in MT4's Strategy Tester;

☐ forward test EA on Demo Account for at least three months;

☐ destroy useless robots: http://bit.ly/2sm1OuV

☐ pending satisfactory forward test, open a Real account with a minimum $10,000 risk capital;

☐ register Real account for rebates on broker commissions at www.rebatekingfx.com

☐ retain all trading statements and expense receipts for taxation;

☐ DON’T GIVE UP: if you fail, return to Step 6;

☐ cumulatively compound profits;

☐ declare all profits and pay your tax honestly;

☐ regularly withdraw profits, maintaining sufficient margin at all times;

☐ upgrade VPS to DS; use FIX API trade execution;

☐ make a positive difference to the world; be generous and help others.

➎ SAFETY/RISKS

▸ Forex trading involves a high degree of risk, including the loss of your entire investment:

◦ Do not invest money you cannot afford to lose;

◦ Do not trade unless you understand the risks;

◦ Past performance is no guarantee of future performance;

◦ Results will vary depending upon broker conditions, VPS provider and EA settings.

▸ Market odds are 1:1 - either up or down. That's better odds than the casino, sports betting and lottery. You then improve your odds by observing:

◦ Long-Term Support / Resistance levels;

◦ Long-Term Overbought / Oversold levels (correlations of same currency with different pairs);

◦ 4H, Daily, Weekly charts;

◦ Fibonacci confirmations;

◦ positive Swaps;

◦ fundamentals and market dynamics.

▸ Forex is the fastest way to wealth and paradoxically to penury. Before considering VPS costs, broker commissions, latency, slippage, low liquidity, etc., the odds are mathematically stacked against you:

◦ a loss of 10% requires a gain of 11.11% to recover;

◦ a loss of 20% requires a gain of 25% to recover;

◦ a loss of 30% requires a gain of 42.86% to recover;

◦ a loss of 40% requires a gain of 66.67% to recover;

◦ a loss of 50% requires a gain of 100% to recover.

▸ Risks in forex include:

◦ high leverage;

◦ broker conditions;

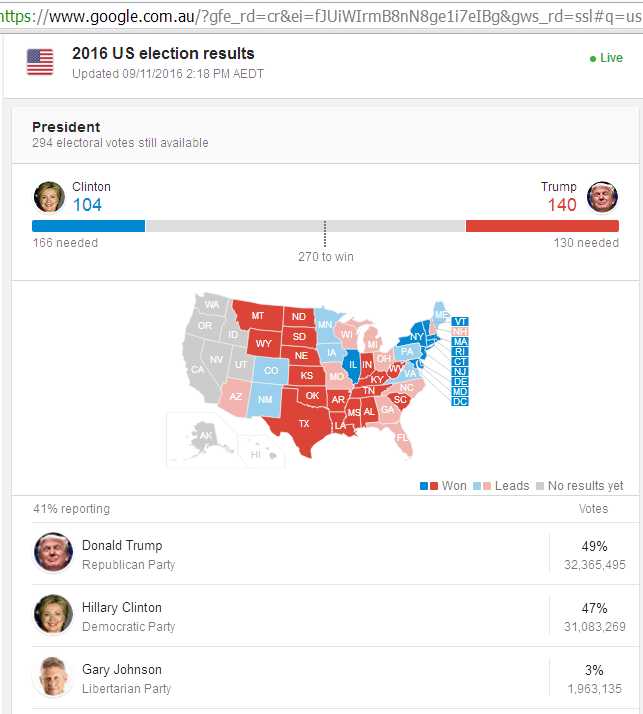

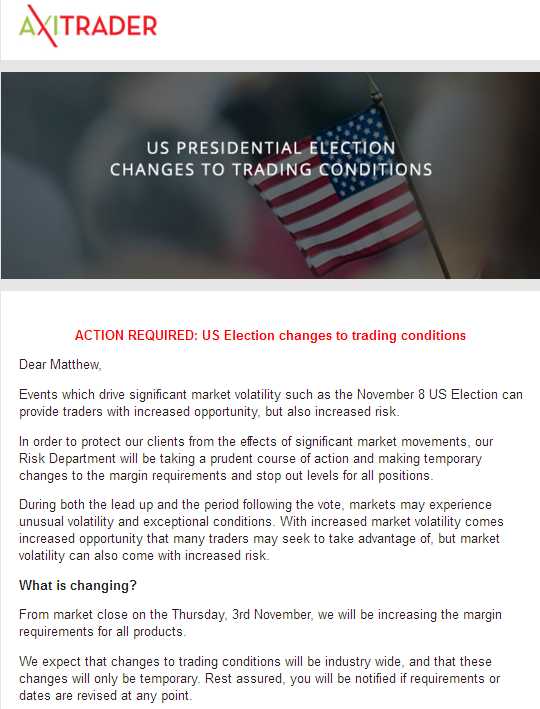

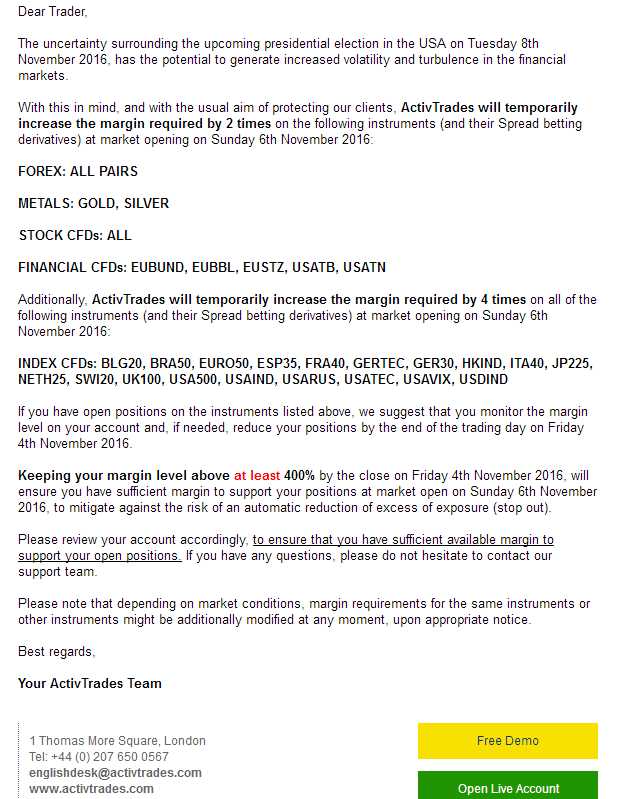

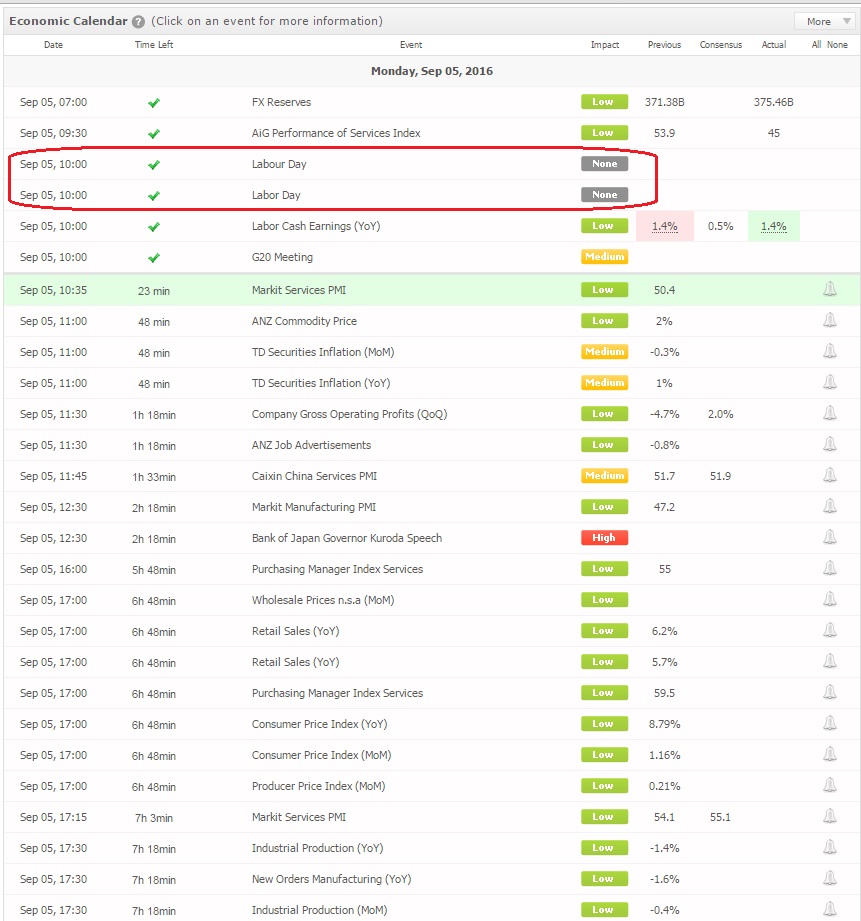

◦ "Black Swan" events: eg. Swiss Franc January 2015, Brexit June 2016, GBPUSD Flash Crash October 2016, Yen Flash Crash January 2019;

◦ News events eg. NFP, FOMC;

◦ strategy, user settings, programming quality of EA or system;

◦ "opportunity cost" when losing time or money.

"Many great entrepreneurs have had a moment when they have lost everything. Monks create this situation intentionally through 'Vairagya' when they give up all money and possessions. Many entrepreneurs end up in the same situation unintentionally." (Roger Hamilton, world renowned futurist and social entrepreneur, http://bit.ly/2E552px )

"A wise man says: 'HIGH RISK HIGH PROFIT, LOW RISK LOW PROFIT, AND NO RISK NO PROFIT.'

Another wise man says: 'THERE IS A DIFFERENCE BETWEEN TAKING RISK AND BEING FOOLISH.' (anon)

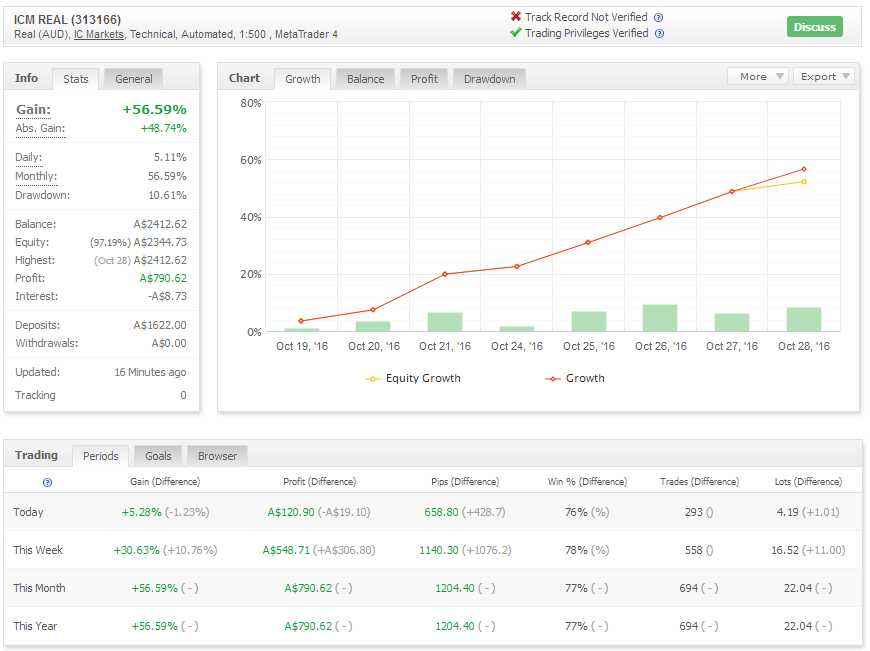

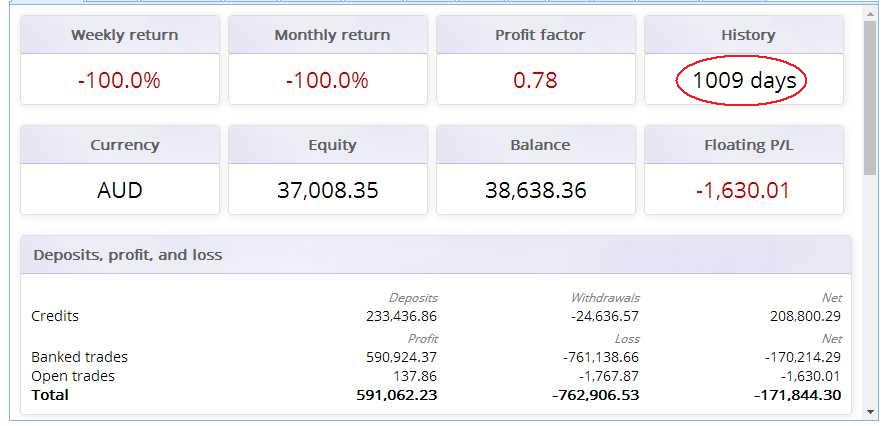

➏ RESULTS

Archived Myfxbook profile: http://bit.ly/2EaQVPA

Current Myfxbook profile: http://bit.ly/2YLQp40

THIS IS NOT DEMO

▸ TAX ASSESSED BUSINESS PROFIT (LOSS):

FY2009: $ (30,499) $5,300 refund

FY2010: $ (37,280) plus $3,693 debt (wrong tax treatment)

FY2011: $ (19,288) plus $5,448 debt (wrong tax treatment)

FY2012: $ (2,904) plus $9,681 debt (wrong tax treatment)

FY2013: $ (159,324) $18,973 refund

FY2014: $ (74,721) $16,719 refund

FY2015: $ (71,542) $18,958 refund

FY2016: $ (91,413) $23,272 refund

FY2017: $ (58,031) $11,758 refund

FY2018: $ (137,530) $29,710 refund

FY2019: $ (1,376,387) $23,496 refund (future tax offset: $1,478,678)

FY2020: $ (213,177) $27,672 refund

FY2021: $ ...

▸ MILESTONES:

$32,000: invested $4k and made 800% return in 4.5 days using CFDs (Aug 2008)

$1.69: started primary account 313166 (22 Nov, 2013)

-$327,127: nadir of primary account 313166 (27 Aug, 2018)

$0 profit: zero point of primary account 313166 (27 Sep, 2018)

$1 million net profit: Posted 9 Oct, 2018

$2 million net profit: Achieved 16 Oct, 2018

$4 million net profit: Achieved 19 Oct, 2018

$6 million net profit: Achieved 1 Nov, 2018

$8 million net profit: Achieved 28 Nov, 2018

$10 million net profit: Posted 4 Dec, 2018

$11 million net profit: Posted 5 Dec, 2018

$12 million net profit: Posted 13 Dec, 2018

$13 million net profit: Posted 21 Dec, 2018

$13.5 million loss (approx) (96%): Posted 3 Jan, 2019

◦ http://bit.ly/2sm431j

◦ http://bit.ly/2E6tvdR

$604: nadir of 20 accounts. Posted 06 June 2020.

$100 million net profit: Posted... http://bit.ly/2sm3i8s

$1 billion net profit: Posted...

$10 billion net profit: Posted...

$100 billion net profit: Posted...

$1 trillion net profit: Posted... http://bit.ly/2ShTeHb

▸ Other examples:

◦ "Gann held a trading record which has been unsurpassed by anyone since. In front of a customs inspector he turned $130 into $12,000 in less than 1 month." ( http://bit.ly/2sn9zkj )

◦ http://bit.ly/34ep3V0

◦ http://bit.ly/2E9iRTL

"Don't let yourself get attached to anything you are not willing to walk out on in 30 seconds flat if you feel the heat around the corner.” (Robert De Niro, American actor)

“When I thought I couldn't go on, I forced myself to keep going. My success is based on persistence, not luck.” (Norman Lear, American television writer)

“You may be disappointed if you fail, but you are doomed if you don't try.” (Beverly Sills, American operatic soprano)

"The AMOUNT of money you have does not matter; what matters is the SYSTEM you use. No AMOUNT of money can save you if you have a bad SYSTEM. Conversely, if you have a good SYSTEM you can start with a small AMOUNT and easily become rich." (Matthew Todorovski)

➐ DISCUSSION

▸ Trading vs Gambling

With experience comes understanding. By this method you will tell who has experience and who has none:

◦ traders with little experience will resent comparisons between "trading" and "gambling" as anathema.

◦ traders with much experience will understand "trading is by very definition gambling".

Refer:

◦ Rule 4 and 5 "Michael Steinhart" (below)

◦ http://bit.ly/2sjo1K6

◦ https://bit.ly/39uiF0m

◦ http://bit.ly/2sjoR9I

◦ http://bit.ly/2PbxvA5

◦ http://bit.ly/35azWZy

◦ http://bit.ly/2E7FckD

◦ http://bit.ly/2PbFFse

◦ http://bit.ly/2E57355

◦ http://bit.ly/2seGd7Y

◦ http://bit.ly/35daCSF

◦ http://bit.ly/349kV8L

◦ http://bit.ly/2qMvuBe

◦ http://bit.ly/2seGub0

◦ http://bit.ly/2P9PGWZ

◦ http://bit.ly/35eSwPZ

◦ http://bit.ly/2E9bpbu

◦ http://bit.ly/2U3I7lW

◦ http://bit.ly/38bBnuN

▸ Expert Advisors

There is a plethora of Expert Advisors (EA) to consider. Essential criterion include:

◦ positive user reviews: http://bit.ly/35cYcKv

◦ verified Real monitoring account(s) with over three months' trade history;

◦ prompt and helpful pre-sales / after-sales support;

◦ fair price and license options;

◦ details of trading strategy;

◦ clear user instructions: pairs, timeframes, parameters;

◦ margin requirements.

◦ During Demo forward test performance, confirm:

- suitability of broker trading conditions;

- EA settings for desired performance;

- reasonable frequency of trading;

- stable EA operations.

◦ Red flags to avoid:

- excessive server messages;

- large StopLoss in comparison to TakeProfit;

- Lotsize increases;

- multiple orders.

▸ Curriculum Vitae

◦ 2003-2008: I attended many investment seminars on shares, property, options, etc. Spent upwards of approximately AUD$50,000.

◦ Oct 2008: I became interested in forex during the GFC (Global Financial Crisis) of 2008, when front-page news highlighted the opportunity. For the first time ever, the Aussie Dollar reached parity with the US Dollar (August 2008) and my first foray into forex began with CFDs at CMC Markets. I heavily sold AUDUSD, turning $4K into $32K within 4.5 days from the Monday until Friday afternoon, but my account was over-leveraged to the extent that open profit dropped by $10K to $22K within 30 minutes! At US$0.89 I decided the market still had a long way to go down, so I kept my positions open expecting I would survive. Unfortunately, the market corrected to US$0.92 and I received my first ever margin call. It was a thrilling learning experience and I was convinced!

◦ 2008-2018: Many hopeful moments, but overall results were quite depressive and devastating. The main failures were over-leveraging, risk-taking, overconfidence (in my own skills and EAs) and impatience. Estimated trading losses approximated AUD$700K(?), but be reminded:

- "You pay for education, whether university or real-life experience";

- "No one becomes successful from Day 1";

- “Nothing worth doing is ever easy" (Theodore Roosevelt, American statesman and writer, 26th POTUS, 1858-1919);

- "Make all your mistakes early in life" (Rule 1 “Michael Steinhardt”, below).

- Losses are offset against Assessable Tax Income with an ABN business. A good tax agent is essential - the difference can be seen in Results above.

◦ Sep 2018: I stopped focusing on low timeframes of 1M, 5M, 15M, 1H, and began focusing on high timeframes of 4H, Daily, and Weekly. With AUD$50,000 ($20K of savings + $30K FY2018 tax refund), I happen-chanced upon the CHFSGD being overbought and nearing long-term resistance after seven-straight Long days. Short CHFSGD was Swap-positive, so even more encouragement to hold the positions for the ride down! I Shorted heavily and made over 800% in less than a month (posted 28 Sep 2018).

◦ Oct 2018: I Shorted EURTRY and boosted my equity from $450K to over $9M (29 November 2018). I could have made at least three times as much, if not for my broker's Trading Desk coercing me to reduce my exposure by half, under duress of reduced leverage. Exposure was reduced by 70%, from 670 Lots to only 200 Lots (posted 16 Oct 2018). Refer Rule 4 and 6 “Michael Steinhart” (below). Opened 20 new broker accounts and received broker sponsorship for 12 new VPS. Daily profits exceeded $100k; monthly volumes exceeded 20,000 Lots (broker rebate = USD$58,000 / 0.375 / $7(RTL).

◦ Jan 2019: Yen Flash Crash costs me $13.5 million (approx. 96% loss) (posted 3 Jan, 2019) due to a combination of factors:

- mirroring the same system and settings to all accounts;

- trading many pairs (correlation risk);

- increasing Risk by 40x;

- splitting money across 20 accounts (lowered available margin);

- not using an equity stoploss;

- exceptional market conditions.

◦ Jan 2020: consolidated 12 VPS (20 accounts) onto one broker-sponsored DS. Use of FIX API.

➑ CONCLUSION

To be DETERMINED...

◦ To be determined: (inconclusive, future tense) to ascertain or establish exactly by research or calculation;

◦ (It has been) DETERMINED: (conclusive, past participle) has been proven definitively; learnt with certainty or assurance; facts have been ascertained.

◦ DETERMINATION will overcome any obstacle: http://bit.ly/35boXik

Prepare yourself for success ( http://bit.ly/34ffNjw )

"The biggest challenge after success is shutting up about it." (Criss Jami, American poet, essayist, philosopher, songwriter, creator/designer)

"Success unshared is failure." (John Paul DeJoria, Greek-Italian-American entrepreneur, a self-made billionaire, philanthropist)

"Don't blame Wall Street. Don't blame the big banks. If you don't have a job and you're not rich, blame yourself!" (Herman Cain, American Politician)

___________________________________________________

►HALL OF SHAME

“Our critics make us strong! Our fears make us bold! Our haters make us wise! Our foes make us active! Our obstacles make us passionate! Our losses make us wealthy! Our disappointments make us appointed! Our unseen treasures give us a known peace! Whatever is designed against us will work for us!” (Israelmore Ayivor, writer)

▸ DISSES

Recorded herein for posterity. All made before I turned $50,000 into $13million in Sep-Oct 2018.

“Matthew you are poor man! The worst trader I know! Probably the worst trader in the world! Why do you comment free products that you are not interest in and you do not know nothing about these products, you financial moron! Just for points? It is your new way of making money? Anyone who lost less money than you is better trader than you!!! Even koala bear LMAO!" (Krzysztof Lorenc, hater, 2018)

“You can't stop, you have an addiction, that's a serious problem. You are mentally sick; you need to see a psychologist." (M. Garwarzad, hater, 2018)

“You were greedy. You should have listened to me all those years ago (2008?) and invested in houses. Houses were $300 K, now they are over $1 million. You could have had a few houses by now. The rent helps pay them off. You could have been retired by [age] 40 (currently 35). You should cut your losses now and stop your gambling. Take out whatever money you have left and invest in gold. Fiat currency is going to be worthless. We are going to see a depression worse than 1930. You have wasted all your money. You wouldn't have to keep working three jobs if you had listened to me back then. You [had] better start saving or else if you lose your job you will have nothing. What will happen if you can't work? If you fall sick? You won't be able to afford medical expenses, and you won't be able to afford rent. You will be out on the streets (begging). Start putting some money away in a savings account. You're lucky you're not in jail for losing all that money." (K. Morel, hater, 2018)

“Quit while you're ahead. Take it out. You should take the money out and buy a property. You don't know what's going to happen (with your health, life, investment, etc.)" (many detractors, most everyone else, 2006-2018)

“You don't really have that money; that is Demo trading." (haters that keep losing, 2018)

▸ REBUTTAL

Forget About Dre: http://bit.ly/2qEFkF4

Broke: http://bit.ly/2P9Mhr8

Why You Always Hatin? http://bit.ly/2E7GQmj

No Love: http://bit.ly/2qHAXJs

Balla Blockin: http://bit.ly/2shCiHv

Lay Low: http://bit.ly/2EaRUzb

IDGAF: http://bit.ly/2smamSx

Fake Ass Bitches: http://bit.ly/2PaZJLm

F*ck Em All: http://bit.ly/2PdfKkc

Fear Nothing: http://bit.ly/2sngOJ1

Killing In the Name: http://bit.ly/2sjvB7w

Titanium: http://bit.ly/2PdrH9B

Till I Die: http://bit.ly/2YIVXMr

I'm a Real 1: http://bit.ly/2E6c7pK

Grew Up A Screw Up: http://bit.ly/348MBe1

I Got the Keys: http://bit.ly/34aMRJx

Forever: http://bit.ly/35eWtEi

Back In Black: http://bit.ly/2Pdkar3

Y.U. MAD: http://bit.ly/2E96CXp

Rollout: http://bit.ly/2sjvYyW

Good Morning: http://bit.ly/2qELgxQ

Bugatti: http://bit.ly/2slCyW0

100 Million: http://bit.ly/2sm3i8s

Cash Flow: http://bit.ly/35eWJDg

All I Do Is Win: http://bit.ly/2YEcm4M

I Made It: http://bit.ly/2E7qPwT

Berzerk: http://bit.ly/2qHkapR

Chillin': http://bit.ly/2sgcgEo

Good Feeling: http://bit.ly/35f9Rsb

My Ass: http://bit.ly/2qJ0r9r

Happy: http://bit.ly/2PcdvgZ

You’re Never Gonna Get It: http://bit.ly/2Pd10BK

Hard Bottoms & White Socks: http://bit.ly/2qELDse

Traders Anthem: http://bit.ly/2YIT2DC

Make It Rain: http://bit.ly/2sm3TqJ

High As Me: http://bit.ly/393hOSr

Hood Rich: http://bit.ly/35ozwic

http://bit.ly/2YDdQwh

http://bit.ly/2YF9rc1

"It doesn’t matter what morons say." (Dan Pena, American businessman and business coach)

“The distance between insanity and genius is measured only by success.” (Bruce Feirstein, American screenwriter)

“Some people try to be tall by cutting off the heads of others.” (Paramahansa Yogananda, Indian yogi and guru, 1893-1952)

“What you habitually think largely determines what you will ultimately become.” (Bruce Lee, Hong Kong-American actor, director, martial artist, martial arts instructor, philosopher, 1940-1973)

"It’s our nature: Human beings like success but they hate successful people." (Carrot Top, American comedian)

"The secret to success is to offend the greatest number of people." (George Bernard Shaw, Irish playwright, critic, polemicist, political activist, 1856-1950)

“The more bold you are, the more rejection you’ll experience.” (Todd Brison, blogger)

"Behind every successful person lies a pack of haters." (Eminem, American rapper)

"Those who try to do something and fail are infinitely better than those who try nothing and succeed." (Lloyd Jones, New Zealand author)

"Winners are not afraid of losing. But losers are. Failure is part of the process of success. People who avoid failure also avoid success." (Robert Kiyosaki, American businessman and author)

“It's hard to soar with the eagles when you're surrounded by turkeys.” (Adam Sandler, American actor, comedian, screenwriter, film producer)

"Can you really explain to a fish what it’s like to walk on land? One day on land is worth a thousand years of talking about it, and one day running a business has exactly the same kind of value." (Warren Buffett, American business magnate, investor, speaker and philanthropist)

"I owe my success to having listened respectfully to the very best advice, and then going away and doing the exact opposite." (G. K. Chesterton, English writer, poet, philosopher, dramatist, journalist, orator, lay theologian, biographer, literary and art critic, 1874-1936)

“Do not save what is left after spending but spend what is left after saving.” (Warren Buffett, American business magnate, investor, speaker and philanthropist)

“Investing puts money to work. The only reason to save money is to invest it.” (Grant Cardone, author, sales trainer, speaker, real estate mogul)

http://bit.ly/2Pc09kH

“A man convinced against his will, stands opposed ever still. A man convinced he is right, gives the effort twice the fight.” (Jeffrey Fry, entrepreneur)

"When everything seems to be going against you, remember that the airplane takes off against the wind, not with it.” (Henry Ford, American captain of industry, business magnate, 1863-1947)

"Always bear in mind that your own resolution to succeed is more important than any other one thing." (Abraham Lincoln, American statesman, lawyer, 16th POTUS, 1809-1865)

"If you think you can, you can. And if you think you can’t, you’re right." (Henry Ford, American captain of industry, business magnate, founder Ford Motor Company, 1863-1947)

"Only those who dare to fail greatly can ever achieve greatly." (Robert F. Kennedy, American politician, lawyer, senator, 1925-1968)

"That some achieve great success, is proof to all that others can achieve it as well." (Abraham Lincoln, American statesman, lawyer, 16th POTUS, 1809-1865)

"The super successful also have a different take on failure. They understand that failure is what happens when you do something. The greatest successes in the world also experienced the greatest failures. The all-time strikeout record in major league baseball is held by… Babe Ruth. But we don’t remember him for his strikeouts. We remember him for setting a home run record that stood for decades, long before performance enhancing drugs destroyed America’s love affair with baseball. No one cares about the Babe’s strikeouts. The point is he kept swinging the damn bat! Most of us never get out of the dugout – let alone up to the plate. Those people not only wonder why they never hit a home run – they even begrudge the determined hitters who do." (Dan Pena, American businessman and business coach)

"I’ve missed more than 9,000 shots in my career. I’ve lost almost 300 games. 26 times I’ve been trusted to take the game winning shot and missed. I’ve failed over and over and over again in my life and that is why I succeed." (Michael Jordan, American former professional basketball player)

"If you have no critics you’ll likely have no success." (Malcolm X, American minister and human rights activist, 1925-1965)

"I’m convinced that about half of what separates successful entrepreneurs from the non successful entrepreneurs is pure perseverance. It is so hard, you pour so much of your life into this thing, there are such rough moments in time, that most people give up. I don’t blame them, it’s really tough." (Steve Jobs, American business magnate, 1955-2011)

"Through perseverance many people win success out of what seemed destined to be certain failure." (Benjamin Disraeli, former British Prime Minister, 1804-1881)

"The distance between insanity and genius is measured only by success." (Bruce Feirstein, American screenwriter)

"The people who succeed are irrationally passionate about something." (Naval Ravikant, CEO Founder AngelList)

“You will fall. And when you fall, the winner always gets up, and the loser stays down.” (Arnold Schwarzenegger, Austrian-American actor, filmmaker, businessman, investor, author, philanthropist, activist, politician, former professional bodybuilder and powerlifter)

"Failure should be our teacher, not our undertaker. Failure is delay, not defeat. It is a temporary detour, not a dead end. Failure is something we can avoid only by saying nothing, doing nothing, and being nothing." (Dr. Denis Waitley, American motivational speaker, writer and consultant)

“If you want to increase your success rate, double your failure rate.” (Tom Watson Sr, American businessman, chairman and CEO of IBM, 1874-1956)

"The season of failure is the best time for sowing the seeds of success." (Paramahansa Yogananda, Indian yogi and guru, 1893-1952)

"The master has failed more times than the beginner has even tried." (Stephen McCranie, writer and illustrator)

"Your willingness to fail is what will let you succeed." (Vinod Khosla, Indian American billionaire engineer, businessman, venture capitalist)

"Failure is simply the opportunity to begin again, this time more intelligently." (Henry Ford, American captain of industry, business magnate, 1863-1947)

"But life will become a burden of existence unless you learn how to fail gracefully. There is an art in defeat which noble souls always acquire; you must know how to lose cheerfully; you must be fearless of disappointment. Never hesitate to admit failure. Make no attempt to hide failure under deceptive smiles and beaming optimism. It sounds well always to claim success, but the end results are appalling. Such a technique leads directly to the creation of a world of unreality and to the inevitable crash of ultimate disillusionment." (Urantia Book 160:4.13)

"Many of life’s failures are people who did not realize how close they were to success when they gave up." (Thomas Alva Edison, American inventor and businessman, 1847-1931)

"Our best successes often come after our greatest disappointments." (Henry Ward Beecher, American Congregationalist clergyman, social reformer, speaker, 1813-1887)

"If you set your goals ridiculously high and it’s a failure, you will fail above everyone else’s success." (James Cameron, Canadian filmmaker, philanthropist, deep-sea explorer)

"Success is almost totally dependent upon drive and persistence. The extra energy required to make another effort or try another approach is the secret of winning." (Denis Waitley, American motivational speaker)

"Dictionary is the only place that success comes before work. Hard work is the price we must pay for success. I think you can accomplish anything if you’re willing to pay the price." (Vince Lombardi, American football player, coach, executive, 1913-1970)

"Ambition is the path to success. Persistence is the vehicle you arrive in. (Bill Bradley, American politician, former professional basketball player)

"Success consists of going from failure to failure without loss of enthusiasm." (Winston Churchill, British politician, statesman, army officer, writer, 1874-1965)

"The first requisite for success is the ability to apply your physical and mental energies to one problem incessantly without growing weary." (Charles Caleb Colton, English cleric, writer, collector, 1780-1832)

"Optimism is the faith that leads to achievement." (Helen Keller, American author, political activist, lecturer, 1880-1968)

"The only question to ask yourself is, how much are you willing to sacrifice to achieve this success?" (Larry Flynt, American publisher)

"Success comes in cans; failure in can’ts." (Wilfred Peterson, American author, 1900-1995)

"If you really want to do something, you will find a way. If you don’t, you’ll find an excuse." (Jim Rohn, American entrepreneur, author, motivational speaker, 1930-2009)

"Success is my only option, failure’s not." (Eminem, American rapper)

"Fall seven times, stand up eight." (Japanese Proverb)

"Success is the good fortune that comes from aspiration, desperation, perspiration, and inspiration." (Evan Esar, American humorist, 1899-1995)

"Men succeed when they realize that their failures are the preparation for their victories." (Ralph Waldo Emerson, American essayist, lecturer, philosopher, poet, 1803-1882)

"Super success is not for the wishy washy. Victory in business, like war, comes to the toughest son-of-a-bitch in the valley." (Dan Pena, American businessman and business coach)

"Behind every successful man there’s a lot of unsuccessful years." (Bob Brown, former Australian politician, medical doctor, and environmentalist)

"A minute’s success pays the failure of years." (Robert Browning, English poet and playwright, 1812-1889)

"I once read an interview with a hedge fund manager, who had one of his traders lose $50 million on a trade. When asked if he was going to fire that trader, he replied “Are you nuts? We just paid $50 million for him to learn that lesson – why would we pack him up and ship him off to another hedge fund to benefit from it?” (Christopher Lee, independent trader, http://bit.ly/34aZ3ds )

"It is a mistake to suppose that men succeed through success; they much oftener succeed through failures. Precept, study, advice, and example could never have taught them so well as failure has done." (Samuel Smiles, author, 1812-1904)

“Formal education will make you a living; self-education will make you a fortune.” (Jim Rohn, American entrepreneur, author and motivational speaker, 1930-2009)

“To be a successful business owner and investor, you have to be emotionally neutral to winning and losing. Winning and losing are just part of the game.” (Robert Kiyosaki, American businessman and author)

"Out of the 241 trades, 16 of them were responsible for ALL of the profit. Most people in this world can't handle it. Yet, it is the only way I have ever seen anyone make money trading. Ever. I was on Wall Street for 23 years. All of the successful fund managers will have long losing streaks, sometimes lasting 6 months to a year. And then... boom! They let their winners run and they wipe out all of their losses. It is how trading works." (Mark Shawzin, thepatterntrader.com)

"The winners pay for thousands of losers." (Jeff Bezos, CEO of Amazon, http://bit.ly/2YM0vBW )

"To turn $100 into $110 is work. To turn $100 million into $110 million is inevitable." (Edgar Bronfman Sr, Canadian-American businessman and philanthropist, 1929-2013)

"The best revenge is massive success." (Frank Sinatra, American singer, 1915-1998)

____________________________________________________________________________________

►E=MC²: EMANCIPATION (E) = MOTIVATION (M) x CONCENTRATION (C)² (aka. intentioned F.O.C.U.S.)

◦ Motivation (M): http://bit.ly/2PdsTJU

◦ Remember The Name: http://bit.ly/2YCE02h

◦ Always Hardcore: http://bit.ly/2E9saDb

◦ Go Hard: http://bit.ly/2YDgbqW

◦ Work Hard Play Hard: http://bit.ly/35f0oRx

◦ We Made It: http://bit.ly/348OhnP

"The difference between the impossible and the possible lies in a man's DETERMINATION." (Tommy Lasorda, manager Los Angeles Dodgers 1976-1996)

"It always seems impossible until IT'S DONE." (Nelson Mandela, former South African President, 1918-2013)

“You will find that you are not a victim of fate but a victim of faith (your own).” (Neville Goddard, prophet, influential teacher, author, 1905-1972)

"Come what may, all bad fortune is to be conquered by endurance." (Virgil, Roman Poet, 70-19BC)

"Without your involvement you can't succeed. With your involvement you can't fail." (A.P.J Abdul Kalam, scientist, science administrator, 11th President of India, 1931–2015)

"Tough times don’t last. Tough people do." (Dan Pena, American businessman and business coach)

"What separates those who go under and those who rise above adversity is the strength of their will and their hunger for power." (50 Cent, American rapper, singer, songwriter, record producer, actor, businessman, investor)

“Imagination is the beginning of creation. You imagine what you desire, and then you believe it to be true. Every dream could be realized by those self-disciplined enough to believe it.” (Neville Goddard, prophet, influential teacher, and author, 1905-1972)

“Dream is not the thing you see in sleep but is that thing that doesn't let you sleep.” (A.P.J. Abdul Kalam, scientist, science administrator, 11th President of India, 1931–2015)

"The fulfillment of your dream is directly proportional to your desire to succeed… and how much you’re willing to sacrifice. If you are not prepared to die, then you are not prepared to live." (Dan Pena, American businessman and business coach)

"Get rich or die trying." (50 Cent, American rapper, singer, songwriter, record producer, actor, businessman, investor)

"Never say die!" http://bit.ly/349x5yI (DragonBall Z, Akira Toriyama, Japanese manga artist)

"One shouldn't take life so seriously. No one gets out alive anyway.” (Jim Morrison, American singer-songwriter, poet)

"We should not fret for what is past, nor should we be anxious about the future; men of discernment deal only with the present moment." (Chanakya, Indian teacher, philosopher, economist, jurist, royal advisor, c.371-283 BC)

"Much of man's sorrow is born of the disappointment of his ambitions and the wounding of his pride. Although men owe a duty to themselves to make the best of their lives on earth, having thus sincerely exerted themselves, they should cheerfully accept their lot and exercise ingenuity in making the most of that which has fallen to their hands." (Urantia Book 149:5.3)

"If all you have is money, you are among the poorest people in the world. You only become truly rich the day you possess something that money cannot buy.” (Matshona Dhliwayo, philosopher, entrepreneur, author)

"Top 15 things money can’t buy: Time. Happiness. Inner Peace. Integrity. Love. Character. Manners. Health. Respect. Morals. Trust. Patience. Class. Common sense. Dignity." (Roy T. Bennett, author)

“While wealth will be a capricious shadow to our lives, true riches lie in strength of character; that is infinitely harder to accumulate. It is the only gold that enhances our potential in terms of what we can offer the world.” (Salma Farook, author)

"A wise person should have money in their head, but not in their heart." (Jonathan Swift, Anglo-Irish satirist, essayist, poet, 1667-1745)

“Does not Dionysius seem to have made it sufficiently clear that there can be nothing happy for the person over whom some fear always looms?" (Sword of Damocles, Tusculan Disputations, Marcus Tullius Cicero, 106-43BC)

"Wealth consists not in having great possessions, but in having few wants." (Epictetus, Greek Stoic philosopher, 50-135AD)

"Just ignore whoever isn't willing to share; don't expect money when you give bread to a beggar." (anon)

"If the faith of the Most High has entered your heart, then shall you abide free from fear throughout all the days of your life. Fret not yourself because of the prosperity of the ungodly; fear not those who plot evil; let the soul turn away from sin and put your whole trust in the God of salvation. The weary soul of the wandering mortal finds eternal rest in the arms of the Most High; the wise man hungers for the divine embrace; the earth child longs for the security of the arms of the Universal Father. The noble man seeks for that high estate wherein the soul of the mortal blends with the spirit of the Supreme. God is just: What fruit we receive not from our plantings in this world we shall receive in the next.” ' (Urantia Book 131:1.9)

"...the object of fear is fear itself. "Nothing," says Seneca, "is terrible in things except fear itself." And Epictetus says, "For it is not death or hardship that is a fearful thing, but the fear of death and hardship." Our anxiety puts frightening masks over all men and things. If we strip them of these masks their own countenance appears and the fear they produce disappears. This is true even of death. Since every day a little of our life is taken from us - since we are dying every day - the final hour when we cease to exist does not of itself bring death; it merely completes the death process. The horrors connected with it are a matter of imagination. They vanish when the mask is taken from the image of death." (Paul Tillich, author, The Courage To Be, p.19)

'One day when Ganid asked Jesus why he had not devoted himself to the work of a public teacher, he said: “My son, everything must await the coming of its time. You are born into the world, but no amount of anxiety and no manifestation of impatience will help you to grow up. You must, in all such matters, wait upon time. Time alone will ripen the green fruit upon the tree. Season follows season and sundown follows sunrise only with the passing of time. I am now on the way to Rome with you and your father, and that is sufficient for today. My tomorrow is wholly in the hands of my Father in heaven.” And then he told Ganid the story of Moses and the forty years of watchful waiting and continued preparation.' (Urantia Book 130:5.3)

"To ask is the first important step. To continue to ask never allows the process to move beyond the asking stage. First ask, assume the answer is on its way and then continue to express appreciation that it is happening in its own perfect wisdom and timing. That 'wisdom and timing' is greatly influenced by the one asking and how well that awareness is able to follow through with the two remaining steps after the initial asking. This is often called prayer. Nothing can happen until there is first asking. Then the next two steps, assuming it is happening (continued FOCUS of intent) and expression of appreciation (allowance) controls the manifestation. It is that simple! A few additional details are helpful. Ask within a framework that allows what might be called 'Divine Intelligence' or thought thinking to fill in the details. Doubt destroys results; trust insures them." (anonymous, Vol III: Becoming, http://bit.ly/2EaUncY )

"Try and leave this world a little better than you found it, and when your turn comes to die, you can die happy in feeling that at any rate, you have not wasted your time but have done your best." (Robert Baden-Powell, British Army officer, writer, author)

"The satisfying joy of high duty is the eclipsing emotion of spiritual beings. Sorrow cannot exist in the face of the consciousness of divine duty faithfully performed. And when man’s ascending soul stands before the Supreme Judge, the decision of eternal import will not be determined by material successes or quantitative achievements; the verdict reverberating through the high courts declares: 'Well done, good and faithful servant; you have been faithful over a few essentials; you shall be made ruler over universe realities.'" (Urantia Book 25:1.6)

13 “When, through and by the ministry of all the helper hosts of the universal scheme of survival, you are finally deposited on the receiving world of Havona, you arrive with only one sort of perfection — perfection of purpose. Your purpose has been thoroughly proved; your faith has been tested. You are known to be disappointment proof. Not even the failure to discern the Universal Father can shake the faith or seriously disturb the trust of an ascendant mortal who has passed through the experience that all must traverse in order to attain the perfect spheres of Havona. By the time you reach Havona, your sincerity has become sublime. Perfection of purpose and divinity of desire, with steadfastness of faith, have secured your entrance to the settled abodes of eternity; your deliverance from the uncertainties of time is full and complete; and now must you come face to face with the problems of Havona and the immensities of Paradise, to meet which you have so long been in training in the experiential epochs of time on the world schools of space.

14 Faith has won for the ascendant pilgrim a perfection of purpose which admits the children of time to the portals of eternity. Now must the pilgrim helpers begin the work of developing that perfection of understanding and that technique of comprehension which are so indispensable to Paradise perfection of personality.

15 Ability to comprehend is the mortal passport to Paradise. Willingness to believe is the key to Havona. The acceptance of sonship, co-operation with the indwelling Adjuster, is the price of evolutionary survival.”

(Urantia Book 26:4.13-15)

“But long before reaching Havona, these ascendant children of time have learned to feast upon uncertainty, to fatten upon disappointment, to enthuse over apparent defeat, to invigorate in the presence of difficulties, to exhibit indomitable courage in the face of immensity, and to exercise unconquerable faith when confronted with the challenge of the inexplicable. Long since, the battle cry of these pilgrims became: “In liaison with God, nothing—absolutely nothing—is impossible.” (Urantia Book 26:5.3)

2 The eternal purpose of the eternal God is a high spiritual ideal. The events of time and the struggles of material existence are but the transient scaffolding which bridges over to the other side, to the promised land of spiritual reality and supernal existence. Of course, you mortals find it difficult to grasp the idea of an eternal purpose; you are virtually unable to comprehend the thought of eternity, something never beginning and never ending. Everything familiar to you has an end.

3 As regards an individual life, the duration of a realm, or the chronology of any connected series of events, it would seem that we are dealing with an isolated stretch of time; everything seems to have a beginning and an end. And it would appear that a series of such experiences, lives, ages, or epochs, when successively arranged, constitutes a straightaway drive, an isolated event of time flashing momentarily across the infinite face of eternity. But when we look at all this from behind the scenes, a more comprehensive view and a more complete understanding suggest that such an explanation is inadequate, disconnected, and wholly unsuited properly to account for, and otherwise to correlate, the transactions of time with the underlying purposes and basic reactions of eternity.

4 To me it seems more fitting, for purposes of explanation to the mortal mind, to conceive of eternity as a cycle and the eternal purpose as an endless circle, a cycle of eternity in some way synchronized with the transient material cycles of time. As regards the sectors of time connected with, and forming a part of, the cycle of eternity, we are forced to recognize that such temporary epochs are born, live, and die just as the temporary beings of time are born, live, and die. Most human beings die because, having failed to achieve the spirit level of Adjuster fusion, the metamorphosis of death constitutes the only possible procedure whereby they may escape the fetters of time and the bonds of material creation, thereby being enabled to strike spiritual step with the progressive procession of eternity. Having survived the trial life of time and material existence, it becomes possible for you to continue on in touch with, even as a part of, eternity, swinging on forever with the worlds of space around the circle of the eternal ages. (Urantia Book 32:5.2-4)

"When persons search for God, they are searching for everything. When they find God, they have found everything." (Urantia Book 117:6.9)

"In the madness of materialism the West delivers its great thinkers to the graveyard of thoughts, and tramples those in the dirt, who wish to abjure this madness with strong and holy words." (Prince V. F. Odoyevsky, Russian philosopher)

"The height of sophistication is simplicity. (Clare Boothe Luce, American author, politician, U.S. Ambassador, 1903-1987)

“He who succeeds in raising himself above his emotions in suppressing in himself anger and the fear of illness, is capable of overcoming the attrition of the years and attaining an age at least double that at which men now die of old age.“ (Adamus St. Germain, 1710–1784)

"This above all: to thine own self be true, And it must follow, as the night the day, Thou canst not then be false to any man." (William Shakespeare, English poet, 1564-1616)

The opposite of FEAR (False Evidence Appearing Real) is FAITH (the First Attribute In Thinking Healthy): https://bit.ly/2UWSnNk

◦ http://bit.ly/2QzdKms

◦ http://bit.ly/358ugiB

◦ www.urantia.org

◦ http://bit.ly/2EaT5yp

◦ http://bit.ly/2PevSSc

◦ www.nohoax.com

◦ http://bit.ly/349tIHN

◦ http://bit.ly/2EaURQk

◦ http://bit.ly/2E5geCy

◦ http://bit.ly/35fbIx9

◦ http://bit.ly/2EcAq5e

◦ www.wespenre.com

◦ http://bit.ly/2EaV6Lb

◦ http://bit.ly/347ylCk

◦ http://bit.ly/2WARhte

◦ http://bit.ly/2UaSWny

◦ http://bit.ly/2y6jJsJ

◦ http://bit.ly/2xak9y9

____________________________________________________________________________________________

►HOW TO INVEST LIKE... MICHAEL STEINHARDT (American investor, hedge fund manager, and philanthropist)

By Filipe R. Costa

▸ A FEW TRADING RULES

In a speech back in 2004, Steinhardt mentioned a few trading rules that he believes to be critical to achieving a successful investment performance. They can be summarised as follows:

1/Make all your mistakes early in life.

Steinhardt is very pragmatic and believes that the most important part of learning comes from one's own mistakes. Investors learn from their bad experiences and become aware of what works and what does not.

2/Always make your living doing something you enjoy.

This allows the commitment to the whole investment process to be strong, which is a requirement in a competitive world. Basically, investment is about brain and heart.

3/Be intellectually competitive.

Investment is a continuous process requiring supervision and action even before some particular asset is selected and added to a portfolio. Constant research is always required to gain an advantage over the market in order to "sense a major change coming in a situation, before anyone else". Sensing the market before all others do has always been a top priority for Steinhardt; it is this that led him to go over his firm's portfolio six times a day, and rendered him the sobriquet Captain Ahab.

4/Make good decisions even with incomplete information.

It is a good idea to gather as much information as possible before entering any single trade, but the available information will never be complete or perfect. Investors need to be trained to work on the facts, figure out what does matter, and take the right trading decisions before all others gain awareness of the situation. They then need to have the courage to put sufficient money behind the trade to achieve a meaningful outcome.

5/Always trust your intuition.

Over the years, investors develop and refine an ability to take the best decisions on their intuition. But this intuition doesn't come from a gut feeling or a hunch. Rather, it is a complex process deriving from the investor's cumulative learning over the years. It's wisdom, like that of a fruit seller guessing weights without a scale. It's an educated intuition.

6/Don't make small investments.

Amazon's stock price climbed from $38 to $820 during the last 10 years, a 2,160% rise. Had you invested $10,000 you would have a respectable $216,000 position by now. But had you invested just $100 you would have missed a potentially life-changing opportunity. After spending so much time and effort researching an asset, investors must make sure that the rewards from the money at risk are meaningful.

▸ A FEW FINAL WORDS

Steinhardt's variant perception is a contrarian approach to the market, but one under which opposing market sentiment is insufficient. Timing is everything. Just because sentiment is very bullish, which is usually the case near market tops, it doesn't mean it can't be even more bullish the next day (the Nifty-Fifty during the 1960s is a good example of this).Trends often last longer than you can stay solvent betting against them. Investors need a strong instinct for the markets, which takes time to develop and effort to improve. Past experience trading the markets is key, as is knowledge acquired through deep research. Steinhardt doesn't believe in pre-set rules. For him, stop-loss orders, buying on weakness selling on strength breakouts and breakdowns, as well as charts and technical analysis, are all superfluous to a successful strategy. "I look at the stock. It has a fantastic chart. The chart has a base like this, and then if it goes up a little bit more, boy it is a real breakout, blah, blah, blah, blah. They all seem the same to me".

Fundamentals and market timing is what matters the most. And, when the right opportunity surges, investors should embrace it without fear, being flexible enough to be net short as easily as they can be net long, and having the boldness to take on large meaningful positions.

http://bit.ly/2YEHtgB

https://bit.ly/2BR21eR

_________________________________________________________

►DAN PENA'S PENAISMS (American businessman and business coach)

◦ Dream big… and dare to fail!

◦ The more you investigate, the less you have to invest.

◦ Never, ever second-guess yourself.

◦ I’ve never seen a “part-time” super successful, high performance person.

◦ Don’t waste time on things you can’t change.

◦ When you deal with the opinionated or egotistical, always give credit where it isn’t due.

◦ You won’t always have all the answers. Only take seriously the advice of others whom you greatly respect.

◦ The consequences of a misguided decision are insignificant in the cosmos of eternity.

◦ Always shoot for the moon. Even if you don’t hit the bulls-eye, you’ll at least get 80%

◦ Everybody else is worried about life after death. My concern is about life before death.

◦ The business world is divided into people with great ideas, and people who take action on those ideas.

◦ If you want things to change, first you have to change.

◦ A man who dwells on his past, robs his future.

◦ There’s a big difference between playing to win and playing not to lose.

◦ The only difference between a champ and a chump is “U”.

◦ A good plan executed today is better than a great plan executed next week.

◦ To achieve “hyper-growth”, avert avoidable mistakes, and let your successes run their course. Do more of what you’re doing right – and less of what you’re doing wrong.

◦ Business opportunities abound – but formidable barriers exist. And the biggest barrier is psychological. It is you.

◦ Conventional wisdom is almost always wrong.

◦ Absence of evidence is not evidence of absence. Just because something has never been done doesn’t mean it can’t be done. The fact you have never seen or heard something is not proof that it doesn’t exist.

◦ Every worthy dream has a “pay-price-to-action”. That means you have to give up something to get something. You can’t have it all.

◦ The best way to predict the future is to create it yourself.

◦ I never met a super successful, high performance person who wasn’t enthusiastic.

◦ Whoever said money can’t buy you happiness doesn’t know where to shop.

◦ Excuses are the crutches of the untalented and unambitious.

◦ You’ve known all along it’s tough to be successful. But you’d rather hear the fairy tales.

◦ Always respect the individual on the other side of the deal. He is not as stupid as you may think. And you’re not as smart as you think.

◦ Logic can be a logical process which leads to a wrong conclusion.

◦ It isn’t a case of taking a big chance. It’s a matter of giving yourself a big chance.

◦ The more self-esteem you give others, the more you have. And the more you have, the easier it is to give away.

◦ Most successful people do it poorly until they do it well. Just keep blundering along. You can’t wait until it’s exactly right. The product of your quest for perfection is… paralysis.

◦ A guarantor is a fool with a pen.

◦ No matter how tempting, never accept short-term solutions to long-term problems.

◦ Too many companies try to patch when they should amputate. ‘Let’s reorganize and save this mess’ is a clarion call to disaster. Cut your losses, kick the cuttings out of your way, and move on.

◦ If you want to travel above and beyond the herd, don’t try to be better. Try to be different. Or better yet, be first!

◦ Find your passion and wrap your career around it.

◦ You’ll be motivated by inspiration… or desperation. It’s your choice.

◦ People with low self-esteem protect themselves by not taking risks. High self-esteem gives you the power of confidence to take chances.

◦ Give yourself permission to make mistakes. It’s called learning.

◦ Being all you can be is possible for anyone, but... super success is not for everyone. Period.

◦ Don’t take high performance advice from your peers, family or friends unless they are high performance people themselves.

◦ The road to success is always under construction.

◦ Progress often masquerades as trouble.

◦ Don’t focus on mistakes, focus on the positive “next time”!

___________________________________________________

THIS IS NOT DEMO

http://bit.ly/34dBmRJ

[̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅] [̲̅$̲̅(̲̅ιοο̲̅)̲̅$̲̅]

Greetings and salutations fellow entrepreneur. Welcome to my profile.

I hope you will find some inspiration and encouragement here to assist you on your trading journey.

For the best trading conditions, I recommend using the world's largest true-ECN forex broker (2015): http://bit.ly/2t8SCL2

If you are unable to due to regulations, I recommend this one: http://bit.ly/2L9mdd2

Earn CashBack on your trading commissions: http://bit.ly/3ryoceI

If you want answers, this will help you: https://bit.ly/3gfkBM0

Thank you for visiting my profile.

May you enjoy many green pips!

Matt Todorovski

Maverick trader, currency speculator, professional gambler

◦ Computer Operator, Technological micro Data (2003-2006)

◦ Shop Assistant, Woolworths Supermarkets (2005 - 2017)

◦ Security Officer, [undisclosed employer] (2006 - today)

◦ Station Officer, [undisclosed employer] (2008 - today)

◦ Entrepreneur and property investor (2003-2012)

◦ Forex Wannabe, aspired self-employment (2008 - 2018)

◦ Forex Millionaire, achieved self-employment (2018 - today)

◦ Forex Trillionaire, achieved financial freedom (fait accompli): https://bit.ly/3e0fNcA

My opinion is gratuitous, your munificence is magnanimous!

http://bit.ly/34dBAs3

◦ High Hopes: http://bit.ly/2PbuVKp

◦ Remember The Name: http://bit.ly/2YCE02h

◦ Trader’s Anthem: http://bit.ly/2YIT2DC

THIS IS NOT DEMO

__________________________________________________

►MODERN DAY ALCHEMY: CREATING MONEY FROM "NOTHING"

"Before you start some work, always ask yourself three questions - Why am I doing it, What the results might be and Will I be successful. Only when you think deeply and find satisfactory answers to these questions, go ahead." (Chanakya, Indian teacher, philosopher, economist, jurist and royal advisor, c.371-283 BC)

➊ AIM

To generate a perpetual income on auto-pilot.

➋ HYPOTHESIS

▸ Hypothesis 1:

Foreign Exchange (forex) is the PRE-EMINENT method to make money:

◦ http://bit.ly/35d2v8p

◦ http://bit.ly/2Pem36Z

The benefits compared to conventional business, property, shares, etc:

◦ greater profit potential (high leverage, volatility) (Time + Leverage = Profit);

◦ lower entry barriers: easier to get started, few overhead costs (no employees, no inventory);

◦ highly liquid: immediate entry & exit of the market;

◦ better risk management: custom position sizing between 0.01 - 100 Lots, using trading strategies (eg. hedging);

◦ business-automation: trading robots (Expert Advisors);

◦ market is open 24 hours x 5 days: more trade opportunities, work when you choose;

◦ simplicity: fewer instruments to analyse and trade;

◦ ease of tax calculations: trading statements provide all evidence;

◦ scalability: ease of multiplying results;

◦ enormous volume: market manipulation more difficult;

◦ geographic independence: trade anywhere, mobile business;

◦ recession-proof: business continuity unaffected by disasters, macroeconomics, etc.;

◦ immediate analysis: obtain an accurate "statement of financial position" at all times.

"The most successful investors don't diversify. Rather, they FOCUS (Follow-One-Course-Until-Successful) and specialize. They get to know the investment category they invest in and how the business works better than anyone else." (Robert Kiyosaki, American businessman and author)

“Wide diversification is only required when investors do not understand what they are doing.” (Warren Buffett, American business magnate, investor, speaker and philanthropist)

“The price of a commodity will never go to zero. When you invest in commodities futures, you are not buying a piece of paper that says you own an intangible of a company that can go bankrupt.” (Jim Rogers, American businessman and financial commentator)

▸ Hypothesis 2:

"All unsustainable moves are corrected." (Scott Barkley, Forex Trainer and analyst, President ProAct Traders)

"This makes sense when you step back and look at the big picture. Nothing goes up in a straight line forever. Not stocks. Not real estate. Not anything. There always have to be periods of corrections… booms followed by busts." (Simon Black, international investor, entrepreneur, founder of Sovereign Man)

➌ EQUIPMENT / PREREQUISITES

☐ reliable external income source;

☐ Australian Business Number (ABN);

☐ Personal Computer (PC) with ADSL internet;

☐ FSA/ASIC-regulated ECN/STP broker (recommended: http://bit.ly/2t8SCL2 );

☐ Virtual Private Server (VPS) or Dedicated Server (DS);

☐ MetaTrader 4 (MT4) trading platform;

☐ minimum $10,000 risk capital;

☐ Expert Advisor (EA) trading robot (recommended EA here: https://bit.ly/3aDT7i1 )

☐ registered tax agent;

☐ determination, fortitude, patience, courage, FOCUS.

➍ METHOD OF PROCEDURE (MOP)

☐ have a reliable income source eg. a JOB (Just Over Broke) or a solid conventional business;

☐ register an ABN for taxation purposes;

☐ open a free $10,000 DEMO account at a regulated broker: http://bit.ly/2t8SCL2

☐ obtain a VPS (broker-sponsored or direct from provider);

☐ install MT4 terminal from broker's website;

☐ install EA on MT4 terminal;

☐ backtest EA in MT4's Strategy Tester;

☐ forward test EA on Demo Account for at least three months;

☐ destroy useless robots: http://bit.ly/2sm1OuV

☐ pending satisfactory forward test, open a Real account with a minimum $10,000 risk capital;

☐ register Real account for rebates on broker commissions at www.rebatekingfx.com

☐ retain all trading statements and expense receipts for taxation;

☐ DON’T GIVE UP: if you fail, return to Step 6;

☐ cumulatively compound profits;

☐ declare all profits and pay your tax honestly;

☐ regularly withdraw profits, maintaining sufficient margin at all times;

☐ upgrade VPS to DS; use FIX API trade execution;

☐ make a positive difference to the world; be generous and help others.

➎ SAFETY/RISKS

▸ Forex trading involves a high degree of risk, including the loss of your entire investment:

◦ Do not invest money you cannot afford to lose;

◦ Do not trade unless you understand the risks;

◦ Past performance is no guarantee of future performance;

◦ Results will vary depending upon broker conditions, VPS provider and EA settings.

▸ Market odds are 1:1 - either up or down. That's better odds than the casino, sports betting and lottery. You then improve your odds by observing:

◦ Long-Term Support / Resistance levels;

◦ Long-Term Overbought / Oversold levels (correlations of same currency with different pairs);

◦ 4H, Daily, Weekly charts;

◦ Fibonacci confirmations;

◦ positive Swaps;

◦ fundamentals and market dynamics.

▸ Forex is the fastest way to wealth and paradoxically to penury. Before considering VPS costs, broker commissions, latency, slippage, low liquidity, etc., the odds are mathematically stacked against you:

◦ a loss of 10% requires a gain of 11.11% to recover;

◦ a loss of 20% requires a gain of 25% to recover;

◦ a loss of 30% requires a gain of 42.86% to recover;

◦ a loss of 40% requires a gain of 66.67% to recover;

◦ a loss of 50% requires a gain of 100% to recover.

▸ Risks in forex include:

◦ high leverage;

◦ broker conditions;

◦ "Black Swan" events: eg. Swiss Franc January 2015, Brexit June 2016, GBPUSD Flash Crash October 2016, Yen Flash Crash January 2019;

◦ News events eg. NFP, FOMC;

◦ strategy, user settings, programming quality of EA or system;

◦ "opportunity cost" when losing time or money.

"Many great entrepreneurs have had a moment when they have lost everything. Monks create this situation intentionally through 'Vairagya' when they give up all money and possessions. Many entrepreneurs end up in the same situation unintentionally." (Roger Hamilton, world renowned futurist and social entrepreneur, http://bit.ly/2E552px )

"A wise man says: 'HIGH RISK HIGH PROFIT, LOW RISK LOW PROFIT, AND NO RISK NO PROFIT.'

Another wise man says: 'THERE IS A DIFFERENCE BETWEEN TAKING RISK AND BEING FOOLISH.' (anon)

➏ RESULTS

Archived Myfxbook profile: http://bit.ly/2EaQVPA

Current Myfxbook profile: http://bit.ly/2YLQp40

THIS IS NOT DEMO

▸ TAX ASSESSED BUSINESS PROFIT (LOSS):

FY2009: $ (30,499) $5,300 refund

FY2010: $ (37,280) plus $3,693 debt (wrong tax treatment)

FY2011: $ (19,288) plus $5,448 debt (wrong tax treatment)

FY2012: $ (2,904) plus $9,681 debt (wrong tax treatment)

FY2013: $ (159,324) $18,973 refund

FY2014: $ (74,721) $16,719 refund

FY2015: $ (71,542) $18,958 refund

FY2016: $ (91,413) $23,272 refund

FY2017: $ (58,031) $11,758 refund

FY2018: $ (137,530) $29,710 refund

FY2019: $ (1,376,387) $23,496 refund (future tax offset: $1,478,678)

FY2020: $ (213,177) $27,672 refund

FY2021: $ ...

▸ MILESTONES:

$32,000: invested $4k and made 800% return in 4.5 days using CFDs (Aug 2008)

$1.69: started primary account 313166 (22 Nov, 2013)

-$327,127: nadir of primary account 313166 (27 Aug, 2018)

$0 profit: zero point of primary account 313166 (27 Sep, 2018)

$1 million net profit: Posted 9 Oct, 2018

$2 million net profit: Achieved 16 Oct, 2018

$4 million net profit: Achieved 19 Oct, 2018

$6 million net profit: Achieved 1 Nov, 2018

$8 million net profit: Achieved 28 Nov, 2018

$10 million net profit: Posted 4 Dec, 2018

$11 million net profit: Posted 5 Dec, 2018

$12 million net profit: Posted 13 Dec, 2018

$13 million net profit: Posted 21 Dec, 2018

$13.5 million loss (approx) (96%): Posted 3 Jan, 2019

◦ http://bit.ly/2sm431j

◦ http://bit.ly/2E6tvdR

$604: nadir of 20 accounts. Posted 06 June 2020.

$100 million net profit: Posted... http://bit.ly/2sm3i8s

$1 billion net profit: Posted...

$10 billion net profit: Posted...

$100 billion net profit: Posted...

$1 trillion net profit: Posted... http://bit.ly/2ShTeHb

▸ Other examples:

◦ "Gann held a trading record which has been unsurpassed by anyone since. In front of a customs inspector he turned $130 into $12,000 in less than 1 month." ( http://bit.ly/2sn9zkj )

◦ http://bit.ly/34ep3V0

◦ http://bit.ly/2E9iRTL

"Don't let yourself get attached to anything you are not willing to walk out on in 30 seconds flat if you feel the heat around the corner.” (Robert De Niro, American actor)

“When I thought I couldn't go on, I forced myself to keep going. My success is based on persistence, not luck.” (Norman Lear, American television writer)

“You may be disappointed if you fail, but you are doomed if you don't try.” (Beverly Sills, American operatic soprano)

"The AMOUNT of money you have does not matter; what matters is the SYSTEM you use. No AMOUNT of money can save you if you have a bad SYSTEM. Conversely, if you have a good SYSTEM you can start with a small AMOUNT and easily become rich." (Matthew Todorovski)

➐ DISCUSSION

▸ Trading vs Gambling

With experience comes understanding. By this method you will tell who has experience and who has none:

◦ traders with little experience will resent comparisons between "trading" and "gambling" as anathema.

◦ traders with much experience will understand "trading is by very definition gambling".

Refer:

◦ Rule 4 and 5 "Michael Steinhart" (below)

◦ http://bit.ly/2sjo1K6

◦ https://bit.ly/39uiF0m

◦ http://bit.ly/2sjoR9I

◦ http://bit.ly/2PbxvA5

◦ http://bit.ly/35azWZy

◦ http://bit.ly/2E7FckD

◦ http://bit.ly/2PbFFse

◦ http://bit.ly/2E57355

◦ http://bit.ly/2seGd7Y

◦ http://bit.ly/35daCSF

◦ http://bit.ly/349kV8L

◦ http://bit.ly/2qMvuBe

◦ http://bit.ly/2seGub0

◦ http://bit.ly/2P9PGWZ

◦ http://bit.ly/35eSwPZ

◦ http://bit.ly/2E9bpbu

◦ http://bit.ly/2U3I7lW

◦ http://bit.ly/38bBnuN

▸ Expert Advisors

There is a plethora of Expert Advisors (EA) to consider. Essential criterion include:

◦ positive user reviews: http://bit.ly/35cYcKv

◦ verified Real monitoring account(s) with over three months' trade history;

◦ prompt and helpful pre-sales / after-sales support;

◦ fair price and license options;

◦ details of trading strategy;

◦ clear user instructions: pairs, timeframes, parameters;

◦ margin requirements.

◦ During Demo forward test performance, confirm:

- suitability of broker trading conditions;

- EA settings for desired performance;

- reasonable frequency of trading;

- stable EA operations.

◦ Red flags to avoid:

- excessive server messages;

- large StopLoss in comparison to TakeProfit;

- Lotsize increases;

- multiple orders.

▸ Curriculum Vitae

◦ 2003-2008: I attended many investment seminars on shares, property, options, etc. Spent upwards of approximately AUD$50,000.

◦ Oct 2008: I became interested in forex during the GFC (Global Financial Crisis) of 2008, when front-page news highlighted the opportunity. For the first time ever, the Aussie Dollar reached parity with the US Dollar (August 2008) and my first foray into forex began with CFDs at CMC Markets. I heavily sold AUDUSD, turning $4K into $32K within 4.5 days from the Monday until Friday afternoon, but my account was over-leveraged to the extent that open profit dropped by $10K to $22K within 30 minutes! At US$0.89 I decided the market still had a long way to go down, so I kept my positions open expecting I would survive. Unfortunately, the market corrected to US$0.92 and I received my first ever margin call. It was a thrilling learning experience and I was convinced!

◦ 2008-2018: Many hopeful moments, but overall results were quite depressive and devastating. The main failures were over-leveraging, risk-taking, overconfidence (in my own skills and EAs) and impatience. Estimated trading losses approximated AUD$700K(?), but be reminded:

- "You pay for education, whether university or real-life experience";

- "No one becomes successful from Day 1";

- “Nothing worth doing is ever easy" (Theodore Roosevelt, American statesman and writer, 26th POTUS, 1858-1919);

- "Make all your mistakes early in life" (Rule 1 “Michael Steinhardt”, below).

- Losses are offset against Assessable Tax Income with an ABN business. A good tax agent is essential - the difference can be seen in Results above.

◦ Sep 2018: I stopped focusing on low timeframes of 1M, 5M, 15M, 1H, and began focusing on high timeframes of 4H, Daily, and Weekly. With AUD$50,000 ($20K of savings + $30K FY2018 tax refund), I happen-chanced upon the CHFSGD being overbought and nearing long-term resistance after seven-straight Long days. Short CHFSGD was Swap-positive, so even more encouragement to hold the positions for the ride down! I Shorted heavily and made over 800% in less than a month (posted 28 Sep 2018).

◦ Oct 2018: I Shorted EURTRY and boosted my equity from $450K to over $9M (29 November 2018). I could have made at least three times as much, if not for my broker's Trading Desk coercing me to reduce my exposure by half, under duress of reduced leverage. Exposure was reduced by 70%, from 670 Lots to only 200 Lots (posted 16 Oct 2018). Refer Rule 4 and 6 “Michael Steinhart” (below). Opened 20 new broker accounts and received broker sponsorship for 12 new VPS. Daily profits exceeded $100k; monthly volumes exceeded 20,000 Lots (broker rebate = USD$58,000 / 0.375 / $7(RTL).

◦ Jan 2019: Yen Flash Crash costs me $13.5 million (approx. 96% loss) (posted 3 Jan, 2019) due to a combination of factors:

- mirroring the same system and settings to all accounts;

- trading many pairs (correlation risk);

- increasing Risk by 40x;

- splitting money across 20 accounts (lowered available margin);

- not using an equity stoploss;

- exceptional market conditions.

◦ Jan 2020: consolidated 12 VPS (20 accounts) onto one broker-sponsored DS. Use of FIX API.

➑ CONCLUSION

To be DETERMINED...

◦ To be determined: (inconclusive, future tense) to ascertain or establish exactly by research or calculation;

◦ (It has been) DETERMINED: (conclusive, past participle) has been proven definitively; learnt with certainty or assurance; facts have been ascertained.

◦ DETERMINATION will overcome any obstacle: http://bit.ly/35boXik

Prepare yourself for success ( http://bit.ly/34ffNjw )

"The biggest challenge after success is shutting up about it." (Criss Jami, American poet, essayist, philosopher, songwriter, creator/designer)

"Success unshared is failure." (John Paul DeJoria, Greek-Italian-American entrepreneur, a self-made billionaire, philanthropist)

"Don't blame Wall Street. Don't blame the big banks. If you don't have a job and you're not rich, blame yourself!" (Herman Cain, American Politician)

___________________________________________________

►HALL OF SHAME

“Our critics make us strong! Our fears make us bold! Our haters make us wise! Our foes make us active! Our obstacles make us passionate! Our losses make us wealthy! Our disappointments make us appointed! Our unseen treasures give us a known peace! Whatever is designed against us will work for us!” (Israelmore Ayivor, writer)

▸ DISSES

Recorded herein for posterity. All made before I turned $50,000 into $13million in Sep-Oct 2018.

“Matthew you are poor man! The worst trader I know! Probably the worst trader in the world! Why do you comment free products that you are not interest in and you do not know nothing about these products, you financial moron! Just for points? It is your new way of making money? Anyone who lost less money than you is better trader than you!!! Even koala bear LMAO!" (Krzysztof Lorenc, hater, 2018)

“You can't stop, you have an addiction, that's a serious problem. You are mentally sick; you need to see a psychologist." (M. Garwarzad, hater, 2018)

“You were greedy. You should have listened to me all those years ago (2008?) and invested in houses. Houses were $300 K, now they are over $1 million. You could have had a few houses by now. The rent helps pay them off. You could have been retired by [age] 40 (currently 35). You should cut your losses now and stop your gambling. Take out whatever money you have left and invest in gold. Fiat currency is going to be worthless. We are going to see a depression worse than 1930. You have wasted all your money. You wouldn't have to keep working three jobs if you had listened to me back then. You [had] better start saving or else if you lose your job you will have nothing. What will happen if you can't work? If you fall sick? You won't be able to afford medical expenses, and you won't be able to afford rent. You will be out on the streets (begging). Start putting some money away in a savings account. You're lucky you're not in jail for losing all that money." (K. Morel, hater, 2018)

“Quit while you're ahead. Take it out. You should take the money out and buy a property. You don't know what's going to happen (with your health, life, investment, etc.)" (many detractors, most everyone else, 2006-2018)

“You don't really have that money; that is Demo trading." (haters that keep losing, 2018)

▸ REBUTTAL

Forget About Dre: http://bit.ly/2qEFkF4

Broke: http://bit.ly/2P9Mhr8

Why You Always Hatin? http://bit.ly/2E7GQmj

No Love: http://bit.ly/2qHAXJs

Balla Blockin: http://bit.ly/2shCiHv

Lay Low: http://bit.ly/2EaRUzb

IDGAF: http://bit.ly/2smamSx

Fake Ass Bitches: http://bit.ly/2PaZJLm

F*ck Em All: http://bit.ly/2PdfKkc

Fear Nothing: http://bit.ly/2sngOJ1

Killing In the Name: http://bit.ly/2sjvB7w

Titanium: http://bit.ly/2PdrH9B

Till I Die: http://bit.ly/2YIVXMr

I'm a Real 1: http://bit.ly/2E6c7pK

Grew Up A Screw Up: http://bit.ly/348MBe1

I Got the Keys: http://bit.ly/34aMRJx

Forever: http://bit.ly/35eWtEi

Back In Black: http://bit.ly/2Pdkar3

Y.U. MAD: http://bit.ly/2E96CXp

Rollout: http://bit.ly/2sjvYyW

Good Morning: http://bit.ly/2qELgxQ

Bugatti: http://bit.ly/2slCyW0

100 Million: http://bit.ly/2sm3i8s

Cash Flow: http://bit.ly/35eWJDg

All I Do Is Win: http://bit.ly/2YEcm4M

I Made It: http://bit.ly/2E7qPwT

Berzerk: http://bit.ly/2qHkapR

Chillin': http://bit.ly/2sgcgEo

Good Feeling: http://bit.ly/35f9Rsb

My Ass: http://bit.ly/2qJ0r9r

Happy: http://bit.ly/2PcdvgZ

You’re Never Gonna Get It: http://bit.ly/2Pd10BK

Hard Bottoms & White Socks: http://bit.ly/2qELDse

Traders Anthem: http://bit.ly/2YIT2DC

Make It Rain: http://bit.ly/2sm3TqJ

High As Me: http://bit.ly/393hOSr

Hood Rich: http://bit.ly/35ozwic

http://bit.ly/2YDdQwh

http://bit.ly/2YF9rc1

"It doesn’t matter what morons say." (Dan Pena, American businessman and business coach)

“The distance between insanity and genius is measured only by success.” (Bruce Feirstein, American screenwriter)

“Some people try to be tall by cutting off the heads of others.” (Paramahansa Yogananda, Indian yogi and guru, 1893-1952)

“What you habitually think largely determines what you will ultimately become.” (Bruce Lee, Hong Kong-American actor, director, martial artist, martial arts instructor, philosopher, 1940-1973)

"It’s our nature: Human beings like success but they hate successful people." (Carrot Top, American comedian)

"The secret to success is to offend the greatest number of people." (George Bernard Shaw, Irish playwright, critic, polemicist, political activist, 1856-1950)

“The more bold you are, the more rejection you’ll experience.” (Todd Brison, blogger)