Hypsilophodons

- Asesores Expertos

- Yvan Musatov

- Versión: 1.0

- Activaciones: 5

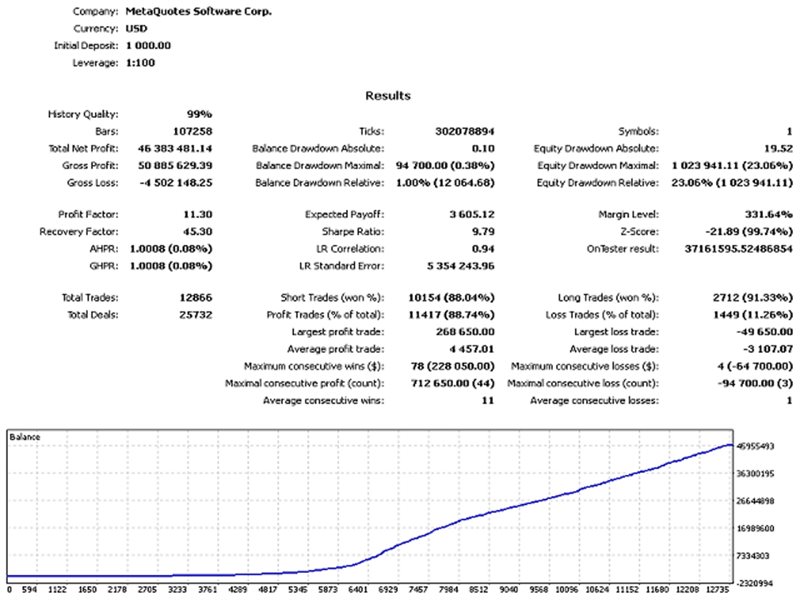

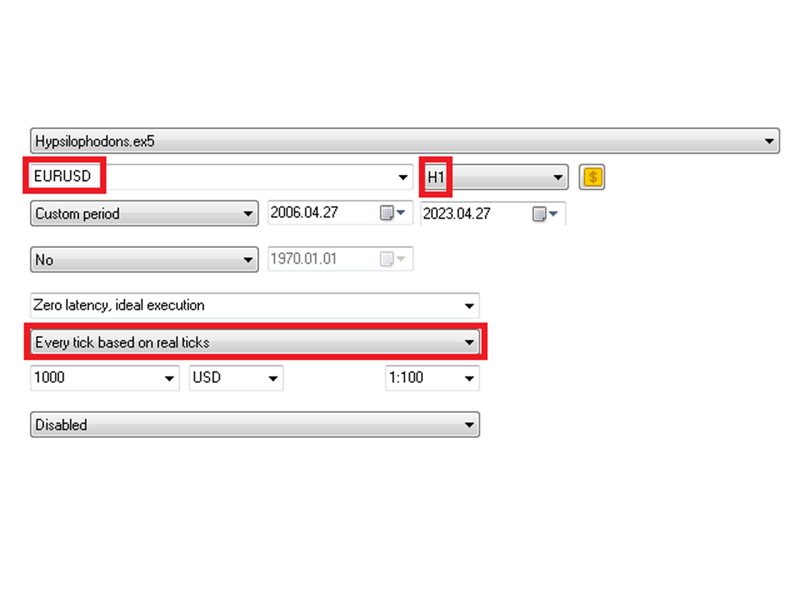

Forex trading robot Hypsilophodons is a computer program based on a set of signals for trading the EURUSD currency. This is an automatic trading software that places orders on the market according to the provided programming code. Hypsilophodons is an automated trading robot available 24/7.

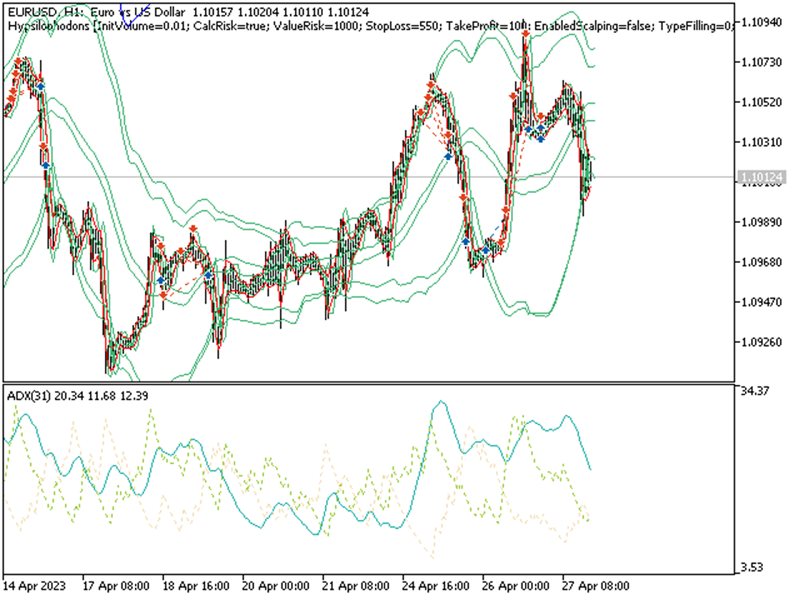

The Hypsilophodons Expert Advisor belongs to the trending Forex robots that trade when the signals match. The basis of the bot's work is trading on short-term trend movements within the framework of the main market trend. Because of the existence of cycles and trends, and the very nature of Forex, trading can be automated. To conclude deals, Hypsilophodons uses signals from reliable technical indicators, with the help of which it determines the main trend movement and enters the market at times of increased volatility and corrective rollbacks. Briefly about the trading method: determining the trend using the Envelopes, ADX, Bands indicators, as well as additional filters. The general algorithm for a simplified understanding, the shortest possible explanation - the product of the value of all indicator lines is taken and the ratio between them is formed using the coefficients and when the resulting product exceeds the threshold level of the generated signal.

A positive aspect of the Expert Advisor is the absence of averaging methods in its mechanism, which allows us to call it stable and safe. In addition, the bot quickly recovers from losses, which can also be called its undoubted advantage. False positives are filtered by stop loss. The Expert Advisor is a stable robot that is designed for long-term operation in various market conditions.

Bot for reasonable and balanced trading, key requirements for work:

- Currency pair: EURUSD.

- Timeframe: H1.

Options:

- Init Volume - Trading volume, which is given as a fixed one.

- Calc Risk - The ability to automatically determine the trading volume.

- Value Risk - setting the dependence of the trading volume on the deposit (regulates the risk).

- Stop Loss (in points) – Stop Loss in points.

- Take Profit (in points) – Take profit in points.

- Enabled Scalping - Allows additional scalping.

- TypeFilling – Type of order execution by balance.

- Magic - Magic number.

- LotDecimal - Determining the trading volume of an order up to a specified number of decimal places.

- MaxSpread - Spread limit, if the spread exceeds the specified value, the bot will not work.

- Level Buy - Threshold level for generating a buy signal.

- Level Sell - Threshold level for generating a signal on the settlement.

- Envelopes Period - Period of averaging the main line of the indicator.

- Envelope Mode - Averaging method. Can be any of the enum values.

- Envelopes Shift - Shift of the indicator relative to the price chart.

- Envelopes Price - Used price. Can be any of the price constants.

- Envelopes Deviation - Deviation from the main line in percent.

- buy kEnvelopes Up – Coefficient of influence on the general signal of the upper line when a buy signal is formed.

- buy kEnvelopes Dn - the coefficient of influence on the general signal of the lower line when a buy signal is formed.

- sell kEnvelopes Up- Coefficient of influence on the general signal of the upper line when a sell signal is formed.

- sell kEnvelopes Dn – coefficient of influence on the general signal of the lower line when a signal is formed on sell.

- ADX Period - Period for calculating the index.

- ADX Price - Used price. Can be any of the price constants.

- buy ADX High – The coefficient of influence on the general signal of the upper line when a buy signal is formed.

- buy ADX Low - The coefficient of influence on the general signal of the lower line when a buy signal is formed.

- sell ADX High – Coefficient of influence on the general signal of the upper line when a sell signal is formed.

- sell ADX Low – Coefficient of influence on the general signal of the lower line when a signal is formed for sell.

- Bands Period - Period of averaging the main line of the indicator.

- Bands Deviation - Deviation from the main line.

- Bands Shift - Shift of the indicator relative to the price chart.

- buy Bands High - The coefficient of influence on the general signal of the upper line when a buy signal is formed.

- buy Bands Low - The coefficient of influence on the general signal of the lower line when a buy signal is formed.

- sell Bands High - The coefficient of influence on the general signal of the upper line when a signal for sell is formed.

- sell Bands Low – Coefficient of impact on the overall bottom line signal when a sell signal is formed.