Roberto Jacobs / Perfil

- Información

|

8+ años

experiencia

|

3

productos

|

75

versiones demo

|

|

28

trabajos

|

0

señales

|

0

suscriptores

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

Fed Statement Leaves Door Open, No Signal of Imminent June Hike - ING Rob Carnell, Chief International Economist at ING explains that it is a relief that the Federal Reserve did not flag a potential June hike and affirmed that the commitment remains data dependent...

Compartir en las redes sociales · 1

128

Roberto Jacobs

USD/JPY Rises to Test Weekly Highs After FOMC A stronger US dollar boosted the USD/JPY pair that rose from 111.25 to 111.75 after the decision of the Federal Reserve to leave rates unchanged. Afterwards it pulled back and it was trading around 111.50/60...

Compartir en las redes sociales · 1

148

Roberto Jacobs

GBP/USD: Offered on Dollar Positives in Statement The Fed left rates on hold with the Fed Funds Rate in the range of 0.25% to 0.50%, and offered less than hawkish statement that, "The stance of monetary policy remains accommodative...

Roberto Jacobs

Fed Leaves Policy Unchanged, Removes Reference to Global Events Posing Risks The Federal Reserve decided to leave the target range for the fed funds unchanged at 0.25%-0.50% as widely expected, and gave no clear signs whether the bank will hike rates at the June 14-15 meeting...

Roberto Jacobs

EUR/USD Drops After Fed Decision EUR/USD dropped from 1.1343 (6-day high) back below 1.1300 after the decision of the Federal Reserve to leave rates unchanged as expected. The central bank removed the reference to global developments and boosted the US dollar across the board...

Roberto Jacobs

Full Statement FOMC Meeting Apr 26-27, 2016 Release Date: April 27, 2016 For release at 2:00 p.m. EDT Information received since the Federal Open Market Committee met in March indicates that labor market conditions have improved further even as growth in economic activity appears to have slowed...

Roberto Jacobs

FxWirePro: Gold Inches Higher As Dollar Weakens ahead of Fed Policy

27 abril 2016, 19:45

FxWirePro: Gold Inches Higher As Dollar Weakens ahead of Fed Policy Gold inched higher on Wednesday as US dollar was modestly weaker on expectation that Federal Reserve would strike a dovish tone ahead of Federal Reserve policy statement...

Roberto Jacobs

AUD/NZD: the Pair is in the Range of 1.1260 and 1.1090 for the Second Month At the beginning of this week the pair AUD/NZD has again rebounded from resistance level of 1.1260 (ЕМА200 on the weekly chart and Fibonacci 38.2% to the last wave of decline since November 2011...

Roberto Jacobs

AUD/NZD: Inflation in Australia has Declined Today, following the release of the inflation data in Australia for Q1, which was below the forecast, the AUD sharply fell on the currency market. It became known that consumer price index (CPI in Q1 fell to -0.2% against the forecast of +0.3...

Roberto Jacobs

NZD/USD: Important Level of 0.6860 In April the pair NZD/USD has traded between the levels of 0.7050 (ЕМА200 on the monthly chart) and 0.6790 (ЕМА200 on the daily chart). A middle line is the level of 0.6860 (Fibonacci 23.6% to the global decline in the pair from the level of 0...

Roberto Jacobs

NZD/USD: Interest Rate Decision by RCNZ will be Known Today

27 abril 2016, 19:28

NZD/USD: Interest Rate Decision by RCNZ will be Known Today Majority of economists believe that RBNZ will leave interest rate unchanged at the level of 2.25%. Today, at 23:00 (GMT+2) will announce its interest rate decision...

Roberto Jacobs

What the Bank of Japan Can Do - BBH According to analysts from Brown Brother Harriman, the Bank of Japan could cut the deposit rate further into negative territory and/or increase the assets it is currently buying or it could offer new types of credits...

Roberto Jacobs

FOMC Preview: What to Expect of EUR/USD? The Federal Open Market Committee (FOMC) will announce its monetary policy decision when it concludes its two-day meeting at 18:00 GMT and it is broadly expected to keep rates unchanged at 0.25-0.50...

Roberto Jacobs

USD/CAD Jumps to 1.2650 as Crude Oil Reverses USD/CAD erased losses in a few minutes boosted by a decline in crude oil prices and rose back above 1.2650. CAD weakens The loonie turned lower across the board after crude oil prices tumbles following inventory data...

Roberto Jacobs

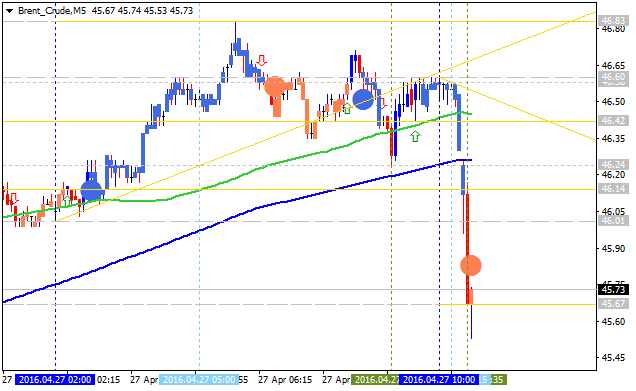

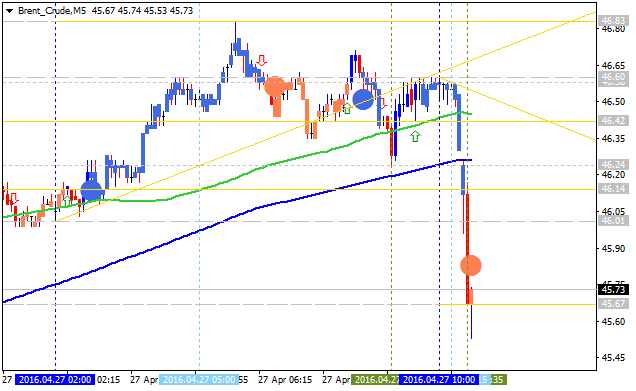

Sergey Golubev

Comentario sobre el tema Forecast for Q2'16 - levels for Brent Crude Oil

U.S. Commercial Crude Oil Inventories: Correction with 44.24 level as a target 2016-04-27 14:30 GMT | [USD - Crude Oil Inventories] past data is 2.1M, forecast data is 1.4M, actual data is 2.0M

Roberto Jacobs

Low Inflation, on Its Own, Not a Trigger for RBA Rate Cut

27 abril 2016, 16:56

Low Inflation, on Its Own, Not a Trigger for RBA Rate Cut Data released earlier today showed Australia’s Q1 headline CPI figures came in at -0.2% q/q versus +0.2% expected and +0.4% previous. The trimmed mean CPI stood at +0.2% versus +0.5% expected and against +0.6% last...

Roberto Jacobs

FxWirePro: GBP/USD Maintains Bullish Bias With Focus on 1.4650 Levels The GBP/USD pair inched higher in the European session after British GDP data printed positive figures. But, the pair turned back after failing to break resistance level 1...

Roberto Jacobs

FxWirePro: Cable's Break-Out of Resistance at 1.4573 Questionable for Sustenance Breaks resistance at 1.4573 levels but could not sustain the rallies. So, can this be another opportunity for shorts in GBPUSD? Breaks resistance at 1...

Roberto Jacobs

USD/CHF Declines but Still Holds Above Yesterday’s Lows USD/CHF is falling for the third day in a row as it retreats after last week rally when it climbed from 0.9570 toward 0.9800. USD/CHF levels ahead of the FED The pair today peaked during the Asian session at 0...

Roberto Jacobs

EUR/USD Remains Capped by 1.1330 EUR/USD remains capped by the 1.1330 area, unable to extend gains beyond that level despite several attempts over the last sessions. EUR/USD has been seesawing around the 1...

: