Reversal Pattern MT4

- Indicadores

- Denis Povtorenko

- Versión: 1.78

- Activaciones: 5

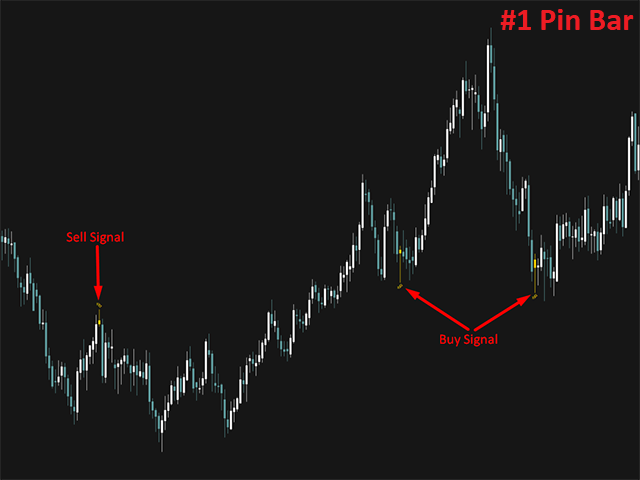

The technical indicator "Reversal patterns" is a mathematical interpretation of the classic reversal patterns: Pin Bar, Harami and Engulfing. That is, the "reversal bar", "Harami" and "Absorption". This indicator allows you to determine the moment of reversal of quotes based on market dynamics and the winner between the "bulls" and "bears".

The indicator displays the moment of reversal at the local highs and lows of the chart of any timeframe, which allows you to increase the accuracy of the signal. Also, the indicator has a wide range of parameters, which makes it possible to adapt Reversal patterns to any conditions and trading system. The built-in alert and sound notification will allow you to open a position immediately after the formation of a reversal signal.

Mode of application:

If quotes reach a local maximum/minimum and a signal is formed on the Reversal patterns indicator, and an overbought/oversold zone is formed on the oscillator, you can open a position under the Low/High value of the signal candle. Stop Loss in this case will become a reverse local high/low.

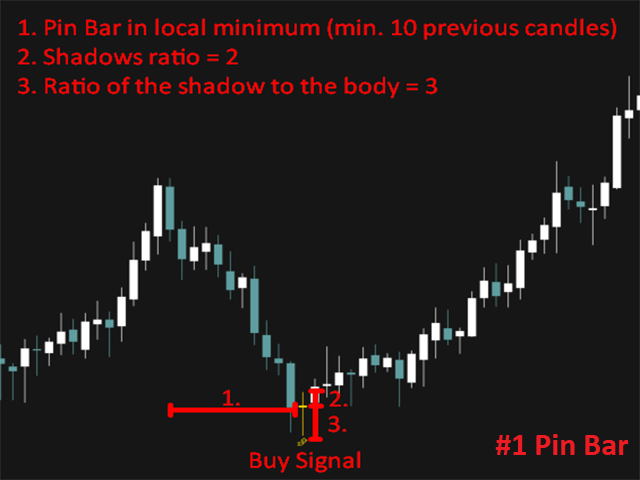

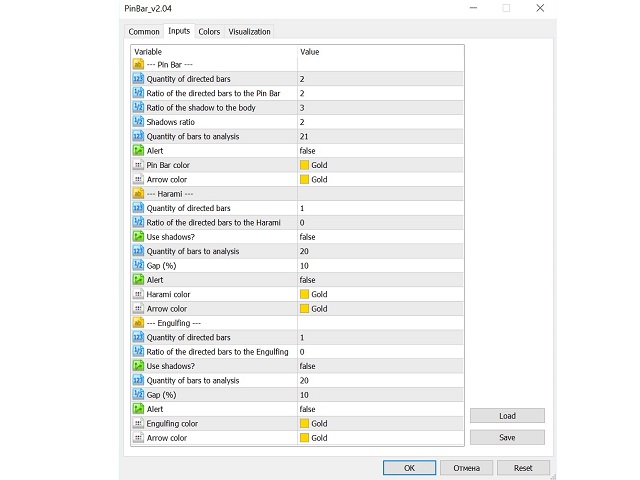

Pin Bar Options:

- Quantity of directed bars: displays the number of directed bars for additional analysis.

- Ratio of directed bars to the Pin Bar: Indicates the ratio of body size between directional bars (trend bars) as well as the pin bar body.

- Ratio of the shadow to the body: The ratio of the body to the shadow.

- Shadows ratio: The ratio of low and high shadows.

- Quantity of bars for analysis: allows you to calculate the number of bars to determine the local maximum or minimum.

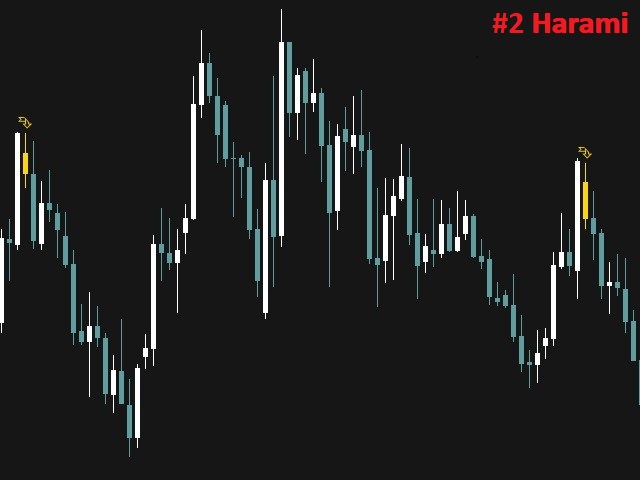

Harami parameters:

- Quantity of directed bars: displays the number of directed bars for additional analysis.

- Ratio of the directed bars to the Harami: Indicates the ratio of the body of the reversal candlestick to the trending one. By default = 0. If 0, then this parameter is ignored. If 1, then the reversal candle should be just smaller than the trend one. If 2, then the reversal candle should be 2 times smaller than the trend one (and so on).

- use shadows? – false/true. Switch. By default = false. What is this? This parameter is for the pattern calculation principle. By default, the trend bar must completely overlap the parameters of the reversal bar exactly with the body. That is, the trend body is larger than the body of the reversal + shadow. With the setting "Use shadows?" = true then the body+shadow of the signal candle should not exceed the body+shadow of the trend one and at the same time have a gap from the closing of the previous one (the parameter below is “Gap (%)”).

- Quantity of bars for analysis: allows you to calculate the number of bars to determine the local maximum or minimum.

- Gap (%): Calculates the percentage at which a reversal candle must open above/below the trend candle. That is, the percentage in points from the previous one.

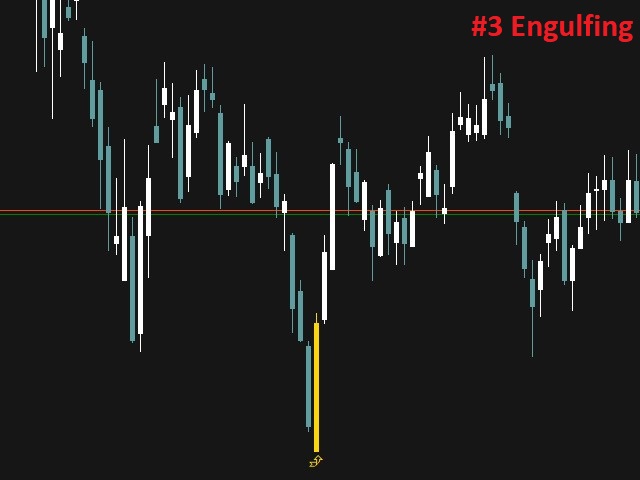

Engulfing options:

- Quantity of directed bars: displays the number of directed bars for additional analysis.

- Ratio of the directed bars to the Engulfing : Indicates the ratio of the body of the reversal candlestick to the trending one.

- use shadows? – false/true. Switch. By default = false. What is this? This parameter is for the pattern calculation principle. By default, the trend bar should be completely “absorbed” by the reversal body. That is, the body + shadows of the trend line are smaller than the body of the reversal line. If the parameter = true, then the bodies of the two figures can be the same, but then the priority will be on the shadow.

- Quantity of bars for analysis: allows you to calculate the number of bars to determine the local maximum or minimum.

- Gap (%): Calculates the percentage at which a reversal candle must open above/below the trend candle. That is, the percentage in points from the previous one.