Artem Slepushkin / Perfil

All trading monitory is available on our web site: bizgroup.info

Amigos

1166

Solicitudes

Enviadas

Artem Slepushkin

Aleksei Kotlovanov

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month. Become our PARTNER. Only three simple steps: - Contact us and ask for a referal link to one of the MAM accounts (http://bizgroup.info). - Give the link to your clients...

Artem Slepushkin

Aleksei Kotlovanov

BILL GROSS: MARKET RISK IS THE HIGHEST SINCE Pre-2008 CRISIS

8 junio 2017, 12:25

At the press conference Bloomberg Invest New York, Gross (the founder of Pimco) said: “Instead of buying low and selling high, you’re buying high and crossing your fingers”...

Artem Slepushkin

Aleksei Kotlovanov

XAU keeps on growing and is very close to the highest peak since the beginning of the year. After last three months it gained 4,2%. Gold is considered to be a safe asset and usually shows growth when the world economy or policy is unstable...

1

Artem Slepushkin

Aleksei Kotlovanov

According to Bloomberg with it’s opinion poll of 15 investment bankers, nevertheless Euro Stoxx 600 (INDEX: EURO STOXX 600 PR Index [STOXX 600]) is showing the best rates since 2009, till the end of 2017 the European stocks will go lower the current level...

2

Artem Slepushkin

Aleksei Kotlovanov

After all of the excitement from the French election, Donald Trump’s “big” tax reform announcement and the prospect of another U.S. government shutdown, there was very little consistency in the performance of the dollar...

1

Artem Slepushkin

Aleksei Kotlovanov

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month. Become our PARTNER. Only three simple steps: - Contact us and ask for a referal link to one of the MAM accounts (http://bizgroup.info). - Give the link to your clients...

3

Artem Slepushkin

Aleksei Kotlovanov

Bizgroup.info представляет вам Партнерскую программу. Наши партнеры получают более 40.000$ с комиссий ежемесячно Стань Партнером прямо сейчас...

3

Artem Slepushkin

Aleksei Kotlovanov

After the first tour of elections in France Macron and Le Pen are the leaders for the final battle on the 7th May. The result of the French presidential elections may determine the fate of the Europian Union...

2

Artem Slepushkin

Aleksei Kotlovanov

Digest from Bizgroup.info: European stocks are going down.

12 abril 2017, 14:11

European stocks are going down, the demand for risk-free assets is growing. Fed chairman Yellen said that the current policy is close to neutral and the rates are going to be slowly increased along with the economic strengthening...

Artem Slepushkin

Aleksei Kotlovanov

UK Prime-minister Theresa May signed the papers about British exit from European Union. It was sent to the head of EU Donald Tusk. GBP/USD reacted with a fall because of Article 50. Support was found at 1.2380. Now it is very hard to predict the future of the pair...

Artem Slepushkin

Aleksei Kotlovanov

The complacency that surrounds Brexit is a far cry from the stark warnings that lled the nancial pages in the wake of Britain’s historic vote in June...

Artem Slepushkin

Bizgroup.info introducing you Partnership programs, processing over $40 thousand worth of commission to our partners each month.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to one of the MAM accounts.

- Give the link to your clients.

- Gain up to 25% from your clients profit every month.

mail to: info@bizgroup.info

skype: bizgroup.info

web: bizgroup.info

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to one of the MAM accounts.

- Give the link to your clients.

- Gain up to 25% from your clients profit every month.

mail to: info@bizgroup.info

skype: bizgroup.info

web: bizgroup.info

Artem Slepushkin

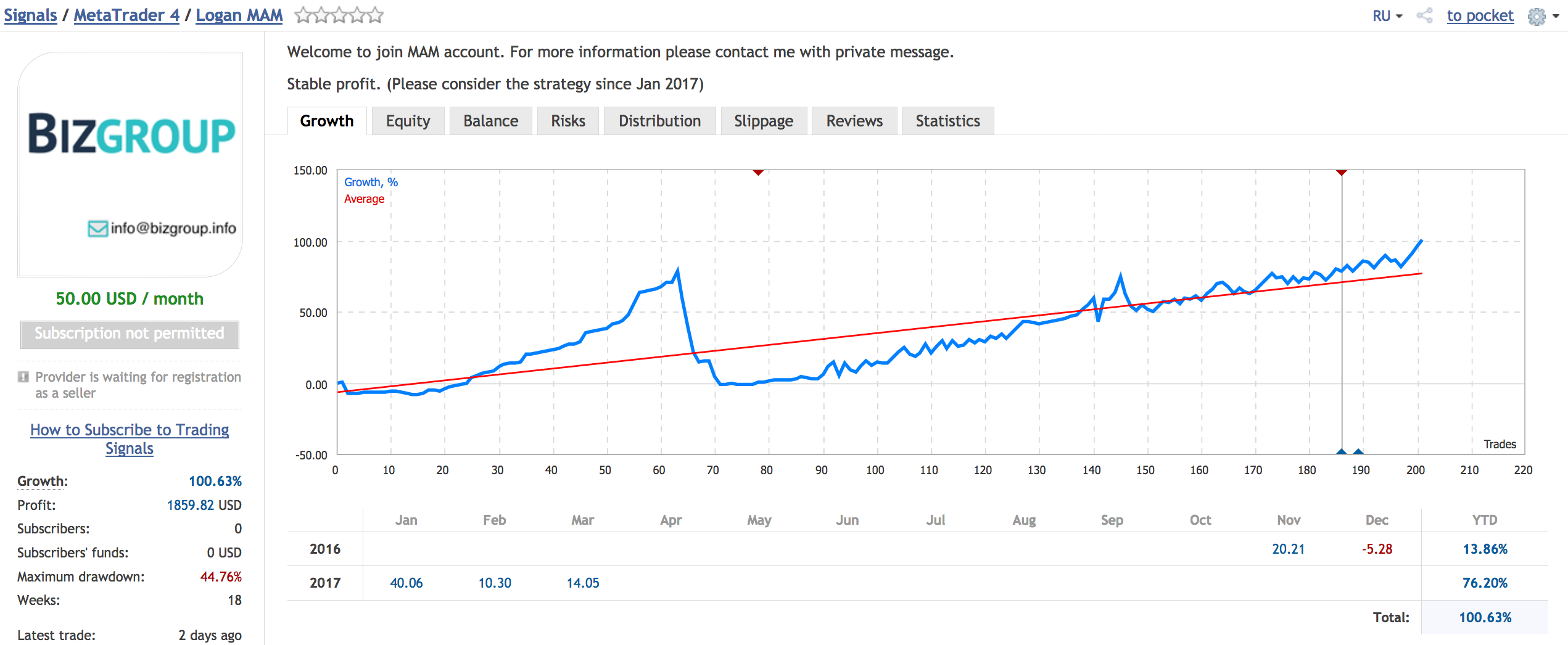

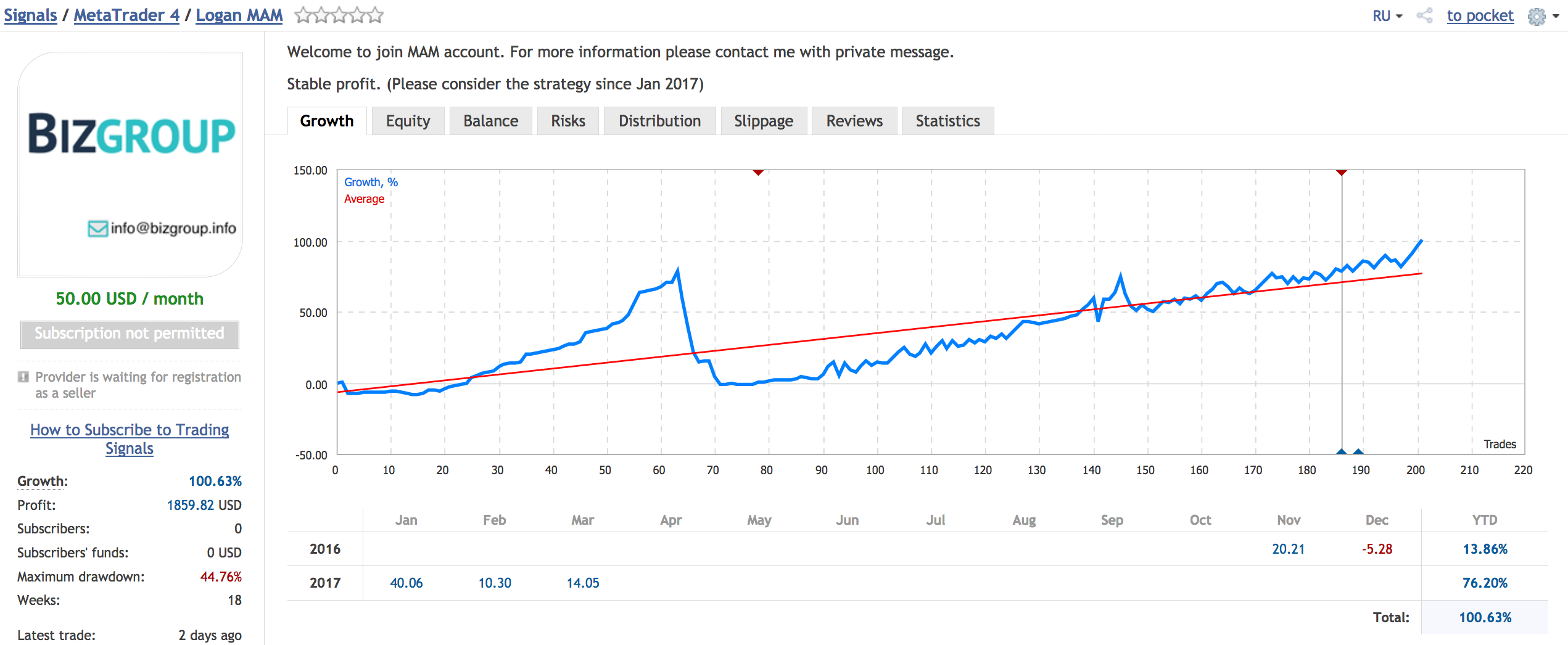

https://www.mql5.com/en/signals/275764

Welcome to MAM account. Join me for big profits. Flexible terms and excelent service.

Welcome to MAM account. Join me for big profits. Flexible terms and excelent service.

Artem Slepushkin

Welcome to join my MAM account. Send me a private message for more information.

https://www.mql5.com/en/signals/234213

https://www.mql5.com/en/signals/234213

Artem Slepushkin

Aleksei Kotlovanov

BIZGROUP.INFO starts a partners program. Gain without investing.

22 marzo 2017, 19:14

Become our PARTNER. Only three simple steps: - Contact us and ask for a referal link to MAM account. - Give the link to your clients. - Gain 10% and more from your clients profit every month. mail to: info@bizgroup.info...

1

Artem Slepushkin

5 Triggers of the next financial crisis

Trump’s promises about tax cut and cancelling Obamacare caused optimism on the market and shares climbed. However due to history investors are prone to ignore the risks on specific markets, which may cause the system crash.

Here are 5 problems which can become a trigger of the next financial crisis.

Real estate bubble

The big cities in USA with the best economic indicators had a fast growth of real estate prices because of low mortgage rate and credits for upper-middle class and money-bags. Now Fed funds rate growth can cause the growth of credit rates and monthly payment higher than approachable for potential house-owners. Also it will influence the rental prices in bi cities.

Students’ credits

The volume of students’ loans is higher than 1,4 trillion USD and more than 40% of the loaners caused or will cause the credit default. In the end there will be 2 options for Federal Government: to pay out hundreds of billions USD or let the banks and bondholders absorb great losses. This is one of the unpopular scenarios, or as we have seen on the Lehman Brothers’ example in 2008, one of the opportunities for the US Government to face the financial instability. Trump’s administration will face a poor choice.

European Banks

European banks are now facing slow economic growth and ultra-low interest rates which cause difficulties with bad loan write off. Around 17% of Italian bank loans have already exceeded time limits. Deutsche Bank (NYSE: Deutsche Bank [DB]) have recently been fined by US Department of Justice (USDOJ). The bank forced the bondholders to exchange bonds for shares in the DB and absorb huge losses. The recurrence of the story may cause panic in Europe. In Italy they already proposed to common bank depositors to buy bonds circuit-wise as Americans invested in certificates of deposit. The forces exchanges for shares in banks may cause big saving losses and economic recession with high consequences for other European and American Banks.

China

Chinese Government sponsored noneffective state ventures. The export companies used available credits and supported the growth of economics. Now the state deficit is 15% GDP, and total national and individual debt is 250% GDP. China was printing money what caused a scary growth of bonds, shares, materials and real estate. Investors are leaving China, what reduces the RMB cost in USD. If these bubbles burst and RMB falls down, Asian countries and other developing economics which depend on export to China will probably become unable to service their USD debts.

Trump’s promises and political discord

Trump’s Economic program may encourage the global growth and ease the regulation on the individual markets. However there are difficulties - he will need to unite the Republicans to force the law on public health and rearrange the corporate tax. His defeat at these lines may easily depress the shares prices and corporate investments, cause one more economic recession and panic among customers. Rough democrats and rightwing are going to force American president keep the ideological simplicity and prevail at the risk of global economical crisis.

Trump’s promises about tax cut and cancelling Obamacare caused optimism on the market and shares climbed. However due to history investors are prone to ignore the risks on specific markets, which may cause the system crash.

Here are 5 problems which can become a trigger of the next financial crisis.

Real estate bubble

The big cities in USA with the best economic indicators had a fast growth of real estate prices because of low mortgage rate and credits for upper-middle class and money-bags. Now Fed funds rate growth can cause the growth of credit rates and monthly payment higher than approachable for potential house-owners. Also it will influence the rental prices in bi cities.

Students’ credits

The volume of students’ loans is higher than 1,4 trillion USD and more than 40% of the loaners caused or will cause the credit default. In the end there will be 2 options for Federal Government: to pay out hundreds of billions USD or let the banks and bondholders absorb great losses. This is one of the unpopular scenarios, or as we have seen on the Lehman Brothers’ example in 2008, one of the opportunities for the US Government to face the financial instability. Trump’s administration will face a poor choice.

European Banks

European banks are now facing slow economic growth and ultra-low interest rates which cause difficulties with bad loan write off. Around 17% of Italian bank loans have already exceeded time limits. Deutsche Bank (NYSE: Deutsche Bank [DB]) have recently been fined by US Department of Justice (USDOJ). The bank forced the bondholders to exchange bonds for shares in the DB and absorb huge losses. The recurrence of the story may cause panic in Europe. In Italy they already proposed to common bank depositors to buy bonds circuit-wise as Americans invested in certificates of deposit. The forces exchanges for shares in banks may cause big saving losses and economic recession with high consequences for other European and American Banks.

China

Chinese Government sponsored noneffective state ventures. The export companies used available credits and supported the growth of economics. Now the state deficit is 15% GDP, and total national and individual debt is 250% GDP. China was printing money what caused a scary growth of bonds, shares, materials and real estate. Investors are leaving China, what reduces the RMB cost in USD. If these bubbles burst and RMB falls down, Asian countries and other developing economics which depend on export to China will probably become unable to service their USD debts.

Trump’s promises and political discord

Trump’s Economic program may encourage the global growth and ease the regulation on the individual markets. However there are difficulties - he will need to unite the Republicans to force the law on public health and rearrange the corporate tax. His defeat at these lines may easily depress the shares prices and corporate investments, cause one more economic recession and panic among customers. Rough democrats and rightwing are going to force American president keep the ideological simplicity and prevail at the risk of global economical crisis.

Artem Slepushkin

Buy Dollar on Dips or Sell on Rallies – What’s the Better Trade? The U.S. dollar traded lower across the board this past week. The best performers were the Australian dollar and British pound but outside of the euro, nearly all of the major currencies appreciated more than 1% against the greenback.

Who would have thought that when the Federal Reserve raised interest rates by 25bp, the U.S. dollar would tank? But that was exactly what happened this past week as the greenback tumbled against all of the major currencies.

Who would have thought that when the Federal Reserve raised interest rates by 25bp, the U.S. dollar would tank? But that was exactly what happened this past week as the greenback tumbled against all of the major currencies.

Artem Slepushkin

Artem Slepushkin

BIZGROUP.INFO starts a partners program. Gain without investing.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

3

Artem Slepushkin

BIZGROUP.INFO starts a partners program. Gain without investing.

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

Become our PARTNER. Only three simple steps:

- Contact us and ask for a referal link to MAM account.

- Give the link to your clients.

- Gain 10% and more from your clients profit every month.

mail to: info@bizgroup.info

Artem Slepushkin

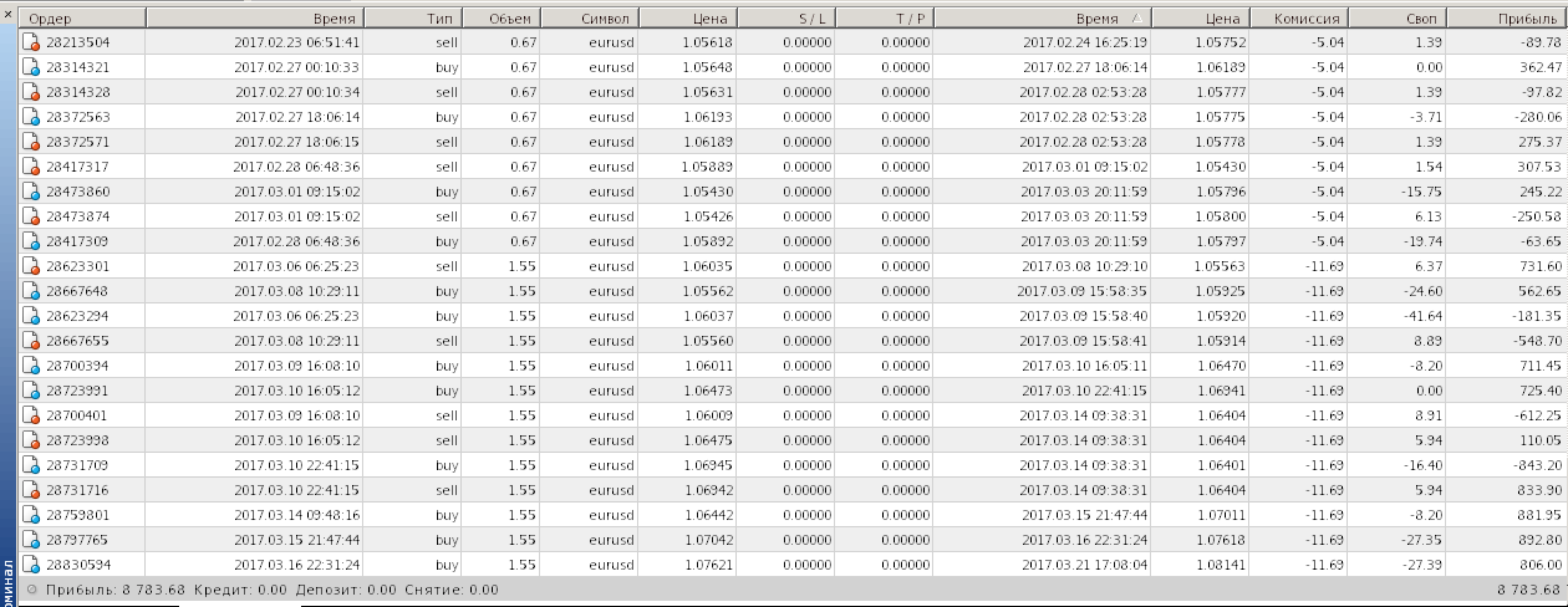

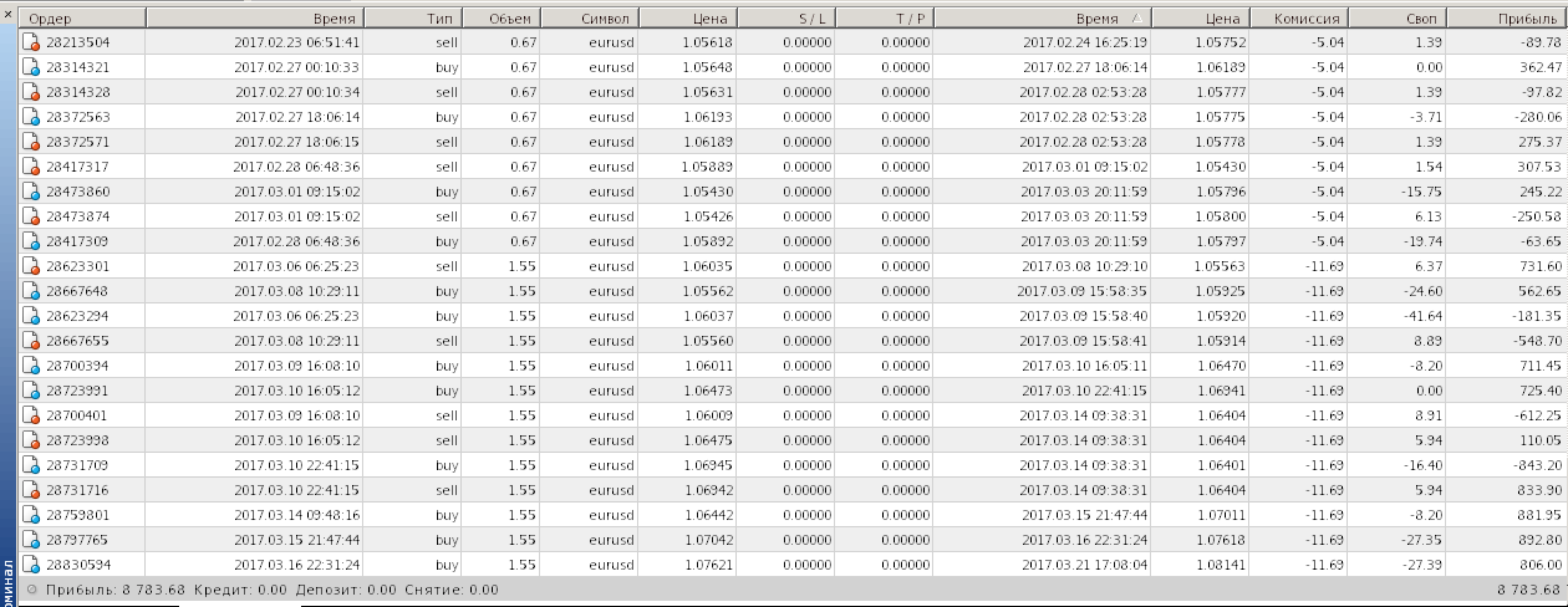

Market analysis

Except Fed this week will also be sessions of eight different banks including Bank of Japan and Bank of England. The results of the sessions will let understand the reactions of other countries on Fed’s session. On Thursday (16.03.2017) Donald Trump will avail the budget estimates to Congress and state the priorities of Presidential Office. This statement will explain the tendency of shares climbed to the all-time peak. After 50 days of Trump’s presidency S&P 500 increased 4,5% and DJIA increased 5,3% what is the best result for a republican president. But if the Trump’s budget estimates will not satisfy the expectations of the market, this may cause a slump in prices. Most of investors are loosing their optimism and now they start understanding the difficulty of processes of tax reduction and implementation of fiscal incentives. After last week all three main American Indexes fell, S&P 500 fell after six weeks of growth.

Except Fed this week will also be sessions of eight different banks including Bank of Japan and Bank of England. The results of the sessions will let understand the reactions of other countries on Fed’s session. On Thursday (16.03.2017) Donald Trump will avail the budget estimates to Congress and state the priorities of Presidential Office. This statement will explain the tendency of shares climbed to the all-time peak. After 50 days of Trump’s presidency S&P 500 increased 4,5% and DJIA increased 5,3% what is the best result for a republican president. But if the Trump’s budget estimates will not satisfy the expectations of the market, this may cause a slump in prices. Most of investors are loosing their optimism and now they start understanding the difficulty of processes of tax reduction and implementation of fiscal incentives. After last week all three main American Indexes fell, S&P 500 fell after six weeks of growth.

: