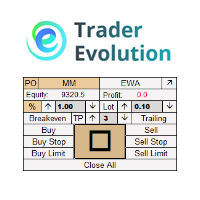

Market Order Buttons with partial close

- Utilidades

- Irmantas Uikis

- Versión: 1.0

- Activaciones: 10

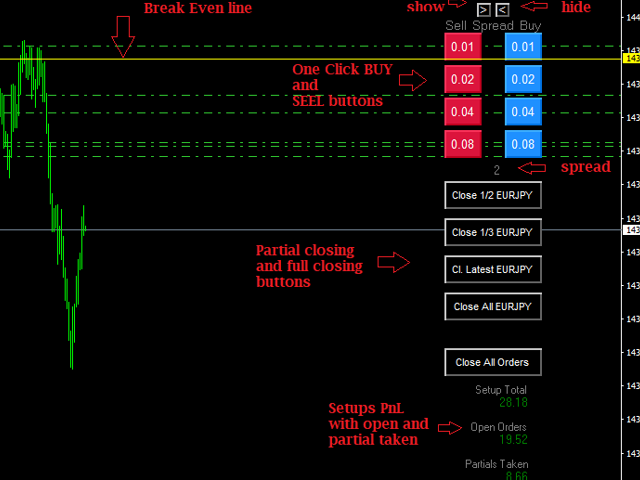

One Click market orders with different lot sizes, partial closing and break even line. Also it shows current setups profit or loss, with partial exits included in total setups PnL.

Great tool for manual trading, when different lot sizes needed as per grid or martingale strategies.

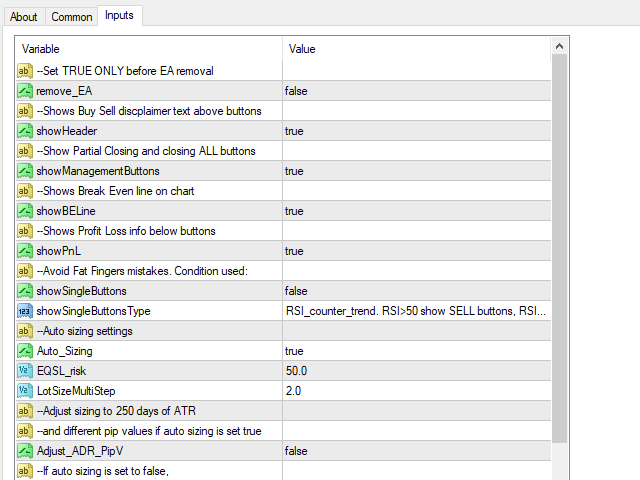

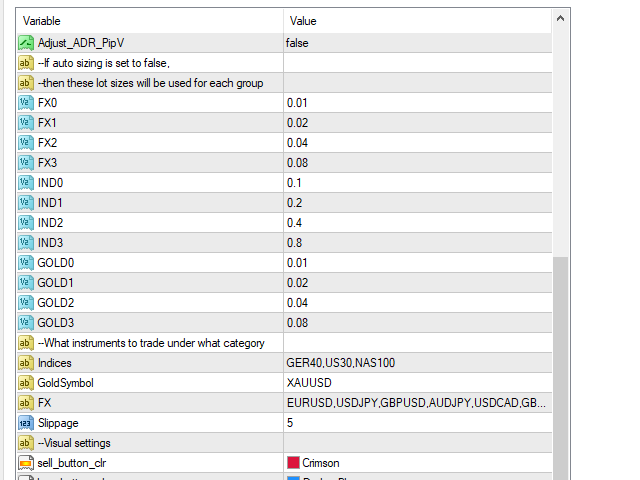

Major future is different symbol category detection. Due different instruments categories there is a need to use different pre determined lot sizes for different risk profiles. So EA has auto detection of different trade instrument category. For now there are 3 categories. Forex, Indices and Gold. It works great when using some symbol changer and your lot sizes are set automatically, which saves time and helps to avoid costly mistakes when you get in with wrong size in wrong instrument, because you forgot to write correct size manually each time when moving through different symbols in default way. Please be aware that each symbol name must be written in certain category, otherwise lot size will be set to minimum. Suffix like EURUSD.pro must be included too.

Partial closing buttons : only closes 1/3 of latest order , 1/2 of latest order, full closing of latest order, close all in current instrument, and close all open orders.

Setup Total (only current instrument) is calculated this way :

Setup Total = Open orders + partially closed orders + fully closed orders + commissions + swaps. It calculates from oldest still open order time. It means that everything what is partial exited or fully closed between now and that oldest still open order will be included, but if something closed before that oldest open order will not be included. BE line + PnL does not work correctly if hedging positions used. But in future versions it can be updated if there will be demand.

Trade manager EA has Fat Finger protection, helps to avoid pressing wrong button. Depending on your strategy (trend or counter trend) and chosen function one side (sell or buy) buttons disappear. If you want simple custom condition I can program it in, please private message or ask in comments section.

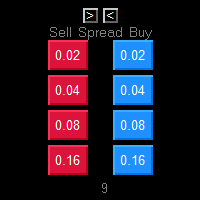

If Auto Sizing is set to false, when EA will take lot values from pre determined categories written manually in settings by you for all 4 buttons. If chosen true then it will calculate this way: default base size is set to 1000 per 0.01 lot if 10 EQSL risk is set. So if you use 2000 account then for 10 risk will calculate 0.02 as base size in 2nd button. First button is always set as half size of 2nd button, in this example it would be 0.01. 3rd and 4th button will be set by multiplying your chosen value by LotSizeMultiStep. Let's say it is set to 2, so it will multiply base size * 2 for 3rd button, and 4th button base size by * 2 *2. All buttons will look like 0.01 0.02 0.04 0.08 lot sizes. Please play around with different settings and you will see how lot values changes when choosing different risk parameter. For indices base size will be 2x bigger than in Forex pairs. For gold base size will be 5x smaller than Forex. If you increase risk setting from 10 to 20, all lot sizes will increase 2 times too. Just play around and find what sizes are good to you.

Adjust_ADR_PipV must be selected only with Auto Sizing together, otherwise it will not work. This function adjust lot sizes only in Forex pairs by something between -30% and +30% of lot sizes by looking into 250 days of ATR(roughly one year) and different pip values. Default base is chosen to be 100 pip range in a day. So if currency pair have let's say 120 pips of ATR over one year, EA will divide lot sizes by 1.2. Also same for pip values. EA compares to majors, 1$ per pip, but if some crosses are used it will divide lot size to 0.7$. Formula for this function is LotSize=LotSize/ATR multiplier/PipValue. It helps to even the field for different volatility and different pip values. If it sounds too complex just set it to false.

If any questions or suggestions please private message me.