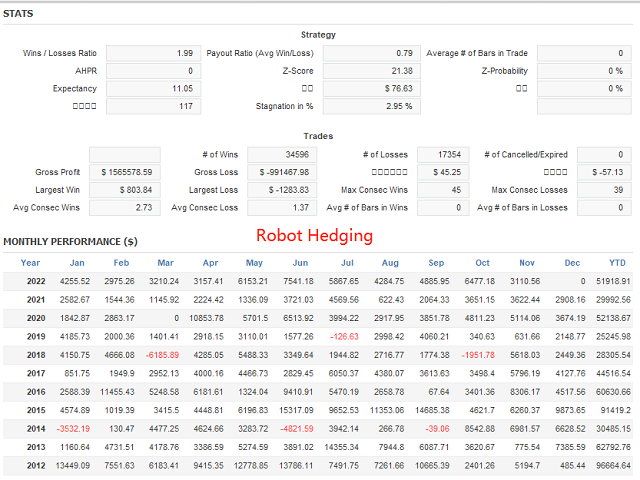

Robot Hedging

- Asesores Expertos

- Dingjia Xiong

- Versión: 2.1

- Activaciones: 5

Before introducing phantoms, post a few signals

The phantom 10 years back to the test data: https://www.mql5.com/zh/code/download/41420/264595/972.1wmzy.zip

Phantom Robot 2.1 is a foreign exchange program trading EA developed by the original EA network, which is an automatic intelligent trading strategy based on price patterns and mathematical statistics.

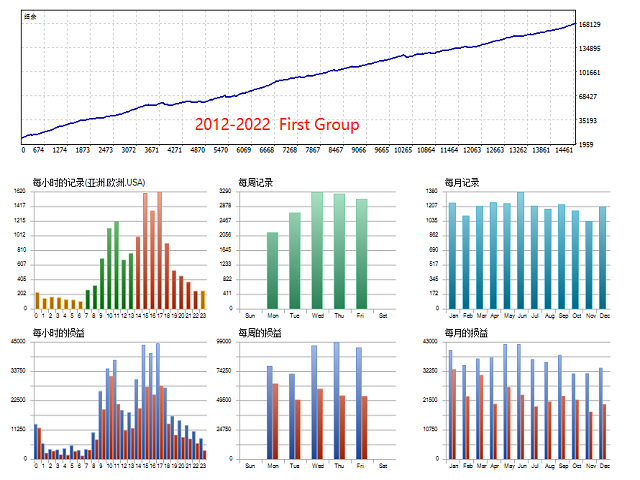

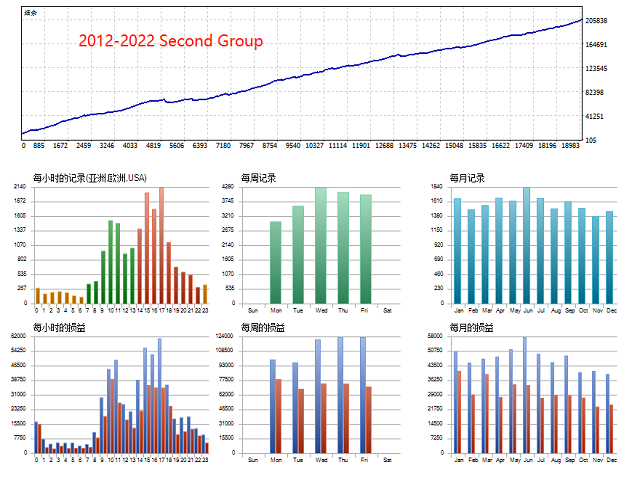

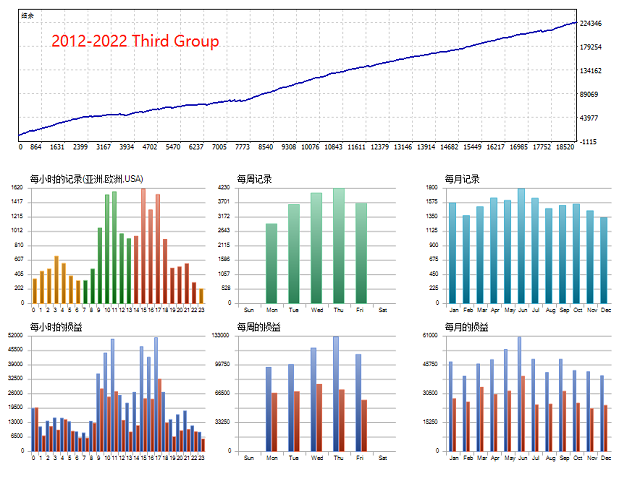

Mainly used for arbitrage trading between related products, it is divided into 3 groups and has a total of 3 currencies. The historical recovery from 2012 to 2022 is excellent, and the solid trading performance from 2019 to 2022 is outstanding and stable.

Gains and retractions:

On the basis of fully considering the spread and the possibility of future market, after excluding the highest and lowest annualized returns, we set the expectation under compound interest as:

Payback ratio: 5:1

Phantom Robot is divided into four positioning modes: conservative, standard, Overweight, and ultra-aggressive.

In conservative mode:

Expected annualized return: 60%

Maximum expected pullback: 12 percent

In standard mode:

Expected annualized return: 100%

Maximum expected pullback: 20 percent

In Augmented mode:

Expected annualized return: 130%

Maximum expected pullback: 30 percent

In Hyperaggressive mode:

Expected annualized return: 260%

Maximum expected pullback: 50%

Transaction frequency, win ratio, and profit/loss ratio:

Frequency: 3100 transactions per year on average, 258 transactions per month;

Win rate: The overall average win rate of the account is 68.14%;

Profit/loss ratio: The average Profit Factor is 1.63.

Phantom by the original EA network research and development, strategy research and development team have more than 7 years of experience in the financial industry, familiar with the rules of the trading market, has a wealth of trading experience.

The programming team has long experience in writing trading programs to ensure the accuracy of strategy execution.

EA basic logic:

Phantom is a carry trade that measures the movements of two highly correlated currency pairs all the time if they rise and fall together.

Then, when the two currencies diverge, it makes a profit by supporting the weak currency (buy) and depressing the strong currency (sell).

Phantoms include:

USDCAD-USDNOK arbitrage strategy:

(This group of strategies belongs to the positive carry trade. The trend strength relationship between the U.S. and Canadian krone is judged based on the Norwegian krone. When the trend strength of the U.S. and Canadian is higher than that of the Norwegian krone, the multiple orders of the Norwegian krone and the short orders of the U.S. and Canadian Krone enter the market, and when the two markets tend to be consistent, the profit will be made.)

AUDUSD-USDNOK arbitrage strategy:

This group of strategies belongs to the reverse carry trade. The trend strength relationship between the Australian and the US and the Norwegian krone is judged based on the Norwegian krone. When the trend strength of the Australian and the US is higher than that of the Norwegian krone, the multiple orders of the Norwegian Krone and the US and Canada enter the market, and when the two markets tend to be consistent, the profit will be made.)

Each currency strategy operates independently.

installation, setting, disc record

The following are the recommended default parameters, which need to be modified are the platform suffix, and the position selection

According to their risk control preference, choose conservative, standard, large, aggressive mode

According to their own platform has no suffixes, fill in the corresponding suffixes, no, do not fill