Roberto Jacobs / Perfil

- Información

- 9+ añosexperiencia3productos76versiones demo28trabajos0señales0suscriptores

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

Technical Analysis of USD/CAD for July 1, 2016 General overview for 01/07/2016: The corrective cycle is evolving towards a more complex and time-consuming pattern. The leg c of this pattern might be completed soon, and the projected target is at the level of 1.2857...

Roberto Jacobs

Technical Analysis of EUR/JPY for July 1, 2016 General overview for 01/07/2016: The ongoing complex corrective cycle in wave iv can be completed anytime...

Compartir en las redes sociales · 2

108

Roberto Jacobs

Technical Analysis of USD/CHF for July 01, 2016 USD/CHF is expected to trade with a bearish bias as key resistance is at 0.9800. The pair failed to break above its horizontal resistance and overlap at 0.9800 after having tested it for at least two times yesterday...

Compartir en las redes sociales · 2

113

Roberto Jacobs

Technical Analysis of NZD/USD for July 01, 2016 NZD/USD is expected to trade with a bullish bias. The pair is turning up and is expected to post further rebound. Meanwhile, a bullish cross has been identified between the 20-period and 50-period moving averages...

Roberto Jacobs

Technical Analysis of GBP/JPY for July 01, 2016 GBP/JPY is expected to trade with a bearish bias. The pair is currently challenging its key resistance at 138, while the relative strength index lacks upward momentum. As long as 138 holds as the key resistance, a drop toward 135 is possible...

Compartir en las redes sociales · 2

103

Roberto Jacobs

DAX30 Faces Strong Resistance at 9860, Break Above Targets 9940/100084 Major resistance – 9860 (21 day MA) The index has broken high 9718 (High made after Brexit) and jumped till 9795. It is currently trading around 9668. DAX30 should close above 9860 for further bullishness...

Roberto Jacobs

Technical Analysis of Gold for July 1, 2016 Gold has broken out of the triangle consolidation and is making higher highs and higher lows. The price is heading at least towards the $1,360 high with expectations of breaking it and reaching $1,400 by the end of next week...

Roberto Jacobs

FxWirePro: CAD/JPY Struggles to Close Above 80, Good to Sell on Rallies Major resistance- 79.95 (55 4H EMA) CAD/JPY has made a high of 79.95 yesterday and started to decline from that level. It is currently trading around 79.19. Short term trend is bearish as long as resistance 80 holds...

Roberto Jacobs

Technical Analysis of EUR/USD for July 01, 2016 When the European market opens, some economic news will be released such as the Unemployment Rate, Italian Monthly Unemployment Rate, Final Manufacturing PMI, German Final Manufacturing PMI, French Final Manufacturing PMI, Italian Manufacturing PMI...

Roberto Jacobs

Technical Analysis of USD/JPY for July 01, 2016 In Asia, Japan will release the Consumer Confidence, BOJ Core CPI y/y, Final Manufacturing PMI, Tankan Non-Manufacturing Index, Tankan Manufacturing Index, Unemployment Rate, National Core CPI y/y, Tokyo Core CPI y/y, and Household Spending y/y...

Roberto Jacobs

Daily Analysis of Major Pairs for July 1, 2016 EUR/USD: This market is bearish – there is a Bearish Confirmation Pattern on the chart...

Compartir en las redes sociales · 2

105

Roberto Jacobs

Daily Analysis of USDX for July 01, 2016 On the H1 chart, the USDX is trying to extend the rally above the 200 SMA, but the support level could be challenged within the next few hours, as the US NFP is coming. A breakout above the 96.60 level will open the doors to test the 97...

Roberto Jacobs

Daily Analysis of GBP/USD for July 01, 2016 GBP/USD had a decline during yesterday's session after BoE's Mark Carney announced that a rate cut is coming this summer. That would put the Cable into a bearish scenario for the next weeks, and it could break the support zone around the 1...

Compartir en las redes sociales · 2

101

Roberto Jacobs

Sergey Golubev

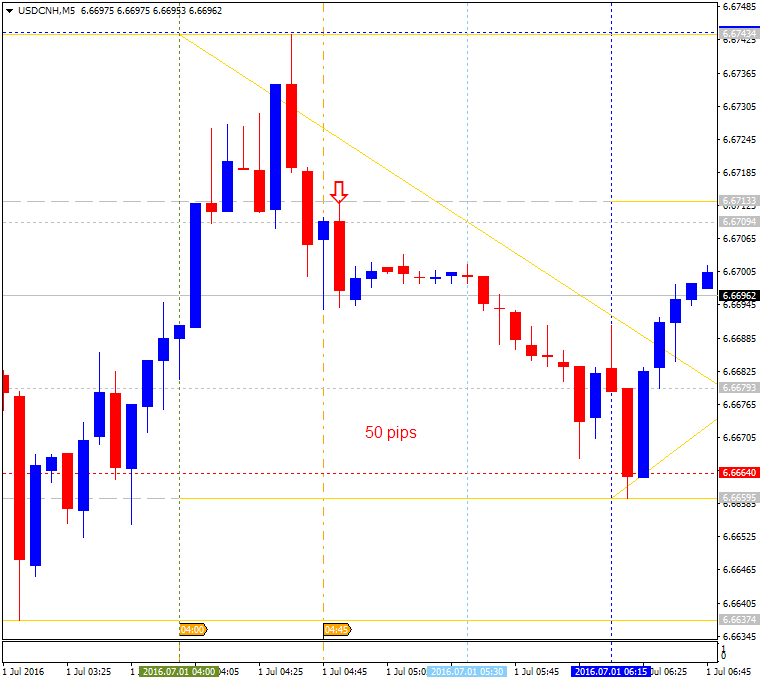

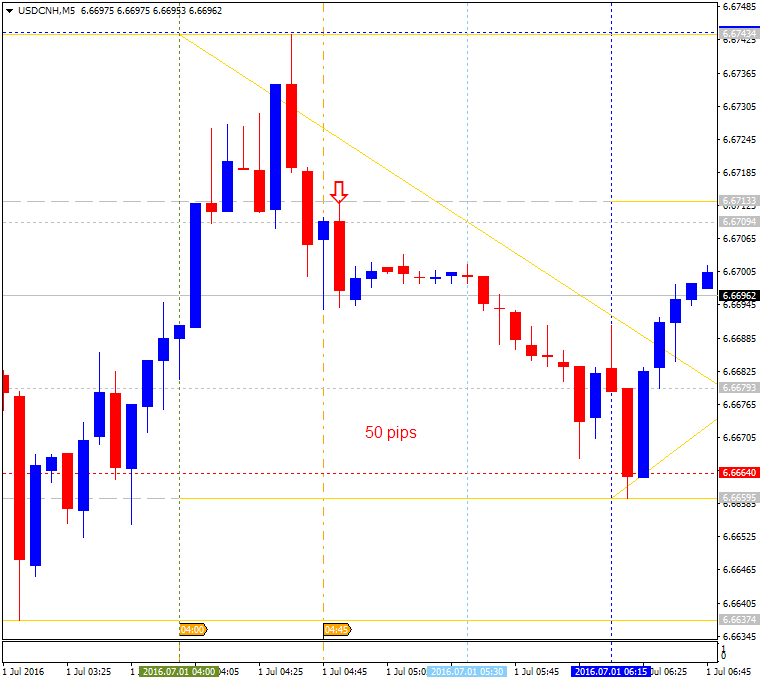

Comentario sobre el tema Press review

USD/CNH Intra-Day Fundamentals: Caixin Manufacturing PMI and 50 pips price movement 2016-07-01 01:45 GMT | [CNY - Caixin Manufacturing PMI] past data is 49.2, forecast data is 49.1, actual data is

Roberto Jacobs

FxWirePro: USD/CNY Hovers Around 6.65 Mark, PBOC Sets Yuan Midpoint at 6.6496 Per Dollar USD/CNY is currently trading around 6.6510 marks. It made intraday high at 6.6519 and low at 6.6453 levels. Intraday bias remains bullish till the time pair holds key support at 6.6330/6.6110 levels...

Compartir en las redes sociales · 2

121

Roberto Jacobs

BoE Monetary Policy Guidance: Summer Rate Cuts Coming - RBS Research Team at RBS, notes that the Bank Of England Governor, Mark Carney, has given a clear indication that the BoE will cut policy rates over the next few months and is primed to sanction additional easing measures: ‘The economic outl...

Compartir en las redes sociales · 2

151

Roberto Jacobs

Asian Stocks headed for Weekly Rise, Higher Oil Underpins The Asian equities trade on a firmer note this Friday, having reversed almost half the post-Brexit slump, and now remain poised to book weekly gain as markets continue to speculate fresh stimulus measures from the global central banks to c...

Roberto Jacobs

Gold Builds on Overnight Gains, Spikes to $ 1330 Gold extended its three-day winning streak and spiked higher over the last hour, heading for its fifth straight weekly gains, as the greenback turned negative across the board amid risk-on market profile. Gold holds above 5-DMA support at $ 1320...