Ethereum Smart Averaging

- Asesores Expertos

- Mark Peter Evans

- Versión: 6.0

- Activaciones: 5

This strategy is a modified version of Dollar Cost Averaging which divides capital into small orders, and places these orders at time intervals.

The main asset is Ethereum (ETHUSD), but it can also be used on Bitcoin (BTCUSD)

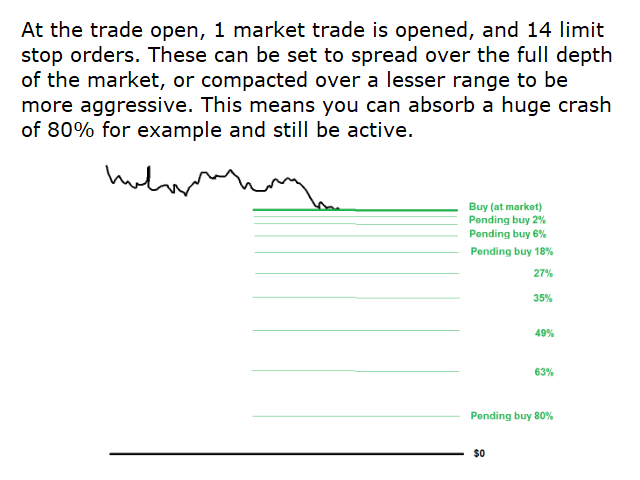

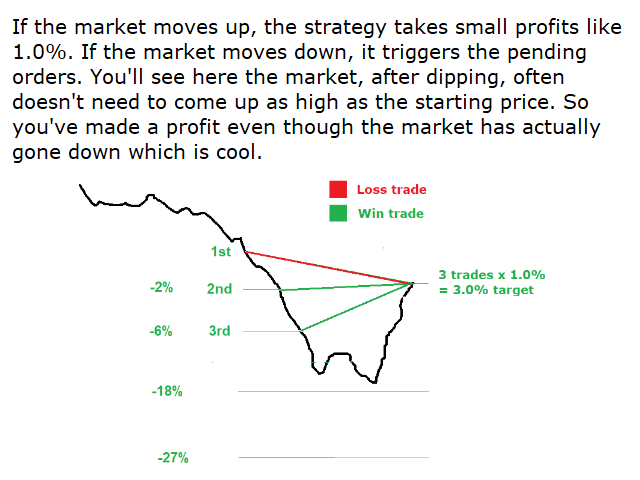

Specifically, this strategy places 1 market order plus 14 pending orders at certain market price intervals as the market price dips. So it's constantly buying the dips.

Everything based on closed candles. Collective Take Profit: When the total account profit of all trades reaches or exceeds a collective profit (1.0% x Account balance x number of open positions), then close all trades.

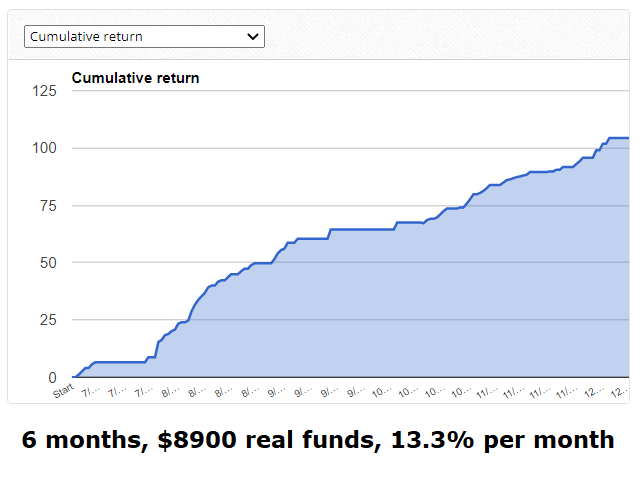

The strategy has been used with around $9,000 of real funds over the last 7 months, and has proven very save. The maximum drawdown in it's history was 29% during a market crash, then it recovered into profit. It's very durable to market movement.

You can find real & live demo account statements at FXBlue:

$8900+ real funds: https://www.fxblue.com/users/ftmo220075571

$670 real funds: https://www.fxblue.com/users/ftmo220073139

$12,300 demo funds: https://www.fxblue.com/users/ftmo11723253

Some advantages:

- All lots are fixed size, so there's no compounding.

- Only small BUY orders are places, as crypto's long term sentiment is strongly upward.

- Proven long term with real funds

- Passes all back testing, although live testing is much more reliable indication.

- $200 minimum capital for ETHUSD

- Can be used on BTCUSD

LOT Settings for different capital (USD). The strategy comes with a spreadsheet to calculate custom settings.

Current settings for ETHUSD:

$200 = 0.01 lots

$500 = 0.03 lots

$1000 = 0.05 lots

$5000 = 0.26 lots

$10,000 = 0.52 lots