Correlation indicator

- Indicadores

- Hendrikus Alberto Lauricella

- Versión: 1.2

- Actualizado: 5 septiembre 2023

- Activaciones: 5

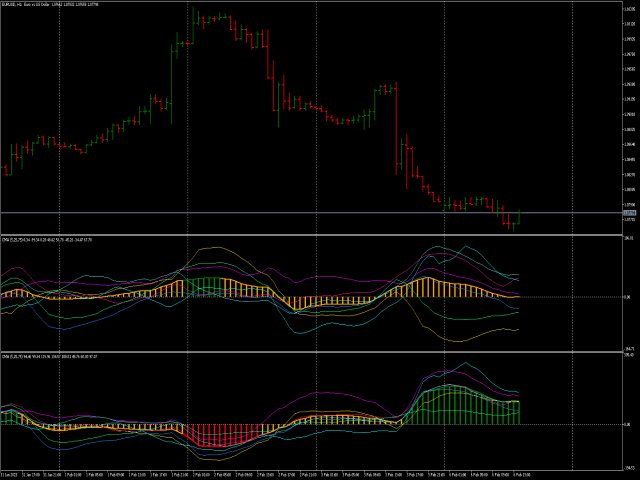

Correlation indicator is a trading indicator that compares price correlations on up to 8 different instruments simultaneously.

This indicator is designed to be very versatile. It can be used to trade many different strategies from scalping to hedging to simple trend-following based on an average trend direction of multiple currency pairs or it can signal only when all the pairs correlate on the same side of a particular moving average. The indicator automatically applies the same moving average settings on all correlation pairs on the same time frame so the correlations are always relative.Features

- Correlation up to 8 symbols.

- Individual weight factor for each symbol.

- Option to show/hide individual symbols.

- Filter for correlation levels.

Settings

1. MARKET

1.1 Frequency (timeframe)

1.2 Symbols (comma separated symbols and weight factors)

1.3 Comment (indicator shortname)

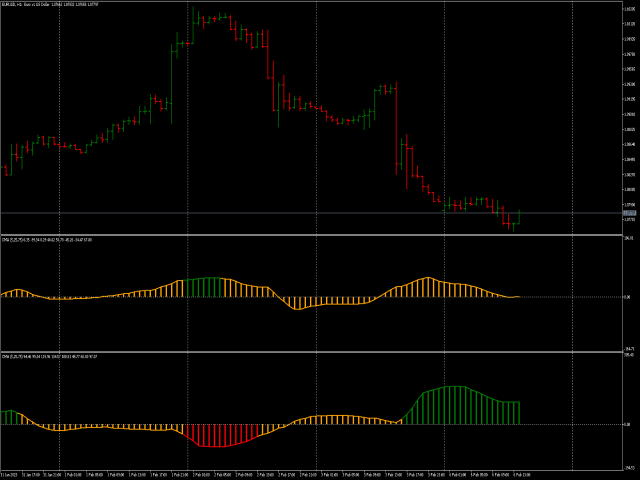

2. MA1 (fast moving average)

2.1 Period (lookback period)

2.2 Method (averaging method)

2.3 Price (applied price)

3. MA2 (medium moving average)

3.1 Period (lookback period)

3.2 Method (averaging method)

3.3 Price (applied price)

4. MA3 (slow moving average)

4.1 Period (lookback period)

4.2 Method (averaging method)

4.3 Price (applied price)

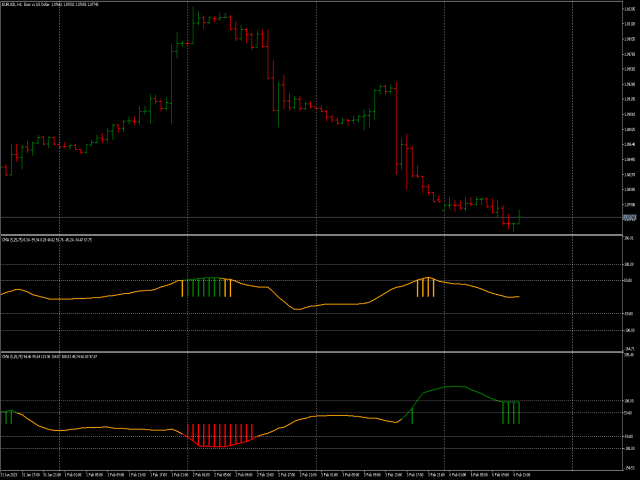

5. CMA (combined moving average)

5.1 Min. down level (minimal down correlation level)

5.2 Max. down level (maximal down correlation level)

5.3 Min. up level (minimal up correlation level)

5.4 Max. up level (maximal up correlation level)