Roberto Jacobs / Perfil

- Información

|

8+ años

experiencia

|

3

productos

|

75

versiones demo

|

|

28

trabajos

|

0

señales

|

0

suscriptores

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

How US Politics will Impact FX – Deutsche Bank Alan Ruskin, Macro strategist at Deutsche Bank, suggests that the channels through which the coming election will influence the USD are complex and sometimes contradictory - which will probably mute the response to some degree...

Roberto Jacobs

FxWirePro: CHF/JPY Faces Strong Resistance at 112.50, Good to Sell on Rallies Major Resistance- 112.50 (21 day MA) The pair has made a high of 112.50 and declined from that level. It is currently trading around 111.54. Short term trend is bearish as long as resistance 112.50 (21 day MA) holds...

Roberto Jacobs

Oil Recovery Now Eyeing $45.00 Level Ahead of EIA Inventory Data After dipping back below $44.00/barrel mark, WTI crude oil future recovered sharply to currently trade at the high point of the day at $44.80...

Roberto Jacobs

BoE Preview: Silence is Golden - ING James Knightley, Senior Economist at ING, suggests that BoE’s dovish tilt in its forthcoming meet may unleash pent-up GBP weakness. Key Quotes “Loss of UK economic momentum has been sizeable...

Roberto Jacobs

GBP/USD Attempting to Extend its Recovery Above 1.4400 Level

11 mayo 2016, 13:46

GBP/USD Attempting to Extend its Recovery Above 1.4400 Level The GBP/USD pair reversed from session high of 1.4467 and dropped to 1.4394 on weak production data, before recovering back to currently trade at 1.4430 level...

Roberto Jacobs

JPY: Recovering From Two-Day Two Percent Decline - BBH Research Team at BBH, notes that the Japanese yen is recovering from two-day two percent decline as the yen is the strongest of the majors today, rising about 0.6...

Roberto Jacobs

USD/JPY: Bears Take a Breather, Selling Stalls Near 108.50

11 mayo 2016, 13:41

USD/JPY: Bears Take a Breather, Selling Stalls Near 108.50 The bears took a breather from the ongoing downward spiral, allowing a minor recovery in USD/JPY from session lows just near the mid-point of 108 handle. USD/JPY re-attempts 109 handle...

Roberto Jacobs

Sergey Golubev

Comentario sobre el tema Press review

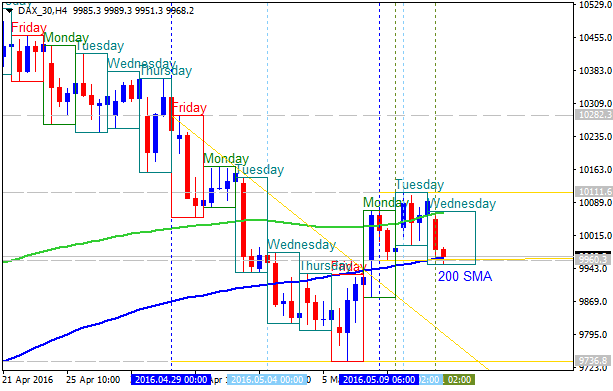

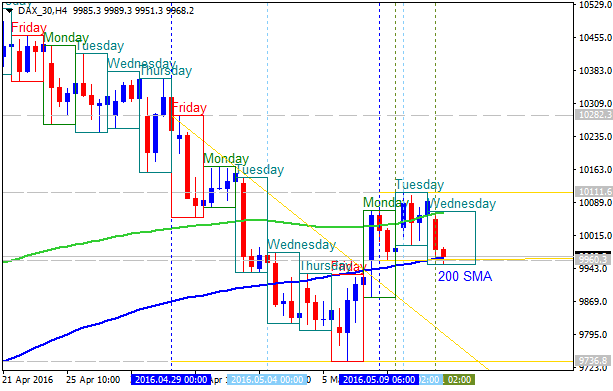

DAX Index Intra-Day Technical Analysis: the trend would no longer be bullish (based on the article ) " On the DAX 30 sliding below last week’s low of 9739, the trend would no longer be bullish

Roberto Jacobs

Global Sentiment Improves, Pound Steadies - Investec Research Team at Investec, suggests that after a sustained period of risk aversion in financial markets it was a sigh of relief to see 'risky assets' perform better yesterday...

Roberto Jacobs

Elliott Wave Analysis of EUR/NZD for May 11, 2016 Wave summary: Support at 1.6610 should ideally be able to protect the downside for the next rally closer to 1.7273 and higher. A break below 1.6610 will be of concern and question the rally from the 1.6063 low. A break below 1...

Roberto Jacobs

Elliott Wave Analysis of EUR/JPY for May 11, 2016 Wave summary: The big question here is whether we only have seen red wave [iii] at 124.45 and red wave [iv] to maximum 123.24 now is unfolding or whether we already have seen the top of wave [i] at 124.45...

Roberto Jacobs

Technical Analysis of EUR/USD for May 11, 2016 When the European market opens, no economic news will be released from the euro zone today. However, the US will release several economic reports such as Federal Budget Balance, 10-y Bond Auction, and Crude Oil Inventories...

Roberto Jacobs

Technical Analysis of USD/JPY for May 11, 2016 In Asia, Japan will release the leading indicators. The US will release some economic data such as Federal Budget Balance, 10-y Bond Auction, and Crude Oil Inventories...

Roberto Jacobs

GBP: Brexit Risk Continues to Cloud Outlook for BoE Policy - MUFG Lee Hardman, Currency Analyst at MUFG, suggests that the main event for the pound this week will be the latest update from the BoE tomorrow on their outlook for monetary policy...

Roberto Jacobs

Nothing Has Changed to Expect Changes in BOE Monetary Policy - Hedge Weaker Sterling Again In UK, the central bank maintained an unchanged interest rate at 0.50% in previous monetary policy, all MPC members unanimously voted for this decision...

Roberto Jacobs

European Bonds Marginally Up on Weak Risk Sentiments The European bonds were trading marginally higher on Wednesday as investors pour into safe-haven assets amid losses in riskier assets including stocks and oil...

Roberto Jacobs

FxWirePro: DAX Faces Resistance at 21 Day MA, Good to Sell on Rallies Major resistance- 10125 (21 day MA) Major support – 9950 (55 day EMA) DAX has made a high of 10110 yesterday and declined till 9970 at the time of writing. It is currently trading around 9985...

Roberto Jacobs

Goldman Sachs: US Dollar Slump is Over In an interview with Bloomberg Radio, Goldman Sachs’s New York-based chief currency strategist, Robin Brooks, noted the US dollar downtrend is over. Key Quotes: We remain dollar bullish and think the trajectory is higher from here...

Compartir en las redes sociales · 3

108

Roberto Jacobs

European Stocks Drop Amid a Calm Session The stocks on the European bourses snapped previous rally and turned back into the red zone, closely tracking the oil price action and risk sentiment prevalent in the markets...

Roberto Jacobs

EUR/USD Remains Capped Below 1.1400, Awaits Fresh Impetus The EUR/USD pair continues to trade around a flat-line amid poor risk environment, awaiting from the Euro zone industrial figure due tomorrow. EUR/USD trades below daily R1 at 1.1401 Currently, EUR/USD trades 0.12% higher at 1...

: