WatchList Stochastic

- Utilidades

- Wojciech Daniel Knoff

- Versión: 1.8

- Actualizado: 23 diciembre 2021

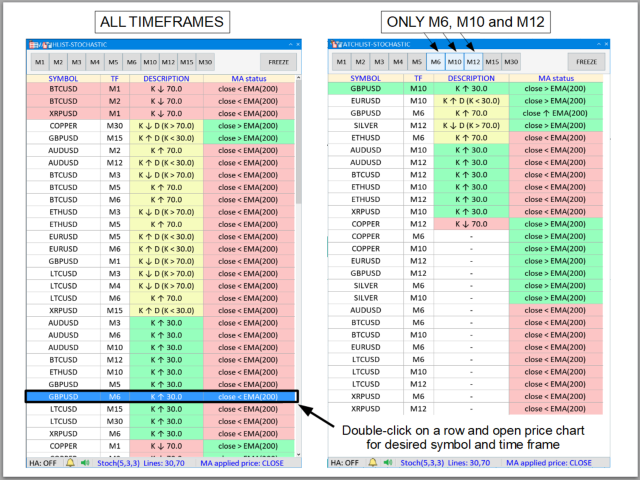

This is a multi-symbol and multi-time frame, fully customizable alert based on a stochastic oscillator (SO) and moving average (used for trend confirmation) calculations. This tool returns most recent buy/sell signal from user-defined time periods on the fly! Alert action can be performed for a specified trade type: "buy", "sell" or "buy or sell" on your wish. Unlike of many alerts, this is a "map" of conditions which gives you full information of indicator positions without opening and searching many charts. This program is a table with cells painted on colors related to trade conditions. If any row have one color, important buy/sell conditions were met.

Key features:- most recent trade signals from user-defined 10 time frames / symbol in real-time

- double click on chosen table row and open price chart for desired symbol and time frame instantly!

- fully customizable indicators (including Heikin Ashi calculations) and alert parameters

Meaning of cell colors in the table (can be redefined by user):

- GREEN - buy signal,

- PINK - sell signal,

- YELLOW - pay attention for incoming potential buy/sell conditions (for example K line cross up 80, so expect that price probably abandom overbought area soon)

- ORANGE and "PENDING" description - waiting for data from broker.

Main GUI:

- User-defined time frame buttons: This is a filter for time frames for alert messages. If neither of them is selected, condition for buy/sell oportunity for all defined time frames will be considered

- FREEZE button: freeze current table view. It is useful when many signals appears and changing at the same time.

Table and meaning of description in cells (table):

"Description" column ("line1" and "line2" are related to oversold and overbought area, respectively):

- K ↓ line1 - "K" line cross down "line1"

- K ↑ line1 - "K" line cross up "line1"

- K ↑ line2 - "K" line cross up "line2"

- K ↓ line2 - "K" line cross down "line2"

- K ↓ D (K > line2) - "K" line cross down "D" line (overbought area)

- K ↑ D (K < line1) - "K" line cross up "D" line (oversold area)

"MA (Moving Average) status" column:

- price ↑ MA - price cross up last "MA" point

- price ↓ MA - price cross down last "MA" point

- price > MA - last two price points above "MA"

- price < MA - last two price points below "MA"

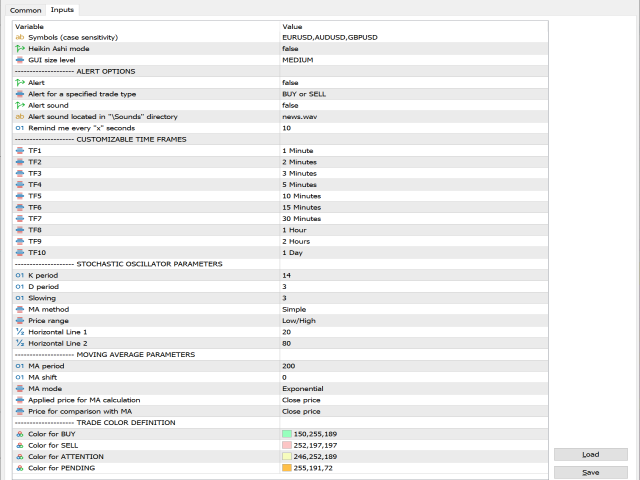

Main parameters (see picture):

- Symbols - Comma-separated list of symbols you wish to analyze. Input values are case sensitivity.

- Heikin Ashi mode - If true, all indicators will be calculated from Heikin Ashi candles except Price for comparison with MA (see MOVING AVERAGE parameters section)

- GUI size level - Change size of graphical user interface. Select: SMALL, MEDIUM or LARGE.

CUSTOMIZABLE TIME FRAMES options:

- TF1 ... TF10 - Choose set of time frames among 10 slots

- K period - N-period of price range used for K-line calculations

- D period - N-period smoothed average of K line

- Slowing - Additional smooth for K and D line

- MA method - Corresponds to a moving average method for D-line calculations (Simple, Exponential, Smoothed, Linear Weighted)

- Price range - Considered lowest and highest price within N-period. Choose between: low-high or close-close.

- Horizontal line 1 and 2 - Lines corresponds to oversold (below Line 1) and overbought (above Line 2) area.

MOVING AVERAGE parameters:

- MA period - Moving average period

- MA shift - How many bars moving average is shifted

- MA mode - Calculation method (Simple, Exponential, Smoothed, Linear Weighted)

- Applied price - Price input for moving average calculations: (open,close,low,high,median,typical,weighted)

- Price for comparison with MA - Type of last two prices for comparing with moving average indicat