Price Rectifier Signals

- Indicadores

- Safwan Rushdi Khalil Arekat

- Versión: 1.0

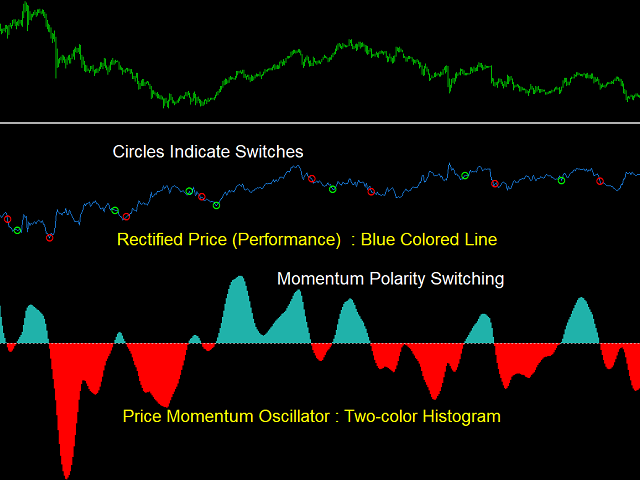

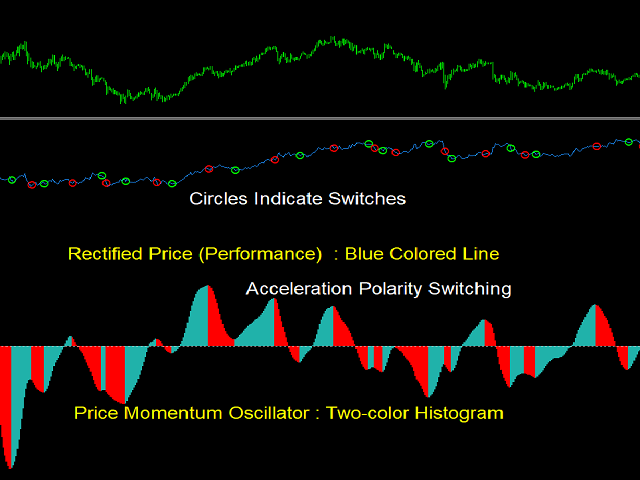

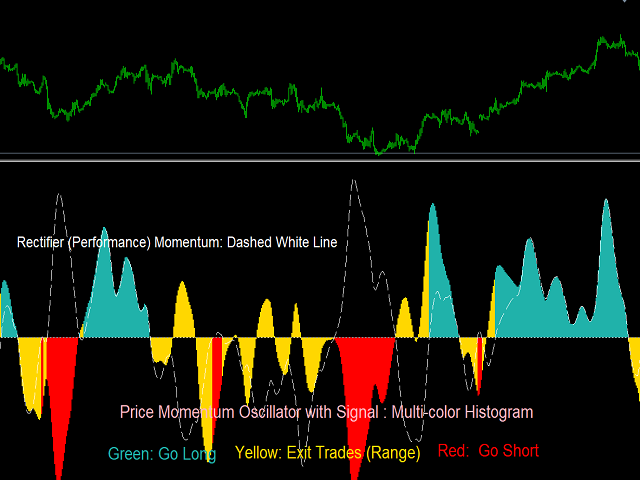

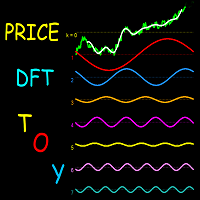

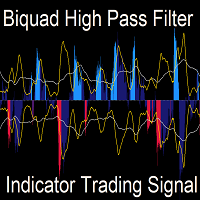

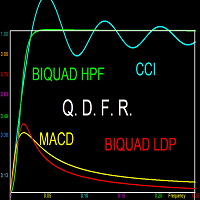

This indicator provides trading signals based on the polarity of the dynamical parameters of two digital signals. The dynamical parameters (momentum-acceleration) are derived by applying a high quality momentum oscillator, MTEMA LPD ( see Top Gun Oscillators) to two digital signals. The MTEMA momentum oscillator is first applied to the price itself. Then, a rectification procedure is applied to the price based on the signals from the momentum oscillator yielding a rectified price signal. This switching procedure is very similar to the process of calculating the performance based on alternating buy and sell signals. Then the MTEMA LPD is applied to the rectified price. The idea is this: We want to filter the price momentum trading signals by using only those we expect to increase the performance - based on its dynamics- while discarding those that reduce the performance.

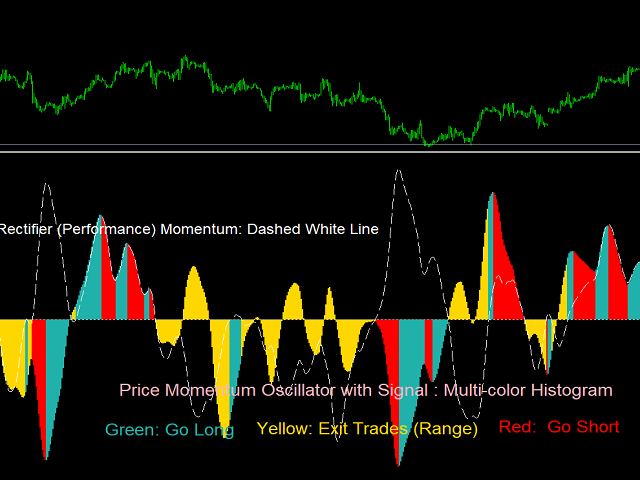

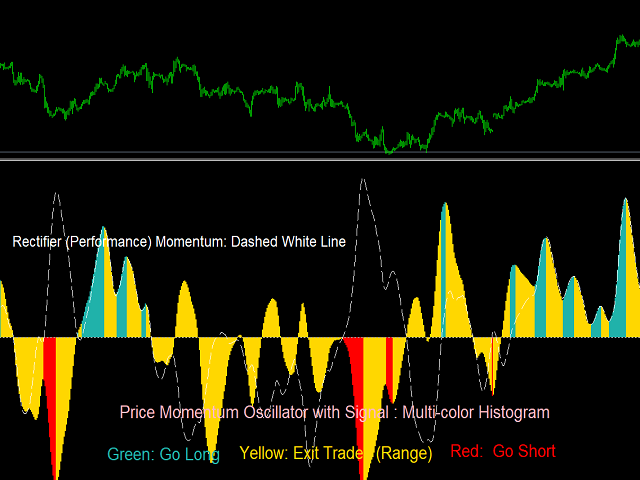

Screenshots 1 and 2 show the rectified price and the price momentum signals used to calculate them in each of the two possible cases based on the input "Rectification_Source".

There are a total of eighteen unique combinations of dynamical paremeters based on polarity that can be use to derive trading signals. With additional options including the input price and changing the periods of the MTEMA LPD's . Strategy testing is critical to select the best performing signals for the pair and time-frame. Some of these are plotted in the screenshots that follow.

The first buffer of the indicator (not plotted) is a trading signal. +10 for going long, and -10 for going short, or zero for exiting trades. This signal is accessed by using the iCustom function call.