Relative trend index RTI

- Indicadores

- Billel Zerrougui

- Versión: 1.2

- Activaciones: 5

The Relative Trend Index or RTI, is a technical indicator that is used to identify trend changes in the price of an asset, as well as the Strength of that trend.

The RTI fluctuate between zero and 100, with values close to 100 indicating a strong sell and values near zero indicating a strong buy

Indicator Parameters:

RTI : the indicator is typically applied to 14 periods of data, so the indicator is showing how many periods it has been since a 14 period high or low

Signal : Cross signal occurs when the RTI crosses the Signal

1. A bearish signal occurs when the RTI crosses from below to above the Signal

2. A bullish signal occurs when the RTI crosses from above to below the Signal

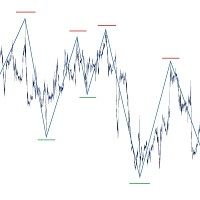

Cloud : show support and resistance levels, as well as momentum and trend direction

The Kumo Breakout signal occurs when the RTI leaves or crosses the Kumo (Cloud) its main trend is changing

How this indicator works

When RTI are decidedly above the Cloud, the issue's trend is negative.

When RTI are decidedly below the Cloud, the issue's trend is positive.

A Sell signal is reinforced when the RTI crosses above the Signal while the RTI and Signal are all below the cloud.

A Buy signal is reinforced when the RTI crosses below the Signal while the RTI and Signal are all above the cloud.