SlingShot and Pinch Strategy

- Indicadores

- Johannes Schoeman

- Versión: 1.10

- Actualizado: 11 julio 2023

- Activaciones: 10

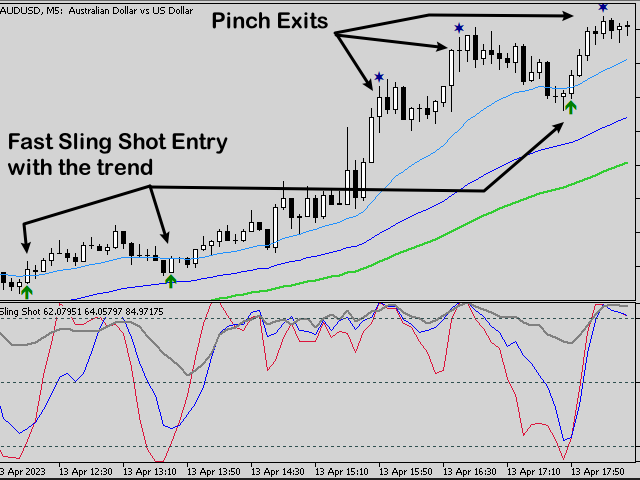

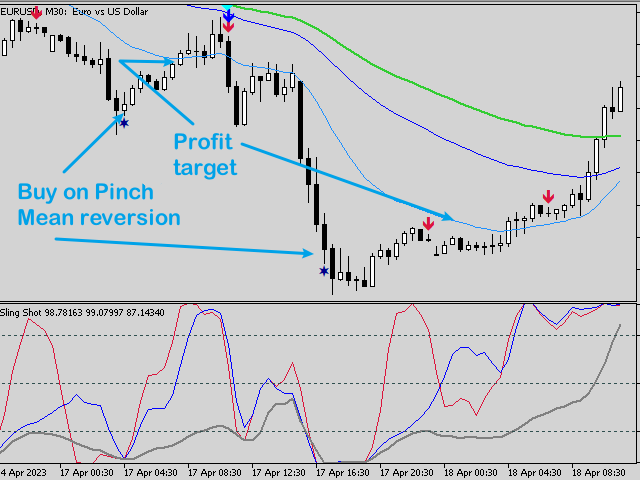

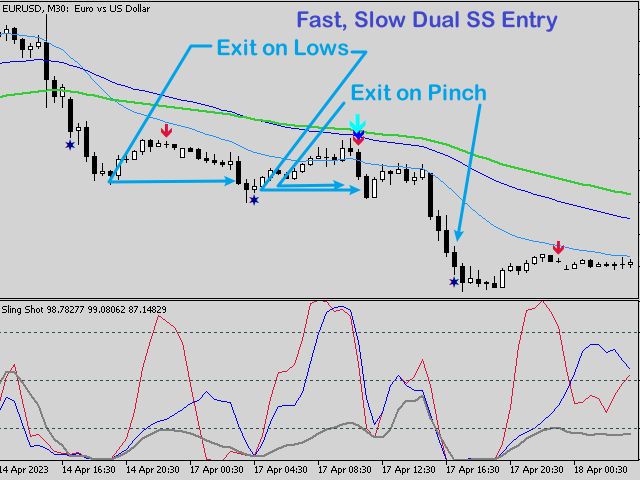

Scalping, Mean reversion or Position trading strategy

Get into an established trend on a pullback in the market.

Use the Pinch in the indicator for profit taking.

Use the Pinch as a mean reversion strategy, scalping back to a moving average line.

Input Parameters

- Fast Sling Shot configuration.

- Slow Sling Shot configuration.

- Dual Sling Shot configuration.

- Price line configuration.

- Trigger zones or levels.

Example of Sling Shot trade idea:

- Price line sets the mood, below the baseline level (50) we look for selling opportunities.

- Fast line, Slow line or both (Dual) indicate a pullback to the opposite extreme level, provided the price line remain below 50.

- Improve your results by trading in the direction of the prevailing trend.

Example of Pinch trade idea:

- All three bands pinch together at the set pinch level.

- Mean reversion type trade idea.

- Trade back to a 20 or 50 EMA for a scalp.

- Use the pinch setting to take profit or partial close on your sling shot entries.

- Use prior lows, highs as profit targets.