The King Hedge EA MT5

- Asesores Expertos

- NGUYEN NGHIEM DUY

- Versión: 2.0

- Activaciones: 5

Trade Bollinger Bands combining Trend, RSI, MACD

1. Trend trading combining the Bollinger and MACD bands is done in the following sequence:

- Use MACD to identify trends

- Determine the potential entry point by re-checking the MA 20 of the price to see if it is in line with the trend.

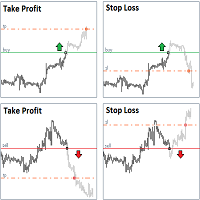

2. Trade Trends with Bollinger Bands

- The mid-line of bollinger bands is simply a moving average of 20 SMA20 periods, known as the Bollinger Bands' average line.

- The bottom line is, when the market is in a strong trend, this Middle Band will act as a "value zone". That means that when the price approaches this line, it's your chance to BUY (or SELL) on trend.

3. Bollinger Bands and RSI

- Once you know the trend, know the value zones to trade with BB, so how do you know if the trend will continue or is coming to an end? How do you know if the trend is strong or weak?

- At this point, the RSI will work. Combine BB with RSI divergation. (Similarly, you can also combine with MACD divergence.)

- Combined with the diverging search, when the price is in the lower BB Range, buy when an up diverging divergation appears. In contrast, SELL when the price is in the upper BB Range and appears diverging diverging.

4. Conclusions

- Bollinger Bands helps you determine when the price is "cheap" and when it is "expensive".

- In the uptrend, you can consider buying when the price approaches the lower BB Range.

- In downtrend, you can consider selling when the price approaches the UPPER BB Range.

- When BB shrinks, there is a signal that a breakout is imminent.

- You can use the MA20 as a value zone when the market is trending.

- Combining RSI, MACD, support, resistance, candlestick pattern... to increase the probability of reversal.