Algorithm Barbossa

- Utilidades

- Alexander Pryakha

- Versión: 1.19

- Actualizado: 3 noviembre 2024

- Activaciones: 13

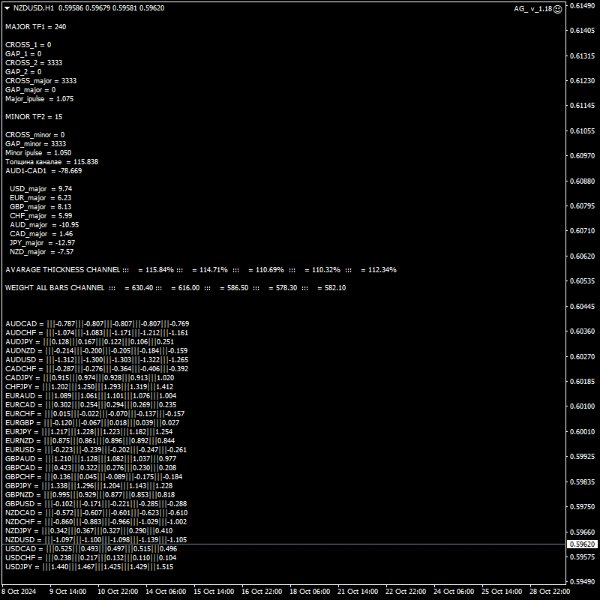

The AG algorithm is an element of a complex trading system for trading a basket of currencies

for 8 major currencies for all 28 currency pairs.

The algorithm is used to process data from the cluster indicator CCFp,

determining the width of the trading range relative to the previous ones,

and to calculate the trend and signal to enter and exit a position.

The algorithm receives data from the indicator CCfp through 8 buffers

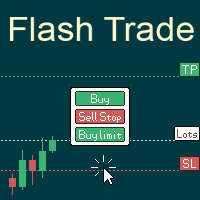

Signals to open and close orders are transmitted for automatic trading to the Barboss Expert Advisor

for all 28 currency pairs through the global variables of the MT4 terminal.

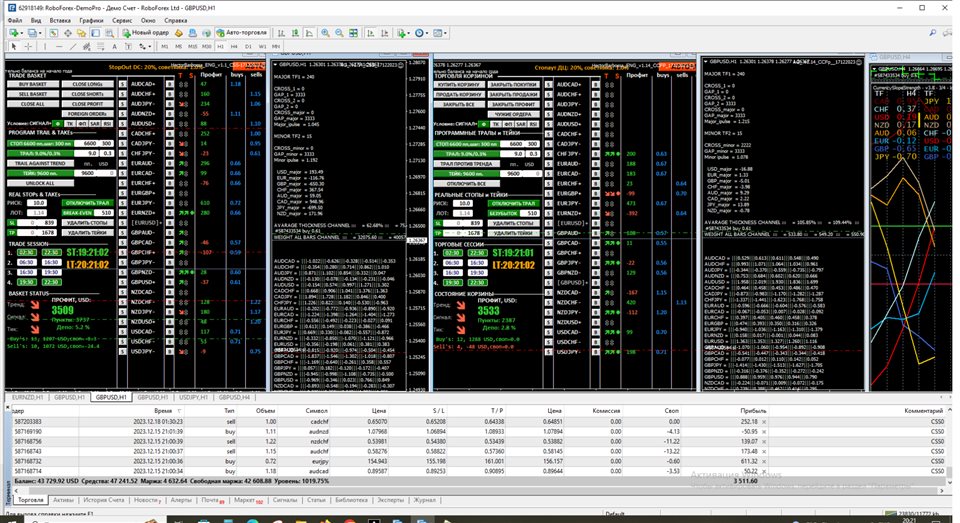

For automatic trading using the algorithm

download free CCFp indicator and Barboss advisor with set.

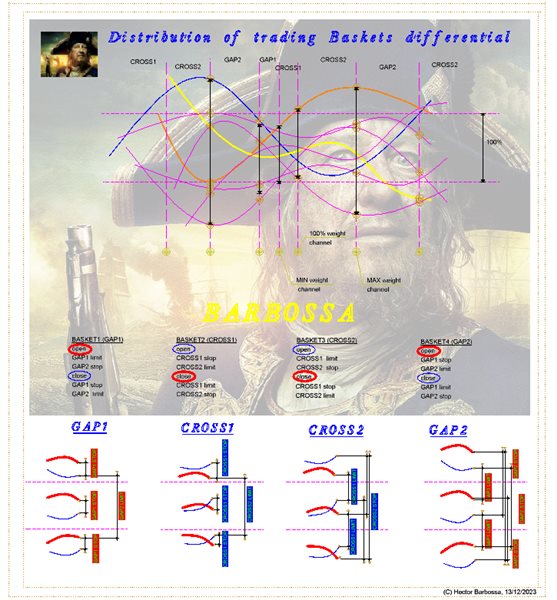

The algorithm determines market entry points, which are called CROSS and GAP.

CROSS is an event in the market (signal to enter/exit from positions),

in anticipation of which, for a certain period, there was a narrowing of the trading channel of the currency market.

COMPRESSION (market compression) - a period of time in the market when the strength of strong currencies decreased,

and the strength of weak currencies increased.

When strong and weak currencies meet at the equator

– the width of the trading channel is maximally compressed and narrowed,

here the width of the channel can no longer narrow and begins to grow

- EXTENSION (stretching) occurs, a reversal occurs in this place, in

this place has an entry point - this is the place where a new trend is born.

In these places of the market, the algorithm gives a signal to buy or sell, lock or exit a position.

GAP is an event in the market (a signal to exit/entry from a position), in the forerunner of which

on a certain period, there was an expansion of the EXTENSION (stretching) of the trading channel.

The width of the trading channel in some period is the maximum - there are very strong and very weak currencies.

Strong currencies are overbought and weak currencies are oversold.

In this place peaked - the financial bubble begins to deflate,

a reversal or correction takes place and COMPRESSION begins in the channel.

This place is not always clearly expressed, it can be extended over a period of up to several bars of the trading range.

At the same time, after corrections, there may be a continuation of the channel stretching,

as it happens according to wave theory, but on a common basket of all major currencies, such a phenomenon is rare,

it all depends on the conditions specified in the AG algorithm.

Usually, when correcting an extended trading channel,

its additional extension can be provided that such currencies are found,

who have not quite completed the turn, are in the process of turning, or are turning later.

In such additional time, a basket is selected for currency pairs that have decided on a trend.