Averaging Helper

- Utilidades

- Sergey Batudayev

- Versión: 1.9

- Actualizado: 22 junio 2023

- Activaciones: 5

Averaging Helper - This sort of trading helper instrument will help you average out your previously unprofitable positions using two techniques:

-

standard averaging

-

hedging with the subsequent opening of positions according to the trend

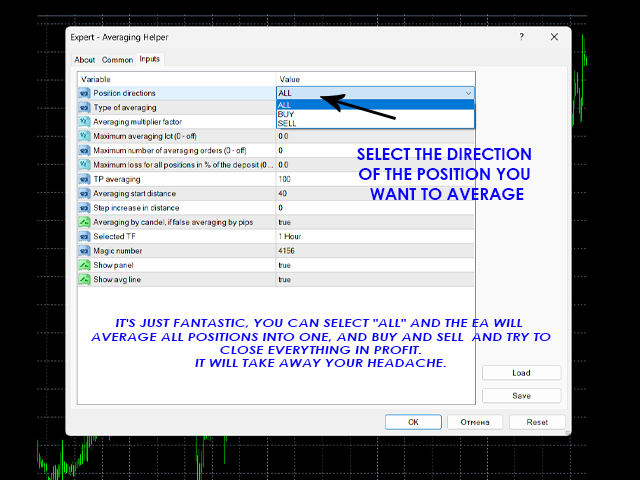

The utility has the ability to sort out several open positions in different directions at once, both for buy and for sell. For example, you opened 1 position for a sell and the second for a buy, and they are both unprofit, or one is in the unprofit and one is in the profit but not enough, and you would like to average these two positions in order to close the trades in plus - this will help you my Averaging Helper utility.

Averaging Helper utility - allows you to automatically calculate the size of the next position, the price of placing an order, the direction for averaging your position and closing it in plus with the take profit size that you specified.

The utility also allows you to open positions using the Buy and Sell buttons. You just need to specify the desired take profit size and starting lot. The utility itself will close the position either at the initially specified take profit or average the position, and will try to close it at the average price, taking into account your take profit set for the averaging series.

In fact, this utility will be a very useful assistant for those who accept and understand the logic of averaging, and are also aware of the risks. In 95% of cases, this technique will help you exit trades in + profit on a full automatic basis.

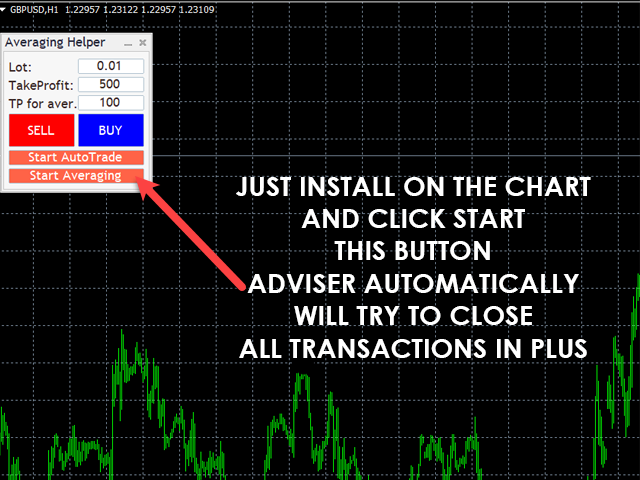

To start working, simply drag the utility onto the chart, set the TP size for averaging and click the Start Averaging button, and the utility will try to close all open trades on the chart by a single take profit.

When using this utility, your initially opened trade should not be a large volume and you should understand the margin of funds, since the adviser will open the next trade with a volume equal to your open trade, build the next TP and then if the price does not go in the right direction, he will add the same volume lot multiplied by the averaging coefficient, and so it may be several times until the deal is closed, so experiment first on a demo account before using. Also, if a position has a SL set, the EA will cancel it and set the Maximum % of loss for all position you specified in the settings, a single stop loss is canceled because it is impossible to perform the averaging logic with it.

In order for the adviser to average your losing trades and try to bring them into profit, just drag it onto the chart and click the Start Averaging button.

Also, the adviser can independently conduct automatic trading, to do this, turn on the Start Auto Trade button and the Start Averaging button, the adviser will automatically conclude transactions.

There are BUY and SELL buttons on the panel, you can make deals directly from the chart using these buttons, setting the starting lot and TF, and if the deal goes in the wrong direction for you, you can average it by clicking the Start Averaging button and the adviser will try to close it in plus . When opening orders from a chart and auto trading, the pass TP is taken from the TakeProfit setting on the panel.

If you do not understand how to use, be sure to send me a private message and I will help.

If you like product and think it helpful, please leave a review, in return, In my gratitude, I will give you a useful bonus.

External variables

Position Direction - selection of the direction of transactions that should be resolved, when ALL is selected, it means that the adviser will try to bring all transactions opened on the chart into plus.

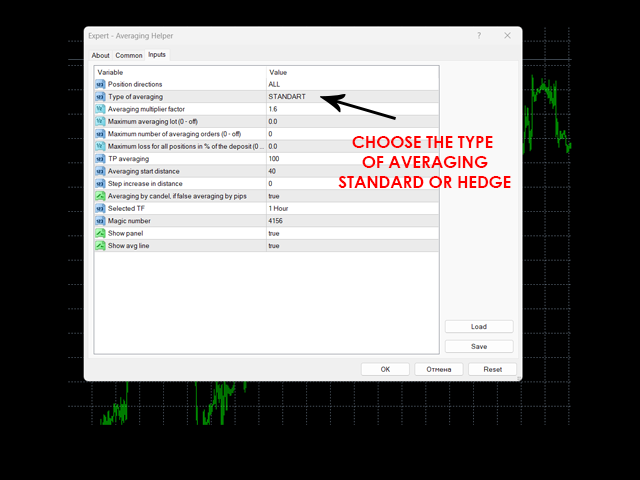

Type of Averaging - standart/ hedge, when hedge is selected, the EA will first hedge the trade in the opposite direction, and then add positions in the opposite direction to the open one. For example, if you had a losing sell position, the EA will add a buy position and then add buy positions until it covers the initial loss of the sell position

Averaging Multiplaer factor - lot increase factor for subsequent orders, the higher it is, the faster you can close deals, but also the greater the risk, the lower it is, the less risk, but the deals will hang longer. Optimal value 1.45 - 1.6

Maximum Averaging Lot - the maximum lot with which it is allowed to open positions for averaging

Maximum of averaging orders - the maximum allowable number of averaging knees ( recommended from 6 to 10)

Maximum % of loss for all position - maximum loss in % for all orders

TP averaging - TP size for averaging

Averaging Start Distance - the minimum distance after which it is allowed to start averaging the position

Step increase in distance - step between averaging orders / for averaging option " Averaging by candel" set 0 in this setting

Averaging by candel, if false averaging by pips - setting to enable averaging by candles of the selected TF, if the size of the distance and step between orders is false, averaging is calculated by pips

Selected TF - time frame of candles on which averaging will take place, the default recommended option is H1

Everyone should try this Utility. It will help you more than you imagine. I advise you to study everything related to Averaging and Hedging and train with small lots. Sergey made this product available to us. Thank you. Respect.